Swarms of investors have gravitated toward holding 'defensive' ASX shares as the winds of economic uncertainty have picked up. However, many assume that must mean investing in mature companies with little to no potential for further expansion.

Who says you need to give up on growth to own defensive investments? While rare, I genuinely believe the best companies to invest in simultaneously carry the sword and the shield, so to speak. Such companies are able to aggressively pursue greater ambitions without too much concern about being breached by the competition.

If I had a spare $5,000 — or any reasonable amount — to invest right now, I'd be running the ruler over a few specific defensive ASX shares. Their moats (competitive advantages) are hard to come by.

ASX shares I'd consider for a defensive portfolio

Before I dive into the nitty-gritty of how each company could be safeguarded from disruption, let's take a look at one metric that suggests a moat is present.

A rule of thumb Warren Buffett follows for evaluating whether a company is in possession of a moat is a net profit margin consistently above 20%. If 20 cents or more can be made on every dollar generated by a product or service, there's probably some form of sustainable advantage at play.

All three defensive ASX shares that I will mention have achieved this, by a substantial margin, during the past three to five years.

Ideally, this margin would be stable or growing. This isn't the case for Clinuvel Pharmaceuticals Limited (ASX: CUV), as depicted in the chart above. However, the upwards trend is visible over a longer time span.

Meanwhile, Carsales.Com Ltd (ASX: CAR) has maintained a net margin above 30% for many years. Reassuringly, its cash from operations has been steadily growing during this time.

Finally, Deterra Royalties Ltd (ASX: DRR) appears as the most lucrative on this list — delivering net margins above 60% since 2019. The majority of its revenue is derived from its royalty over BHP Group Ltd's (ASX: BHP) Mining Area C.

Network effect

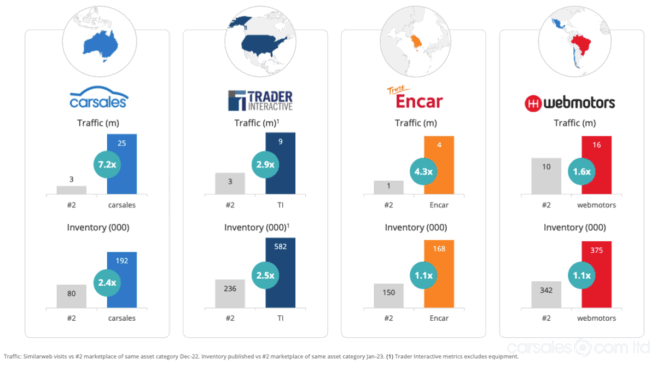

It is only logical to seek out the platform with the largest audience when hoping to sell a vehicle. The more visitors to the site, the greater the odds of finding a buyer. Conversely, the more vehicles advertised on a single site, the better experience it is as a potential buyer.

The above scenario is network effects in a nutshell. Toting the most popular vehicle marketplaces in several countries by a considerable margin (pictured above), Carsales is a cut above the rest. At the same time, the company could still satisfy further expansion through new markets.

Carsales shares are up 27.8% over the past year, outpacing the S&P/ASX 200 Index (ASX: XJO) by 25.6%.

Profit machine

Mining companies seldom make an appearance in my portfolio. The high capital and operational expenditure (CapEx and OpEx) associated with the industry can result in extremely lumpy cash flows. However, there is an ASX share that I believe is more defensive than many others on the local bourse… Deterra Royalties.

Unlike some other royalties, Deterra's claim to 1.232% of MAC revenue is indefinite with no expiration. That means Deterra will be clipping the ticket on all future revenue over the life of BHP's mine — an attractive proposition considering iron ore production at the mine is anticipated to increase moving forward.

The royalty model is highly advantageous. By definition, Deterra doesn't need to 'compete' against anyone, keeping operating expenses low and maximising shareholder returns.

Deterra shares are largely flat compared to a year ago, yet have returned 7.6% when including dividends.

Patented protection

Finally, Clinuvel Pharmaceuticals is a defensive ASX share with herculean potential, in my opinion. In recent times, the upcoming drug developer has enjoyed rapidly growing revenues by and large due to its Scenesse product.

Treating an extremely rare condition known as erythropoietic protoporphyria (EPP), Clinuvel holds a strong market position as the only US-approved drug. The company also holds patents over Scenesse ranging from 2026 to 2033.

As a result, Clinuvel is relishing in jumbo earnings that can be redeployed into the future development of other proprietary drugs.

Clinuvel shares are up 31.3% over the past year and are trading on a price-to-earnings (P/E) ratio of 40 times.