Business News›Tech›Newsletters›Morning Dispatch›Bhavik Koladiya sues Ashneer Grover; govt extends feedback deadline for draft gaming rules

Morning Dispatch Morning Dispatch |

Bhavik Koladiya sues Ashneer Grover; govt extends feedback deadline for draft gaming rules

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

BharatPe’s estranged cofounder Ashneer Grover, who is being sued by the company for alleged misappropriation of funds and reputational harm, now faces a lawsuit from Bhavik Koladiya, another cofounder of the troubled fintech firm, who is looking to reclaim his shares in the company.

Also in this letter:

■ Govt extends deadline for feedback on draft gaming rules

■ Coffee company Blue Tokai bags $30 million from A91, others

■ Top four IT firms record sharp drop in net hiring, lowest in 11 quarters

Five months after cutting ties with BharatPe, a company he founded, Bhavik Koladiya has filed a case against his former partner Ashneer Grover, another cofounder, looking to reclaim his shares in the company.

The case will be heard in the Delhi High Court on January 18.

Catch up quick: Koladiya founded the fintech firm in 2017 with Shashvat Nakrani, his schoolteacher's son. In 2018, they began searching for a chief executive for the company and eventually joined hands with Grover.

Shortly thereafter Koladiya, who held a 30.21% stake in the company, had to exit the cap table owing to his past conviction for credit card fraud in the US.

The dispute: Conventionally, people pledge such shareholding to existing stakeholders with a call-option agreement, which is a contract between two or more parties under which the buyer earns the right to exercise his option to buy a particular asset from the seller for a specific period of time.

According to documents accessed via the Registrar of Companies, Koladiya transferred his shares to Grover, Nakrani, and Mansukhbhai Mohanbhai Nakrani, and some other early-stage and angel investors in December 2018.

But in multiple conversations, Grover has maintained that Koladiya had sold his shares to him and other buyers including Nakrani and early investors. Koladiya said in a statement he had triggered an agreement signed with Nakrani and Grover in 2018 to get his ‘pledged shares’ of BharatPe.

The government has extended the deadline for public consultations on the draft online gaming rules to January 25.

Catch up quick: The Ministry of Electronics and Information Technology released the draft rules on January 2 and had asked stakeholders to submit their views by January 17.

Stakeholder meeting: On Tuesday, Minister of State for Electronics and Information Technology Rajeev Chandrasekhar met representatives of online gaming companies and intermediaries and said industry bodies would not be permitted to become self-regulatory organisations (SRO).

“It is wrong to assume that an industry body will automatically become an SRO (self-regulatory organisation). Any industry body will not be SRO. It will be a body representing all the stakeholders,” he said.

The proposed a self-regulatory body would be responsible for certifying games and ensuring that online games that operate in India follow the rules. Apart from the SRO, the IT ministry had also proposed a mandatory KYC verification of online gamers.

Pushback: Some of the stakeholders, including WinZo games, expressed apprehension about the requirement of games being allowed to operate in India only after registration with an SRO. It said such pre-registrations were “highly likely to compromise the confidentiality of information required to be submitted for evaluation/certification and lead to IP leaks”.

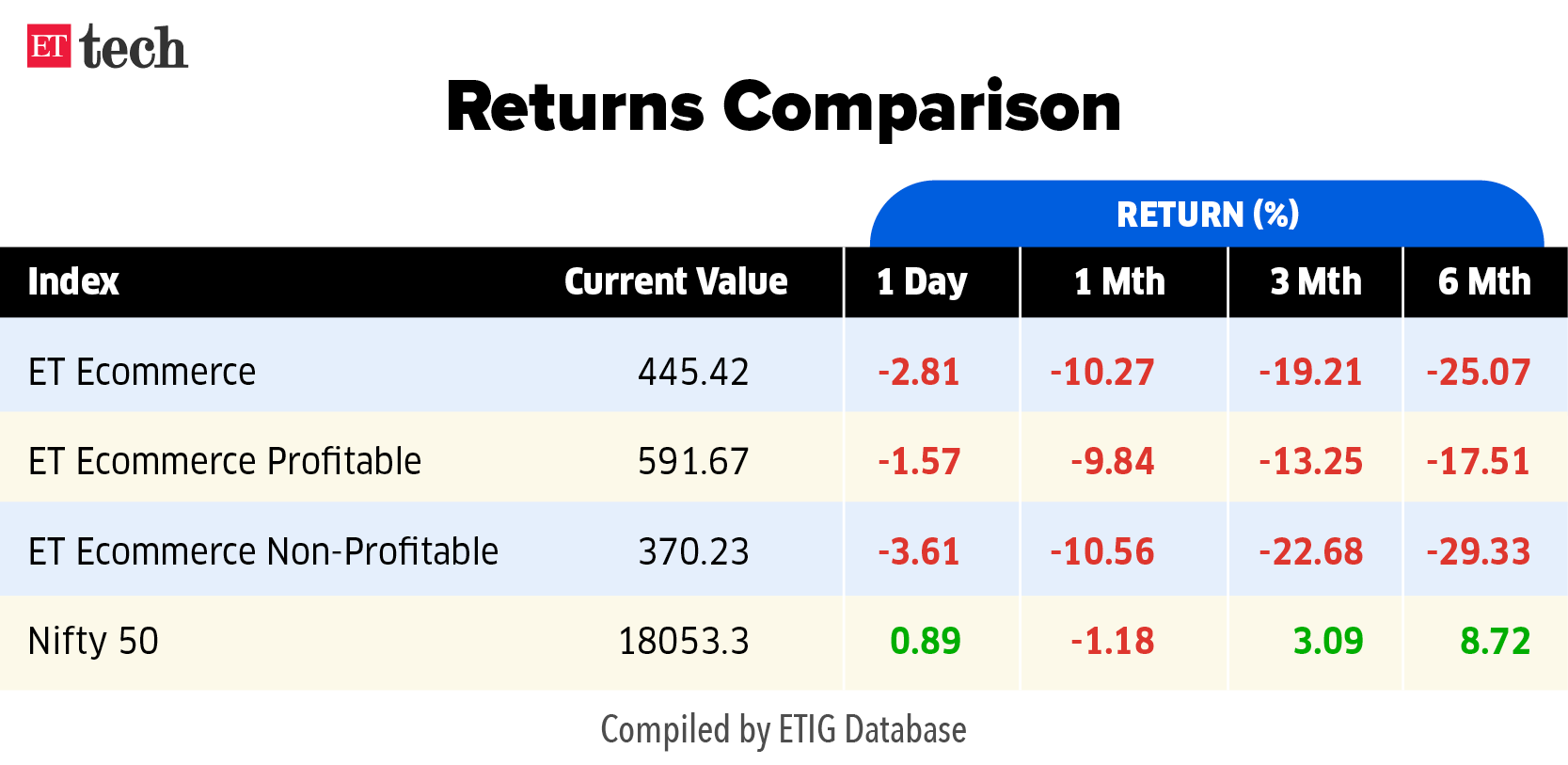

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

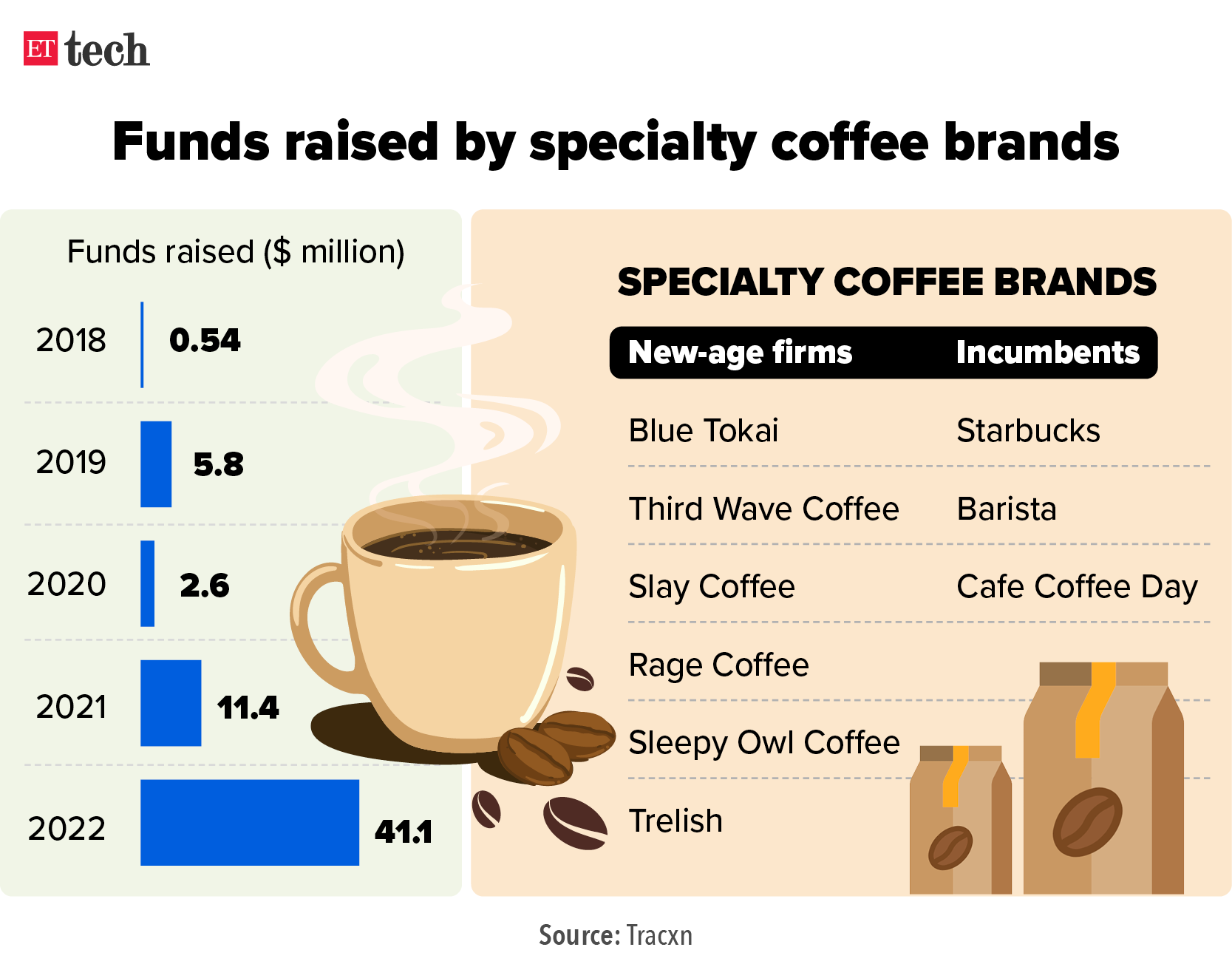

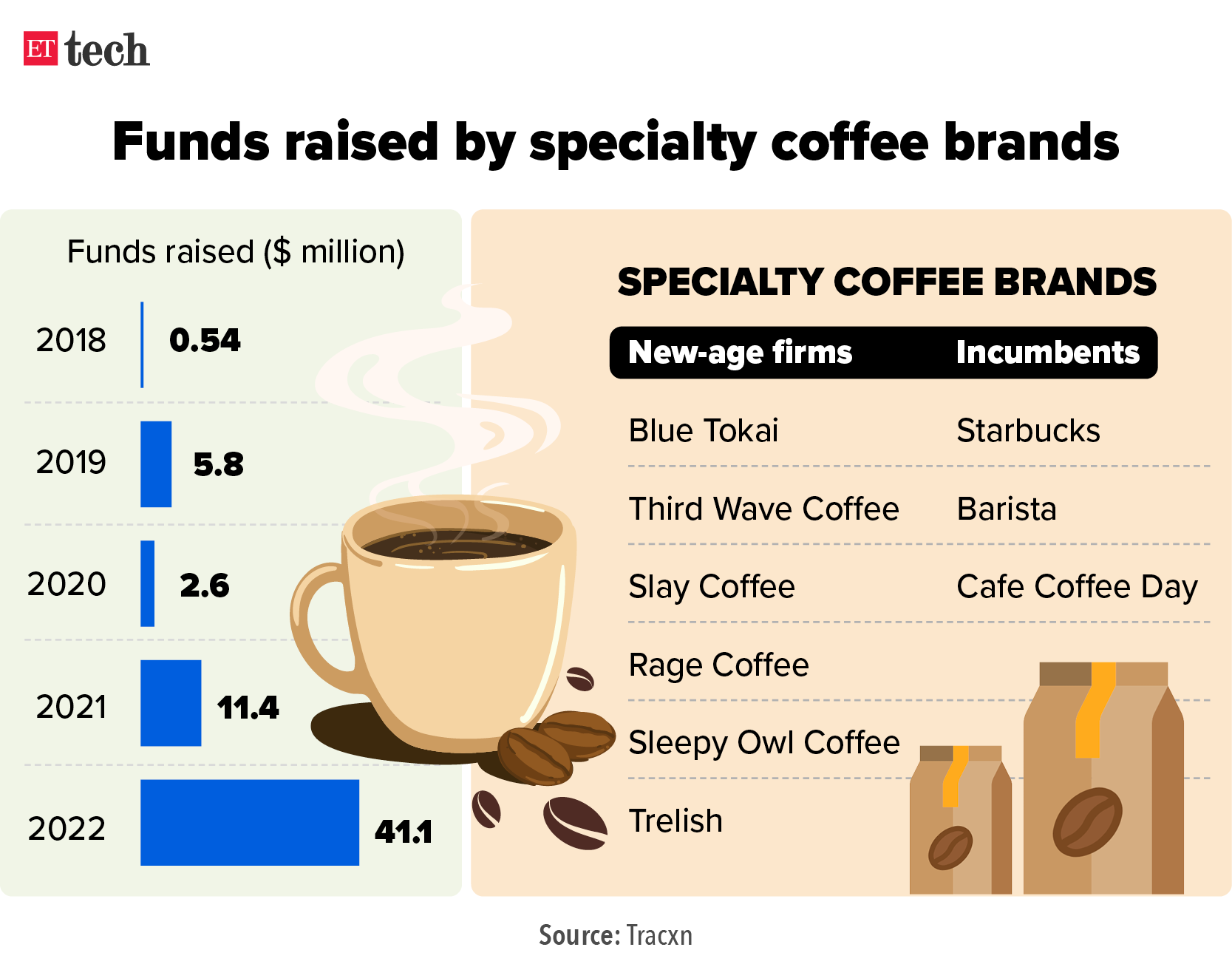

Specialty coffee brand Blue Tokai Coffee Roasters has raised $30 million in its latest funding round, led by Mumbai-based investment firm A91 Partners. White Whale Ventures, and existing investors including Grand Anicut Fund and 8i Ventures, also participated in the funding round.

Shot of funding: Blue Tokai’s latest capital raise comes on the back of other new age specialty coffee firms like Third Wave Coffee Roasters, Slay Coffee, Sleepy Owl, Hatti Kaapi, and Rage Coffee, also drawing increased consumer and investor interest. These companies compete with established coffee chains like Starbucks, Cafe Coffee Day and Barista.

Data sourced from research platform Tracxn showed that specialty coffee startups raised $41.1 million in 2022, up from $11.4 million in 2021.

ETtech Done Deals

India’s top four software exporters – Tata Consultancy Services, Infosys, HCL Tech and Wipro – together recorded a net addition of 2,000 employees in the quarter ended December 2022, the lowest in 11 quarters, as demand for technology services slows amid global macroeconomic uncertainty and geopolitical concerns.

By the numbers: The decline marks a sharp drop of 97% sequentially from the net addition of 61,137 employees by the big four IT firms in the third quarter of FY22 when they competed aggressively for talent to meet the rising demand for digitisation triggered by the pandemic.

At the end of December 2022, Tata Consultancy Services' overall headcount dropped by 2197 employees. In Bangalore, Wipro recorded a decrease of 435 in the same period.

Freshers: Each of the top four IT majors could hire between 15,000-50,000 fresh engineers from campuses in 2023. This comes on the back of aggressive on-campus hiring by tech exporters in recent years. Collectively the top four IT firms onboarded around 227,000 freshers in fiscal 2022.

Investment platform Mumbai Angels Network has launched two funds, an angel fund with a target of Rs 1,000 crore and a green shoe option of Rs 200 crore, and a venture capital fund of Rs 300 crore with a Rs 200-crore green shoe option.

Mumbai Angels, recently acquired by 360 One, has backed startups such as InMobi, Dhruva Space, Myntra, Purplle and BluSmart.

Jargon Buster: A green shoe option allows the underwriter to sell more shares, than planned by the issuer, if the demand for security is higher than expected.

In November, IIFL Wealth (now 360 One) said it had acquired a 91% stake in Mumbai Angels for Rs 45.73 crore. As of September 30, 2022, 360 One had aggregate assets of more than Rs 3.33 lakh crore under management.

Z3Partners fund: Venture capital-backer Z3Partners announced the final close of its first fund at Rs 550 crore. This comes almost two years after the fund announced its first close in January 2021.

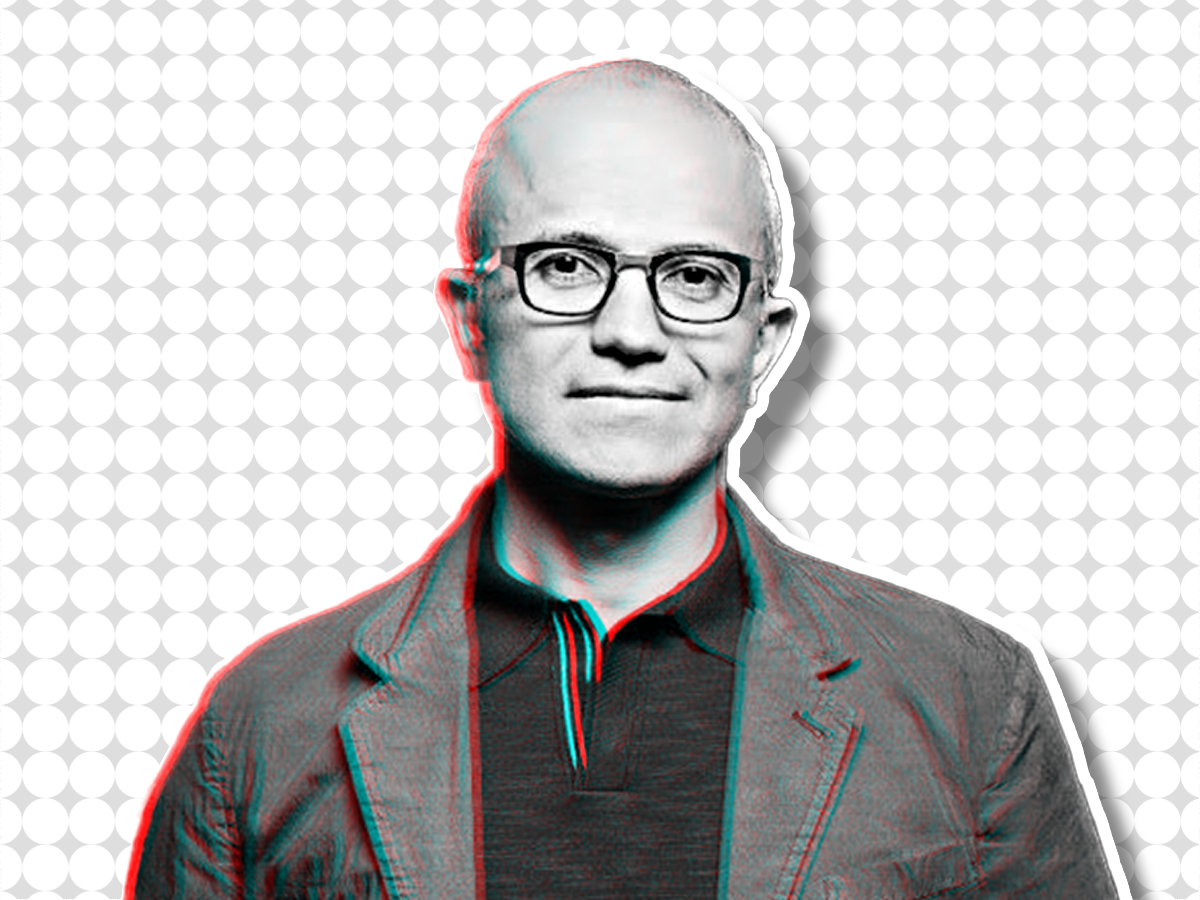

Microsoft will add OpenAI’s ChatGPT to Azure, says Nadella: Microsoft CEO Satya Nadella announced on Monday that ChatGPT will soon be made available to the Azure OpenAI Service - the firm’s cloud business. “ChatGPT is coming soon to the Azure OpenAI Service, which is now generally available, as we help customers apply the world’s most advanced AI models to their own business imperatives.” he said.

Goldman expects Paytm to turn profitable in March quarter: Goldman Sachs expects Paytm to turn adjusted-Ebitda profitable by March 2023 and has revised the target price upwards to Rs 1,120. Paytm had earlier said in its guidance that it aimed to become Ebitda-profitable by the September 2023 quarter.

■ Big Tech’s layoffs highlight how the US fails immigrant workers (Wired)

■ Drone boats: inside the US Navy’s latest unmanned AI tech (WSJ)

■ How Messi fans organized to break an Instagram world record (Rest of World)

Also in this letter:

■ Govt extends deadline for feedback on draft gaming rules

■ Coffee company Blue Tokai bags $30 million from A91, others

■ Top four IT firms record sharp drop in net hiring, lowest in 11 quarters

Bhavik Koladiya sues Ashneer Grover, over BharatPe share dispute

Five months after cutting ties with BharatPe, a company he founded, Bhavik Koladiya has filed a case against his former partner Ashneer Grover, another cofounder, looking to reclaim his shares in the company.

The case will be heard in the Delhi High Court on January 18.

Catch up quick: Koladiya founded the fintech firm in 2017 with Shashvat Nakrani, his schoolteacher's son. In 2018, they began searching for a chief executive for the company and eventually joined hands with Grover.

Shortly thereafter Koladiya, who held a 30.21% stake in the company, had to exit the cap table owing to his past conviction for credit card fraud in the US.

The dispute: Conventionally, people pledge such shareholding to existing stakeholders with a call-option agreement, which is a contract between two or more parties under which the buyer earns the right to exercise his option to buy a particular asset from the seller for a specific period of time.

According to documents accessed via the Registrar of Companies, Koladiya transferred his shares to Grover, Nakrani, and Mansukhbhai Mohanbhai Nakrani, and some other early-stage and angel investors in December 2018.

But in multiple conversations, Grover has maintained that Koladiya had sold his shares to him and other buyers including Nakrani and early investors. Koladiya said in a statement he had triggered an agreement signed with Nakrani and Grover in 2018 to get his ‘pledged shares’ of BharatPe.

Govt extends deadline for feedback on draft gaming rules

The government has extended the deadline for public consultations on the draft online gaming rules to January 25.

Catch up quick: The Ministry of Electronics and Information Technology released the draft rules on January 2 and had asked stakeholders to submit their views by January 17.

Stakeholder meeting: On Tuesday, Minister of State for Electronics and Information Technology Rajeev Chandrasekhar met representatives of online gaming companies and intermediaries and said industry bodies would not be permitted to become self-regulatory organisations (SRO).

“It is wrong to assume that an industry body will automatically become an SRO (self-regulatory organisation). Any industry body will not be SRO. It will be a body representing all the stakeholders,” he said.

The proposed a self-regulatory body would be responsible for certifying games and ensuring that online games that operate in India follow the rules. Apart from the SRO, the IT ministry had also proposed a mandatory KYC verification of online gamers.

Pushback: Some of the stakeholders, including WinZo games, expressed apprehension about the requirement of games being allowed to operate in India only after registration with an SRO. It said such pre-registrations were “highly likely to compromise the confidentiality of information required to be submitted for evaluation/certification and lead to IP leaks”.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Coffee company Blue Tokai bags $30 million from A91, others

Specialty coffee brand Blue Tokai Coffee Roasters has raised $30 million in its latest funding round, led by Mumbai-based investment firm A91 Partners. White Whale Ventures, and existing investors including Grand Anicut Fund and 8i Ventures, also participated in the funding round.

Shot of funding: Blue Tokai’s latest capital raise comes on the back of other new age specialty coffee firms like Third Wave Coffee Roasters, Slay Coffee, Sleepy Owl, Hatti Kaapi, and Rage Coffee, also drawing increased consumer and investor interest. These companies compete with established coffee chains like Starbucks, Cafe Coffee Day and Barista.

Data sourced from research platform Tracxn showed that specialty coffee startups raised $41.1 million in 2022, up from $11.4 million in 2021.

ETtech Done Deals

- Beaconstac, a Quick Response (QR) code-based Software-as-a-Service (SaaS) company, has raised $25 million in its first external funding round, dubbed Series A, led by San Francisco-based Telescope Partners. Accel India also participated in the round, the company said in a statement.

- Fintech Neogrowth has secured $10 million debt capital from US-based impact investor Microvest Capital Management. Last month the company had raised Rs 300 crore from a clutch of investors in debt and equity, led by a Rs 160-crore equity capital by Dutch lender FMO.

- Deeptech startup Chara Technologies has raised $4.75 million in a funding round led by Bengaluru-based Exfinity Venture Partners. Vietnam-based Big Capital, the venture arm of Bitexco and Log9 Materials, as well as returning investors Kalaari Capital and ciie.co also participated in the round.

- Enterprise AI company Mad Street Den (MSD) has raised $30 million in its Series C funding round, led by Avatar Growth Capital. Existing investors Sequoia Capital and Alpha Wave Global (formerly known as Falcon Edge Capital) also participated in the round.

Top four IT firms record sharp drop in net hiring, lowest in 11 quarters

India’s top four software exporters – Tata Consultancy Services, Infosys, HCL Tech and Wipro – together recorded a net addition of 2,000 employees in the quarter ended December 2022, the lowest in 11 quarters, as demand for technology services slows amid global macroeconomic uncertainty and geopolitical concerns.

By the numbers: The decline marks a sharp drop of 97% sequentially from the net addition of 61,137 employees by the big four IT firms in the third quarter of FY22 when they competed aggressively for talent to meet the rising demand for digitisation triggered by the pandemic.

At the end of December 2022, Tata Consultancy Services' overall headcount dropped by 2197 employees. In Bangalore, Wipro recorded a decrease of 435 in the same period.

Freshers: Each of the top four IT majors could hire between 15,000-50,000 fresh engineers from campuses in 2023. This comes on the back of aggressive on-campus hiring by tech exporters in recent years. Collectively the top four IT firms onboarded around 227,000 freshers in fiscal 2022.

Mumbai Angels Network launches two new funds

Investment platform Mumbai Angels Network has launched two funds, an angel fund with a target of Rs 1,000 crore and a green shoe option of Rs 200 crore, and a venture capital fund of Rs 300 crore with a Rs 200-crore green shoe option.

Mumbai Angels, recently acquired by 360 One, has backed startups such as InMobi, Dhruva Space, Myntra, Purplle and BluSmart.

Jargon Buster: A green shoe option allows the underwriter to sell more shares, than planned by the issuer, if the demand for security is higher than expected.

In November, IIFL Wealth (now 360 One) said it had acquired a 91% stake in Mumbai Angels for Rs 45.73 crore. As of September 30, 2022, 360 One had aggregate assets of more than Rs 3.33 lakh crore under management.

Z3Partners fund: Venture capital-backer Z3Partners announced the final close of its first fund at Rs 550 crore. This comes almost two years after the fund announced its first close in January 2021.

Other Top Stories By Our Reporters

Microsoft will add OpenAI’s ChatGPT to Azure, says Nadella: Microsoft CEO Satya Nadella announced on Monday that ChatGPT will soon be made available to the Azure OpenAI Service - the firm’s cloud business. “ChatGPT is coming soon to the Azure OpenAI Service, which is now generally available, as we help customers apply the world’s most advanced AI models to their own business imperatives.” he said.

Goldman expects Paytm to turn profitable in March quarter: Goldman Sachs expects Paytm to turn adjusted-Ebitda profitable by March 2023 and has revised the target price upwards to Rs 1,120. Paytm had earlier said in its guidance that it aimed to become Ebitda-profitable by the September 2023 quarter.

Global Picks We Are Reading

■ Big Tech’s layoffs highlight how the US fails immigrant workers (Wired)

■ Drone boats: inside the US Navy’s latest unmanned AI tech (WSJ)

■ How Messi fans organized to break an Instagram world record (Rest of World)

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.