SolarCity, the nation's largest rooftop solar financier and installer, is offering another $201.5 million in asset-backed securities. This is its third serving of asset securities notes, and it looks a lot like the previous portfolio, notes Shayle Kann, VP of Research at GTM, except in size (much bigger) and newness of the contracts (much newer). Otherwise, it has a similar FICO requirement and a similar mix of project geography, price and sector mix.

From S&P's presale notice:

Late last year, SolarCity executed on a solar financing milestone and offered a private placement of $54.4 million of an "aggregate principal amount of Solar Asset Backed Notes, Series 2013-1." That was one of the first times securitization was employed for distributed solar generation.

"Securitization is the practice of pooling disparate sources of debt and selling it as a package to investors on the secondary market," notes GTM's Stephen Lacey. Securitization improves liquidity and can spur demand (and could be applied to energy efficiency as well). It has the potential to lower the cost of solar financing while enlarging the finance pool. (Learn a lot more about this financial tool by reading our article, "The Encyclopedia of Solar Securitization.")

The yield on SolarCity's BBB+ rated 2013-1 notes was 4.80 percent. As a banker colleague noted at the time, "It's not a bad rate. A little under where a swapped bank deal would end up. Rumor is that the required coverage ratio is relatively high, so the amount of leverage is relatively low -- which is to be expected for a first deal."

Offer 2014-1 came with a new set of insights into SolarCity's securitization strategy and a slightly better yield of 4.6 percent.

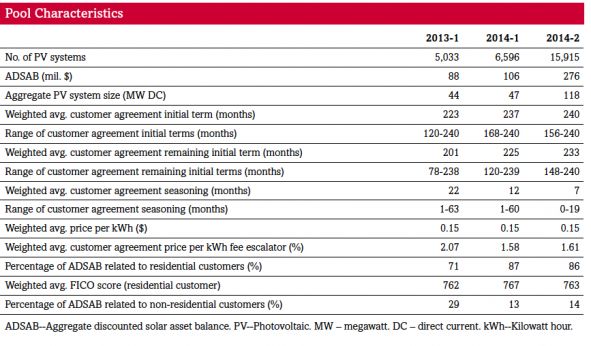

- 2013 vs. 2014: The number of PV systems in the pool jumps from 5,033 to 6,596, and the price-per-kilowatt-hour escalator drops a bit. The 2014 pool leans toward longer customer agreements with a greater focus on residential rooftops, because the money for this type of company is in long residential leases.

- Inverter modeling: S&P anticipates inverter replacement ten years after each solar system is put into service. "The transaction has a reserve built up, leading up to this expected expense."

The most recent set of asset-backed notes, Offer 2014-2, ups the ante with almost 16,000 rooftop PV systems in the pool, about three times the amount in previous offerings, with an aggregate size of 118 megawatts (DC) and a yield of 4.32 percent. S&P notes, "SolarCity raised $201.5 million in two tranches ($160 million and $41.5 million at 4.026 percent and 5.450 percent yields, respectively) with a weighted yield of 4.319 percent," an improvement from the first two raises.

S&P quotes a recent edition of the SEIA/GTM U.S. Solar Market Insight report in noting that the U.S. solar residential sector roughly tripled in size to 792 megawatts (DC) in 2013 from 246 megawatts in 2010.

Offer 2014-2 Pool Characteristics:

An experienced financier tells Greentech Media, "I would say this is 'as expected.' All the metrics moved in the right direction as investors are gaining more experience with the asset class. There were no market events exogenous to the deal that would have affected the trend. Most interesting to me is the tail risk -- looks like a portion is non-amortizing, which means SolarCity and investors expect future financing to be even more favorable and available. There is event risk, of course, that could change that conclusion, but we won't know that for just short of seven years."

Credit Suisse Equity Research reported that SolarCity was able to raise $1.71 per watt on top of tax equity (typically $1.80 to $2.20 per watt), indicating that at a minimum SolarCity is now able to raise ~$3.50 per watt, covering all of the cash flow needs to grow rapidly, noting, "SolarCity should be able to grow rapidly without having to raise dilutive capital through convertibles or secondary equity issuances to fund the core business."

"Raising ~$1.71 per watt indicates SolarCity can utilize securitization after the ITC declines to 10 percent in 2017 when higher-cost tax equity will fund a smaller portion of initial capital outlay," writes the investment bank.

S&P also looks out to SolarCity's Q2 earnings call on August 7 for news on an updated cost reduction roadmap and the closing of the Silevo acquisition. Regarding the China module tariff decision due this week, the analysts note that "SolarCity is relatively immune as solar module supply has been secured at reasonable rates and modules are available for late 2014 and into 2015 at comparable price (~$0.75 per watt) without exposure to trade outcomes."

It's fair to say that distributed solar has reached the scale where it can access larger pools of once-unavailable, lower-cost capital. It's another piece of the equation in which solar is cutting cost and going mainstream.