Fossil Fuel Subsidies–The Truth

By Paul Homewood

The CO2 coalition have published a new paper, analysing the question of fossil fuel subsidies:

Executive Summary

A number of studies claim that pervasive subsidies provide an unfair competitive advantage to fossil fuels over renewable energy. Many estimates have been made of the value of direct and indirect subsidies provided to fossil fuels, the most extreme being the 2015 study by the International Monetary Fund estimating fossil fuels subsidies at $5 trillion annually.

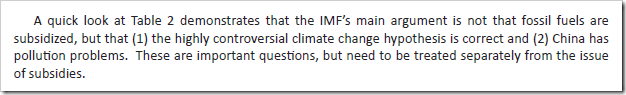

On examination, many of the direct subsidies in this study turn out to be generally available to other businesses, and most of the value of the indirect subsidies is estimated from uncertain projections of future damages from fossil-fueled global warming, which are discussed in detail in a previous CO2 Coalition White Paper, The Social Cost of Carbon and Carbon Taxes: Pick a number, any number. The most thoughtful and transparent evaluations of subsidies are those of the Organization for Economic Cooperation and Development (OECD), a European-based coalition of 36 market economies, and its International Energy Agency (IEA). Many of the roughly 2,200 items listed by the OECD as “subsidies” are debatable. However, focusing on subsidies alone obscures the real policy issue, which is whether government policy in total reduces fossil fuel prices below their hypothetical market level and whether these distortions occur in markets where renewables are trying to compete.

To address this issue, this White Paper (a) distinguishes “subsidies” from “externalities,” (b) includes taxes in the calculation, and (c) makes proper geographic distinctions. Taking these factors into account, the paper concludes that, even taking at full value the direct subsidies cited by the OECD and IEA, fossil fuels are significantly overtaxed and not unfairly advantaged in most countries of the world.

In fact, although most countries do offer some subsidies to fossil fuels, as outlined in the OECD data, the massive taxes imposed by most governments are generally far higher, resulting in a net increase in the price of fossil fuels. Taking into account all taxes and subsidies, fossil fuels in the United States are overtaxed by an estimated $50 billion per year. The 28 other largest industrial democracies (most of the European countries, Canada, South Korea, New Zealand and Australia) are overtaxed an estimated $363 billion, and the BRIC countries (Brazil, Russia, India, and China) are overtaxed an estimated $104 billion. The primary exceptions to this rule are found in oil-producing developing countries that offer their citizens heavily subsidized motor fuels but are not likely candidates for renewable energy.

The principal researcher for this White Paper is Bruce Everett, Ph.D. During his 45-year career in international energy, Dr. Everett was an economist with the U.S. Department of Energy and an executive with ExxonMobil.

He taught energy economics at the Georgetown University School of Foreign Service for ten years and was also an Adjunct Associate Professor of International Business at the Fletcher School of Tufts University for 17 years.

The paper begins by critiquing the conventional approach of calculating subsidies, used by the IMF and OECD:

It then proceeds to point out that taxation also needs to be taken account of:

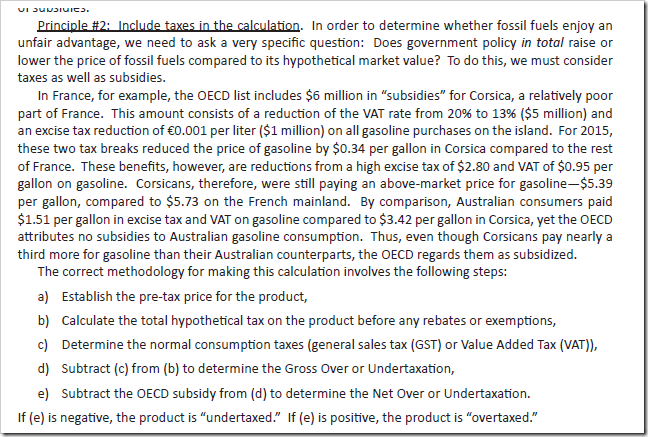

A detailed look at the US shows that fossil fuels are actually overtaxed by $60bn a year – in other words this is the amount raised by taxation OVER AND ABOVE standard taxation, such as State sales tax:

According to official OECD figures, US hands out annual subsidies worth $10bn to fossil fuels:

Meaning net overtaxation of $49bn:

The study carries out the same analysis for 28 other major industrial countries (excl BRICS), finding overtaxation of $362bn:

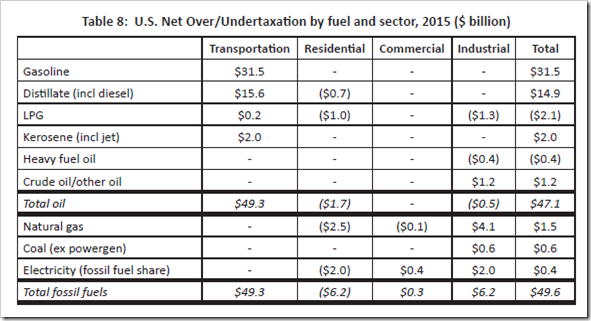

Even the BRICS countries are overtaxing fossil fuels:

It appears that fossil fuels only receive net subsidies in oil producing countries, notably Iran, Saudi, Indonesia and Venezuela:

As the report emphasises, it is a nonsense aggregating global subsidies, particularly when the numbers are used to claim that renewable energy is being unfairly penalised.

Comments are closed.

” … fossil fuels are significantly overtaxed …”

Just one example – fuel excise duty – from the UK:

Plus fuel duty and VAT. TAX on TAX.

And compare that with the subsidies, sorry payments, made to renewables.

“fossil fuels are significantly overtaxed”

No surprise there then.

Petrol in the UK is TAXED at OVER 200%.

I must admit that I have never received a subsidy payment when I fill up my oil tank There does seem to be tax all the way from VAT back to the producers.

Yes I saw this report, it’s a statement of the blindingly obvious, still nice to see someone attempt to put numbers on it.

It’s why the greens have to come up with all sorts of one sided fake ‘costs’ of carbon (and ignore the value of all the benefits).

How often did we used to hear that renewables needed subsidies until they became mature technologies? If they aren’t mature by now, and able to compete cost-wise on a level playing field, when will they ever be!

I wonder what will make up the significant shortfall in revenue to the exchequer once we’re all forced to stop using petrol and diesel and move to electric. Brace yourselves!

In the great left coast state of Washington (USA), investigations of a tax on miles driven have been on-going for about 3 years. Drivers now pay about 67 cents per gallon (note classic units), only 3 other states are higher. Money is being used for repair of roads and bridges. The “greens” objected to the 2015 tax hike because not a large enough percentage was to go to their favored projects.

Gas taxes had to go up because of the costs of materials and labor. Infrastructure was/is crumbling.

As more EVs enter the fleet, taxing will shift to them and there will be less ‘happy talk’ about owning one. As mentioned, planning for this is well along; political-will to follow.

Subsidies on fossil fuels and renewables should be judged on the basis of the net energy output and benefits to society. Omitting that is pure manipulation and fake news.

The subsidies claim, just like all the other claims the climate industry comes up is just a spoiler to distract those who like to understand what we are being sold from asking the obvious question which should be on everyone’s lips. This question is: SHOW US THE STATISTICALLY SIGNIFICANT EMPIRICAL DATA which demonstrates conclusively that CO2 alone controls the temperature of the air and by inference the surface of the planet and that it is ONLY CO2 removed from the Carbon Cycle many millions of years ago and returned to the carbon Cycle by man and not NATURE which is the control. Also SHOW US THE STATISTICALLY SIGNIFICANT EMPIRICAL DATA which demonstrates that the current warming which began 350 years ago, the fourth warming in recent human history controls the climate.

If there is no proven cause, there can be no proven effect Q.E.D.

Those are the fundamental questions which need to be answered with empirical proof before we waste even a nanosecond on any of the pointless trivia that the Climate Industrial Complex uses as a smoke screen to hide the fact that there is no basis for their trillion dollar industry.

What hampers the development of wind and solar power is cost and intermittency, plus the fat that neither are practical sources of energy for travel. It is long ago that the tea clippers were eclipsed. There are several stages of problems in incorporating wind and solar into grid electricity supply.

1) When the supply is large enough to cause grid flicker and stability problems that require additional investment in stabilisation (a problem that increases with each increase in penetration);

2) When peak supply leaves an insufficient inertia margin, causing the onset of curtailment, something that increases sharply from this point on, increasing the costs of curtailment that must be borne by consumers;

3) As supply is geographically unbalanced relative to demand, causing the need for additional grid transmission capacity;

4) Giving rise to the need for increasing volumes of reserve capacity to cover days and nights of unfavourable weather, and to hand rapid transitions in weather conditions;

5) As supply increases across a wide geographic area to the point where interconnectors merely serve to link up oversupplied markets when production is at high utilisation, and markets in shortage when the weather is unfavourable, with limited benefit from interconnection as a means of balancing local markets;

6) When the subsidies run out and the whole system starts falling over.

“Do government policies favoring fossil fuels hamper the development of wind and solar power?”

Perhaps it should be stated another way. “Do reluctant government policies capitulating to the obvious truth that fossil fuels are efficient and cost-effective hamper the development of schemes shown to be high-priced failures such as wind and solar power”?

There, that’s better.