- AUD/USD bias remains bearish.

- Chinese CPI missed market consensus, weighing further on the pair.

- China’s trade balance came better than expected, while the PBOC is expected to lower the RRR.

The AUD/USD price looks bearish biased below the 0.7400 key level. The price is 0.16% down, at 0.7352 while writing.

The Australian dollar has remained largely unchanged against the US dollar since the inflation in China, with factory prices pushing out of bounds in August. Due to Australia’s high trading volume with China, China’s economic data often affect the Australian dollar.

-Are you looking for automated trading? Check our detailed guide-

Last month, China’s consumer price index (CPI) rose 0.8%, missing the consensus of 1.0%. However, according to the Producer Price Index (PPI), Factory Gate prices rose 9.5% over the same period, exceeding predictions of 9.0% growth.

Economic growth is directly threatened by prices rising quickly. Early this year, the closure of ports and train stations, coupled with supply bottlenecks, caused many commodities’ prices to reach record levels. However, the resurgence of Covid cases caused by the Delta variant has caused some price spikes, which has worsened economic growth forecasts.

This, in turn, helped ease pressure on Chinese policymakers who took steps earlier this year to combat soaring prices for commodities like iron ore and copper. These commodities are vital to China’s recovery.

The Chinese trade balance was higher than expected earlier this week, which lowered the stakes on Beijing’s decision on additional support for the economy. Today’s pressure on the CPI will probably contribute to further cooling of those rates. The Chinese regulators are likely to be concerned if producer prices rise more than expected.

According to analysts, China’s People’s Bank of China (PBOC) is expected to lower its reserve requirement ratio (RRR) this month. China’s financial system will benefit from such a move. A reduction in the RRR was last made in July by the NBK.

Manufacturers are reluctant to pass on costs to consumers, as indicated by the disparity between inflation and factory prices compared to their respective forecasts. Businesses probably believe that their production costs are temporary and that their profits will cover these higher prices.

A decline in raw material prices is likely based on the weakness of raw materials and the progress made in the global vaccination campaign. Prices for steel and agricultural products have declined, but businesses will not immediately reap the savings as prices for the basket of goods have declined. This is because prices are usually provided several months in advance by manufacturers through contracts.

Although it is expected that factory gate prices will fall in the months to come if raw material prices remain moderate. Less stimulus for the Chinese economy could result in lower demand for Australian imports, which may not be a good sign for the Australian dollar.

-If you are interested in forex day trading then have a read of our guide to getting started-

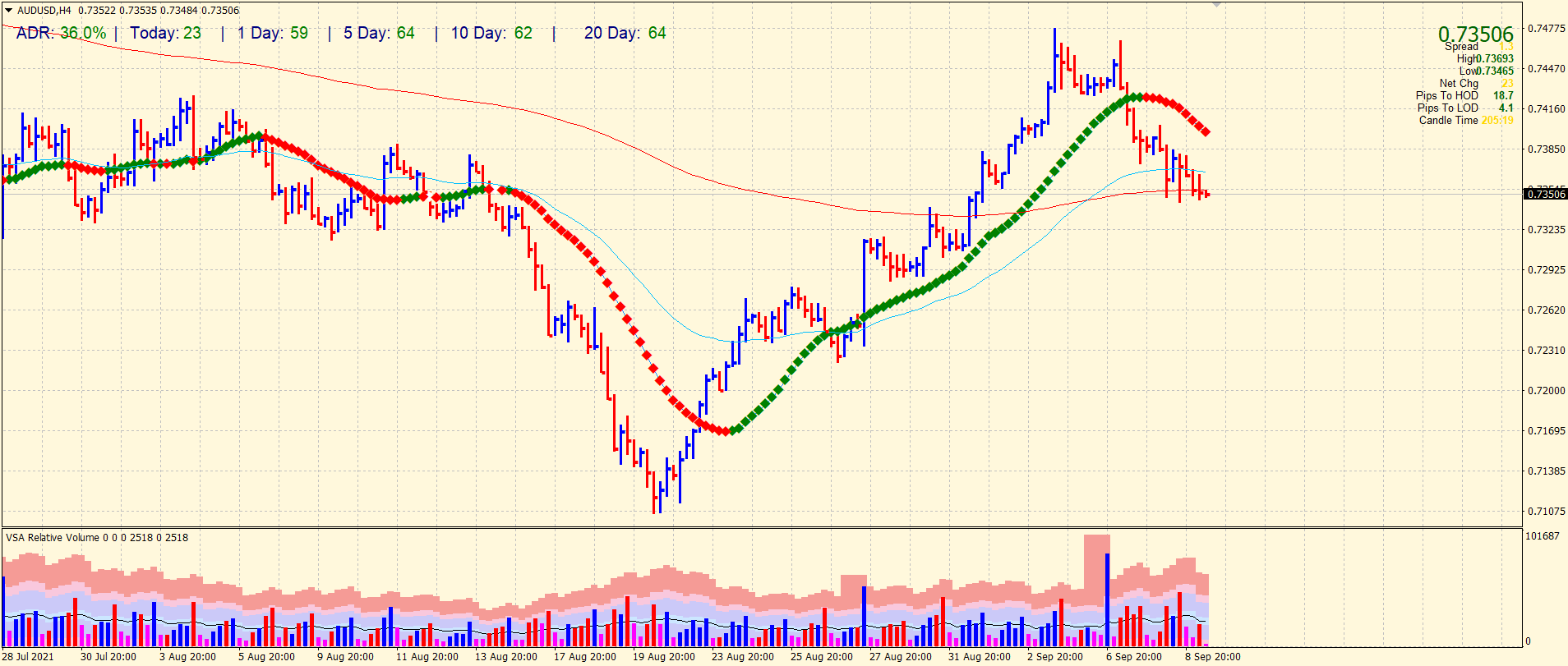

AUD/USD price technical analysis: 200-SMA supporting

The AUD/USD price is wobbling around the 200-period SMA on the 4-hour chart. The price dropped below the 50-period SMA but remains slightly supported by the 0.7350 level. The average daily range so far is 36% which indicates a normal trading activity. We may expect the price to decline to 0.7300 ahead of 0.7275. On the upside, we may see resistance around 0.7400.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.