The Fed fuels fallen angels: Forecasting credit spreads on ING’s Covid-19 scenarios

Late last week the US Fed went where no central bank has gone before, indicating that fallen angels (downgraded from investment grade to high yield) would be part of their purchasing plans and no less significantly indicating it will also buy High Yield ETFs

A clear message to the ECB

Besides fuelling a relief rally in riskier parts of the credit spectrum, the message to the ECB is now clear –you’re up next. Indeed, the 7 April commentary opened this window, and we expect the ECB to follow suit, but only in part. This activity has given more comfort to our view on credit spreads if the base case ING economic scenario holds. The action has reduced the tail risk of a credit crunch but not evaporated it. Any scenario whereby lockdowns continue for longer will, in our view, see a rating migration and defaults approach and subsequently exceed Global Financial Crisis numbers, and spreads and funding levels alike will spiral.

A wise move

Late last week the Fed announced that non-financial corporates rated investment grade on 22 March 2020 will be included in their primary purchasing programme (PMCCF) and secondary market facility (Facility), as long as the rating (from at least two agencies) remains BB- or higher. Subsequently, they also indicated that they will expand their exchange-traded funds (ETF) purchasing to include not just Investment-grade corporate bond funds but also US high-yield corporate funds.

The move to some comes as no surprise given the market's discomfort in the BBB universe at large along with the higher level of leverage in the US credit markets, where the weight of the potential fallen angel universe made the issue particularly acute. The downgrade by S&P on Ford on 25 March might well have been the catalyst, as the name now benefits from the Fed’s Primary Market Corporate Credit Facility and secondary facility.

Buying ETFs is far more contentious

So, what about the European Central Bank? On 7 April the ECB, on announcing its package of temporary collateral easing measures, added in the last paragraph that it mandated Eurosystem committees to assess measures to mitigate collateral availability from rating downgrades, hence opening the door to a similar move in terms of allowing fallen angels to be part of the CSPP or PEPP environment. We believe the move by the Fed ensures that the ECB will take this course of action. However, buying ETFs is far more contentious. The ECB already buys most of the underlying bonds directly, and by including fallen angels expands that universe, making it less necessary to take the ETF route.

As a reminder, for the Fed programmes, the facility can purchase corporate bonds that at the time of purchase has a remaining maturity of less than 5 years and the Facility and PMCCF will carry limits per names (10% of the maximum of what was outstanding per issuer for the calendar year up to 22 March 2020).

We believe this is a wise move given the scenario where no less than 10% of current BBB rated debt in the US and in our estimation 7% European BBB rated debt could fall into the fallen angel bucket in the next 12 months. We must not forget about speculative-grade issuers (pre-22 March) for whom the current purchasing from the Fed and the expected purchasing from the ECB will do little in terms of their funding conundrum. They still often fall between a rock and a hard place in terms of financing possibilities as in terms of the cost of debt and the whether the market is open, they struggle but also the ECB’s Corporate Sector Purchase Programme and the Fed’s SMCCF are not accessible for them, similarly leveraged loan market for use of CLOs has stalled and the bank loan market will come at a steep cost. Thus, the tail risk of a full credit crunch has therefore only been reduced but has not evaporated. At the end of the day, the situation is most acute for true high yield players and apart from pricing stabilisation through ETF purchasing, it won’t really improve financing opportunities.

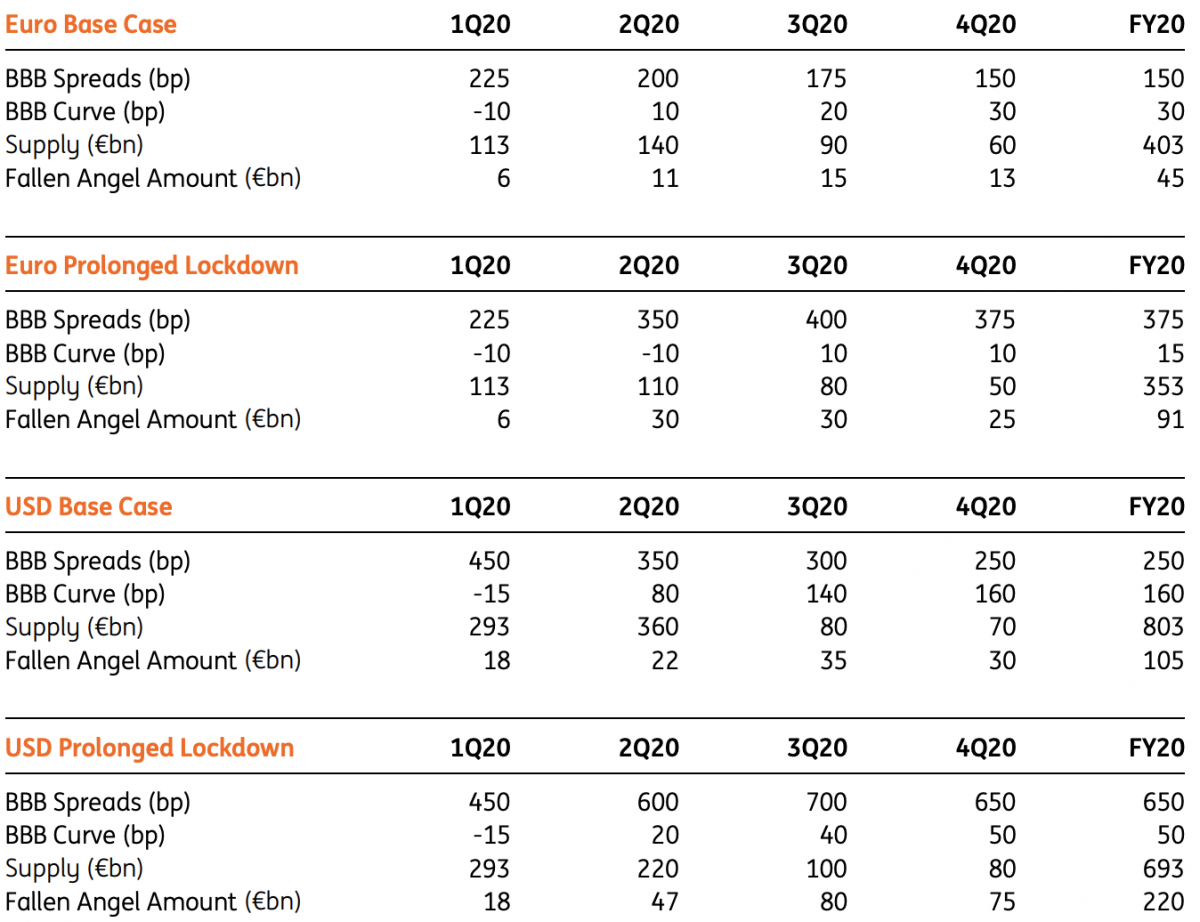

Fig 1 - Credit Forecasts

From a broader perspective, credit forecasts based on ING’s base case scenario and the scenario of a prolonged downturn, for the European and US markets we identify some potential forecasts for the upcoming year. At present, credit markets are showing various positive nodes, and on top of mutual fund inflows in Euro and US Investment Grade and High Yield, we are also seeing a tightening in spreads, particularly in QE eligible debt. This is occurring despite the substantial supply coming to the market, as many corporates are front-loading their refinancing needs and shoring up liquidity.

As per the forecasts in Figure 1, we estimate spread levels of BBB non-financials, the curve shape on BBB credit, the supply levels for investment-grade corporates and finally the level of fallen angels from investment grade to high yield.

Fig 2 - ING GDP Scenarios (%)

For reference, Figure 2 illustrates ING GDP scenarios. As mentioned, we use the base case scenario and a prolonged downturn, which falls between the worst-case scenario and the winter lockdown scenario, as a proxy. In the base case scenario, we expect default rates to fall between 7% to 10%. However, in the case of a prolonged lockdown we expect default rates to reach up to the levels of the 2008 Global Financial Crisis of around 13%.

Using BBB non-financial spreads, we identify the wide spread of 225bp in 1Q in Euro and 450bp in 1Q in USD. We expect them to gradually tighten over the coming year under the base case and with that we expect the curve to steepen considerably from the inverted points of 1Q. As illustrated in Figure 3, both Euro and USD had inverted curves, however, with the considerable short end financing stimulus we will likely see a sharp steepening of the curves.

Fig 3 - BBB Curves in Euro and USD

Another record-breaking year

Initially, we had forecast a 2020 corporate supply of €340bn, however, now we estimate around the €400bn to mark another record-breaking year. This is despite the expectation of considerably less reverse Yankee supply. The majority of the supply has and will come in the first half of the year as many corporates are refinancing and front loading. The significant liquidity financing paired with the reduced earnings will be detrimental to leverage ratios, which will, in turn, lead to a higher level of downgrades.

We believe many corporates will happily take the risk of a downgrade in return for shoring up liquidity to ensure long-term survival. Therefore, we forecast fallen angels to increase, and be about 10% of the BBB universe. The same story can be said for the Base Case in the US. There was already some reason for concern in the US high yield and leveraged loan space, which is certainly evident now in times of crisis because the US entered this crisis with significantly more leverage. Additionally, there has already been a significant rise in downgrades over the past two years. Therefore, we are likely to see a higher negative rating migration, and continued downgrade dominance.

Fig 4 - US Rating Migrations and US & Europe Up/Down ratio

In the alternative scenario of a prolonged lockdown, which will result in a 2008 Global Financial Crisis style default rates (or higher) and increased spreads, up to 400bp in Euro and 700bp in USD. If so, we expect fallen angels to be about 20% of the BBB universe in both Euro and USD, as there will be considerably more downgrades across the board. Rating transition is the name of the game with manageable default rates under the base case; prolonged lockdowns change that game from a focus on transition to widespread defaults.

Download

Download article17 April 2020

Covid-19: Every angle to the global response This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more