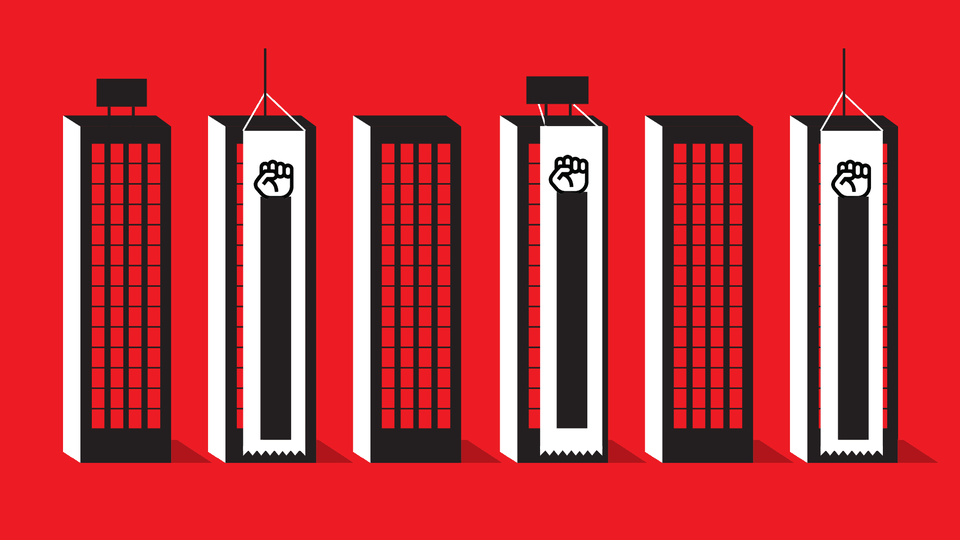

Beware of Corporate Promises

When firms issue statements of support for social causes, they don’t always follow through.

Change is afoot in corporate America. For the past two months, everyone from Chevron to Comcast and Hershey’s to Harvard Business School has put out statements containing the phrase “We stand in solidarity with the Black community,” or some very close variant. The sudden outpourings of corporate sentiment were widely dismissed as meaningless, hypocritical, opportunistic, or all three. But there’s reason to believe that such vocal calls for change from corporations could actually be worse than meaningless—and in fact damage the chances that corporations will follow through on meaningful change in the months and years ahead.

Why? Less than a year ago, nearly 200 CEOs signed a solemn pledge, issued by the Business Roundtable, to stop caring primarily about their shareholders and to serve the needs of their workers, communities, and country too. The Wharton management professor Tyler Wry has been compiling data on the signatories’ behavior since. “We were interested in whether these statements were worth the paper they were printed on, or just symbolic,” he told me recently. “When COVID hit, it was a natural experiment and a chance to see if companies were living up to their word.”

The results have startled him. As COVID-19 spread in March and April, did signers give less of their capital to shareholders (via dividends and stock buybacks)? No. On average, signers actually paid out 20 percent more of their capital than similar companies that did not sign the statement. Then, as the coronavirus swept the country, did they lay off fewer workers? On the contrary, in the first four weeks of the crisis, Wry found, signers were almost 20 percent more prone to announce layoffs or furloughs. Signers were less likely to donate to relief efforts, less likely to offer customer discounts, and less likely to shift production to pandemic-related goods. “Signing this statement had zero positive effect,” said Wry. Why, though, would it produce a negative effect?

Wry told me he has yet to nail down a causal explanation. (His first theory—that signing the statement drew counterpressure from institutional investors—found no supporting evidence.) But he said his findings are not inconsistent with psychological explanations. Behavioral psychologists have observed an effect they call “moral self-licensing”: If people are allowed to make a token gesture of moral behavior—or simply imagine they’ve done something good—they then feel freer to do something morally dubious, because they’ve reassured themselves that they’re on the side of the angels.

One of the starker examples happens to involve police and racial prejudice. In a 2001 study, the Princeton and Stanford psychologists Benoît Monin and Dale Miller asked subjects to imagine themselves as the police chief of a small town that has historically been exclusively white. Police officers in the department harbor racist attitudes and—a few years earlier—an African American officer had quit, citing the hostile environment. Now they need to hire a new officer. Should ethnicity be a factor? Is the job better suited for a Black candidate? Or a white one?

It didn’t matter, participants said.

But a second group was allowed to rubber-stamp the hiring of a Black candidate for an unrelated consulting job prior to being presented with this scenario. It was the most perfunctory of decisions—the three white consulting candidates were less qualified—but apparently enough to establish the participants’ moral bona fides such that they could then comfortably veer into prejudice. This second group was measurably more likely than the first to say that the policing job was better suited for a white person.

Was this all about avoiding the appearance of racism? Interestingly, no. The effect persisted in a similar experiment, even when no one else could see the subjects’ choices. So they weren’t protecting solely their reputation. It was also, at least partially, about their self-image. Maintaining a consistently good view of one’s self is very important to people—and very easily accomplished. In a 2008 version of the police-chief study, merely indicating that they would vote for Barack Obama in the upcoming election licensed participants to favor a white applicant for the position. In another setup in the 2001 study, the chance to disagree with brazenly sexist statements enabled people to favor male candidates over identically qualified women.

And therein lies the danger of tokenistic statements. They carry little risk of fooling the public—and a lot of risk of fooling the people who issue them. Which may partly explain why a decade of corporate commitments to “expanding diversity” has yielded so little palpable progress. In 2002, there were four Black CEOs atop Fortune 500 companies. Today there are … four. As Wes Moore, the CEO of the anti-poverty nonprofit Robin Hood told The New York Times, “We’ve been satisfied by putting John Rogers on every board,” referencing the Black investor who has served as a director at Exelon, McDonald’s, Nike, and the New York Times Company.

A few companies may have begun to grasp this. “Because we’re in brand building, our initial instinct is to say something, to post something,” the Procter & Gamble marketing chief, Marc Pritchard, said at a June business summit. But, he continued, “the days of ‘My thoughts and prayers are with you’ are over.”

Companies raise their odds of getting it right by asking questions instead of making statements. “Is this who we are?” “Are we getting this right?” And they realize that the real audience they’re trying to reach is themselves. This might require throwing the PR people out of the room. Ideally, too, firms will implement concrete changes while saying little about “change” in the abstract. Research is firm on this point: If you view initial steps as evidence of real progress toward a goal, you’re much more likely to drift away from it.