By Kirstin Ridley

LONDON (Reuters) - A former top Barclays (L:BARC) executive, on trial in London on fraud charges, would have risked a 50 million pound ($64 million) "good leaver" package if he had sought a criminal deal with Qatar during the credit crisis, a court heard on Thursday.

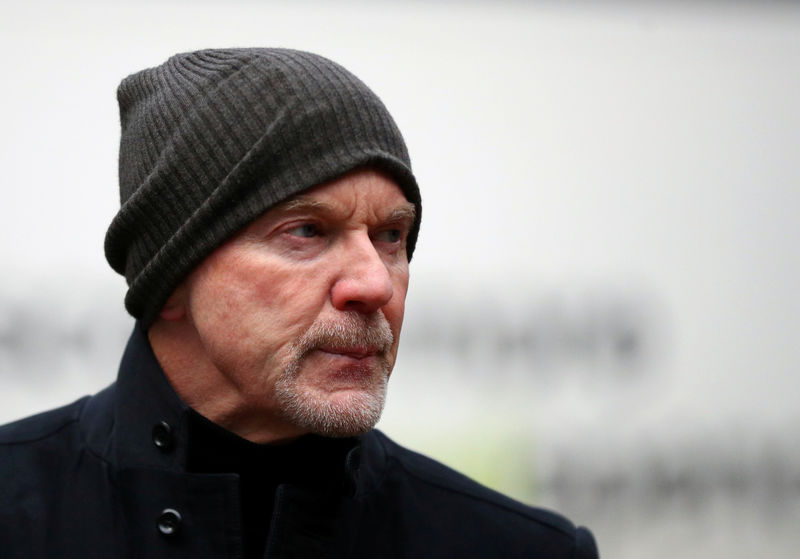

It would have been "lunacy" for Roger Jenkins, one of three men charged with fraud over undisclosed payments to Qatar during emergency fundraisings in 2008, to risk such accrued benefits and a job that had paid him 38 million pounds in 2007 alone, his lawyer told a jury at the Old Bailey criminal court.

The high-profile Serious Fraud Office (SFO) case revolves around how Barclays -- one of the few major British banks to survive the credit crisis without direct government aid -- raised more than 11 billion pounds ($14 billion) from Qatar and other investors to avert a state bailout as markets roiled.

Prosecutors allege that former top executives lied to the market and other investors by not properly disclosing 322 million pounds paid to Qatar, disguised as "bogus" advisory services agreements (ASAs), in return for around four billion pounds in two fundraisings over 2008.

Jenkins, the former head of the bank's Middle East business, Tom Kalaris, who ran the wealth division and Richard Boath, a former head of European financial institutions, deny charges of conspiracy to commit fraud by false representation and fraud by false representation.

Lawyers for Jenkins and Kalaris told the jury the case against their clients was misconceived, perverse and illogical and that there was no evidence the ASAs were a sham or fake.

In brief opening speeches before the prosecution continues laying out its case, they alleged the defendants believed the ASAs were genuine agreements to secure lucrative business for Barclays in the Middle East -- a region it was keen to exploit.

They said the agreements were side deals during emergency fundraising that June and October that had been approved by internal and external lawyers and cleared by the board.

"The unequivocal, repeated advice was that this was legitimate - providing the ASA was a genuine contract for the provision of benefits to Barclays," said John Kelsey-Fry, a senior lawyer representing Jenkins.

Jenkins, who will give evidence later, had pursued and won the trust of Sheikh Hamad bin Jassim bin Jabr al-Thani, the former prime minister of Qatar, and wanted to unseat Credit Suisse (SIX:CSGN) as the wealthy, gas-rich Gulf state's preferred bankers, the jury heard.

Had Jenkins considered a fraudulent deal with Sheikh Hamad, the sheikh might have rung up Barclays bosses and said: "Neither I nor QIA (the sovereign wealth fund) are putting a penny in a bank like yours. I will never do business with you again," Kelsey-Fry said.

Qatar Holding, part of QIA, invested in Barclays alongside Challenger, Sheikh Hamad's investment vehicle.

The case against Kalaris, meanwhile, hung on three conversations he had with Boath on the afternoon of June 11, 2008, that the prosecution had "fundamentally misunderstood", his lawyer Ian Winter said.

When Kalaris told Boath: "Noone wants to go to jail here" and that lawyers would provide "air cover", he was trying to ensure that a genuine ASA would be approved by legal experts as a legitimate means of paying Qatar for real value, Winter said.

All three men, aged between 60 and 64, are charged over the June fundraising. Jenkins, alone, also faces charges over the October fundraising.

The trial is scheduled to last around five months.