Beanisimo Coffee

Executive Summary

Beanisimo Coffee is a start up Salem, Oregon based coffee roaster that has developed a line of premium coffees and espressos. Beanisimo Coffee has been formed as an Oregon S Corporation by the founder Frank Jones. Frank has brought old world Italian traditions and recipes to meet the market need for premium coffees.

Keys to Success

Beanisimo Coffee has identified three keys that will be instrumental to its success. The first is the need to develop the finest coffee available. The second requirement to develop a top notch customer service organization that exceeds customer expectations. The last element is to employ strict financial controls. The development and implementation of finance and accounting controls will help ensure fiscal success.

Target Market Segments

Beanisimo Coffee has identified three distinct customer segments that it will actively pursue. The first group is made up of coffee houses, drive thru establishments, and espresso carts. This customer segment has 187 potential customers and is growing at a 7% annual rate. The second group is restaurants with 107 possible customers and is growing at an 8% annual rate. The last segment is grocery stores that sell unprepared beans to their customers in either whole bean or ground forms. This segment has 97 potential customers and a 7% growth rate.

Management

Beanisimo Coffee is being lead by Frank Jones. Frank has a strong educational background and a wealth of applicable industry experience. Frank received his Bachelor degree and MBA from Willamette University. Frank has worked at several coffee shops, and has worked in Italy as a coffee roaster under the wing of an Italian master roaster.

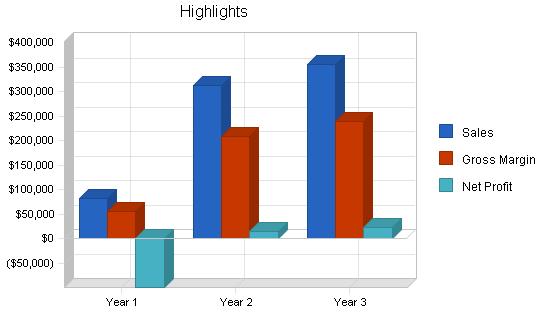

Through a combination of a solid business model, strong educational credentials, and proprietary coffee roasting techniques, Frank will be able to turn Beanisimo Coffee from a start-up business to a significant market player in the high-end coffee market in the Willamette River Valley. Sales for year two are forecasted to be $312,000 rising to $355,000 in year three. Net profit is projected to be 7.58% for year two and will jump to 9.58% in year three.

1.1 Mission

It is Beanisimo Coffee’s mission to offer the finest selection of coffees. By using the customs from a 54-year-old Italian master roaster, Beanisimo Coffee’s products will surpass all of its competition. A strong customer service ethic will support the fantastic product.

1.2 Objectives

Beanisimo Coffee’s objectives are to build brand awareness and customer service excellence, while increasing sales. Beanisimo Coffee intends to utilize the following strategies to achieve these objectives:

- Develop a high-quality menu of different coffee blends.

- Provide an excellent service experience, anticipating the needs of the customers and delivering the best service.

- Leverage the old traditional Italian roasting methods to increase market penetration with the finest product available.

1.3 Keys to Success

Beanisimo Coffee has identified several keys which will be instrumental in the success of the company.

- Develop the finest product.

- Exceed customer expectations.

- Employ strict financial controls.

Company Summary

Beanisimo Coffee is a start up Salem, Oregon based coffee roaster that has developed a line of premium coffees and espressos. Beanisimo Coffee has been formed as an Oregon S Corporation by the founder Frank Jones. Frank has brought old world Italian traditions and recipes to meet the market need for premium coffees.

2.1 Company Ownership

Beanisimo Coffee is an Oregon S Corporation. The primary stockholder and founder is Frank Jones.

2.2 Start-up Summary

The following equipment will be needed for the start up of the company:

- Three workstation computers and one central file server.

- Two laser printers.

- Computer software: Microsoft Office, and Peachtree Accounting.

- Assorted office furniture and equipment.

- Assorted buckets, labels, bags, labels, and hooks.

- Topre Izmir perforated drum roaster.

- Heat based bag sealer.

- Hobart scale.

- Van.

| Start-up | |

| Requirements | |

| Start-up Expenses | |

| Legal | $5,000 |

| Stationery etc. | $500 |

| Brochures | $1,000 |

| Consultants | $1,500 |

| Research and Development | $3,000 |

| Total Start-up Expenses | $11,000 |

| Start-up Assets | |

| Cash Required | $116,000 |

| Start-up Inventory | $0 |

| Other Current Assets | $0 |

| Long-term Assets | $78,000 |

| Total Assets | $194,000 |

| Total Requirements | $205,000 |

| Start-up Funding | |

| Start-up Expenses to Fund | $11,000 |

| Start-up Assets to Fund | $194,000 |

| Total Funding Required | $205,000 |

| Assets | |

| Non-cash Assets from Start-up | $78,000 |

| Cash Requirements from Start-up | $116,000 |

| Additional Cash Raised | $0 |

| Cash Balance on Starting Date | $116,000 |

| Total Assets | $194,000 |

| Liabilities and Capital | |

| Liabilities | |

| Current Borrowing | $0 |

| Long-term Liabilities | $0 |

| Accounts Payable (Outstanding Bills) | $0 |

| Other Current Liabilities (interest-free) | $0 |

| Total Liabilities | $0 |

| Capital | |

| Planned Investment | |

| Investor 1 | $80,000 |

| Investor 2 | $65,000 |

| Other | $60,000 |

| Additional Investment Requirement | $0 |

| Total Planned Investment | $205,000 |

| Loss at Start-up (Start-up Expenses) | ($11,000) |

| Total Capital | $194,000 |

| Total Capital and Liabilities | $194,000 |

| Total Funding | $205,000 |

Products

Beanisimo Coffee offers a wide range of specially blended and roasted coffees. Beanisimo Coffee will be using customs passed down from a 54 year old Italian master coffee roaster. Beanisimo Coffee first will select and cup the coffee, then blend different beans before roasting.

The key to a wonderful bag of roasted beans is the blending of different coffee beans. Coffee beans are a global commodity. There are many different types of beans, distinctive in the genre of plant that the bean comes from as well as the region that the bean is grown. Beyond these distinctions, beans are still a commodity.

Blending different types of beans makes huge differences. Beanisimo Coffee is privy to decades old blending recipes from old world Italy.The roasting technique also plays a role in the taste of the coffee.

Beanisimo Coffee will offer a wide range of coffees including:

- Italian Roast

- French Roast

- Columbian Dark

- African Roast

- Sumatra

- Bistro Blend

- Kona

- Kenya

- Decaf- available in the following blends: Bistro, Sumatra, French and Italian Roasts

- Espresso and Decaf Espresso

Each coffee is available in one pound and five pound packages, in both whole bean and ground versions. Every product that Beanisimo Coffee produces attempts to be the best in its respective product category based on quality and taste.

Market Analysis Summary

Beanisimo Coffee has decided to concentrate on three distinct customer segments. The first is coffee houses/drive thru/espresso carts, restaurants, and the last is grocery stores. Each of the customers is distinct. The first segment prepares beverages for their clients, as does the second group along with meals, and the third segment sells the whole bean and ground coffee unprepared to their customers.

While the coffee industry as a whole has been stagnate for a while, the high-end gourmet coffee market is still growing. This can be attributed to a number of factors including the maturing and increased sophistication of the American palette. Beanisimo Coffee faces competition from several competitors who focus on convenience or price as opposed to product quality which is the strength of Beanisimo Coffee.

4.1 Market Segmentation

Beanisimo Coffee has segmented their market into three distinct customer segments:

- Coffee houses/drive thrus/carts: These customers are purchasing coffee beans for the preparation and sale of coffee and espresso based drinks. Their establishments serve a wide variety of coffee and espresso beverages to customers that visit the coffee houses, drive thrus, or cart based servers.

- Restaurants: These establishments are purchasing coffee and espresso to serve to their retail food customers.

- Grocery Stores: These customers are purchasing the beans for either prepackaged, or bulk, resale to their customers. The grocers do not prepare the drinks for the customers like the other customer segments, they only sell the Beanisimo product as is purchased from Beanisimo Coffee.

Below is some demographic information of the end consumers of the above customer segments.

U.S. Demographic Coffee Consumption Patterns

2001- 2002 U.S. Coffee Drinking Trends Survey (according to the National Coffee Association):

| 2002 | 2003 | |

| U.S. adults who drank coffee every day | 107 million | 108.7 million |

| U.S. adults who drank coffee occasionally | 57 million | 52 million |

Gender:

- Men and women consume the same number of cups per day.

- Women are more excited about varieties and source of relaxation (social).

- Men like that coffee helps them “get things done.”

- Women are more price conscious than men.

Age:

- 18-25: prefer high caffeine, hot or iced drinks, all high octane, richer blends.

- 30-60: prefer premium and espresso with half the caffeine. Lite blends and half-caffeinated grew approximately 7% in 2001.

Other:

- 64% of all coffee is consumed at breakfast; 28% between meals; 8% at all other meals.

- Sweetened or plain: 35% drink coffee black; 65% add sweetener and/or creamer.

- The average daily coffee drinker consumes 3.1 cups per day.

- In 2002, there were 29 million people who drank gourmet coffee every day. Gourmet is defined as specialty coffee (premium), espresso-based beverages (cappuccino, latte, café mocha, espresso), or frozen and iced coffee beverages.

| Market Analysis | |||||||

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |||

| Potential Customers | Growth | CAGR | |||||

| Coffee houses, etc. | 7% | 120 | 128 | 137 | 147 | 157 | 6.95% |

| Restaurants | 8% | 107 | 207 | 224 | 242 | 261 | 24.97% |

| Grocery stores | 7% | 97 | 104 | 111 | 119 | 127 | 6.97% |

| Total | 13.88% | 324 | 439 | 472 | 508 | 545 | 13.88% |

4.2 Target Market Segment Strategy

Beanisimo Coffee will be focusing on the three previously mentioned customer segments because of their desire of having a high-quality product.

The coffee shops/drive thrus/carts segment often appreciates the finest quality coffee/espresso product. Restaurants are another customer segment that is attractive because they have a constant need for coffee and coffee/espresso is a common beverage served with meals, especially when people eat out.

Additionally, restaurants are a year round business that serves coffee at all times during the day. Lastly, Beanisimo Coffee will target grocery stores which sell coffee in unprepared forms to a wide range of customers. Grocery stores are a natural customer since many people buy the bulk of the food they consume during the week from a grocery store, including coffee.

4.3 Industry Analysis

Global Coffee Market: Coffee is the second-largest commodity traded after oil, with the worldwide retail coffee market being a $56 billion industry.

The coffee belt is roughly bounded by the Tropics of Cancer and Capricorn and is mainly comprised of 28 countries. The top-ten coffee-producing countries are, in descending order: Brazil, Vietnam, Columbia, Indonesia, Mexico, Ethiopia, India, Guatemala, Ivory Coast, and Uganda.

During the 1990’s, Vietnam moved from fourth largest to second largest producer of coffee in the world, with most of its production in robusta beans. Coffee is available in several forms: bean, ground, liquid, and soluble: powdered, granules, freeze-dried. Worldwide, with the exception of North America, people prefer instant coffee and coffee is mainly prepared at home.

Top coffee-importing countries as a % of world supplies:

| USA | 55.6% |

| Germany | 14.0% |

| Japan | 7.7% |

| France | 7.5% |

| Italy | 6.2% |

| Spain | 3.8% |

| Holland | 3.4% |

| UK | 3.4% |

| Sweden | 2.2% |

Top coffee-consuming regions (by pounds consumed per capita per year):

| Northern Europe* | 23 |

| Central Europe | 16 |

| South America | 7 |

| Southern Europe | 10 |

| North America | 10 |

| Australia | 5 |

| Japan | 5 |

* Does not include the UK, which only consumes 5 pounds per capita per year.

U.S. Coffee Market: The total U.S. coffee market is projected to exceed $25 billion in 2002:

| 1993 | 1999 | 2001 | |

| Revenues | $13 B | $18.5 B | $20.7 B |

The overall U.S. consumption of coffee has stagnated in recent years. However, consumers’ purchase of gourmet coffee (specialty and premium) is increasing, according to the National Coffee Association.

Consumers are choosing to drink higher-grade coffees, moving away from price-based purchasing to trends that focus on increased quality in a wide variety of products. In the U.S., the coffee market has been segmented into two major categories: mass-market and specialty coffees.

- Mass-Market: Mainly lower-priced product sold through grocery retail outlets and convenience stores. Mass-market coffee consumption is declining approximately 5% per year as people of all ages embrace out-of-home specialty coffees. Grocery retail outlets are providing the consumer with more premium coffee choices and are partnering with specialty coffee roasters capturing an increasing share of the mass-market sales channels.

- Specialty Coffee: Characterized by a quality grade product with branding, historically sold only through coffee shops. Five years ago, there was a clear line between mass-market and specialty coffees in quality, price and distribution channels. Today, there are two sub-categories that make the positioning more blurred: Premium and Specialty coffees.

Specialty coffee retailers sell higher quality coffee at premium prices. Now, premium coffees have been introduced into other distribution channels to sell below specialty coffee retailer prices, undercutting the exclusive advantage coffee retailers once had. Specialty coffee sales grew 38% from $7.76 billion in 2000 to $10.71 billion in 2001, comprising 30% of the total U.S. coffee market. The specialty coffee market is characterized by being high fragmented with one large player, several mid-tier companies, and thousands of small regional companies.

Before the success of the specialty coffee retailers in the 90’s, coffee was a breakfast drink and choices were caffeinated or decaffeinated. The incredible success of the specialty coffee retailer can be attributed to introducing coffee as a social drink and providing the consumer with new unimagined choices of coffee drinks while introducing and conditioning the consumer to the taste of specialty coffees.

Trends within the Industry:

- In the U.S., Specialty coffee sales grew 38% from $7.76 billion in 2000 to $10.71 billion in 2001, comprising 30% of the market. Thanks in large part to the marketing efforts of Starbucks, specialty coffee has become mainstream. It is the primary growth driver in the otherwise flat or declining coffee industry. Specialty coffee, which was once limited to coffee shops, is now available in a wide variety of mass-market channels.

- Specialty coffee is moving into mass-market channels. Coffee is no longer being viewed as just a breakfast beverage; it is now a social beverage, and people like to drink premium branded coffee throughout the day.

This has spurred partnerships with convenience stores and service companies that provide coffee to offices and throughout the hospitality industry. There is also a change in the type and quality of vending machines. Coffee vending companies are converting their vending machines to branded coffee.

4.3.1 Competition and Buying Patterns

Beanisimo Coffee several different competitors:

- Allan Brothers: This Oregon based company operates as both a roaster as well as running coffee houses in Salem, Eugene, and Corvalis. The price point for their coffee is midway. The quality is decent, particularly at its price point.

- Caffetto: This company widely distributes their roasted coffee throughout the Willamette River Valley. The quality and price point is pretty low. This company’s coffees are attractive if the customer is very price sensitive and need an inexpensive product.

- Assorted varieties distributed by food service vendors (e.g., Food Service of America and Sysco): These varieties are offered at a mid-price point with a low product quality. What you do get with these offerings is individual serving sizes. For a lot of restaurants this is advantageous, but the costs is carried over to the customer for this feature.

The buying patterns for customers is based on convenience, cost, and quality. Some customers are willing to pay more for the convenience of individual sized servings and the benefit of buying coffee from their existing food product vendor. For others coffee is just one more thing on the menu and quality is not that important. Lastly, there are many companies that recognize high quality coffee and espresso and will not settle for anything less.

Strategy and Implementation Summary

Beanisimo Coffee will leverage its competitive edge of the highest quality product to quickly gain market penetration. This competitive edge is sustainable because it is based on the traditional roasting techniques of an old Italian master roaster. Beanisimo Coffee’s marketing effort will be based on the communications that assert that Beanisimo Coffee has by far the best products. Beanisimo Coffee will be vocal in their assertion of the message that while its coffee costs a bit more, the variance is not material and the difference in quality is immeasurable. The sales strategy will work on converting perspective customers into long-term customers by emphasizing high-quality products and high levels of customer service. This strategy recognizes the fact that even though the company may have the best product, without excellent customer service the organization will not succeed.

5.1 Competitive Edge

Beanisimo Coffee’s competitive edge is its market leading product quality. By leveraging personal relationships, Beanisimo Coffee has gained the recipes and knowledge of an old Italian master roaster. Part of Beanisimo Coffee’s secret is the old world roasting techniques, part of the winning formula is the art of blending different green beans to come up with special recipes. Green coffee beans are a commodity, therefore any variations in one company’s coffee to another is based on roasting techniques if they are using the same types of beans. Beanisimo Coffee is able to stand out among its competitors by using time tested blends of different green beans to come up with compelling final products. This competitive edge is sustainable in the sense that this information that Beanisimo Coffee possesses is a trade secret and not available to other roasters. This will ensure Beanisimo Coffee will always have the finest products.

5.2 Marketing Strategy

Beanisimo Coffee’s marketing strategy will communicate to the target customer segments that its product clearly exceeds all of the competitors. The strategy will employ several methods to communicate the message. The first will be a print advertising campaign. Several different sources will be used including a local restaurant industry journal as well as a regional coffee shop trade publication. Advertisements in these publications will be effective in reaching the target audience.

A second method that Beanisimo Coffee will use to “get out the word” will be by having several different cuppings. A cupping is analogous to a wine tasting where many different varieties are tasted, compared, and analyzed. The cuppings will be a perfect opportunity for Beanisimo Coffee to have prospective customers taste the difference between its products and the competition. To develop awareness of the superior product offerings, Beanisimo Coffee must offer a superior level of customer service to support the products. Beanisimo Coffee recognizes that you cannot solely compete on product alone, that much of the transaction involves excellent customer service.

5.3 Sales Strategy

The sales strategy recognizes the need for the company as a whole to back up its superior product offerings with excellent service. This mantra is important because if there was not a service organization to back up the product, there would be no customers after the second or third purchase. Consequently, the sales strategy will focus on customer support and making the customer’s experience with Beanisimo Coffee as positive as possible. This strategy will use account managers that look after individual customers, ensuring that their needs are being met. The account managers will be responsible for a certain number of existing accounts as well as will be provided the resources to attract new accounts.

5.3.1 Sales Forecast

The sales forecast, described graphically in the following charts, is conservative in order to prevent unrealistic expectations and to help ensure the achievement of these goals. Sales will grow slowly but incrementally. As a start-up organization, it is realistic to expect that it will take time to grow the customer base so that it is at a sustainable level.

As mentioned in the previous section, account managers will be used to service existing customers as well as generate new accounts. Having account managers with a vested interest in the satisfaction of the customers will help ensure disciplined sales growth. Without account managers, the management believes that it would be too easy for customers to “fall through the cracks.”

| Sales Forecast | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | |||

| Coffee houses | $35,824 | $136,004 | $154,545 |

| Restaurants | $22,211 | $84,322 | $95,818 |

| Grocery stores | $24,360 | $92,483 | $105,091 |

| Total Sales | $82,395 | $312,809 | $355,454 |

| Direct Cost of Sales | Year 1 | Year 2 | Year 3 |

| Coffee houses | $11,822 | $44,881 | $51,000 |

| Restaurants | $7,330 | $27,826 | $31,620 |

| Grocery stores | $8,039 | $30,519 | $34,680 |

| Subtotal Direct Cost of Sales | $27,190 | $103,227 | $117,300 |

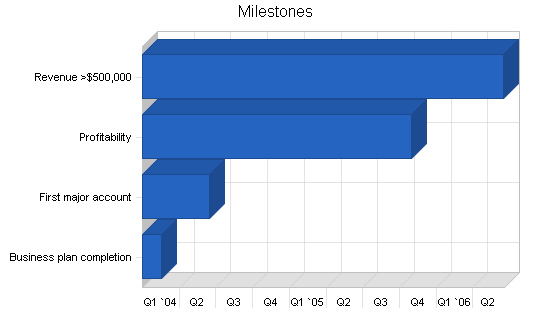

5.4 Milestones

Beanisimo Coffee has developed several milestones that will serve as a goal to which the entire organization will strive to achieve. All of the milestones are measurable allowing the responsible department to track progress and assess their ability to reach the milestone.

- Business plan completion.

- First major account: This will be the first large account that provides the company with a material recurring revenue stream.

- Profitability: For the accounting/finance department, this is a significant milestone.

- Revenue exceeding $300,000.

| Milestones | |||||

| Milestone | Start Date | End Date | Budget | Manager | Department |

| Business plan completion | 1/1/2004 | 2/15/2004 | $0 | Frank | Operations |

| First major account | 1/1/2004 | 6/15/2004 | $0 | Sales Manager | Sales |

| Profitability | 1/1/2004 | 10/30/2005 | $0 | Frank | Accounting |

| Revenue >$500,000 | 1/1/2004 | 6/15/2006 | $0 | Sales Manager | Sales |

| Totals | $0 | ||||

Web Plan Summary

A website will be used to provide information regarding Beanisimo Coffee and the offered products to current and prospective customers. The site will be used for informational purposes, it will be not initially used for commerce purposes. Once the organization has been operating for a while they will reconsider the demand for coffee to be sold via the website.

6.1 Website Marketing Strategy

The marketing strategy for the website will attempt to develop awareness for the website thereby directing people to the site for more information regarding the complete line of coffees and espressos that Beanisimo Coffee offers. Beanisimo Coffee will make submissions to search engines such as Google! to ensure that when a perspective customer types in “gourmet coffee” or some other such key word that Beanisimo Coffee’s site is high up on the list of hits. In addition to search engine submissions, all of Beanisimo Coffee’s promotional material will have the URL for the website, encouraging people to visit the site.

6.2 Development Requirements

As mentioned before, the website will be used as a source of information. Because it will not, at least initially, have an e-commerce component to it, the development requirements will not be that significant. Beanisimo Coffee will leverage the technical expertise of a computer science graduate student (who typically work at below market wages) to develop the informational site.

Management Summary

Frank Jones, the founder and driving force of Beanisimo Coffee will be the main component of the management team. Frank received his Bachelor of Arts and MBA from Willamette University. Frank has worked as a barista at several different coffee houses, and with an Italian master roaster who took him under his wing and showed him all aspects of the business. After one year in Italy Frank returned to the states and began to work on a business plan for a coffee roasting company.

7.1 Personnel Plan

Responsibilities within Beanisimo Coffee will be delegated as follows:

- Frank: Business development, some accounting, some sales, and roasting.

- Sales manager: This person is responsible for the sales effort and will be the account manager for all of the accounts initially and will develop new sales accounts as well.

- Sales: As the business grows a sales person will be hired for account management responsibilities as well as some new sales development.

- Shipping: One person will be hired for the position of shipping and delivery. For delivery within the Willamette River Valley, deliveries will be made by the company vehicle. Other shipments that are of greater distance from Beanisimo Coffee will be sent via UPS. This position will coordinate all aspects of order fulfillment.

- Support staff: This position will employ initially one person in a capacity of supporting operations in a multitude of ways based on need. At times they will help support production and shipping.

- Administrative support: This position will help with some of the accounting activities as well as other administrative support functions.

| Personnel Plan | |||

| Year 1 | Year 2 | Year 3 | |

| Frank | $24,000 | $24,000 | $30,000 |

| Sales manager | $20,000 | $24,000 | $30,000 |

| Sales | $10,500 | $18,000 | $18,000 |

| Support | $11,520 | $15,360 | $15,360 |

| Shipping | $7,680 | $15,360 | $15,360 |

| Administration | $10,240 | $15,360 | $15,360 |

| Total People | 6 | 6 | 6 |

| Total Payroll | $83,940 | $112,080 | $124,080 |

Financial Plan

The following sections will outline important financial information.

8.1 Important Assumptions

The following table details important Financial Assumptions.

| General Assumptions | |||

| Year 1 | Year 2 | Year 3 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

8.2 Break-even Analysis

The Break-even Analysis indicates that approximately $19,000 will be needed in monthly revenue to reach the break-even point.

| Break-even Analysis | |

| Monthly Revenue Break-even | $19,170 |

| Assumptions: | |

| Average Percent Variable Cost | 33% |

| Estimated Monthly Fixed Cost | $12,844 |

8.3 Projected Profit and Loss

The following table will indicate Projected Profit and Loss.

| Pro Forma Profit and Loss | |||

| Year 1 | Year 2 | Year 3 | |

| Sales | $82,395 | $312,809 | $355,454 |

| Direct Cost of Sales | $27,190 | $103,227 | $117,300 |

| Other Costs of Goods | $0 | $0 | $0 |

| Total Cost of Sales | $27,190 | $103,227 | $117,300 |

| Gross Margin | $55,205 | $209,582 | $238,154 |

| Gross Margin % | 67.00% | 67.00% | 67.00% |

| Expenses | |||

| Payroll | $83,940 | $112,080 | $124,080 |

| Sales and Marketing and Other Expenses | $8,394 | $11,208 | $12,408 |

| Depreciation | $15,600 | $15,600 | $15,600 |

| Rent | $14,400 | $14,400 | $14,400 |

| Utilities | $7,800 | $7,800 | $7,800 |

| Insurance | $9,000 | $9,000 | $9,000 |

| Payroll Taxes | $12,591 | $16,812 | $18,612 |

| Other | $2,400 | $2,400 | $2,400 |

| Total Operating Expenses | $154,125 | $189,300 | $204,300 |

| Profit Before Interest and Taxes | ($98,920) | $20,282 | $33,854 |

| EBITDA | ($83,320) | $35,882 | $49,454 |

| Interest Expense | $0 | $0 | $0 |

| Taxes Incurred | $0 | $6,085 | $10,156 |

| Net Profit | ($98,920) | $14,198 | $23,698 |

| Net Profit/Sales | -120.06% | 4.54% | 6.67% |

8.4 Projected Cash Flow

The following table and chart will detail information regarding Cash Flow.

| Pro Forma Cash Flow | |||

| Year 1 | Year 2 | Year 3 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $20,599 | $78,202 | $88,863 |

| Cash from Receivables | $43,327 | $182,958 | $257,031 |

| Subtotal Cash from Operations | $63,926 | $261,161 | $345,895 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $0 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $20,000 | $0 |

| Subtotal Cash Received | $63,926 | $281,161 | $345,895 |

| Expenditures | Year 1 | Year 2 | Year 3 |

| Expenditures from Operations | |||

| Cash Spending | $83,940 | $112,080 | $124,080 |

| Bill Payments | $77,036 | $178,464 | $193,666 |

| Subtotal Spent on Operations | $160,976 | $290,544 | $317,746 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 |

| Purchase Other Current Assets | $0 | $0 | $0 |

| Purchase Long-term Assets | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal Cash Spent | $160,976 | $290,544 | $317,746 |

| Net Cash Flow | ($97,050) | ($9,383) | $28,148 |

| Cash Balance | $18,950 | $9,567 | $37,715 |

8.5 Projected Balance Sheet

The following table displays the Projected Balance Sheet.

| Pro Forma Balance Sheet | |||

| Year 1 | Year 2 | Year 3 | |

| Assets | |||

| Current Assets | |||

| Cash | $18,950 | $9,567 | $37,715 |

| Accounts Receivable | $18,469 | $70,118 | $79,677 |

| Inventory | $4,722 | $17,928 | $20,372 |

| Other Current Assets | $0 | $0 | $0 |

| Total Current Assets | $42,141 | $97,612 | $137,763 |

| Long-term Assets | |||

| Long-term Assets | $78,000 | $78,000 | $78,000 |

| Accumulated Depreciation | $15,600 | $31,200 | $46,800 |

| Total Long-term Assets | $62,400 | $46,800 | $31,200 |

| Total Assets | $104,541 | $144,412 | $168,963 |

| Liabilities and Capital | Year 1 | Year 2 | Year 3 |

| Current Liabilities | |||

| Accounts Payable | $9,461 | $15,135 | $15,988 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Subtotal Current Liabilities | $9,461 | $15,135 | $15,988 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $9,461 | $15,135 | $15,988 |

| Paid-in Capital | $205,000 | $225,000 | $225,000 |

| Retained Earnings | ($11,000) | ($109,920) | ($95,723) |

| Earnings | ($98,920) | $14,198 | $23,698 |

| Total Capital | $95,080 | $129,277 | $152,975 |

| Total Liabilities and Capital | $104,541 | $144,412 | $168,963 |

| Net Worth | $95,080 | $129,277 | $152,975 |

8.6 Business Ratios

The following table shows important Business Ratios, specific to Beanisimo as well as the industry as a whole.

| Ratio Analysis | ||||

| Year 1 | Year 2 | Year 3 | Industry Profile | |

| Sales Growth | 0.00% | 279.64% | 13.63% | -2.25% |

| Percent of Total Assets | ||||

| Accounts Receivable | 17.67% | 48.55% | 47.16% | 20.65% |

| Inventory | 4.52% | 12.41% | 12.06% | 16.07% |

| Other Current Assets | 0.00% | 0.00% | 0.00% | 21.35% |

| Total Current Assets | 40.31% | 67.59% | 81.53% | 58.07% |

| Long-term Assets | 59.69% | 32.41% | 18.47% | 41.93% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 9.05% | 10.48% | 9.46% | 21.87% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 19.28% |

| Total Liabilities | 9.05% | 10.48% | 9.46% | 41.15% |

| Net Worth | 90.95% | 89.52% | 90.54% | 58.85% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 67.00% | 67.00% | 67.00% | 32.41% |

| Selling, General & Administrative Expenses | 187.06% | 62.46% | 60.33% | 21.65% |

| Advertising Expenses | 0.00% | 0.00% | 0.00% | 1.81% |

| Profit Before Interest and Taxes | -120.06% | 6.48% | 9.52% | 1.84% |

| Main Ratios | ||||

| Current | 4.45 | 6.45 | 8.62 | 2.24 |

| Quick | 3.95 | 5.27 | 7.34 | 1.31 |

| Total Debt to Total Assets | 9.05% | 10.48% | 9.46% | 3.37% |

| Pre-tax Return on Net Worth | -104.04% | 15.69% | 22.13% | 45.32% |

| Pre-tax Return on Assets | -94.62% | 14.04% | 20.04% | 6.17% |

| Additional Ratios | Year 1 | Year 2 | Year 3 | |

| Net Profit Margin | -120.06% | 4.54% | 6.67% | n.a |

| Return on Equity | -104.04% | 10.98% | 15.49% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 3.35 | 3.35 | 3.35 | n.a |

| Collection Days | 55 | 69 | 103 | n.a |

| Inventory Turnover | 10.91 | 9.12 | 6.13 | n.a |

| Accounts Payable Turnover | 9.14 | 12.17 | 12.17 | n.a |

| Payment Days | 27 | 24 | 29 | n.a |

| Total Asset Turnover | 0.79 | 2.17 | 2.10 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.10 | 0.12 | 0.10 | n.a |

| Current Liab. to Liab. | 1.00 | 1.00 | 1.00 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $32,680 | $82,477 | $121,775 | n.a |

| Interest Coverage | 0.00 | 0.00 | 0.00 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 1.27 | 0.46 | 0.48 | n.a |

| Current Debt/Total Assets | 9% | 10% | 9% | n.a |

| Acid Test | 2.00 | 0.63 | 2.36 | n.a |

| Sales/Net Worth | 0.87 | 2.42 | 2.32 | n.a |

| Dividend Payout | 0.00 | 0.00 | 0.00 | n.a |

Appendix

| Sales Forecast | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | |||||||||||||

| Coffee houses | 0% | $0 | $0 | $0 | $2,500 | $2,656 | $2,899 | $3,365 | $3,989 | $4,545 | $4,989 | $5,225 | $5,656 |

| Restaurants | 0% | $0 | $0 | $0 | $1,550 | $1,647 | $1,797 | $2,086 | $2,473 | $2,818 | $3,093 | $3,240 | $3,507 |

| Grocery stores | 0% | $0 | $0 | $0 | $1,700 | $1,806 | $1,971 | $2,288 | $2,713 | $3,091 | $3,393 | $3,553 | $3,846 |

| Total Sales | $0 | $0 | $0 | $5,750 | $6,109 | $6,668 | $7,740 | $9,175 | $10,454 | $11,475 | $12,018 | $13,009 | |

| Direct Cost of Sales | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Coffee houses | $0 | $0 | $0 | $825 | $876 | $957 | $1,110 | $1,316 | $1,500 | $1,646 | $1,724 | $1,866 | |

| Restaurants | $0 | $0 | $0 | $512 | $543 | $593 | $688 | $816 | $930 | $1,021 | $1,069 | $1,157 | |

| Grocery stores | $0 | $0 | $0 | $561 | $596 | $651 | $755 | $895 | $1,020 | $1,120 | $1,172 | $1,269 | |

| Subtotal Direct Cost of Sales | $0 | $0 | $0 | $1,898 | $2,016 | $2,200 | $2,554 | $3,028 | $3,450 | $3,787 | $3,966 | $4,293 | |

| Personnel Plan | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Frank | 0% | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Sales manager | 0% | $0 | $0 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 | $2,000 |

| Sales | 0% | $0 | $0 | $0 | $0 | $0 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 | $1,500 |

| Support | 0% | $0 | $0 | $0 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 |

| Shipping | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 |

| Administration | 0% | $0 | $0 | $0 | $0 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 | $1,280 |

| Total People | 1 | 1 | 2 | 2 | 3 | 5 | 6 | 6 | 6 | 6 | 6 | 6 | |

| Total Payroll | $2,000 | $2,000 | $4,000 | $5,280 | $6,560 | $8,060 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | |

| General Assumptions | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Profit and Loss | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Sales | $0 | $0 | $0 | $5,750 | $6,109 | $6,668 | $7,740 | $9,175 | $10,454 | $11,475 | $12,018 | $13,009 | |

| Direct Cost of Sales | $0 | $0 | $0 | $1,898 | $2,016 | $2,200 | $2,554 | $3,028 | $3,450 | $3,787 | $3,966 | $4,293 | |

| Other Costs of Goods | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Cost of Sales | $0 | $0 | $0 | $1,898 | $2,016 | $2,200 | $2,554 | $3,028 | $3,450 | $3,787 | $3,966 | $4,293 | |

| Gross Margin | $0 | $0 | $0 | $3,853 | $4,093 | $4,467 | $5,185 | $6,147 | $7,004 | $7,688 | $8,052 | $8,716 | |

| Gross Margin % | 0.00% | 0.00% | 0.00% | 67.00% | 67.00% | 67.00% | 67.00% | 67.00% | 67.00% | 67.00% | 67.00% | 67.00% | |

| Expenses | |||||||||||||

| Payroll | $2,000 | $2,000 | $4,000 | $5,280 | $6,560 | $8,060 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | |

| Sales and Marketing and Other Expenses | $200 | $200 | $400 | $528 | $656 | $806 | $934 | $934 | $934 | $934 | $934 | $934 | |

| Depreciation | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | $1,300 | |

| Rent | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | $1,200 | |

| Utilities | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | $650 | |

| Insurance | $750 | $750 | $750 | $750 | $750 | $750 | $750 | $750 | $750 | $750 | $750 | $750 | |

| Payroll Taxes | 15% | $300 | $300 | $600 | $792 | $984 | $1,209 | $1,401 | $1,401 | $1,401 | $1,401 | $1,401 | $1,401 |

| Other | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | $200 | |

| Total Operating Expenses | $6,600 | $6,600 | $9,100 | $10,700 | $12,300 | $14,175 | $15,775 | $15,775 | $15,775 | $15,775 | $15,775 | $15,775 | |

| Profit Before Interest and Taxes | ($6,600) | ($6,600) | ($9,100) | ($6,848) | ($8,207) | ($9,708) | ($10,590) | ($9,628) | ($8,771) | ($8,087) | ($7,723) | ($7,059) | |

| EBITDA | ($5,300) | ($5,300) | ($7,800) | ($5,548) | ($6,907) | ($8,408) | ($9,290) | ($8,328) | ($7,471) | ($6,787) | ($6,423) | ($5,759) | |

| Interest Expense | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Taxes Incurred | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Net Profit | ($6,600) | ($6,600) | ($9,100) | ($6,848) | ($8,207) | ($9,708) | ($10,590) | ($9,628) | ($8,771) | ($8,087) | ($7,723) | ($7,059) | |

| Net Profit/Sales | 0.00% | 0.00% | 0.00% | -119.09% | -134.35% | -145.59% | -136.82% | -104.94% | -83.91% | -70.48% | -64.27% | -54.26% | |

| Pro Forma Cash Flow | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $0 | $0 | $0 | $1,438 | $1,527 | $1,667 | $1,935 | $2,294 | $2,613 | $2,869 | $3,004 | $3,252 | |

| Cash from Receivables | $0 | $0 | $0 | $0 | $144 | $4,321 | $4,596 | $5,028 | $5,841 | $6,913 | $7,866 | $8,620 | |

| Subtotal Cash from Operations | $0 | $0 | $0 | $1,438 | $1,671 | $5,988 | $6,530 | $7,321 | $8,454 | $9,782 | $10,870 | $11,872 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $0 | $0 | $0 | $1,438 | $1,671 | $5,988 | $6,530 | $7,321 | $8,454 | $9,782 | $10,870 | $11,872 | |

| Expenditures | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $2,000 | $2,000 | $4,000 | $5,280 | $6,560 | $8,060 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | $9,340 | |

| Bill Payments | $110 | $3,300 | $3,317 | $3,943 | $8,054 | $6,607 | $7,247 | $8,098 | $8,696 | $9,057 | $9,293 | $9,314 | |

| Subtotal Spent on Operations | $2,110 | $5,300 | $7,317 | $9,223 | $14,614 | $14,667 | $16,587 | $17,438 | $18,036 | $18,397 | $18,633 | $18,654 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Spent | $2,110 | $5,300 | $7,317 | $9,223 | $14,614 | $14,667 | $16,587 | $17,438 | $18,036 | $18,397 | $18,633 | $18,654 | |

| Net Cash Flow | ($2,110) | ($5,300) | ($7,317) | ($7,786) | ($12,943) | ($8,679) | ($10,056) | ($10,117) | ($9,582) | ($8,615) | ($7,762) | ($6,782) | |

| Cash Balance | $113,890 | $108,590 | $101,273 | $93,487 | $80,544 | $71,865 | $61,809 | $51,692 | $42,110 | $33,495 | $25,732 | $18,950 | |

| Pro Forma Balance Sheet | |||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $116,000 | $113,890 | $108,590 | $101,273 | $93,487 | $80,544 | $71,865 | $61,809 | $51,692 | $42,110 | $33,495 | $25,732 | $18,950 |

| Accounts Receivable | $0 | $0 | $0 | $0 | $4,313 | $8,750 | $9,430 | $10,639 | $12,492 | $14,492 | $16,185 | $17,332 | $18,469 |

| Inventory | $0 | $0 | $0 | $0 | $2,087 | $2,217 | $2,420 | $2,809 | $3,330 | $3,795 | $4,165 | $4,362 | $4,722 |

| Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Current Assets | $116,000 | $113,890 | $108,590 | $101,273 | $99,887 | $91,512 | $83,715 | $75,257 | $67,514 | $60,396 | $53,845 | $47,427 | $42,141 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 | $78,000 |

| Accumulated Depreciation | $0 | $1,300 | $2,600 | $3,900 | $5,200 | $6,500 | $7,800 | $9,100 | $10,400 | $11,700 | $13,000 | $14,300 | $15,600 |

| Total Long-term Assets | $78,000 | $76,700 | $75,400 | $74,100 | $72,800 | $71,500 | $70,200 | $68,900 | $67,600 | $66,300 | $65,000 | $63,700 | $62,400 |

| Total Assets | $194,000 | $190,590 | $183,990 | $175,373 | $172,687 | $163,012 | $153,915 | $144,157 | $135,114 | $126,696 | $118,845 | $111,127 | $104,541 |

| Liabilities and Capital | Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $0 | $3,190 | $3,190 | $3,673 | $7,835 | $6,367 | $6,978 | $7,809 | $8,394 | $8,747 | $8,983 | $8,988 | $9,461 |

| Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Current Liabilities | $0 | $3,190 | $3,190 | $3,673 | $7,835 | $6,367 | $6,978 | $7,809 | $8,394 | $8,747 | $8,983 | $8,988 | $9,461 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $0 | $3,190 | $3,190 | $3,673 | $7,835 | $6,367 | $6,978 | $7,809 | $8,394 | $8,747 | $8,983 | $8,988 | $9,461 |

| Paid-in Capital | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 | $205,000 |

| Retained Earnings | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) | ($11,000) |

| Earnings | $0 | ($6,600) | ($13,200) | ($22,300) | ($29,148) | ($37,355) | ($47,062) | ($57,652) | ($67,280) | ($76,051) | ($84,138) | ($91,861) | ($98,920) |

| Total Capital | $194,000 | $187,400 | $180,800 | $171,700 | $164,853 | $156,645 | $146,938 | $136,348 | $126,720 | $117,949 | $109,862 | $102,139 | $95,080 |

| Total Liabilities and Capital | $194,000 | $190,590 | $183,990 | $175,373 | $172,687 | $163,012 | $153,915 | $144,157 | $135,114 | $126,696 | $118,845 | $111,127 | $104,541 |

| Net Worth | $194,000 | $187,400 | $180,800 | $171,700 | $164,853 | $156,645 | $146,938 | $136,348 | $126,720 | $117,949 | $109,862 | $102,139 | $95,080 |