Guest Bloomberg Oil Strategist Correcting by David Middleton

Oil Prices Are Down. Nobody Told the Gas Pumps

Julian Lee

19 August 2018(Bloomberg Opinion) — Oil’s popularity isn’t what it used to be.

[…]

Although dollar-denominated crude prices are currently around 40 percent below their level just before the 2014 price crash, the same is not true of retail gasoline or diesel prices, not even in the U.S.

American average premium gasoline prices peaked in June 2014 at a little over $4 a gallon before sliding below $2.50 in early 2015 and as low as $2.20 a year later. But since then they have staged a steady recovery, coming within a whisker of $3.50 in the run-up to this summer’s driving season.

[…]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Julian Lee is an oil strategist for Bloomberg. Previously he worked as a senior analyst at the Centre for Global Energy Studies.

American average premium gasoline prices peaked in June 2014 at a little over $4 a gallon before sliding below $2.50 in early 2015 and as low as $2.20 a year later. But since then they have staged a steady recovery, coming within a whisker of $3.50 in the run-up to this summer’s driving season.

Hey Bloomberg oil strategist!

The gasoline prices you are citing are for premium unleaded and include taxes. The vast majority of motorists use regular unleaded. Crude oil prices don’t include taxes; although you never specify which benchmarks you are referring to.

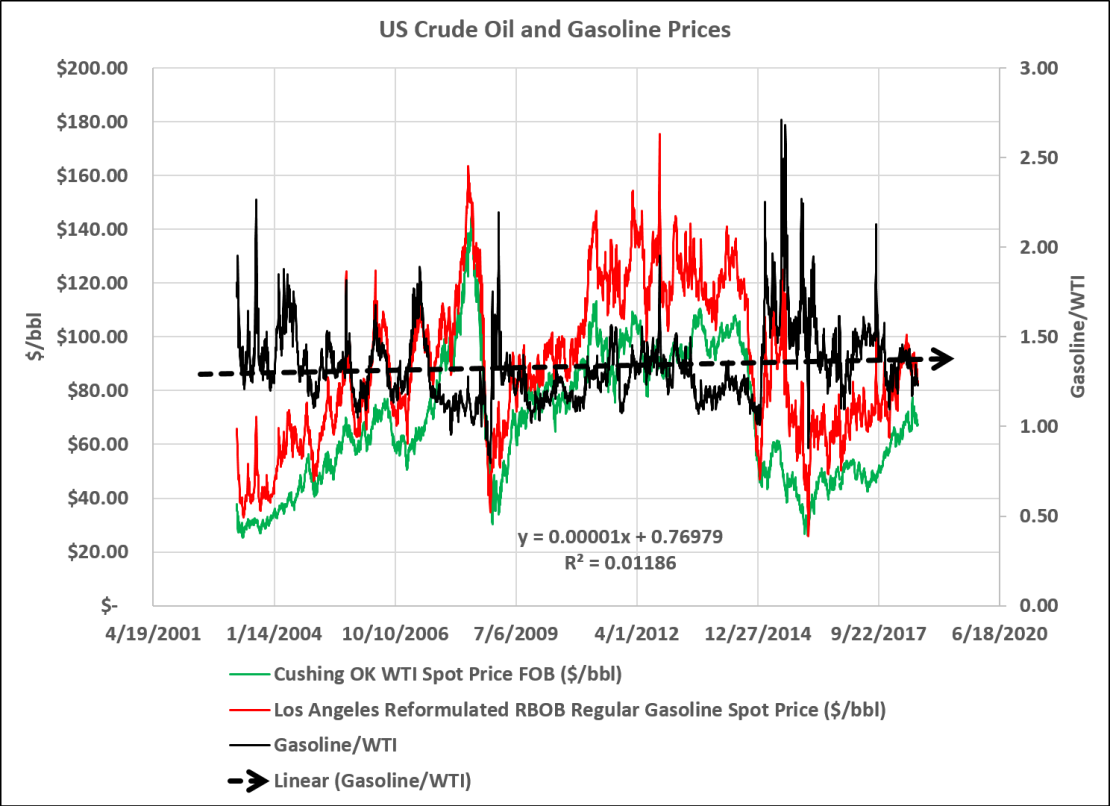

The US Energy Information Administration reports daily gasoline and crude oil benchmark prices sans taxes. Anyone with access to the Internet can actually look this up:

- Los Angeles Reformulated RBOB Regular Gasoline Spot Price ($/gal)

- Cushing, OK WTI Spot Price FOB ($/bbl)

Regular unleaded gasoline is currently going for about $1.97 a gallon before State and Federal taxes. While gasoline prices don’t instantaneously follow the ups and downs of crude oil prices, since 2003 the ratio of gasoline to crude oil prices has been relatively constant, averaging 1.34 with a standard deviation of 0.21.

Furthermore, even if we cherry pick June 2014 as a starting point, we get the same result:

Maybe Mr. Lee should be a climate data strategist for NOAA or NASA-GISS.

This Is Funny!

I Googled Mr. Lee’s former employer, Centre for Global Energy Studies, and got this Bloomberg summary:

Company Overview

Centre for Global Energy Studies operates as an energy forecasting company specializing in the analysis of oil markets, and economics and politics of energy markets. It forecasts oil demand, supply and prices, strategic hedging, politics and economics of the main oil producing regions, and OPEC policy in the Middle East, Russia, and the Former Soviet Union. The company also provides tailor-made consultancy and holds energy-related events. It publishes specialist studies, reports, and oil market subscriptions. The company’s subscription reports include global oil insight, oil product price report, monthly oil report, and FSU oil and gas advisory services. It conducts studies relating to world…

Detailed Description

17 KnightsbridgeLondon, SW1X 7LY

United Kingdom

Founded in 1987

Phone:

xxxxxxxxxxxxxxFax:

xxxxxxxxxxxxxx

So I clicked on their link, and it took me to EMERGENCY, REPAIR AND MAINTENANCE

SERVICE, a London-based home maintenance outfit… Too fracking funny!

It turns out that the Centre for Global Energy Studies was shuttered in 2014.

I no longer think any of them are stupid….they just flat out lie

It’s impossible to be this wrong, this many times, on accident.

PS: Anyone want to stake odds on how many trolls take advantage of this straight line?

exactamundo…………

This may well be true in the US but here, Canada, in particular BC, the price per litre for unleaded has remained steady for the last two years at $1.46 give or take a nickel, taxes have remained unchanged in that time except for major centres where local government has added taxes to support mass transit

Oil prices have been fairly stable over the last 2 years.

bc is not a good example of anything when it comes to fuel, one refinery no spare capacity, having to purchase the short fall from washington state which is in little better position from a access to oil view point. And to top off bc has higher requirements for co2 output on any fuel sold in bc. Means your getting hosed.

Alberta the price has been up and down by about .50 cents a l these last 2 years.

There was a good article in the national post iirc on the issue with bc and fuel prices, if I find it again ill post it.

Australia’s gas stations are definitely profit gouging. Recently in my area, most pump prices were A$1.57 (per litre) Yet one station had a pump price of $1.37. Was he operating at a loss? No, he was the only honest one in the crowd.

You can sell gas for a profit, and still be losing a lot of money.

Gas is just one product that such stations sell, and they have many expenses in addition to the cost of buying the next liter of gas.

If you think that gas stations are making such outrageous profits, why don’t you open one up, then you can be rich as well.

Several years ago we had a gas station start selling gas below cost as a short term sales gimmick and it stuck around because his overall profit went up. Cheaper gas then his neighbors brought more people to his station that then came inside and bought drinks, snacks, etc. that have a higher profit margin than gas does.

If there is nothing hampering market forces (hurricanes, floods, terrorism), then it isn’t profit gouging. It is simply profiting. It happens. Its called capitalism. That price is what the market will bear. The only way to lower it is to increase supply at a given price.

Or… as mentioned below by both MarkW and Darrin, change your business model.. Microsoft lowered their prices so much for windows and office under certain circumstances that it became unprofitable for other people to enter the market.. This was called anti-competitive. The Japanese were charged with dumping some time ago for prices that were too low. The saudi arabians “attacked” our energy industry by increasing output at a lower price to drive our energy producers back into hibernation.

With respect to the latter issue, we became efficient at both mothballing and restoration of production.. So now we thank the saudis for the cheap gas.

Ya…well if you twits in BC, or whoever are the twits over there, would have supported the Kinder Morgan and other pipelines out that way you could easily be paying about $1 now.

As for mass transit, why the hell can’t it be self supporting, Oh wait…..needs those hefty subsidies from those terrible fossil fuels.

Most people in BC actually support the Kinder Morgan pipeline. The Green party (with 3 whole seats in the legislature) is the tail wagging the dog of the government, and of course there are the paid activists to contend with.

And since the minimum tax we pay is about 34 cents per litre of gasoline – no, we wouldn’t be paying $1/litre today even if the pipeline was built 10 years ago.

Hi Kevin, I live in BC too, and just this year in our city (not in the Lower Mainland or on Vancouver Island), the prices have fluctuated from $1.079 to $1.369 for regular gas at the cheapest place in town.

A few of the gas stations keep trying to bump the price to $1.469, but the one gas station holds steady and after a few days they lower the price again.

I think the refiners are also making a bit extra mark-up as compared to 7-8 years ago. Of course, their costs have increased to, but still. Too bad we didn’t have more refineries coming online, at least that would keep the raw cost competitive although the real culprit is just plain old gas taxes, which are a licence to steal for Govt’s everywhere. And where they have a ‘carbon’ tax…it is just that much worse.

The ‘renewable fuels mandate’ regulations are driving smaller refiners out of business and repressing any new refinery construction.

It’s (Michael) Bloomberg. Nothing gets reported by his toy noisemaker which doesn’t agree with his idée fixe.

Here’s a graph of the relationship between WTI and retail gasoline prices from 1990 through today using a starting index of 100 for both data series as of 8/20/90:

https://fred.stlouisfed.org/graph/?g=kW4v

Weighted average based on sampling of approximately 900 retail outlets, 8:00AM Monday. The price represents self-service unless only full-service is available and includes all taxes. See (http://www.eia.doe.gov/oil_gas/petroleum/data_publications/wrgp/mogas_home_page.html) for further definitions. Regular Gasoline has an antiknock index (average of the research octane rating and the motor octane number) greater than or equal to 85 and less than 88. Octane requirements may vary by altitude.

Suggested Citation:

U.S. Energy Information Administration, US Regular All Formulations Gas Price [GASREGW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GASREGW, August 21, 2018.

Thank you for the info. If you look at the graph from this link: https://www.eia.gov/petroleum/gasdiesel/ the person is comparing the gasoline price in the gulf coast ($2.20/gallon) and the rest of the country (up to $2.50) in 2016 to the price of gasoline in California and the west coast in 2018 (around $3.50/gallon).

In early 2016, California and the west coast were at $3.00 per gallon.

Currently, the gulf coast is around $2.60/gallon and the highest in the rest of the country around $2.90.

The commentator is either an idiot or an intentional liar.

Re: “The company also provides tailor-made consultancy….”

Yep. Looks to be tailor made for alarmism and head lines!

Marketing Axiom:

Sell the ‘sizzle’. Don’t tell the useful idiots their steak is dog meat.

WUWT readers can read this long table for the component cost of gasoline:

https://www.eia.gov/petroleum/gasdiesel/gaspump_hist.php

‘Next Time, Maybe Do a Little Research!’

‘Research’ is irrelevant – this is simply trying to force messaging.

Thanks David.

In central Washington (Ellensburg/Yakima) the current price at the pump is about $3.20.

[Non-ethanol gas for power tools is available, but higher.]

After PA, WA has the highest gasoline tax — voted up a couple of years ago.

Combined taxes just under 70 cents.

Greens did not like that vote because the new money was to fix highways — not bike paths and other things that don’t pay taxes.

Indeed, the highways are being worked on.

Many county bridges need repaired or replaced and there is no money for most of those.

They were put in place many years ago and are not up to modern (larger) traffic.

For the time being (?) some are closed.

This summer I had to deal with driving through road repairs in Arizona, Nevada, Utah, and Wyoming. Even California is doing major road replacement of I-8 east of El Centro. I would guess some of that money came from increasing use of gas due to expanded travel under the present administration.

On a recent drive on I-20 to I-10 through Midland-Odessa on my way back to Tucson in early July, the price of gasoline shot up in Midland-Odessa section by around 20-30 cents higher for a hundred mile stretch. Every station along the interstate from Big Spring to Pecos had regular advertised at exactly $3.03/gal. Even all the big rig truck stop stations, Flying J, Loves, Petro, etc.

Outside that strip on I 20, gas prices fell back to ~$2.70-$2.85/gal. That was obviously some price-fixing collusion going there with the knowing that the oil drilling-fracking companies and oil field service companies would just pay it (the higher pump price) because they were in a frenzied production ramp up.

Price fixing? Maybe. More likely, it’s econ 101.

They were all exactly $3.03. And refineries everywhere. The much hyped oil-gas pipeline bottlenecks should make the gas there cheaper.

I don’t get it either, Joel. When Wood River, IL (right across the river from St Louis, MO) had one of the largest refineries in the world, fuel was higher in the region around St. Louis than it was in Hot Springs AR. Go figure…

Delivery costs are only a part of the cost of gasoline, and not one of the larger ones.

Regular is 2.499 $/gal where I live.

$2.50 per gallon here.

6.233 USD/gal (95 oct) were i live in Sweden.

General comment:

The gas price “where you live” includes taxes. The US Federal gasoline tax is $0.184/gal. State taxes range from $0.1225/gal in Alaska to $0.582/gal in Pennsylvania. Some States also impose sales taxes and allow local municipalities to impose taxes.

The US spot price, the immediate cash wholesale price, is around $1.97/gal. This doesn’t include taxes.

The only gasoline price relevant for comparisons with crude oil prices is the spot price.

People fret over gas prices all the to time but really the diesel prices are costing most of you more than the gas. The price of almost everything you buy is effected by the price of shipping and the single largest expense in trucking is fuel and virtually every thing you buy or at least the materials or components with which it was made was transported by truck. Despite being a less refined product, diesel is much more per gallon than regular gas.

As I type this I’m parked at the Petro Truck Stop at exit 41 off I 90 in NY. I drove the 502 miles here today from Vandalia, OH. Tomorrow morning I’ll pickup parts for Toyota in Auburn, Buffalo, and Orchard Park, NY and take them back to the terminal in Vandalia and have driven 530 mi to do so

By Friday at about 19:00 I will have completed three of these round trips this week and driven about 3,100 mi. The computer on the 2015 Freightliner Cascadia I’m driving says my average fuel milage is 7.7 mpg.

I’ve always disliked the MPG (or KPL) measures. Efficiency should always be in delivered mass times distance per gross fuel energy content.

Which, by the way, makes any “all electric” hauler (passenger or freight) just about the least efficient transportation on the roads, rails, or waterways.

That’s my average mpg over the 309,314 miles I’ve put on this truck. I got in it when it was new and it has been very well maintained.

Only weigh loads when there is a need to insure compliance with the law. There is a huge varience in milage depending on the weight of the rig, terrain, driving style, tire pressures, ratio of urban verses open road, idle time, etc, etc, etc.

I carry 240 gallons of fuel so even the fuel state effects the gross weight and thus milage to a measurable extent. No matter the weight though the most efficient speed in this truck is 62 mph.

The engine in this truck is governed to 68 mph. It has a free wheeling feature. IOW when I’m going down hill and the speed reaches that set on the cruise control the engine idles. Once a speed of 5 mph over that set on the cruise is reached the engine brake automatically kicks in to try and maintain that speed. This truck has four stage engine brake but that alone cannot control the speed on steep inclines hauling a heavy load. It’s up to the driver to control the speed based on a judgement of the potential inertia, road conditions, traffic, etc

When an experienced driver uses the air brakes on long steep inclines to control their speed they will “punch brake”. Using the brakes harder for a shorter time (about 5 seconds) minimizes the heat build up in the brakes as opposed to riding the brakes and thus allowing no cooling time. Usually when you smell brakes, you or some driver around you is screwing up.

$2.38 gallon here in Louisiana.

I drove back from the Upper Peninsula yesterday and got regular gas at Sam’s Club in East Lansing at $2.44.9/gal. What blew me away was that the Marathon station two blocks away had regular ar $2.94.9/gal. I’ve never seen that big a price difference, it’s usually about 10 cents.

And now we know why CGES was shuttered in 2014.

So are we paying unreasonable price?

You missed the major point of the piece, unlike those of us that do use premium gas. Over the last few years the differential price between premium and regular has doubled although the price of regular has retreated.

David, I think it would be very useful to add the retail price of regular gasoline to both those graphs. Would make it much easier to see what’s going on.

Nice work!