The United States space industry is booming, and not everyone is excited about it. The Europeans, who dominated commercial spaceflight before the rise of American upstarts like SpaceX, are suddenly worried that the America's effort “now represents a further strong challenge to European competitiveness and freedom to act in space.”

That hand-wringing comes from a new report by a leading European space advocacy group. ASD-Eurospace fears that Europe has not only lost its comfortable lead in commercial spaceflight, but also is falling far behind the curve and won’t have the launch hardware and spacecraft to keep up.

“U.S. commercial actors are seen as the 3rd pillar of the U.S. national space enterprise strategy [aside from NASA and the Pentagon] and fully participate as such in the comprehensive approach to U.S. space dominance,” reads the ASD-Eurospace report. In other words, the uniquely American approach of government support and investment in private space is paying dividends, creating an industry that could swallow the comparatively moribund European effort. “Europe must react quickly and define independently its own ambitions."

This represents a stunning turnaround for the U.S. To understand the magnitude of the comeback, one need only look back to the beginning of this decade.

Turning Tables

Breaking news about the U.S. space industry comes fast and furious in 2018: A private customer paying for a trip around the moon, new launch providers snagging the rights to launch military missions, international sales of flights on U.S. rockets, new rockets and spaceports announced—even a potential sixth branch of the military dedicated to space.

Things weren’t always so rosy. The space shuttle's retirement in 2011 was the most visible sign of America's waning status as the leading spacefaring nation. That year, no American spaceports launched any commercial sats despite healthy global demand. “The industry was completely dominated by government-backed launcher-providers from Russia, Europe, and (to a lesser extent) China,” we said in 2013.

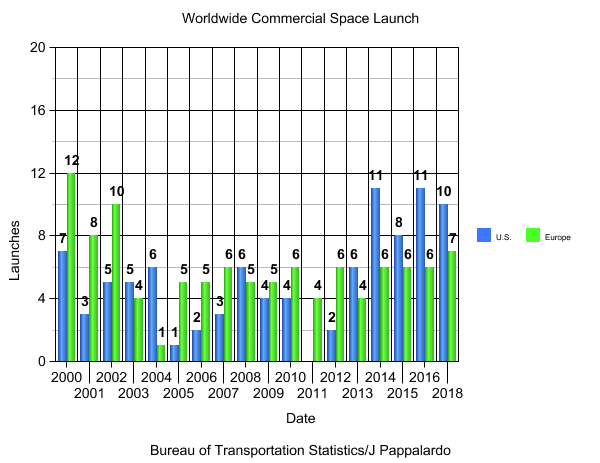

Now the stats on commercial space launches are reversed. Using data from the Bureau of Transportation Statistics, it’s clear that U.S. commercial launches have caught up to and surpassed Europe’s. What's happened so far is thanks in large part to SpaceX and its roster of satellite launches and space station missions. And with so many new players just about to come online, Jeff Bezos's Blue Origin being just one of them, these stats are poised to rise.

As the U.S. launch market expanded, with spaceports opening up to accommodate research and operations, the European market stayed fairly stagnant. As SpaceX proved that innovation could drive down costs, the European launch provider Arianespace accelerated its own plans to introduce a small rocket launcher, the Italian Vega-C (due in 2019), and a new heavy lift rocket called the Ariane 6 (expected in 2020). The Ariane 6 will cost about half the $178 million that Arianespace charges for Ariane 5. These vertical launch rockets will all rise from the EU’s equatorial spaceport in French Guiana.

These rockets will all face competition that Europe formerly didn't have to consider. For example, the Ariane 6 will vie for launches against Blue Origin and the United Launch Alliance in the United States, as well as heavy rockets built and operated by Russia, China, Japan and India.

The Eurospace report pleads for protectionism to help safeguard its homegrown space industries. (“No Buy European Policy exists to match the explicit Buy American policy,” it claims.) It also lobbies the European Commission to “support European space exports with regulations favoring exports and economic diplomacy, monitoring market distortions or asymmetries in markets.” The report also recommends Europe level the playing field by cutting red tape and echoing what the U.S. government has done to get out of the way of the new industry, specifically mentioning the Trump administration’s adoption of a single license for all types of commercial space flight, launch, and re-entry operations.

Uncle Sam's Deep Pockets

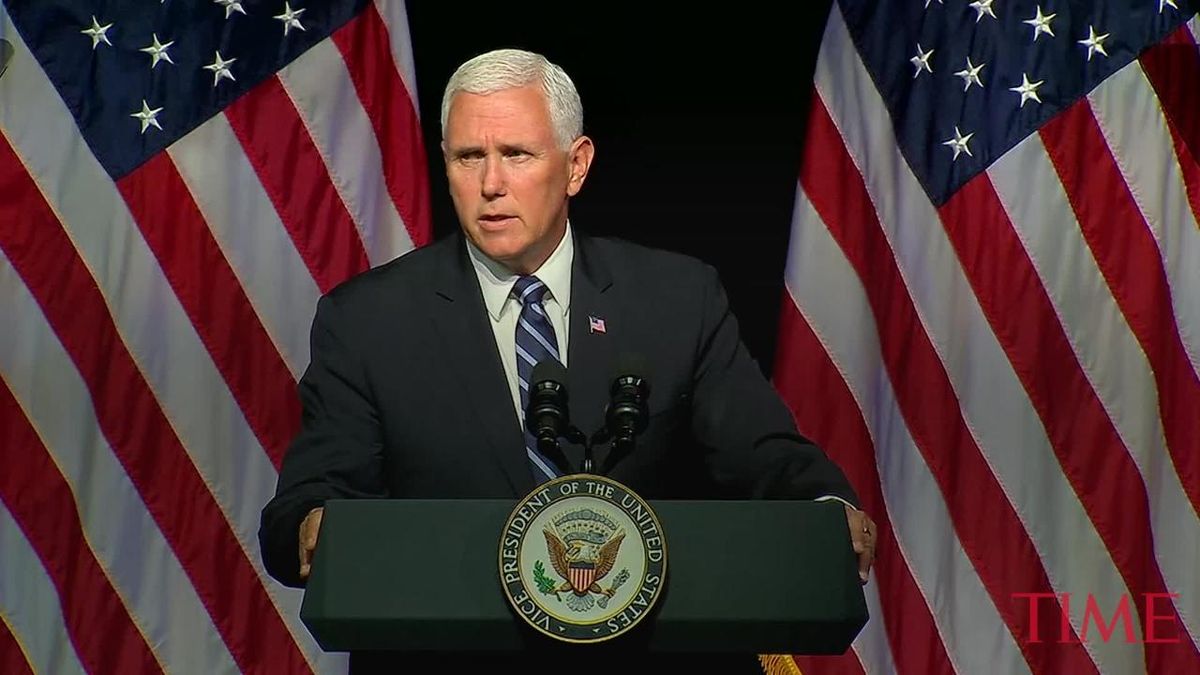

The Trump administration is accelerating what earlier administrations started. “While the notion of U.S. dominance in space is not a novelty, the Trump administration now unequivocally presents it as a comprehensive national security strategy encompassing military, civil and commercial goals,” the report says. “In this regard, President Trump’s policies are consistent with his predecessors, but with greatly strengthened execution.”

Of course, the U.S. government spends an order of magnitude more money on space programs than the EU does, and the dollars are really flowing now that the Pentagon is heavy into enhancing its capabilities in space. And when Uncle Sam pays, he pays for the whole ride to orbit. The Euro report says the U.S. has an estimated budget of $40 billion for military space development. European companies usually must co-fund development. When it comes to innovative orbital demonstrations, that’s a prohibitive commitment.

The private space sector is America's secret weapon. Again, consider the world of 2011, when the U.S. military was launching satellites at a reasonable clip, relying on the expensive but reliable services of the United Launch Alliance. That changed as SpaceX and others have broken into the national security launch market, bringing cost savings with them. Just last week, Orbital and Blue Origin scored military rocket deals, another sign that, as the Europeans put in the ASD-Eurospace report, “the U.S. military is also looking at leveraging the dynamism of the commercial sector in order to increase resilience and reduce costs.”

Signs of Life

The U.K.’s space industry may not have the size of the United States’ one, but there are signs of private space industry life across Europe. Many of the world’s best communications satellites are built in Europe. The value of its space industry has tripled since 2000, and the U.K. this year introduced a space industry bill meant to spark more innovation. Scotland and Scandinavia are locked in a race to open the first spaceport in Europe.

The European Space Agency is trying to find niches where it can excel, like orbital debris removal and satellite servicing. The agency has also set up business incubation centers across Europe and has embraced the idea of the public-private partnership.

“There should be some kind of financial investment of industry in exploration, and we are doing this,” Jan Wörner , the ESA Director General, said in a recent interview. “We have a public-private partnership to really stimulate industry to get money from Earth observation.”

Allowing companies to make money from government investments in space hardware? Why, that’s starting to sound downright American.

Joe Pappalardo is a contributing writer at Popular Mechanics and author of the new book, Spaceport Earth: The Reinvention of Spaceflight.