The USD is mostly lower

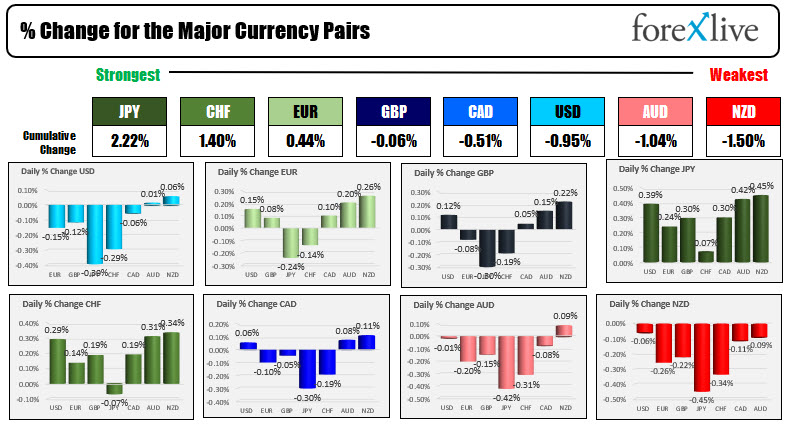

As North American traders enter for the day, the JPY is the strongest, while the NZD is the weakest. The USD is mostly lower with small gain versus the AUD and NZD to start the NY session. China economic data over night showed a slowing further in August led by Covid lockdowns. Retail sales slowed to 2.5% on the year which was much lower than the 6.9% expected. Industrial growth also slowed more than expected to 5.3% from 8.4% last month. The China real estate developer Evergrange Group is also reported to be on the verge of default. All of which helped to pressure China stocks which saw major indices moving lower. The Hang Seng index fell by -1.84%. As US traders enter, the major stock indices are mixed. The NASDAQ has declined 5 consecutive days. It is up modestly in premarket trading. The S&P and NASDAQ have been down five of the last six trading days. The US yields are little changed with a modest flattening.

In other markets, the US morning snapshot shows:

- Spot gold is trading down $1.59 or -0.09% at $1802.50.

- Spot silver is down four cents or -0.17% at $23.79.

- WTI crude oil futures continuing their move to the upside with the contract trading up one dollar or 1.43% at $71.47

- The price of bitcoin is trading up $532 and $47,635

In the premarket for US stocks, the futures are implying a mixed opening:

- Dow Jones -15 points after yesterday's -292.06 point decline

- S&P up 3.5 pointsafter yesterday's -25.66 point decline

- NASDAQ index up 25 points after yesterday's -67.82 point point

In the European equity markets, the major indices are lower:

- German DAX -0.15%

- France's CAC -0.5%

- UK's FTSE 100 unchanged

- Spain's Ibex -1%

- Italy's FTSE MIB -0.6%

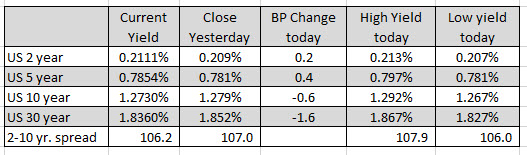

In the US debt market, the yields are mixed with a flatter bias. The two – 10 year spread as contracted by about one basis .2 106.2 basis point. The 30 year yield is trading at 1.836%, -1.6 basis point on the day.

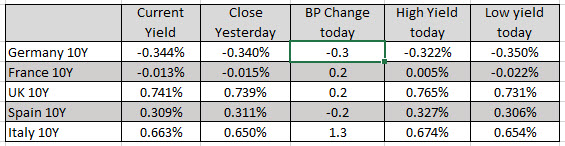

In the European debt market, the benchmark France 10 year yield is in negative territory at -0.013%. It has been waffling above and below the 0.0% level of late. The German benchmark 10 yearis trading down -0.3 basis points.

Economic calendar:

- Canada CPI, 8:30 AM. Month-to-month +0.1%

- US Empire say manufacturing index,, 8:30 AM. Estimate 18.1 versus 18.3 last month

- US import prices, 8:30 AM. Estimate 0.3%

- US industrial production capacity utilization. 9:15 AM. Industrial production 0.5% estimate and capacity utilization 76.3% estimate.

- Ctherude oil inventories will be released at 10:30 AM ET