Cargill Inc. is the largest privately held corporation in the United States. It is involved in the purchasing, trading, processing and distribution of food, agriculture, financial and industrial products and services. Cargill is also one of the largest food companies in Brazil, where it operates 22 processing factories, six port terminals, and 192 warehouses and transshipment points. It is one of the main soy traders in Maranhão, a booming soy state that has seen high clearing rates of native Cerrado vegetation. Planned soy expansion in the state threatens remaining Cerrado forests, as Brazil’s 2015 Forest Code allows for 65 percent of Cerrado land to be cleared legally. Cargill’s approach to zero-deforestation supply chains still leaves room for ongoing land clearing by its suppliers in Maranhão. This could result in a number of business risks, including reputation risks and market access risks.

Key Findings

- Cargill holds a soy export market share of 21 percent (454,000 MT out of 2,140,000 MT) in Maranhão, making it the largest trader in the state. It operates four soybean silos in Maranhão, three of which are strategically located in the state’s main grain producing areas in the south.

- From 2010 to 2017, an estimated 336,426 ha of land was cleared for soy in south Maranhão. 1.5 million ha of native vegetation remains that is economically viable for soy production.

- Cargill’s zero-deforestation approach still leaves room for ongoing deforestation in its supply chain. Its 2030 cut-off date and prioritization of tackling illegal deforestation allows producers to continue Cerrado deforestation. Opaque supplier relations may keep environmental and social risks from sight of investors.

- The value of Cargill’s fixed assets in Maranhão is less than USD 100 million, equaling only 0.4 percent of its global total fixed assets. As Cargill exports 454,000 MT (USD 180 million annually) from Maranhão and only a part of this comes from recently deforested Cerrado land, the impact of ending these supplies will be less than 0.2 percent on Cargill’s global sales and profits.

- Revenue-at-risk of USD 7 to 17 billion may be linked to the European signatories of the Cerrado Manifesto. This risk is limited due to the dominance of a few large traders in the global supply chain, a lack of alternatives for European customers and the dominance of Asian buyers of Brazilian soy.

- Privately-owned Cargill is mainly financed by bondholders with no significant deforestation policies. In recent years, Cargill has paid down bank debt. Future loan deals with banks with deforestation policies may raise discussions around legal deforestation in valuable natural habitats entering Cargill’s soy supply.

Chain Reaction Research is a coalition of:

Aidenvironment

Climate Advisers

Profundo

1320 19th Street NW, Suite 300

Washington, DC 20036

United States

www.chainreactionresearch.com

Authors:

Tim Steinweg, Aidenvironment

Gerard Rijk, Profundo

Gabriel Thoumi, Climate Advisers

This company profile builds (partly) on fieldwork by consultant Geraldo Mosimann da Silva. The sustainability risk analysis has been shared with Cargill before publication. Comments were received via email on April 6, 2018. Cargill’s comments have been addressed in the final text.

Cargill: One of the Leading Food Companies in Brazil’s Cerrado

Cargill is a large, international company involved in the purchasing, trading, processing and distribution of food, agriculture, financial and industrial products and services. With FY2017 revenue of USD 109.7 billion, Cargill Inc. is the largest privately

held corporation in the United States. Adjusted operating earnings were USD 3.0 billion and net earnings were USD 2.8 billion. Based on revenue, Cargill would be in the top 20 of the Fortune 500 if it were a publicly listed company.

Cargill is one of the largest food companies in Brazil and operates 22 processing factories, six port terminals, and 192 warehouses and transshipment points in the country. In 2016, the company had invested nearly BRL 775 million (USD 215 million)

in logistics and port infrastructure in Brazil. Cargill’s subsidiary in Brazil, Cargill Agrícola S.A., generated BRL 33.1 billion (USD 9.2 billion) net operating revenue in 2016. Undoubtedly, Brazil is a key market for Cargill.

Cargill’s Operations in a Booming Soy State

Cargill is one of the main soy traders in Maranhão. In the 2016/2017 agricultural season, soy production in Maranhão was 2.3 million metric tons (MT), nearly double the previous year. A 12 percent increase in soybean area planted (from 822,000 to 920,000 ha) is estimated for 2017/2018, with the soybean harvest forecasted at 2.6 million MT.

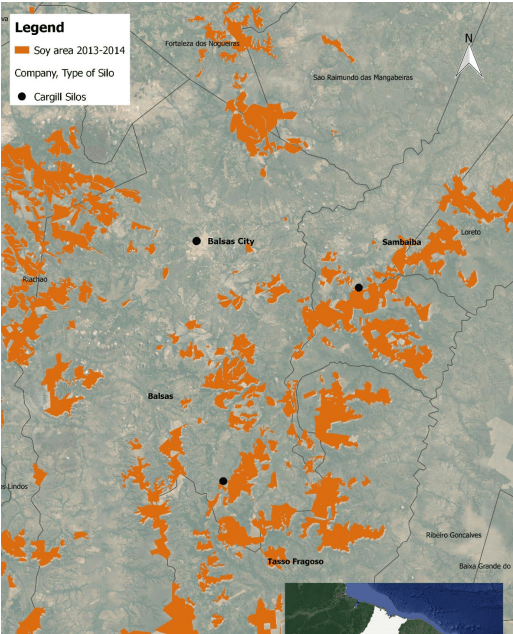

Cargill operates four soybean storage facilities (silos) in Maranhão. There are three silos in south Maranhão. As shown in Figure 1 (below), most are strategically located in the state’s main grain producing areas. In this region, the top-three soybean producing municipalities of Balsas, Tasso Fragoso and Sambaíba, respectively produced 505,300, 439,200 and 155,100 MT of soybeans in the 2016/2017 agricultural season. These are also the municipalities where Cargill sources the majority of its soybeans.

Figure 1: Silos of Cargill in south Maranhão.

Source: Sistema de CadastroNacional de Unidades Armazenadoras (SICARM).

According to recent shipment data (October 2016-September 2017, Figure 2 – below), Cargill exports the largest volumes of soy from Maranhão. The soy production of Maranhão is mainly commercialized in the form of soybeans (in contrast to soymeal or oil) as a result of favorable tax conditions.

Figure 2: Top 5 soy exporters from Maranhão, Oct 2016 to Sep 2017.

Source: Panjiva.

Cargill ships its sourced soybeans from Maranhão through the port of Itaqui. Whereas international agribusiness giants Cargill and Bunge were initially the main soybean exporters from this port, they now face competition from the Tegram grain terminal built in 2015 built by a consortium of Glencore Plc, Amaggi, Louis Dreyfus, NovaAgri and CGG Trading. Nevertheless, shipment data from October 2016 to September 2017 demonstrates that Cargill’s subsidiary Cargill Agrícola S.A is still responsible for 21 percent of soy exports (454,000 MT out of 2,140,000 MT) from Maranhão.

Environmental and Social Impacts of Soy Expansion in Maranhão

Maranhão consists of 64 percent of Cerrado vegetation. The state is under pressure of significant soy expansion that causes deforestation and other socio-environmental impacts to local communities.

The Cerrado is a large tropical savanna biome that covers more than 20 percent of Brazil. The Cerrado biome hosts five percent of the world’s biodiversity and is the most biodiverse savanna in the world. Crop production in the Cerrado biome has expanded by 87% between 2000-2014, with soybeans representing 90 percent of all agriculture in the Cerrado. Maranhão is part of the Matopiba region (Maranhão, Tocantins, Piauí and Bahia), often referred to as the “last soy frontier”. This region saw agricultural expansion of 253%, of which 62-68% occurred over native vegetation.

Soy-Driven Deforestation in Maranhão

Soy drives land conversion in Maranhão. It was responsible for 93 percent of the total agricultural land use in the state in 2013/14. Figure 3 (below) shows that in the period from 2010 until 2017, 336,426 ha of forest were cleared on land used for soy production in south Maranhão. In comparison, soy-related deforestation in adjacent state Piauí accounted for 123,917 ha between 2010 and 2017.

Figure 3: Soy-driven deforestation in south Maranhão (2010-2017).

Source: Chain Reaction Research Landsat and Sentinel-2 satellite analysis, SICARM and Hansen/UMD/Google/USGS/NASA.

Of the cleared land for soy production in Maranhão, 95 percent of the original native vegetation is classified as forest (forested savanna and wooded savanna) by Brazil’s Ministry of the Environment.

The rise of soy agribusiness has had negative social impacts in Maranhão. The state is leading in the number of agrarian land conflicts and lacks a skilled labor force. With the arrival of international soy trading companies, there is preference for skilled technicians. Maranhão also has reported cases of slave labor. Local research in Maranhão in February 2018 further indicate that local communities suffer from agrochemical pollution, drying up of springs and waterways and pesticides poisoning all related to soy production and land bank expansion.

Traditional communities in the Matopiba region (which are officially recognized by the National Council of People and Traditional Communities) have accused agribusiness of “green land grabbing”, which means that companies acquire land that is kept as legal reserve. This land can then no longer be used by communities who have farmed, grazed, and harvested these native lands held by the Brazilian government for centuries. The Brazilian Forest Code does not require that these protected lands be contiguous with developed croplands. Therefore, large-scale farms have increasingly laid claim to natural lands – often held without deed by traditional communities – with agribusiness counting them as their reserves. Despite the soy boom, Maranhão remains one of the poorest and most deprived states in the country and was one of the lowest scoring states in UNDP’s Human Development Index (HDI) in 2014. The HDI is a composite statistic of education, income and longevity indices, calculated in order to measure social and economic development within countries.

Further Soy Expansion Results in Accelerated Cerrado Conversion

Opening of new areas suitable for soy production, in contrast to intensified production of already conversed land, continues to take place in Maranhão. Figure 3 (above) shows ongoing and recent soy-related deforestation in south Maranhão in new areas.

As Maranhão is limited in already-converted areas suitable for agriculture, interviews with state officials and soy stakeholders pointed to the need of further expansion into native vegetation areas; in other words, continued deforestation of native Cerrado vegetation. The Balsas Municipal Secretary of Industry and Commerce of Maranhão aims for the legal conversion of around 1.5 million ha of Cerrado vegetation into cropland that represents economically viable areas for soy production. This coincides with geospatial analysis of land stock in Maranhão with high agricultural capacity showing the availability of 1,455,369 ha in areas of native vegetation remnants.

There are indications that conversion into cropland currently takes place at an accelerated rate. According to market experts in Maranhão and given soy’s dominance in the region, producers are rapidly clearing their properties to ensure a stock of open land for future expansion of soy production. This is in anticipation of the potential expansion of the soy moratorium to the Cerrado by leading downstream companies and the implementation of the main soy traders’ zero-deforestation policies.

Cargill’s Zero-Deforestation Commitment Continues Deforestation of the Cerrado

Cargill’s Forest Protection Action Plans are insufficient to halt ongoing Cerrado deforestation in Maranhão, despite a company policy to create zero-deforestation supply chains.

In September 2014, 179 governments, companies, indigenous peoples and civil society organizations convened to adopt the New York Declaration on Forests. Cargill was one of the signatories, pledging for “eliminating deforestation from the production of agricultural commodities such as palm oil, soy, paper and beef products by no later than 2020”. However, one year after its publication, Cargill started using a 2030 deadline for elimination of all forms of deforestation in its agricultural supply chains.

Cargill’s Forest Protection Action Plans for Brazil encourage soy suppliers to comply with Brazilian legislation through the following sourcing criteria and requirements:

1) The Brazilian Forest Code

2) Registry in the Rural Environmental Registry (CAR)

3) The list of embargoed areas published by the Brazilian Environmental Ministry

4) The list of slave labor distributed by the Inpacto (Pact for the Eradication of Slave Labor Institute).

Cargill informed CRR that it has internal procedures to ensure that the company does not buy any products from suppliers on the slave labor list. Indeed, the taxpayer registration number of these suppliers are blocked in Cargill’s systems. The company also said that it does not buy any produce from producers that deforest illegally. These producers are on the list of embargoed areas from the Brazilian Institute of Environment and Renewable Natural Resources (IBAMA), which is updated daily, and they are blocked in Cargill’s systems. Cargill has internal procedures to ensure that it also does not source from embargoed areas.

Cargill’s 2017 Report on Forests, a report tracking the company’s progress towards its commitment to end deforestation, highlights the expansion of Cargill’s Soya Plus Program (an environmental and social management program for soy in Brazil) to the states of Maranhão, Piauí, Tocantins and Bahia. In this program, soy farmers receive training to help to comply with the Brazilian Forest Code and registry in the Rural Environmental Registry (CAR).

While Cargill encourages its suppliers to register their operations in the CAR, the reality of this registration system is that supplier structures remain vague. The Brazilian land tenure system is characterized by unclear land titles, collective properties and a system of land lease. Property owners, usually indebted, lease their properties and provide production services to large soybean producing groups. Therefore, registered landowners may not be the ultimate users of the agricultural land.

2030 Cut-Off Date Allows Cargill’s Suppliers to Continue Deforestation

Cargill’s 2030 cut-off date is later than the 2020 cut-off date for agriculture driven deforestation as agreed in the New York Declaration on Forests. It is also later than the deadlines set by some of its key competitors. Environmental groups such as Mighty Earth have accused Cargill of backtracking on the 2020 deadline. In Cargill’s soy supply chain, this delayed deadline could create incentives to continue to deforest for a longer period. As highlighted in the previous section, it also leaves considerable space for soy producers in the Cerrado to continue to deforest until 2030. Cargill has indicated to CRR that it wants to be thoughtful on how the timing of its deforestation work might impact farmer livelihoods. However, Cargill did not provide details on how much it sources from smallholder farmers, for whom livelihoods concerns are arguably more pressing, compared to large industrialized farming companies.

Cargill’s Compliance with Brazilian Laws Does Not Equal Zero-Deforestation

Cargill states that it complies with relevant Brazilian legislation such as the Brazilian Forest Code and the list of embargoed areas. The Forest Code requires private landowners in the Cerrado (including Maranhão) to maintain 35 percent of land as legal reserves (in contrast, legal reserves in the Amazon must cover 80 percent). It leaves room for soy producers to legally deforest large tracts of native Cerrado vegetation.

Cargill prioritizes tackling illegal deforestation. It states that only once illegal deforestation is “under control,” Cargill aims to take steps at tackling the issue of legal deforestation. Meanwhile, significant areas of Cerrado vegetation in Maranhão are legally converted into cropland at an accelerated rate. Despite Cargill addressing illegal deforestation -using the list of embargoed areas published by the Brazilian Environmental Ministry- the wording of Cargill’s policy suggests that soy from legally deforested areas continues to be accepted. Commenting on a draft version of this report, Cargill said that the Brazilian Forest Code allows producers to expand and that “deforestation is not linked to illegal deforestation in every case”. This comment confirms that Cargill allows legal deforestation in its supply chain.

Secret Suppliers Hide Environmental and Social Risks from Investors

Whereas Cargill has made some progress in traceability in its palm oil supply chain, it is not as transparent about its soy suppliers. Because Cargill does not disclose a list of its soy suppliers, it is difficult to attribute any deforestation directly to Cargill operations. Hidden suppliers are a risk in an environment that is under pressure of negative environmental and social impacts from soy agribusiness.

It is likely that Cargill sources from some of the larger soy producers that control vast areas of Maranhão farmland. Fieldwork in Maranhão in February 2018 highlighted that a handful of larger soy producers (SLC Agrícola, Agrinvest Brasil, Risa S/A, Agrex Inc/Mitsubishi Corporation and Bartira Agropecuária S.A) control a total area of 300,000 to 400,000 ha of farmland in south Maranhão, some of them fully relying on leased lands (e.g. Agrex Inc/Mitsubishi). Previous Chain Reaction Research on farmland investments in Matopiba also highlighted that land holdings are highly concentrated in this region; ten agribusiness and real estate firms control a total area of 1 million ha of farmland. Some of the identified large landholders are confirmed suppliers of Cargill, such as SLC Agrícola and Risa S/A.

As shown in Figure 4 (below), one confirmed Cargill supplier has actively deforested Cerrado forests in Maranhão. Satellite imagery from March 2018 demonstrates that soy producer SLC Agrícola – with three soy farms in Maranhão – has deforested 4,541 ha of Cerrado vegetation in south Maranhão from 2011 to 2016. Cargill confirmed to CRR that “all deforestation regarding SLC is legal” and that it strongly believes that SLC is “a case of success in terms of sustainability”.

Figure 4: 2011 and 2016 deforestation in SLC Agrícola’s Parnaíba farm in south Maranhão.

Source: Sentinel-2 satellite images

Recent Deforestation in Vicinity of Cargill Facilities

To improve transparency in its soy supply chain, Cargill currently develops a baseline for measuring and managing deforestation across high-risk sourcing areas. In the vicinity of Cargill’s sourcing areas (e.g. sourcing radius of 30 or 50 km), Cargill analyzes and measures forest loss.

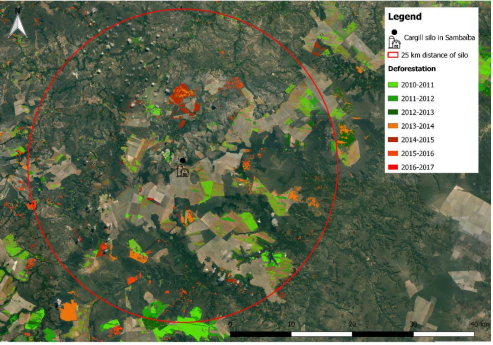

Within a 25 km radius around Cargill’s warehouse facility in Sambaíba in Maranhão, as shown in Figure 5 (below), satellite imagery by Aidenvironment shows a loss of 7,507 ha of native Cerrado vegetation. This suggests that forest loss around Cargill’s facilities might be significant. Commenting in April 2018, Cargill said it was “still investigating” to verify these findings.

Figure 5: Soy-driven deforestation in a 25 km radius around Cargill’s silo in Sambaíba municipality (2010-2017).

Source: CRR Landsat & Sentinel-2 satellite analysis, SICARM and Hansen/UMD/Google/USGS/NASA

Cargill states that: “The forest impacts should not be interpreted as directly attributable to the commodity of interest or to Cargill’s sourcing itself. There are many overlapping causes of deforestation and many actors (including Cargill’s commodity trading peers) operating in the same landscapes. As such, only a closer study of Cargill’s actual sourcing using production-level footprint data will produce an accurate measurement of forest loss in Cargill’s supply chains and the reduction thereof”.

However, it is impossible for stakeholders to carry out a “closer study of Cargill’s actual sourcing using production-level footprint data” when supplier structures around Cargill facilities are unclear. As the previous section highlighted, registered landowners around Cargill’s facility may not be the ultimate users of the properties and Cargill does not disclose a list of its soy suppliers. Cargill offices in Maranhão did not respond to repeated requests from CRR researchers to elaborate on this issue.

Business Risks

Ongoing deforestation in Cargill’s supply chain, whether legal or illegal, as well as the company’s less ambitious zero deforestation goal compared to its agribusiness peers, exposes the company to several operational risks.

Reputation Risk

Cargill is less ambitious than its peers in setting zero-deforestation goals, which poses reputation risks. The company has committed to eliminating deforestation in its soy supply chain by 2030, whereas competitors – such as Bunge – have committed to doing so five to ten years earlier.

Several key initiatives and declarations have also set more ambitious targets. The Sustainable Development Goals aim to halt deforestation by 2020. The Amsterdam Declaration towards eliminating deforestation from agricultural commodity chains

aims to eliminate all deforestation by no later than 2020, with a stronger focus on more responsible private-sector management of supply chains and trade. The governments of the Netherlands, Denmark, France, Germany, Norway and the UK have endorsed the Declaration.

Cargill also lags when it comes to soy supply chain transparency and traceability. It does not publish a list of suppliers on its website or communicate openly about its suppliers. While in general traceability is lagging for commodities such as soy and cattle, ADM and Unilever have made progress in the levels of traceability to their soy suppliers.

Market Risk

Cargill’s clients likely include large consumer goods companies that are members of the Consumer Goods Forum and that have adopted their own zero-deforestation commitments. Ongoing deforestation in Cargill’s supply chain might jeopardize its business relations with these clients.

The Consumer Goods Forum, with a membership base of 400 retailers, manufacturers and service providers, has adopted a resolution to achieve zero net deforestation by 2020 through the responsible sourcing of four key commodities, including soy. The Consumer Goods Forum recommends a twin track approach for the implementation of zero-deforestation commitments: accelerating the implementation of relevant national legal frameworks (e.g. Forest Code) while simultaneously ensuring development and implementation of measures to exclude all deforestation from soy supply chains.

The 2020 cut-off date for these public commitments could pose market access risks that are only partially mitigated by Cargill’s own zero-deforestation commitment with its 2030 cut-off date. Consumer goods companies that look to meet their publicly stated goals could revisit their relations with suppliers unable to meet their responsible sourcing targets.

Furthermore, 61 consumer goods companies have issued a statement that addresses the issue of deforestation in the Cerrado. In 2017, a coalition of civil society groups published the Cerrado Manifesto, calling for private sector efforts to halt deforestation in the Cerrado. Since January 2018, 61 of the world’s largest food companies have signed a Statement of Support to the Cerrado Manifesto.

This statement of support explicitly states that: “This wide gap between tackling ‘illegal’ deforestation and achieving zero net deforestation goals is a cause for major concern.” This illustrates that the position of some of Cargill’s large clients might be at odds with Cargill’s prioritization of illegal deforestation.

Finally, the Cerrado Manifesto and the statement of support both emphasize the position that soy and cattle expansion should take place in already cleared land, rather than areas that need to be converted. As described above, soy expansion plans in Maranhão, where Cargill is an important market actor, requires further deforestation of native Cerrado vegetation.

Financial Risk Analysis

This section discusses the potential financial implications of the sustainability risks, elaborated on above:

- The financial costs of a zero-deforestation supply chain. This calculation will focus on Cargill’s assets in Maranhão which might not be used and the impact on the top line.

- The revenue-at-risk related to customers which have zero-deforestation commitments that cover the Cerrado.

- The cost of capital risk. Who is financing Cargill’s debt and how will noncompliance related to deforestation in Maranhão impact these relations?

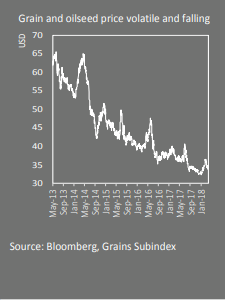

Recent results and financials

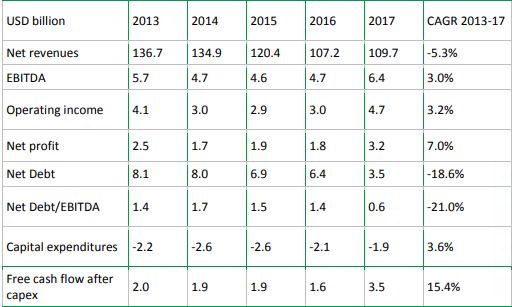

In the last five years (2013-2017), Cargill’s net revenue decreased 5.3 percent from USD 136.7 billion (2013) to USD 109.7 billion (2017). This decrease is explained partially by the falling prices in the grains market (see graph below). From 2013 to 2017, Cargill’s profitability has improved with EBITDA moving up to USD 6.4 billion in 2017 (3.0 percent CAGR) and net profit reaching USD 3.2 billion (7.0 percent CAGR).

In 2017, net revenues increased slightly versus 2016. EBITDA showed a much stronger increase and also free cash flow generation improved strongly. In the last few years, Cargill has become more focused on efficiencies and more stringent on capital expenditures in all its global activities. The first nine months of the financial year 2018 (ending May 31, 2018) showed a decrease in net revenues, but a small increase in profitability excluding one-off items.

In 2013-2017, as shown in Figure 6 (below) Cargill has been actively reducing net debt. In total, net debt decreased by 57 percent from USD 8.1 billion (2013) to USD 3.5 billion (2017) due to free cash flow generation. As a consequence, the ratio net debt/EBITDA has declined to 0.6X end of 2017.

Figure 6: Key Figures of Cargill

Source: Bloomberg, Chain Reaction Research. Fiscal Year is end of May.

Cargill has divided its activities into four divisions/product groups:

- Animal Nutrition & Protein.

- Food Ingredients & Applications.

- Origination & Processing.

- Industrial & Financial Services.

As a private company, Cargill is not transparent in the split in sales and EBITDA per product group. The segment Animal Nutrition & Protein was, according Cargill, the “largest contributor” in the company’s operating earnings in 2017.

However, in geographical terms the company shows a split in sales and in FTEs (but not in EBITDA). In 2017, 13 percent of sales were generated in Latin America (see figure in the sidebar). Of personnel, 19 percent was employed in Latin America, along with 36 percent in Asia-Pacific, 30 percent in North America, and 15 percent in EMEA.

Strategy Change: Efficiency, Value-Added Products, Sustainability

As shown above, in 2013-2016 the operating profit and EBITDA were relatively weak, despite the underlying global growth drivers from rising population and increasing protein and edible oil intake. The ABCD group (ADM, Bunge, Cargill, Louis Dreyfus) has been feeling increasing pressure from more competition, improved market knowledge by all participants and increased farmer storage.

In addition to a greater focus on efficiency that led to a higher EBITDA in 2017, Cargill is also in the process of changing its strategy to match other traders in the ABCD group. Cargill’s role as a trader will become less important, while increasing its activities in value-added activities, including a larger focus on ingredients. At the same time, the company is initiating more sustainability initiatives. Among others, it has taken initiatives to reduce the use of antibiotics in its meat activities in order to catch up in growing segments of the meat supply chain. Despite the change in strategy, Cargill will likely remain in contact with growers. Because of its size, it will be able to request specific characteristics of the soybeans it is sourcing.

Stranded Asset Risk is Material, Size of Risk is Small

In the event that Cargill will meet its publicly stated zero-deforestation commitment, the financial risk is linked to underutilization of a part of the (fixed) assets in Maranhão.

As mentioned above, 13 percent of Cargill’s sales are from Latin America, of which the majority – 10 percent – is from Brazil. In Brazil, Cargill operates 22 processing factories, six port terminals, and 192 warehouses and transshipment points, of which four silos are in Maranhão.

For Cargill’s competitor Bunge, which has more than 100 facilities in Brazil, Bunge’s assets are valued at USD 2.5 billion. As Cargill has more than 200 facilities, its value is estimated to be USD 5 billion. The four silos in Maranhão have an estimated asset value of USD 100 million, representing 0.4 percent of Cargill’s global fixed asset base. Cargill may suffer relatively small write-downs if it excludes deforestation-linked soy from these silos.

The 454,000 MT from Maranhão sold by Cargill to exports markets is estimated on a value of USD 181 million (nearly USD 400 per MT), or only 0.2 percent of the 2017 global net revenues. The contribution to profitability is of the same magnitude. Of course, not all these exports will be affected as only a part of the handled soy is grown on recently deforested land in Maranhão.

Cerrado Manifesto Drives Revenue-at-Risk, But Asia Offers Escape

As mentioned above in the sustainability risk analysis, Cargill faces reputation risk because it is lagging behind in the timing of its no-deforestation goals. Reputation risk does not inflict direct losses to firms but rather materializes indirectly through future revenue losses and/or higher costs. This can relate to highly qualified employees who could decide to work for competitors or in other sectors, but also customers who can change purchasing to other suppliers, both now and in the future.

Cargill’s customer relationship base is mainly business-to-business. The main customer groups are in Animal Nutrition (compound feed companies, livestock farmers), food & beverage companies, bio-industrial customers, foodservice (e.g. McDonald’s) and retailers (meat), agriculture, industrial companies, personal care companies and pharmaceutical companies. The company’s Products & Services website page gives further insight on the breakdown of these customer groups. For many of these customers, in particular those that are members of the Consumer Goods Forum (CGF, see above), Cargill’s 2030 end-of-deforestation date might pose a reputation risk when they are still sourcing from Cargill. The 61 companies that have signed the Cerrado Manifesto will be even stricter on this.

Thus, Cargill’s 2030 date might lead to market access risk through CGF members as well as by key customers who have signed the Cerrado Manifesto. If these customers expand this sourcing substitution towards product groups other than soy, the impact on net revenues and EBITDA of Cargill could be substantial. However, several of these dynamics are not yet pronounced because of two reasons:

- North American customers who source, for instance, North American soybeans from Cargill, will not easily change their purchasing behavior. Latin American soybeans are mainly shipped to Asia and Europe. The Cerrado Manifesto is not signed by Asian, but rather by European, clients.

- The market structure in agricultural commodity trading, which is oligopolistic, reduces the opportunities to avoid Cargill as a supplier.

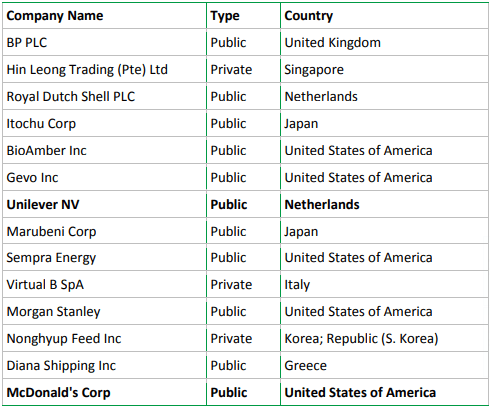

As Cargill is a private company, the transparency of the customers list is relatively low. Figure 7 below shows that two companies that have signed the Cerrado Manifesto belong to a key customer list. Note that the list shows the key customers in all of Cargill’s product groups in addition to Brazilian soybeans, however without sizes or percentages.

Figure 7: Key customers of Cargill.

The bold printed companies are signatories of the Cerrado Manifesto

Source: Thomson Reuters

Particularly the European signatories of the Cerrado Manifesto are likely sourcing from Latin America and Brazil. Nearly all signatories are European-based or have European branches. Two-thirds of the signatories are active in (food) retail, and 15 percent are active in food processing. The rest are active in food service and other parts of the food chain.

Each member might have direct or indirect purchasing relationships with Cargill. This might amount to 0.1 to 0.25 percent of Cargill’s turnover, per member, meaning that 6 to 15 percent of Cargill’s turnover might be at risk. This revenue-at-risk ranges from USD 7 to 17 billion, which would mean a substantial part of the sales in Europe, Middle East and Africa (24 percent of Cargill’s total, or USD 26 billion). As Cargill does not publish a gross margin, the EBITDA margin (2017: 6 percent) is used as a proxy.

Thus, the EBITDA-at-risk might be USD 0.4 to USD 1.0 billion:

- EBITDA could be hurt by 6 to 16 percent versus 2017;

- This could lead to a net profit hit of USD 0.3 to 0.8 billion, or 9 to 25 percent versus 2017’s net profit;

- Pro forma net debt/EBITDA for 2017 would nearly not be affected and would remain 0.6X, which is a safe level for financiers.

However, one should be aware that the balance of power in the soy chain differs from that in the palm oil chain. For downstream companies, it is less easy to avoid Cargill or one of the other large soy traders due to the oligopolistic nature of this part of the soy supply chain. On top of this, Brazil’s soy is also sold to southeast Asia, where the downstream consumer good companies have often not signed the Cerrado Manifesto, yet.

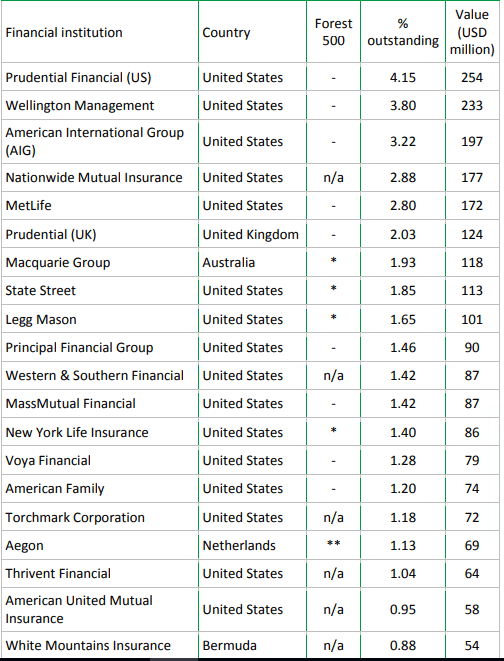

Financing Risk Limited Due to Cargill’s Debt Reduction

Cargill is a privately-owned company whose shares are controlled by family/trusts. On top of this private financing, the company is financed by debt. As shown in Figure 6 (above) the level of debt has declined in the 2013-2017 period and the important net debt/EBITDA ratio has declined to a safe level of below 1X.

From 2013 to 2017, Cargill issued several bonds and attracted loans from a number of financial institutions. On April 5, 2018 the company’s amount of total gross debt outstanding stood at USD 6.1 billion (Thomson Reuters). In total, USD 3.8 billion were found in bonds.

Figure 8 (below) shows the top 20 financial institutions holding bonds of Cargill, at most recent filing dates. The analysis shows that the largest bondholders of Cargill score low according on the Forest 500 index (from 0 to 5*). This implies that there is a low level of inclination to engage or divest.

Figure 8: Top 20 bondholders, most recent filing date.

Source: Thomson Reuters, Forest500, Chain Reaction Research

During the period from 2014 to 2017, Cargill attracted USD 13.5 billion in loans with arranged maturity dates after October 2018. However, Cargill currently has no loans outstanding as it seems that they have paid off the loans early. When Cargill will need to access capital in the future, it is highly possible that it will turn to one of the banks that have financed the company in the recent past.

According to Thomson Reuters/Bloomberg, among the most important banks providing loans to Cargill from 2014 to 2017 were BNP Paribas, JPMorgan Chase and Citigroup. Given that these banks have taken steps to strengthen their deforestation policies in recent years, legal deforestation of natural habitats may also become an issue in future discussions with clients such as Cargill. The company may risk losing access to credit facilities or face increasing costs of financing in the future.

Disclaimer:

This report and the information therein are derived from selected public sources. Chain Reaction Research is an unincorporated project of Aidenvironment, Climate Advisers and Profundo (individually and together, the “Sponsors”). The Sponsors believe the information in this report comes from reliable sources, but they do not guarantee the accuracy or completeness of this information, which is subject to change without notice, and nothing in this document shall be construed as such a guarantee. The statements reflect the current judgment of the authors of the relevant articles or features, and do not necessarily reflect the opinion of the Sponsors. The Sponsors disclaim any liability, joint or severable, arising from use of this document and its contents. Nothing herein shall constitute or be construed as an offering of financial instruments or as investment advice or recommendations by the Sponsors of an investment or other strategy (e.g., whether or not to “buy”, “sell”, or “hold” an investment). Employees of the Sponsors may hold positions in the companies, projects or investments covered by this report. No aspect of this report is based on the consideration of an investor or potential investor’s individual circumstances. You should determine on your own whether you agree with the content of this document and any information or data provided by the Sponsors.