Oregon Business Tax Increase, Measure 97 (2016)

| Oregon Measure 97 | |

|---|---|

| |

| Election date November 8, 2016 | |

| Topic Taxes | |

| Status | |

| Type State statute | Origin Citizens |

| 2016 measures |

|---|

| November 8 |

| Measure 94 |

| Measure 95 |

| Measure 96 |

| Measure 97 |

| Measure 98 |

| Measure 99 |

| Measure 100 |

| Polls |

| Voter guides |

| Campaign finance |

| Signature costs |

The Oregon Business Tax Increase Initiative, also known as Measure 97, was on the November 8, 2016, ballot in Oregon as an initiated state statute.[1] It was defeated.

| A "yes" vote supported this proposal to remove the cap on the corporate gross sales tax, also known as the "minimum tax," and establish a 2.5 percent tax on gross sales that exceed $25 million. |

| A "no" vote opposed this proposal and retained the existing corporate tax structure. |

If approved, the new tax would have been implemented on January 1, 2017. According to the state's fiscal impact statement, state revenue would have increased by an estimated $548 million between January 1 and June 30, 2017. Thereafter, additional revenue from the measure would have been expected to be around $3 billion per year.[2]

In 2016, five other states had business taxes based on gross sales. Oregon had one of the lowest rates. If Measure 97 had been approved, Oregon would have had the highest top rate.

The campaigns surrounding Measure 97 engaged in the most expensive ballot measure battle in state history.[3] A combined total of $47,293,418 was raised in support of or opposition to the initiative. The previous record was set in 2014, when supporters and opponents of Measure 92, which would have mandated the labeling of foods containing GMOs, raised a combined total of $29 million.

Election results

| Measure 97 | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 1,164,658 | 59.03% | |||

| Yes | 808,310 | 40.97% | ||

- Election results from Oregon Secretary of State

Overview

Corporate income tax in Oregon

Measure 97’s tax increase would have impacted one type of corporation known as a C-corporation. "C-corporation" is an IRS designation for a business that pays its own taxes.[4] In Oregon, these businesses pay either what is known as a "minimum tax" of roughly 0.1 percent on sales or 6.6 percent on taxable income up to $1 million and 7.6 percent over $1 million, whichever amount is greater. The minimum tax on sales is capped at $100,000.[5][2]

Initiative design

Measure 97 would have transformed the structure of the minimum tax on sales. The cap of $100,000 would have been eliminated. Sales above $25 million would have been taxed at a rate of $30,001 plus 2.5 percent. Sales below $25 million would have continued to be taxed at roughly 0.1 percent. C-corporations with a high enough income would have continued to be taxed according to their income rather than gross sales. Businesses that adopted goals to help communities and the environment, also known as "benefit companies," would have been exempt from the increase.[1][6]

A C-corporation with $25 million or less in sales would not have been affected by the change. A corporation with $100 million dollars in sales would have seen its minimum tax obligation increase from 0.1 percent to 1.91 percent. For more examples of the direct impact of the initiative on hypothetical corporations, see the table below:

| C-corporation minimum tax going into the election and under Measure 97 | ||||

|---|---|---|---|---|

| Gross sales | Minimum tax under law in 2016 | As percent of sales under 2016 law | Minimum tax under Measure 97 | As percent of sales under Measure 97 |

| $1 million | $1,000.00 | 0.10% | $1,000.00 | 0.10% |

| $2 million | $1,500.00 | 0.08% | $1,500.00 | 0.08% |

| $3 million | $2,000.00 | 0.07% | $2,000.00 | 0.07% |

| $5 million | $4,000.00 | 0.08% | $4,000.00 | 0.08% |

| $7 million | $7,500.00 | 0.11% | $7,500.00 | 0.11% |

| $10 million | $15,000.00 | 0.15% | $15,000.00 | 0.15% |

| $25 million | $30,000.00 | 0.12% | $30,000.00 | 0.12% |

| $30 million | $30,000.00 | 0.10% | $155,001.00 | 0.52% |

| $50 million | $50,000.00 | 0.10% | $655,001.00 | 1.31% |

| $75 million | $75,000.00 | 0.10% | $1,280,001.00 | 1.71% |

| $100 million | $100,000.00 | 0.10% | $1,905,001.00 | 1.91% |

| $150 million | $100,000.00 | 0.07% | $3,155,001.00 | 2.10% |

| $250 million | $100,000.00 | 0.04% | $5,655,001.00 | 2.26% |

| $500 million | $100,000.00 | 0.02% | $11,905,001.00 | 2.38% |

| $1 billion | $100,000.00 | 0.01% | $24,405,001.00 | 2.44% |

The initiative would have instructed the state to spend revenue generated by the increase on public early childhood and K-12 education, healthcare, and services for senior citizens.[1]

State of ballot measure campaigns

The No on 97 campaign outraised supporters by $9 million. Yes on 97 raised $19.16 million and opponents raised $28.13 million. The top donor to the "Yes" campaign was the Oregon Education Association, which contributed $5.17 million. The top donors to the "No" campaign were Albertsons Safeway, Costco, and Kroger/Fred Meyer. Each contributed $2.38 million. The New York-based Wall Street Journal opposed the measure. While Gov. Kate Brown (D) supported Measure 97, her opponent in the 2016 gubernatorial election, Bud Pierce (R), opposed it. Polls indicated that support for Measure 97 decreased between mid September and October 14, 2016. An average of polls showed support around 46 percent and opposition near 42 percent prior to the election.

Background

- See also: Tax policy in Oregon

Business tax structure

According to the Anderson Economic Group (AEG), Oregon had the lowest business tax burden among all of the 50 states and Washington, D.C., in 2016. The AEG report stated that corporate tax revenue in Oregon amounted to 6.58 percent of pre-tax earnings. Alaska had the highest business tax burden at 16.83 percent of pre-tax earnings.[7]

In 2013, only $500 million of the $6.2 billion the state collected in business taxes was from corporate income.[8] Only five other states had taxes based on gross receipts in 2016, and, if this measure had passed, Oregon would have had the highest rate.[9] The gross receipt tax rate in Washington ranged from 0.138 percent to 3.3 percent. Ohio had a 0.26 percent gross receipt tax. These rates compare to 2.5 percent in Oregon as proposed under Measure 97 and 0.1 percent under the law going into the election.[10] Measure 97 would not have changed the existing corporate income tax of 6.6 percent on taxable income up to $1 million and 7.6 percent on taxable income over $1 million. Whichever rate amounted to a higher tax payment would have applied: either the 2.5 percent on gross sales or the 6.6/7.6 percent tax on income.

In 2012, about 70 percent of corporations payed the minimum tax rather than the corporate income tax.[11] Under the business tax structure going into the election, 9 percent of business tax revenue comes from the corporate minimum tax and 91 percent comes from the corporate income tax. Under Measure 97, 6 percent would have come from the corporate income tax and 94 percent would have come from the corporate minimum tax.[12]

Similar taxes in other states

According to the Tax Foundation, five other states — Delaware, Ohio, Nevada, Texas, and Washington — had taxes on the gross sales receipts of businesses in 2016. Some states, including Nevada and Washington, varied the tax according to industry. Texas allowed businesses to deduct the costs of goods and employee compensation. New Mexico also has a gross receipts tax of 5.125 percent to 8.6875 percent which is often passed on to the customer and acts similarly to a sales tax. The table below illustrates taxes on the gross sales receipts of businesses across the six states in 2016:[13][14]

| Measure 97 and gross sales receipts taxes in 2016 | |||||||

|---|---|---|---|---|---|---|---|

| State | Tax rate | ||||||

| Delaware | 0.0945% - 0.7468% | ||||||

| Nevada | 0.0051% - 0.331% | ||||||

| Ohio | 0.26% | ||||||

| Oregon (2016) | 0.1% | ||||||

| Oregon (Measure 97) | 0.1% - 2.5% | ||||||

| Texas | 0.331% - 0.75% | ||||||

| Washington | 0.13% - 3.3% | ||||||

| New Mexico[15] | 5.125%[16] | ||||||

| *Sources: The Tax Foundation, "Oregon Measure 97," April 28, 2016 | |||||||

Text of measure

Ballot title

The ballot title was as follows:[2]

| “ | Increases corporate minimum tax when sales exceed $25 million; funds education, healthcare, senior services

Result of 'Yes' Vote: 'Yes' vote increases corporate minimum tax when sales exceed $25 million; removes tax limit; exempts "benefit companies"; increased revenue funds education, healthcare, senior services. Result of 'No' Vote: 'No' vote retains existing corporate minimum tax rates based on Oregon sales; tax limited to $100,000; revenue not dedicated to education, healthcare, senior services. Summary: Current law requires each corporation or affiliated group of corporations filing a federal tax return to pay annual minimum tax; amount of tax is determined by tax bracket corresponding to amount of corporation's Oregon sales; corporations with sales of 100 million or more pay $100,000. Measure increases annual minimum tax on corporations with Oregon sales of more than $25 million; imposes minimum tax of $30,001 plus 2.5% of amount of sales above $25 million; eliminates tax cap; benefit companies (business entities that create public benefit) taxed under current law. Applies to tax years beginning on/after January 1, 2017. Revenue from tax increase goes to: public education (early childhood through grade 12); healthcare; services for senior citizens.[17] |

” |

Ballot summary

The explanatory statement was as follows:[2]

| “ | Ballot Measure 97 increases the corporate minimum tax for corporations with at least $25 million in Oregon sales. Currently, Oregon C corporations pay the higher of either an excise tax or a minimum tax based on the corporation’s sales in Oregon.

Ballot Measure 97 increases the annual minimum tax on corporations with Oregon sales of more than $25 million. It imposes a minimum tax of $30,001 plus 2.5 percent of amount of sales above $25 million. Oregon sales under $25 million would not be affected. Ballot Measure 97 exempts “benefit companies” from the increased rate of minimum tax. “Benefit companies” are defined under Oregon law. Ballot Measure 97 states that revenues generated from the increase in the corporate minimum tax are to be used to provide additional funding for education, healthcare and services for senior citizens.[17] |

” |

Full text

The full text of the measure was as follows:[2]

Section 1. ORS 317.090 is amended to read: (1) As used in this section:

(2) Each corporation or affiliated group of corporations filing a return under ORS 317.710 shall pay annually to the state, for the privilege of carrying on or doing business by it within this state, a minimum tax as follows:

(3) The minimum tax is not apportionable (except in the case of a change of accounting periods), and is payable in full for any part of the year during which a corporation is subject to tax. Section 2. The amendments to the minimum tax made by Section 1 of this 2016 Act do not apply to any legally formed and registered “benefit company,” as that term is defined in ORS 60.750. A legally formed and registered “benefit company” shall pay the minimum tax set forth in ORS 317.090(2) in effect prior to the passage of this 2016 Act. Section 3. All of the revenue generated from the increase in the tax created by this 2016 Act shall be used to provide additional funding for: public early childhood and kindergarten through twelfth grade education; healthcare; and, services for senior citizens. Revenue distributed pursuant to this section shall be in addition to other funds distributed for: public early childhood and kindergarten through twelfth grade education; healthcare; and, services for senior citizens. Section 4. The amendments to ORS 317.090 made by Section 1 of this 2016 Act and Sections 2 and 3 of this 2016 Act apply to tax years beginning on or after January 1, 2017. Section 5. If any provision of this 2016 Act is held invalid for any reason, all remaining provisions of this Act shall remain in place and shall be given full force and effect. |

Fiscal impact statement

- See also: Fiscal impact statement

The fiscal impact statement was as follows:[2]

| “ | The measure is anticipated to increase state revenues by $548 million from January 1st to June 30th of 2017, and approximately $3 billion for every year beginning July 1st after that.

The financial impact on state expenditures by program is indeterminate. The increased revenue will require increased expenditures by the state in the areas of public early childhood and kindergarten through grade 12 education, health care, and senior services, but the exact amount and the specific uses within the three identified programs cannot be determined. Although there is no direct financial effect on local government expenditures or revenues, there is likely to be an indirect and indeterminate effect on the state economy and local government revenues and expenditures.[17] |

” |

Support

Yes on 97, also known as A Better Oregon, led the campaign in support of Measure 97.[18]

The initiative campaign was backed by Our Oregon, a coalition of labor unions and other groups.[8]

Supporters made the following arguments in support of Measure 97:[2]

- The measure would make large and out-of-state corporations pay their fair share in taxes.

- Less than 1 percent of businesses would see a tax increase under Measure 97.

- The measure would protect small businesses.

- The measure would help the state budget become stable and decrease the risk of budget cuts.

- The measure would increase investment in Oregon's children and families.

- The measure would improve graduation rates, make healthcare more accessible, and provide seniors with in-home care.

Supporters

Officials

- Gov. Kate Brown (D)[2]

- U.S. Sen. Bernie Sanders (I) of Vermont[19]

- U.S. Sen. Elizabeth Warren (D) of Massachusetts[20]

- Labor Commissioner Brad Avakian (D)

- Sen. Michael Dembrow (D-23)

- Sen. Sara Gelser (D-8)[21]

- Sen. Diane Rosenbaum (D-21)

- Sen. Chip Shields (D-22)

- Rep. Jeff Barker (D-28)

- Rep. Phil Barnhart (D-11)

- Rep. Peter Buckley (D-5)

- Rep. Margaret Doherty (D-35)

- Rep. Shemia Fagan (D-51)

- Rep. Lew Frederick (D-43)

- Rep. Joseph Gallegos (D-30)

- Rep. David Gomberg (D-10)[22]

- Rep. Chris Gorsek (D-49)

- Rep. Mitch Greenlick (D-33)

- Rep. Paul Holvey (D-8)

- Rep. Alissa Keny-Guyer (D-46)

- Rep. Tina Kotek (D-44)

- Rep. Ann Lininger (D-38)

- Rep. Susan McLain (D-29)

- Rep. Rob Nosse (D-42)

- Rep. Dan Rayfield (D-16)

- Rep. Tobias Read (D-27)[23]

- Rep. Kathleen Taylor (D-41)

- Rep. Barbara Smith Warner (D-45)

- Rep. Jennifer Williamson (D-36)

Former officials

- Gov. Ted Kulongoski (D)

- Gov. Barbara Roberts (D)

Candidates

The following were candidates for the Oregon House of Representatives who supported Measure 97:[21]

The following were candidates for the Oregon Senate who did not hold an elected office and supported Measure 97:[21]

|

Organizations

Civic organizations

Education organizations

|

Businesses

|

Unions

- American Association of University Professors (AAUP) – Oregon

- American Federation of State, County and Municipal Employees (AFSCME)

- American Federation of Teachers (AFT) Oregon

- Carpenters Union Local 271

- Communications Workers of America

- Hillsboro Classified United – AFT Local 4671

- Oregon AFL-CIO

- Oregon Education Association

- Oregon Nurses Association

- Oregon School Employees Association

- Portland Community College Federation of Classified Employees American Federation of Teachers Local 3922

- Service Employees International Union (SEIU) 503

- Service Employees International Union Local 49

- United Academics of the University of Oregon

- United Food and Commercial Workers (UFCW) Local 555

- United Steelworkers District 12

- USW Oregon L&E

- Western Oregon University Federation of Teachers

Individuals

Local officials

School board members

Teachers and academics

Religious leaders

Healthcare professionals

|

Arguments

Yes on Measure 97’s “Oregon's Numbers Problem"

|

Yes on 97 argued five points in support of Measure 97:[27]

| “ | We can reduce our class sizes by hiring 7,500 teachers.

We can grow Career and Technical Education so our kids can transition to good jobs. We can make health care more affordable and decrease out-of-pocket expenses. We can help 20,000 Oregon seniors retire in dignity by providing them with quality in-home care. We can hold big corporations accountable for their share and build a better Oregon![17] |

” |

Rep. Phil Barnhart (D-11) and Rep. Peter Buckley (D-5) wrote an opinion piece supporting Measure 97 featured in The Register-Guard. An excerpt from their article was as follows:[28]

| “ | We have already shortchanged two generations of Oregon students — and if we don’t act now, we will shortchange more Oregonians. With IP 28 [Measure 97], we can finally start reinvesting in our children and families. We’ll see our students graduate at higher rates, prepared for success. We’ll make health care affordable for all Oregonians, and allow more seniors to retire with dignity.

And with IP 28 [Measure 97], we can make those improvements in a progressive way by asking large and out-of-state corporations to start paying their share. It’s time do right by Oregon. It is time for giant international corporations to finally pay their fair share for the most basic services that they benefit from.[17] |

” |

Other arguments in support of the measure included:

- House Speaker Tina Kotek (D-44) argued, "We have a revenue problem in this state. ... [While the measure is not perfect,] it would solve our revenue problem."[29]

Citizens' review arguments

The Oregon Citizen Initiative Review Panel wrote a statement in favor of and a statement opposed to Measure 97. The following was the statement in favor:[2]

| “ | We, 11 members of the Citizens’ Initiative Review, support Measure 97 for the following reasons:

(11 of 20 panelists took this position)[17] |

” |

Submitted arguments

A total of 18 arguments were submitted to appear in the voter guide in support of Measure 97. Some of these arguments appear below:[2]

|

Campaign advertisements

The following video advertisements were produced by Yes on 97:[30]

|

|

|

|

|

|

Allegation of Comcast demands

Yes on 97 alleged that Comcast, a contributor to No on Prop 97, was demanding that television advertisements run on its channels not mention "Comcast." John Coghlan, an advertiser purchaser for Yes on 97, said, "They [Comcast] told us we would have to remove any reference to Comcast, including their logo." Yes on 97 abided, removing references to Comcast from the ads designated for its channels. Examples of changes made included:[31][32]

- In the ad titled "Oregon Is Dead Last In Corporate Taxes. Measure 97 Makes Big Corporations Pay Their Fair Share," Yes on 97 modified the line "... large and out-of state corporations like Comcast and Montsano pay little to nothing" to "... large and out-of state corporations like Wells Fargo and Montsano pay little to nothing."

- In an ad featuring Rob Cohen, owner of Falling Sky Brewing, Cohen said, "turns out I’m paying a higher tax rate than large out-of-state corporations like Comcast." The altered ad dropped the comparison to Comcast.

- In an ad featuring economics professor Matin Hart-Landsberg, Comcast was one of the logos in the background. The version of this ad that ran on Comcast replaced the Comcast logo with a BP logo.

Shamus Lynsky, executive director of the Oregon Consumer League, responded to the allegations, stating, “This is a clear and unprecedented act of censorship by Comcast. Voters deserve to know the truth about Comcast and other large corporations that have gotten away with paying close to nothing in Oregon taxes for years.” KOIN 6 asked Comcast for a statement, but one was not received.[33]

Opposition

No On Measure 97, also known as Defeat the Tax on Oregon Sales, led the campaign in opposition to Measure 97.[34]

Opponents made the following arguments against Measure 97:

- The measure would increase taxes $600 per year per capita—the biggest tax increase in state history.

- The measure would be a regressive tax, burdening low-income earners more than high-income earners.

- The measure would tax gross sales, not profits.

- The measure would hurt farmers and small businesses.

- The measure would decrease the rate of job creation.

- The measure would not do enough to guarantee that revenue is spent on education, healthcare, and seniors.

Opponents

Officials

- Bud Pierce (R), 2016 gubernatorial candidate[35]

- Jeff Gudman (R), 2016 Treasurer candidate[23]

- Sen. Brian Boquist (R-12)[21]

- Sen. Ted Ferrioli (R-30)

- Sen. Bill Hansell (R-29)

- Rep. Cliff Bentz (R-60)

- Rep. Knute Buehler (R-54)

- Rep. Sal Esquivel (R-6)

- Rep. Victor Gilliam (R-18)

- Rep. Jodi Hack (R-19)

- Rep. John Huffman (R-59)

- Rep. Mark Johnson (R-52)

- Rep. Bill Kennemer (R-39)

- Rep. Mike McLane (R-55)

- Rep. Mike Nearman (R-23)

- Rep. Ron Noble (R-24)

- Rep. Julie Parrish (R-37)

- Rep. Bill Post (R-25)

- Rep. Jeff Reardon (D-48)

- Rep. Carl Wilson (R-3)

- Clackamas County Board of Commissioners[36]

- Washington County Board of Commissioners

Former officials

Candidates

The following were candidates for the Oregon House of Representatives who opposed Measure 97:[21]

The following were candidates for the Oregon Senate who did not hold an elected office and opposed Measure 97:[21]

|

Organizations

|

Businesses

|

Arguments

A No on 97 advertisement

|

No On Measure 97 argued seven points in opposition to Measure 97:[41]

| “ | #1. Measure 97 is a tax on total sales - not profits - that would increase consumer costs for all types of products and services.

|

” |

Steve Buckstein, founder and senior policy analyst at Cascade Policy Institute, wrote:[42]

| “ | While the unions portray their measure as making large, out-of-state corporations pay their fair share of Oregon taxes, the nonpartisan Legislative Revenue Office has released a detailed report giving a much more balanced perspective, which includes:

Perhaps most telling, the Legislative Revenue Office concludes that IP 28 will act largely like a consumption tax. It estimates that roughly two-thirds of that $6 billion per biennium tax increase will be passed on to Oregon consumers in the form of higher prices. Another name for a consumption tax is a sales tax. The reality that IP 28 would effectively be a sales tax should be a lesson for all Oregonians that businesses generally don’t pay taxes, people do. Even the largest corporations are made up of people, namely employees, and sell their goods and services to other people, namely customers. It is largely these two groups of people who pay so-called business taxes like the one that IP 28 would impose.[17] |

” |

Citizens' review arguments

The Oregon Citizen Initiative Review Panel wrote a statement in favor of and a statement opposed to Measure 97. The following was the statement in opposition:[2]

| “ | Citizen Statement Opposed to the Measure:

We, 9 members of the Citizens’ Initiative Review, are opposed to Measure 97 for the following reasons:

The passage of M97 would create a regressive tax. A regressive tax takes a larger percentage of income from low income earners creating an unnecessary burden on many Oregon families. One of the major risks of passing M97 is significant job loss. Another result of passing M97 could be a large increase in costs to corporations resulting in increased costs to consumers. This could lead to decreased economic stability and bring financial harm to all Oregonians. Efficiency, transparency, and fairness are the core values at stake in this matter. (9 of 20 panelists took this position)[17] |

” |

Submitted arguments

A total of 52 arguments were submitted to appear in the voter guide in opposition to Measure 97. Some of these arguments appear below:[2]

|

Campaign advertisements

The following video advertisements were produced by No On Measure 97:[43]

|

|

|

|

|

|

Campaign finance

| Total campaign contributions: | |

| Support: | $19,160,608.07 |

| Opposition: | $28,132,809.64 |

As of February 7, 2017, the support campaign for this initiative featured four ballot question committees, Yes on 97, Defend Oregon, NICEPAC, and A Better Oregon VI. A Better Oregon VI was active during the signature petition circulation for Initiative 28, which became Measure 97, and the committee was officially registered as an initiative petition committee rather than a ballot measure committee. The support campaign received a total of $19,160,608.07 in contributions.[44]

The opposition campaign for the initiative featured two ballot question committees, Defeat the Tax on Oregon Sales and Create Jobs PAC, that received a total of $28,132,809.64 in contributions.[45]

Support

Cash donations

The following ballot question committees registered to support this initiative as of February 7, 2017. The chart below shows cash donations and expenditures current as of February 7, 2017.

Defend Oregon was registered in support of seven measures on the 2016 ballot. Due to how committees report funds, it was impossible to disaggregate the Defend Oregon's contributions and expenditures between the measures.

For a summary of in-kind donations, click here.[44][46][47]

Note: Committees that have less listed for either donations or expenditures than reported on the secretary of state's website were used to provide funds to other committees and were not designed to spend all of their money directly on a supporting or opposing campaign. See Ballotpedia's campaign finance methodology below.

| Committee | Amount raised[48] | Amount spent |

|---|---|---|

| Yes on 97 | $15,545,527.01 | $15,449,755.45 |

| Defend Oregon | $1,627,079.90 | $1,355,522.04 |

| NICEPAC | $7,460.00 | $7,671.85 |

| A Better Oregon VI[49] | $48,807.91 | $48,807.91 |

| Total | $17,228,874.82 | $16,861,757.25 |

In-kind services

As of February 7, 2017, the ballot question committees registered to support this initiative received in-kind services in the amount of $1,931,733.25. The top in-kind donor was Our Oregon.[44]

Top donors

As of February 7, 2017, the following were the top five donors to Yes on 97 and A Better Oregon VI:[44]

| Donor | Amount |

|---|---|

| Oregon Education Association | $5,168,272.00 |

| SEIU Local 503 | $3,693,278.00 |

| National Education Association | $2,361,974.00 |

| SEIU | $1,543,579.20 |

| Oregon AFSCME Council 75 | $1,501,107.00 |

Defend Oregon was excluded from the top donors table because contributors were not donating to a specific measure. As of February 7, 2017, the top donors to Defend Oregon were: Citizen Action for Political Education ($706,750), AFT - Oregon Issues PAC ($250,000), National Education Association ($150,000), Nurses United Political Action Committee ($100,000), and Oregon AFSCME Council 75 ($100,000).

Opposition

Cash donations

The following ballot question committees registered to oppose this initiative as of February 7, 2017. The chart below shows cash donations and expenditures current as of February 7, 2017. For a summary of in-kind donations, click here.[45]

| Committee | Amount raised[48] | Amount spent |

|---|---|---|

| Defeat the Tax on Oregon Sales | $27,597,607.28 | $26,466,026.36 |

| Create Jobs PAC | $210,356.00 | $223,740.69 |

| Total | $27,807,963.28 | $26,689,767.05 |

In-kind services

The committees opposed to the initiative received $324,846.36 in in-kind services as of February 7, 2017.[45]

Top donors

As of February 7, 2017, the following were the top five donors in opposition to Measure 97:[50]

| Donor | Amount |

|---|---|

| Albertsons Safeway (Portland Division) | $2,383,000.00 |

| Costco Wholesale Corporation | $2,383,000.00 |

| Kroger/Fred Meyer | $2,383,000.00 |

| Lithia Motors, Inc. | $555,000.00 |

| Cambia | $480,000.00 |

Methodology

To read Ballotpedia's methodology for covering ballot measure campaign finance information, click here.

Media editorials

- See also: 2016 ballot measure media endorsements

Support

- The Eugene Weekly said, "Education is one of the most important investments Oregon could possibly make. For the past two decades, our state has shortchanged its future by selling our public school system short. Enough is enough, and it’s time to fund schools with a 'yes' vote on Measure 97."[51]

- The Portland Mercury said, "It’s clear, given both our state’s challenges and basic fairness, that large companies should pay more. We’re not sure Measure 97 is exactly the right type of 'more,' but it’s something—which is more than Oregon has been able to accomplish on this issue in far too long."[52]

- The Salem Weekly: "Oregon, too, has struggled to satisfy demands that a growing population places upon our transportation infrastructure, state police, parks, schools, and health care system. ... This is not a regressive sales tax. Levied only on 'C' corporations with over $25 million in sales, 99.75% of Oregon’s businesses will not have to pay the tax, and most of those that will pay are large, interstate chains such as Walmart, Comcast, Bank of America, and McDonalds. ... Citizens expect government to deliver high quality services. Measure 97 will make it possible for Oregon to regain some of the ground recently lost and to rebalance the tax burden."[53]

- Street Roots said: "This is a flawed measure, no question. But it swings the pendulum in the right direction and gives the Legislature a foundation to build upon. It needs to be modified to alleviate potential pressures on lower income residents, particularly regarding the increase of utility costs and health care. But the push has to come from somewhere, and low-income Oregonians are also already bearing the brunt of Oregon’s underfunded public schools and limited access to health care."[54]

Opposition

- The Bend Bulletin said, "The measure, which would bump up taxes on Oregon sales of $25 million or more, goes much further than that, right into your wallet, as a matter of fact. ... We’ve noted before that while IP 28 [Measure 97] would bring pots of new tax money into state coffers, it would do so at a terrible price, one paid by virtually every person in the state. The measure does not simply apply to 'rich' out-of-state corporations. It applies to regulated power companies, booksellers, perhaps the family doctor, even companies not making a profit at all. And as each of those raises prices, it’s the customers who will pay."[55]

- The Corvallis Gazette-Times said, "We recommend a 'no' vote on this poorly conceived measure, which will end up costing Oregon consumers."[56]

- The Dalles Chronicle said, "The board voted 6-1 in opposition to Measure 97... The majority were against the measure out of the belief it is poorly crafted and funding disbursement of about $3 billion per year would be left up to the Legislature, so would not necessary go where promised."[57]

- East Oregonian endorsed a "No" vote.[58]

- The Mail Tribune said, "We are not suggesting that Oregon does not need more revenue, or that its tax system does not need reform. But Measure 97 would generate more revenue by making the tax system less fair, not more. The state is long overdue for a real overhaul of its lopsided tax structure. Measure 97 is not it, and if it passes, that needed overhaul will be even less likely to happen."[59]

- The Oregonian said, "It should go without saying that money's not free. The state's taxation decisions should be driven by an honest discussion of tradeoffs and consequences. That's responsible policymaking. Measure 97 is not."[60]

- Pamplin Media Group, publisher of the Lake Oswego Review, said, "As a report from the nonpartisan Legislative Revenue Office has shown, families will pay much of this regressive tax — which will be levied on a corporation’s Oregon sales exceeding $25 million — because the businesses affected by it are selling the very products that ordinary people use each day: groceries, clothing, gasoline, medicine and electricity. ... A tax expansion as massive as Measure 97 — which would increase total state government tax receipts by 25 percent — would hit every household budget in Oregon. If families have less money available, they are less likely to approve bond measures that also will add significantly to their monthly expenses."[61]

- The Portland Tribune said, "Supporters of Measure 97 have tried to depict it as a tax that applies 'only to 1,000 corporations.' What they don’t tell you is that those businesses account for 88 percent of the corporate retail sales in Oregon. Think about how many locations Fred Meyer, Safeway, Walgreens, Target, Walmart or similar companies have across the state and you will begin to understand it’s not just 1,000 companies — it’s tens of thousands of stores."[62]

- The Register-Guard said, "Businesses in Oregon are already looking at their options if Measure 97 passes. Among them are leaving the state, delaying or canceling expansion, expanding out of state, cost-cutting strategies such as layoffs, closing lower-performing outlets to reduce gross sales below the $25 million threshold and restructuring C corporations (taxes are assessed on the business itself) as S corporations (taxes are paid by the owners at their individual tax rates). None of these bode well for the proposed tax."[63]

- The Wall Street Journal said, "Progressives claim they can pay for their grand spending ambitions by soaking the rich, but the little guy invariably gets wet. The latest illustration is Oregon, where unions are campaigning for a gross-receipts tax on large corporations that even state budget analysts warn will drench the 99% too. ... While the referendum is billed as a progressive tax to help fund education and health services for the poor, the real beneficiaries as usual will be public unions. Oregon’s gross-receipts tax would be one more regressive income redistribution from the private economy to the privileged government class.[64]

- The Willamette Week said, “On its face, Measure 97 is elegantly designed: Somebody else pays it, and many of those somebodies are large, unloved corporations. But like a fake Rolex, the moving parts underneath the surface are less elegant. … It is our hope that the Legislature, which will probably continue under Democratic control, can craft something better.”[65]

- The World said, "Measure 97 is a back-door method of prying more revenues out of individual hard-working Oregonians, not big corporations. Yes, we have liabilities that need to be addressed. But we should be doing so above board and with transparency."[66]

Polls

- See also: 2016 ballot measure polls

- In early September 2016, DMH Research found 60 percent of respondents in favor of and 20 percent opposed to Measure 97.[67]

- An icitizen poll conducted in early September 2016 estimated support for Measure 97 to be around 59 percent and opposition to be approximately 21 percent.[68]

- Between September 29 and October 1, 2016, Hoffman Research conducted a poll and found lower support for Measure 97 than prior polls, with support at 41 percent and opposition at 47 percent.[69]

- A mid-October 2016 poll conducted by SurveyUSA found support at a low 28 percent. A significant number of respondents, about 29 percent, were undecided. The groups for which over 50 percent of respondents supported Measure 97 were Democrats, people who described their ideology as “very liberal,” and people who view education as a top issue this election.[70]

- In mid October, DMH Research surveyed 600 voters and found 49 percent of respondents opposing and 45 percent supporting Measure 97.[71]

- Riley Research Associates found support for Measure 97 around 46 percent during the first two weeks of October. Democrats had the highest level of support for the initiative at 70 percent. Republicans had the highest opposition to the measure at 77 percent.[72]

- DHM Research surveyed 504 voters for FOX 12 in late October 2016. The poll found support at 40 percent and opposition at 53 percent.[73]

| Oregon Measure 97 (2016) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Support | Oppose | Undecided | Margin of error | Sample size | ||||||||||||||

| FOX 12-DHM Research 10/24/2016 - 10/29/2016 | 40.0% | 53.0% | 7.0% | +/-4.4 | 504 | ||||||||||||||

| Riley Research Associates 10/4/2016 - 10/14/2016 | 46.0% | 47.0% | 7.0% | +/-3.97 | 608 | ||||||||||||||

| DMH Research 10/6/2016 - 10/13/2016 | 45.0% | 49.0% | 6.0% | +/-4.0 | 600 | ||||||||||||||

| SurveyUSA 10/10/2016 - 10/12/2016 | 28.0% | 44.0% | 29.0% | +/-3.9 | 800 | ||||||||||||||

| Hoffman Research 9/29/2016 - 10/1/2016 | 41.0% | 47.0% | 12.0% | +/-4.0 | 605 | ||||||||||||||

| icitizen 9/2/16 - 9/7/16 | 59.0% | 21.0% | 20.0% | +/-4.0 | 610 | ||||||||||||||

| DMH Research 9/1/16 - 9/6/16 | 60.0% | 30.0% | 10.0% | +/-4.3 | 517 | ||||||||||||||

| AVERAGES | 45.57% | 41.57% | 13% | +/-4.08 | 606.29 | ||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to editor@ballotpedia.org. | |||||||||||||||||||

Reports and analyses

Oregon Legislative Revenue Office

The Oregon Legislative Revenue Office issued an economic analysis of the proposed initiative. The report said that the measure would increase the tax burden of Oregonians by about $600 per capita and raise at least $6 billion each biennium. The analysis can be found here.

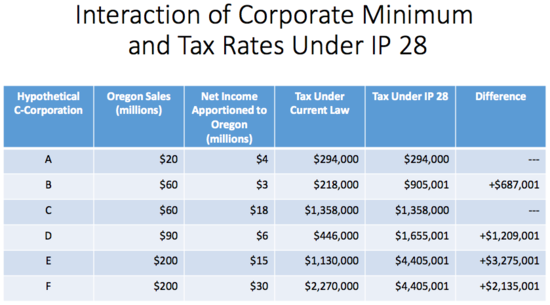

The direct impact of the initiative on hypothetical corporations, as detailed in the report, can be seen below:[12]

Northwest Economic Research Center

The Northwest Economic Research Center at Portland State University published a report in June 2016. The study showed that the measure would increase revenue by $3.38 billion in the first year of the tax increase. By 2027, this number would rise to $4.3 billion. The report also predicted that, under Measure 97, the private sector would create fewer jobs than previously projected in the five years following passage of measure. The report estimated that Measure 97 would result in an increase in public sector jobs. According to The Oregonian, the report concluded that Measure 97 would result in a net increase in jobs over projected growth by between 13,000 and 21,600, with all of the gains in the public sector.[74]

The full report can be found here.

Tax Foundation

The Tax Foundation found that the measure would increase the price of goods by 0.9 percent by 2022, costing consumers a total of $2 billion. The study also reported that the Legislative Revenue Office's report may have underestimated the compounding nature of gross receipts taxes on firms with long supply chains. This oversight underreported the potential costs of the tax.[13]

The report can be found here.

Oregon Consumer League

The Oregon Consumer League published a report with results counter to the Tax Foundation's findings. The League's study concluded that consumer prices likely would not rise, as the prices of consumer goods do not react to increases or decreases in corporate tax rates. Instead, the report said, changes in consumer prices reflect regional differences, such as transportation costs.[75]

The full study can be found here.

Path to the ballot

- The proposal was submitted by Gary Cobb, Laura Illig, and Ben Unger and approved for circulation September 1, 2015.[1]

- A title was issued by the Oregon attorney general's office on April 29, 2015.[1]

- 88,184 valid signatures were required for qualification purposes.

- Supporters had until July 8, 2016, to collect the required signatures.

- The Oregon Secretary of State certified the measure on June 6, 2016.[1]

Cost of signature collection:

Sponsors of the measure hired Our Oregon[76] to collect signatures for the petition to qualify this measure for the ballot. A total of $110,244.00 was spent to collect the 88,184 valid signatures required to put this measure before voters, resulting in a total cost per required signature (CPRS) of $1.25.

State profile

| Demographic data for Oregon | ||

|---|---|---|

| Oregon | U.S. | |

| Total population: | 4,024,634 | 316,515,021 |

| Land area (sq mi): | 95,988 | 3,531,905 |

| Race and ethnicity** | ||

| White: | 85.1% | 73.6% |

| Black/African American: | 1.8% | 12.6% |

| Asian: | 4% | 5.1% |

| Native American: | 1.2% | 0.8% |

| Pacific Islander: | 0.4% | 0.2% |

| Two or more: | 4.1% | 3% |

| Hispanic/Latino: | 12.3% | 17.1% |

| Education | ||

| High school graduation rate: | 89.8% | 86.7% |

| College graduation rate: | 30.8% | 29.8% |

| Income | ||

| Median household income: | $51,243 | $53,889 |

| Persons below poverty level: | 18.4% | 11.3% |

| Source: U.S. Census Bureau, "American Community Survey" (5-year estimates 2010-2015) Click here for more information on the 2020 census and here for more on its impact on the redistricting process in Oregon. **Note: Percentages for race and ethnicity may add up to more than 100 percent because respondents may report more than one race and the Hispanic/Latino ethnicity may be selected in conjunction with any race. Read more about race and ethnicity in the census here. | ||

Presidential voting pattern

- See also: Presidential voting trends in Oregon

Oregon voted for the Democratic candidate in all six presidential elections between 2000 and 2020.

Pivot Counties (2016)

Ballotpedia identified 206 counties that voted for Donald Trump (R) in 2016 after voting for Barack Obama (D) in 2008 and 2012. Collectively, Trump won these Pivot Counties by more than 580,000 votes. Of these 206 counties, two are located in Oregon, accounting for 0.97 percent of the total pivot counties.[77]

Pivot Counties (2020)

In 2020, Ballotpedia re-examined the 206 Pivot Counties to view their voting patterns following that year's presidential election. Ballotpedia defined those won by Trump won as Retained Pivot Counties and those won by Joe Biden (D) as Boomerang Pivot Counties. Nationwide, there were 181 Retained Pivot Counties and 25 Boomerang Pivot Counties. Oregon had two Retained Pivot Counties, 1.10 of all Retained Pivot Counties.

More Oregon coverage on Ballotpedia

- Elections in Oregon

- United States congressional delegations from Oregon

- Public policy in Oregon

- Influencers in Oregon

- Oregon fact checks

- More...

Related measures

- See also: Taxes on the ballot

Recent news

The link below is to the most recent stories in a Google news search for the terms Oregon 2016 Measure 97 Tax. These results are automatically generated from Google. Ballotpedia does not curate or endorse these articles.

See also

External links

Basic information

- Initiative Petition for Measure 97

- Oregon 2016 Voters' Pamphlet

- League of Women Voters of Oregon 2016 Ballot Measures Guide

Support

Opposition

Additional reading

Footnotes

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 Oregon Secretary of State, "A Better Oregon VI," accessed June 7, 2016

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 2.11 Oregon Secretary of State, "Military/Overseas Voters' Guide," accessed September 26, 2016

- ↑ Portland Tribune, "Measure 97 breaks fundraising record," October 21, 2016

- ↑ Oregon Secretary of State, "Articles of Incorporation Information," accessed September 26, 2016

- ↑ League of Women Voters of Oregon, "2016 Ballot Measures," accessed September 26, 2016

- ↑ Oregon Secretary of State, "File to Become a Benefit Company," accessed September 26, 2016

- ↑ Anderson Economic Group, "2016 State Business Tax Burden Rankings Report," accessed August 15, 2016

- ↑ 8.0 8.1 Statesman Journal, "Ballot measure would raise corporate taxes," December 31, 2015

- ↑ Associated Press, "'Gigantic' corporate tax hike likely headed to Oregon voters," May 24, 2016

- ↑ Moss-Adams, "How Initiative Petition 28 Could Impact Oregon Residents, Businesses with New Tax," accessed July 21, 2016

- ↑ Portland City Club, "Are Oregon Corporate Tax Rates Too Low?" accessed October 24, 2016

- ↑ 12.0 12.1 Legislative Revenue Office, "Initiative Petition 28: Description and Analysis," accessed July 19, 2016

- ↑ 13.0 13.1 Tax Foundation, "Oregon Initiative Petition 28: The Threat to Oregon’s Tax Climate," April 2016

- ↑ New Mexico Taxation and Revenue, "Gross Receipts Overview," accessed December 31, 2016

- ↑ Note: New Mexico's gross receipts tax is counted as a sales tax by some.

- ↑ Note: New Mexico's gross receipts tax is counted as a sales tax by some.

- ↑ 17.00 17.01 17.02 17.03 17.04 17.05 17.06 17.07 17.08 17.09 17.10 17.11 17.12 17.13 17.14 17.15 17.16 17.17 17.18 17.19 17.20 17.21 17.22 17.23 17.24 17.25 17.26 17.27 17.28 17.29 17.30 17.31 17.32 17.33 17.34 17.35 17.36 17.37 17.38 17.39 17.40 17.41 17.42 17.43 17.44 17.45 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ A Better Oregon: Yes on 97, "Home," accessed September 26

- ↑ Eugene Weekly, "Bernie Sanders endorses Oregon Ballot Measure 97," October 19, 2016

- ↑ Statesman Journal, "Bernie Sanders, Elizabeth Warren endorse Measure 97," October 24, 2016

- ↑ 21.0 21.1 21.2 21.3 21.4 21.5 The Oregonian, "Oregon candidates on Measure 97," accessed October 25, 2016

- ↑ Tillamook County Pioneer, "Commentary: Why I’m voting ‘yes’ on Measure 97," October 5, 2016

- ↑ 23.0 23.1 23.2 OPB, "Measure 97, PERS Divide Candidates For Oregon Treasurer, Secretary Of State," September 29, 2016

- ↑ Our Revolution, "Ballot Initiatives," accessed October 4, 2016

- ↑ The Register-Guard, “LLC board backs Measure 97,” September 30, 2016

- ↑ The Register-Guard, “School board votes to formally endorse Measures 97, 98,” November 2, 2016

- ↑ Yes on 97, "Why Measure 97?" accessed September 26, 2016

- ↑ The Register Guard, "Build a better Oregon with a fair corporate tax," June 9, 2016

- ↑ Portland Tribune, "Oregon heads for ballot brawl over tax increase," January 28, 2016

- ↑ Youtube, "Yes On 97," accessed October 9, 2016

- ↑ KGW, “Comcast accused of censoring 'Yes on 97' ads,” October 7, 2016

- ↑ Willamette Week, “Yes on Measure 97 Campaign Ads Slamming Comcast Can’t Run on Comcast,” October 8, 2016

- ↑ KOIN 6, "Yes on 97: Comcast is censoring our ads," October 9, 2016

- ↑ Defeat the Tax on Oregon Sales, "Help defeat the $6 Billion tax increase on Oregon sales," accessed September 26, 2016

- ↑ OPB, "Measure 97 Divides Brown And Pierce In 1st Debate," September 24, 2016

- ↑ Portland Tribune, "Clackamas board opposes Measure 97," October 4, 2016

- ↑ Bend Bulletin, "Former Gov. Kitzhaber opposes Measure 97," October 24, 2016

- ↑ Pamplin Media, "District 26 candidate switches stance on Measure 97," October 25, 2016

- ↑ The Dalles Chronicle, "Guest Commentary: Local chamber joins opposition to M97," October 1, 2016

- ↑ Portland Business Journal, "Backers abandon ballot measure to put liquor in Oregon grocery stores," April 27, 2016

- ↑ No On Measure 97, "Get the Facts," accessed September 26, 2016

- ↑ The World, "A sales tax by any other name...," June 1, 2016

- ↑ Youtube, "No On Measure 97," accessed September 26, 2016

- ↑ 44.0 44.1 44.2 44.3 Oregon Secretary of State, "Account summary: A Better Oregon VI," accessed February 7, 2017

- ↑ 45.0 45.1 45.2 Oregon Secretary of State, "Account summary: Defeat the Tax on Oregon Sales," accessed February 7, 2017

- ↑ Oregon Secretary of State, "Account Summary for Yes on 97," accessed February 7, 2017

- ↑ Oregon Secretary of State, "Account Summary for Defend Oregon," accessed February 7, 2017

- ↑ 48.0 48.1 Note: The totals listed below do not include in-kind donations, which are detailed in a separate section below.

- ↑ Note: A Better Oregon was largely active during the signature petition campaign prior to the certification of Measure 97 for the ballot and was officially registered as a petition committee rather than a ballot measure committee.

- ↑ Oregon Secretary of State, "Finance Activity for Defeat the Tax on Oregon Sales," accessed February 7, 2017

- ↑ Eugene Weekly, "Eugene Weekly's Election Endorsements," October 20, 2016

- ↑ The Portland Mercury, "Forcing the Issue: The Mercury’s 2016 Endorsements," October 19, 2016

- ↑ Salem Weekly, "Why We Need Measure 97," September 15, 2016

- ↑ Street Roots, "Street Roots' 2016 endorsements: Ballot measures," October 20, 2016

- ↑ The Bulletin, "Editorial: Tax increase would hit far and wide," June 10, 2016

- ↑ Corvallis Gazette-Times, "Editorial: Our positions on the state measures," October 24, 2016

- ↑ The Dalles Chronicle, "Editorial: Mixed vote on state measures," October 29, 2016

- ↑ East Oregonian, "Our view: Endorsement overview," November 4, 2016

- ↑ Mail Tribune, "Our View: Measure 97 is not the right answer," October 9, 2016

- ↑ The Oregonian, "Measure 97's false promise of free money: Editorial," November 3, 2016

- ↑ Lake Oswego Review, "Our Opinion: Tax will stress family budgets and could affect other requests for funding," July 21, 2016

- ↑ Portland Tribune, "Our Opinion: Measure 97 based on deceptions," September 15, 2016

- ↑ The Register-Guard, "Editorial: Gross receipts tax: No," October 2, 2016

- ↑ The Wall Street Journal, "Oregon’s Regressive Tax Referendum," August 11, 2016

- ↑ Willamette Week, "WW’s Fall 2016 Endorsements: State Measures," October 12, 2016

- ↑ The World, "Corp. tax proposal a bad idea," August 9, 2016

- ↑ DMH Research, "Support for Measure 97 outweighs opposition 60% to 30%," September 8, 2016

- ↑ Blue Mountain Eagle, "Poll: Support for Measure 97 erodes when voters hear pros/cons," September 12, 2016

- ↑ OPB, "Oregon Poll: Clinton Gains Big Lead Over Trump; Measure 97 Opposition Grows," October 4, 2016

- ↑ SurveyUSA, "Results of SurveyUSA Election Poll #23213," October 13, 2016

- ↑ Portland Tribune, "Poll: Support drops for Measure 97, Richardson leads," October 17, 2016

- ↑ Riley Research Associates, "Oregon Statewide Likely Voter Survey," October 18, 2016

- ↑ Fox 12, "FOX 12-DHM Poll: Clinton leads Trump in Oregon; Measure 97 trends toward defeat," November 1, 2016

- ↑ Northwest Economic Research Center, "The Economic Impacts of a Gross Receipt Tax for Oregon with Implications for Initiative Petition 28," June 2016

- ↑ Oregon Consumer League, "Side-by-Side Shopping Cart Study: State Corporate Taxes Do Not Drive State Consumer Prices," accessed October 5, 2016

- ↑ Our Oregon was paid $40,000 to collect signatures. The remaining $70,244 in signature gathering services were in-kind contributions by Our Oregon.

- ↑ The raw data for this study was provided by Dave Leip of Atlas of U.S. Presidential Elections.

| |||||||||||

State of Oregon Salem (capital) | |

|---|---|

| Elections |

What's on my ballot? | Elections in 2024 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |