Bet on Macau casinos, where too much is never enough, stock analysts say

- Casinos amp up their ‘wow’ factor to catch ‘minnow’ family gamblers, who are outpacing ‘big whale’ VIPs

- Trade war is a scary wild card, even as casinos prepare to roll out splashy new projects and upgrades, like Sands China’s The Londoner with a replica ‘Big Ben’ tower

Betting on glitzy Macau’s casino stocks is a good long-term gamble, many analysts say – not because of high-rolling big whales but because of the casinos’ new determination to lure wave upon wave of mom-and-pop minnows.

“It’s an attractive long-term story for me,” says Kenny Wen, wealth management strategist at Everbright Sun Hung Kai. “More and more people will come there. The revenue not only comes from gambling. The father will go to the casino, and the children and wife can spend their money in other places.”

Those other places include jaw-droppingly blingy, Marie Antoinette-meets-Walt Disney fantasy worlds: opera-singing gondoliers navigate indoor canals. A laser light and water show stars an asteroid-sized swirling purple “diamond.” Free cable cars whisk riders around an undulating, dragon-backed fountain as Frank Sinatra croons “I’ve got the world on a string.”

Yes, this Las Vegas on steroids is once again amping up its dosage.

Macau, which in 2006 surpassed the Las Vegas Strip as the world’s top gambling centre, is a spunky survivor. Deep-pocketed casino barons are doubling down, betting the future of this former Portuguese trading post turned Chinese Special Administrative Region is paved with gold.

But Macau hasn’t forgotten that its luck can run out. With the swiftness of a croupier sweeping away losers’ chips, Macau stocks and gaming revenue plunged in 2014 as President Xi Jinping cracked down on corruption and extravagance. Macau’s high rollers vanished and stayed away until, two years later, they felt safe hitting its VIP tables.

Good times – though more subdued than before Xi’s crackdown – were coming back until the middle of last year, when the trade war flared up and China’s economy slowed, sending casino stocks tumbling.

Now, two big changes are afoot: the hot Cotai Strip, a reclaimed area across from old Macau and its tired-feeling casinos, is experiencing a new building boom, with fanciful creations and upgrades in the works, such as Sands China’s upcoming The Londoner, with a 96-metre-tall “Big Ben,” and SJM Holdings’ long-awaited, chateau-inspired Grand Lisboa Palace, which is set to have a grand wedding pavilion and theatre in addition to 2,000 hotel rooms and hundreds of gaming tables.

Second, while VIPs will always be lavishly courted, new attention is being directed at catching “minnows” – the mom-and-pop gamblers pouring in from mainland China with selfie-loving kids and even grandparents in tow. Casino operators are scrambling to create non-gaming attractions to woo them – retail, dining and over-the-top entertainment – which, while about 12 per cent of total revenue last year, generates 40 per cent to 90 per cent profit margins, exceeding casino margins, according to Bloomberg.

“In the next few years, we are going to see a lot of those first-time travellers go to Macau from all parts of China,” said Margaret Huang, Asia-Pacific gaming and global lodging analyst for Bloomberg Intelligence.

What analysts call the “mass” gamblers now outpace VIP-generated revenue, according to Bloomberg, a trend that is expected to continue in the second half of the year. Sands China already rakes in 30 per cent of this segment, followed by Galaxy at nearly 19 per cent and SJM at 16 per cent. China has nearly 1.4 billion people.

Huang calls Macau casino stocks a “good long-term bet,” partly because the city plays into China’s tourism push for the Greater Bay Area, which links Guangdong province, Hong Kong and Macau into a community.

As Macau juices up its wow factor – like the new light rail line that will soon connect the mammoth casinos – monthly gross gaming revenue jumped in June by 5.9 per cent year-on-year to US$2.95 billion – growing for a second straight month. That’s coming off May, what JP Morgan calls “a month to forget,”when the US-China trade war escalated and casino stocks suffered mightily.

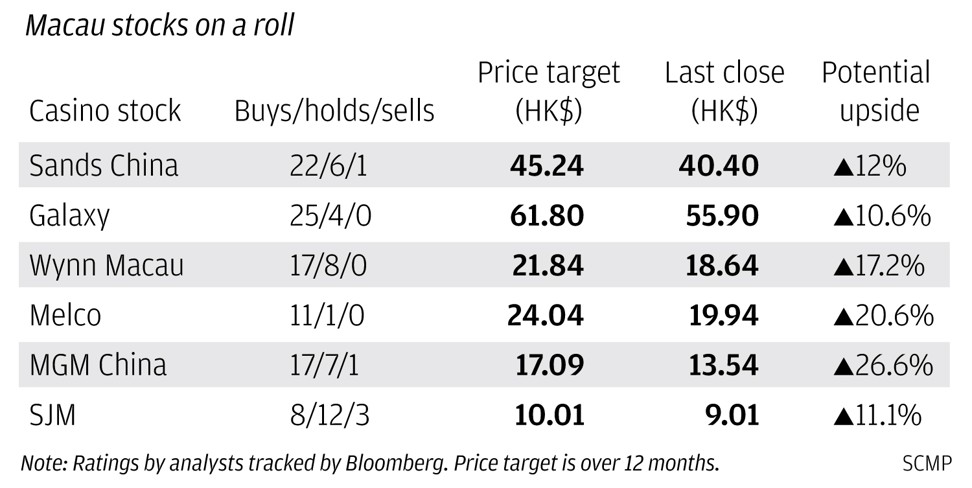

The restart of trade talks last month boosted casino stock prices, but analysts still see buying opportunities.

JP Morgan is overweight Wynn Macau, and in its in-depth report on Macau casinos in June, it said its top picks are Galaxy Entertainment and “king of mass” Sands China.

Credit Suisse also likes Sands China, which in recent days has been an outperformer, as well as MGM China, Galaxy Entertainment, Wynn Macau and Melco International.

Only SJM Holdings has fewer analysts tracked by Bloomberg saying to buy it than hold or sell it (eight/12/three). It’s the only casino operator without an operation in the Cotai Strip – yet. Its Grand Lisboa Palace is expected to open before the end of the year, which may help it combat eroding market share. For 40 years, it held a casino monopoly in Macau, but has struggled against flashier Cotai competitors since 2015.

For now, the trade war remains a scary wild card.

Until it’s resolved, many high rollers will opt to stay home and focus on safeguarding family wealth.

What’s more, most of Macau’s gamblers come from neighbouring Guangdong, a province disproportionately dependent on exports and, thus, especially vulnerable to the trade war’s ill winds.

Meanwhile, casino concession permits are up for renewal in 2022, and three American casino operators – Sands China, Wynn Macau and MGM – could discover that Beijing sees them as useful pawns in the trade war or that it wants to require joint ventures with Chinese partners to keep some of their staggering Macau profits: US$120 billion in the past 20 years, according to Bloomberg Intelligence’s Huang.

The big push toward non-gaming revenue should please Macau’s government, which wants to diversify its tourism. Being a leader in non-gaming options could help the American players in their concession renewal.

A final concern for Macau investors is that Japan – beloved by Chinese tourists and a magnet for business conferences – is moving into the casino business, potentially forcing Macau to share some of its jackpots.

Strategist Wen says the coming dogfight will leave winners and losers.

“Yes, growth potential is high, but competition is also fierce. The market share will change,” he said.

Huang of Bloomberg Intelligence sees Macau as winning more broadly.

“China will never let Macau fail. It is a part of China,” she said. “They did the (corruption) clean-up. Now it’s about people coming here to enjoy their vacation.”