The Star Entertainment Group Ltd (ASX: SGR) share price is being spared after the release of its half-year results.

Still sitting in a trading halt, investors are none the wiser as to whether the market is taking today's results positively or negatively.

Star share price frozen as tarnishing takes its toll

Here are the highlights of the company's half-year results:

- Statutory revenue up 76% year on year to $1,013 million

- Earnings before interest, tax, depreciation, and amortisation (EBITDA) grew by 550% to $199.7 million

- Net losses deepened by 1,603% to reach $1,264 million

- Net assets fell 37% to $2,153.4 million

- An $800 million equity raising at $1.20 per share announced today

- Dividends suspended until the long-term target leverage of 2 to 2.5 times is reached and all licenses are returned

The six months ending December 2022 was unquestionably a diabolical stretch of time for the casino operator. Troubled by investigations, license stripping, and fines, Star Entertainment is perhaps lucky to still be standing.

Surprisingly, despite all the rumblings, some of the company's casinos performed strongly. Revenue from Star's Gold Coast and Brisbane locations increased by 30% and 9% respectively compared to their pre-pandemic levels. Although, the performance of its Sydney casino was not glowing, with revenue slipping 14% to the pre-COVID comparable.

The company's staggering $1.3 billion loss is comprised of several significant items. These include nearly a billion dollars in impairment costs to Star's Sydney property assets and goodwill; $350 million worth of penalties; and ongoing costs tied to its regulatory reviews.

What else happened in the first half?

There was little in the way of good news throughout the back half of 2022.

On 17 October, it was unveiled that the New South Wales gaming regulator — NSW Independent Casino Commission (NICC) — had handed down a $100 million fine.

In addition, NICC suspended the company's gaming license following unsettling findings from an inquiry. Remarkably, the Star share price rose more than 1% on the news.

Another spanner that was thrown into the works during the half was the New South Wales government's announced plans to bring reform to casino tax rates. Under the new reform, pokies will garner a top tax rate of 60.67%.

What did management say?

Star group CEO and managing director Robbie Cooke discussed the difficulties and the successes during the half, stating:

We have been pleased with the ongoing strength of trading across our Queensland-based properties while trading at The Star Sydney has been impacted by operational changes associated with the outcome of the Bell Review and increased competition.

Cooke put an emphasis on regaining the trust and confidence of the community moving forward. In doing so, a key focus is to prove its casinos are fit for purpose and to regain licenses.

What's next?

After entering a trading halt yesterday, Star has now announced capital structure initiatives to shore up the company amid the heightened uncertainty.

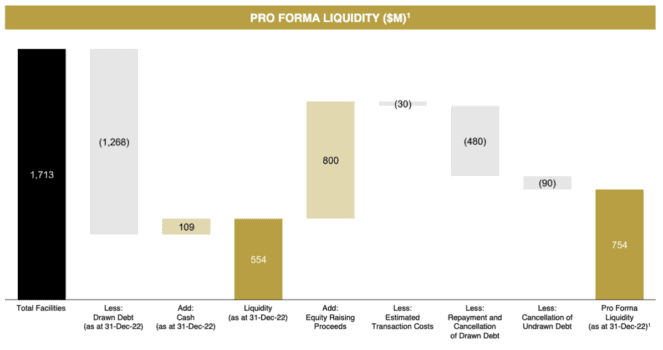

The plan is to raise $800 million in total through a $685 million entitlement offer and a $115 million institutional placement. Notably, this capital will be raised at a 21% discount to the current Star share price.

According to the release, the proceeds will be used to repay debt and increase liquidity.

Star Entertainment share price snapshot

Shares in the Australian casino operator have been in a world of pain. Not only over the past year, but across the last five years. The company's share price was unable to reclaim its pre-pandemic level after initially bouncing back.

The last 12 months have seen the Star share price crumble 56%, with steep falls in December and February.