Five things in the economy this week, from the Chinese National Congress to Brexit negotiations

Here in the UK the thing to look for will be whether the economy is strong enough to stand a rise in interest rates next month

The big event of the week will be what happens in the world’s second largest economy. On Wednesday the Chinese Communist Party leadership meets in Beijing for the start of its 19th National Congress.

These meetings happen only once every five years and give us the best feeling for the direction of policy over the years to come. For example, last time we got a clear message that the aim of policy would be to slow the rate of economic growth but improve its sustainability, and the quality of life of people in China. That has indeed happened – or at least there has been a shift in direction.

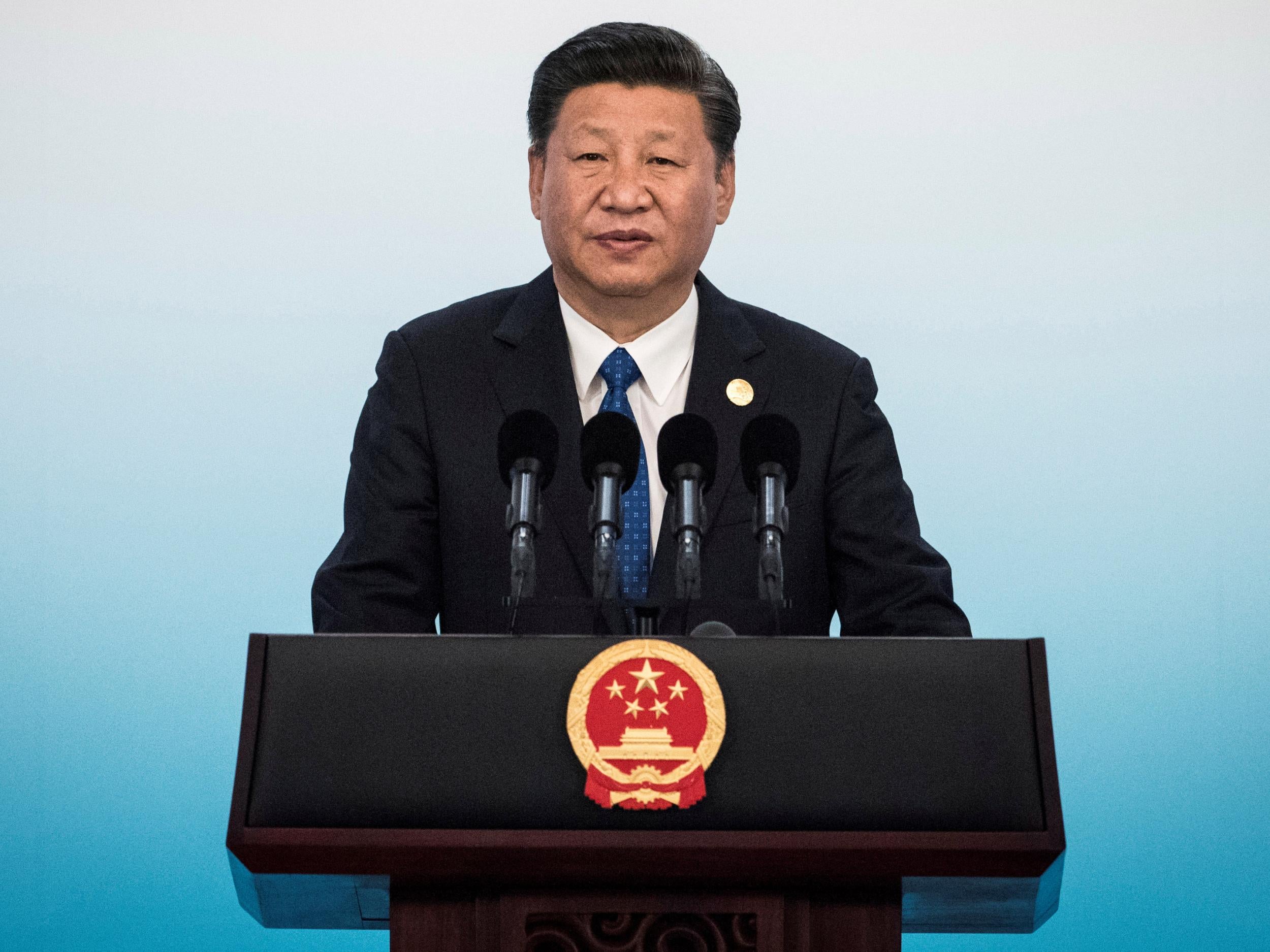

Now the thing to look for will be whether this is a purely political occasion, a “coronation” of President Xi Jinping, who is about to start his second five-year term of office, or whether we will learn more about the direction of the economy. China will continue to be committed to globalisation, unsurprisingly you might think, because it has done very well out of it. So expect that to be reasserted. The more interesting thing will be to what extent it is committed to economic reform: making the state-owned enterprises more market-sensitive, or allowing economic (though not political) dissent.

We won’t get the full works this week, for the congress continues until the middle of next. But the thing to do will be to look beyond the politics and beyond the celebration of the President, to see to which extent China is able to make the transition from an export- and infrastructure-led economy to one that expands its service industries and improves the working conditions (and the health) of its people. I am modestly optimistic, but let’s see.

Here in the UK the thing to look for will be whether the economy is strong enough to stand a rise in interest rates next month. There are various indicators coming through: retail sales, employment, wages and inflation. This will be the last batch of data for the Bank of England to mull over, and it will look particularly at employment and wages. As yet there has been little or no sign of a slowdown in hiring, and some small sign of a rise in real pay. But the Brexit backcloth has become more clouded, as might be expected. My guess: we are still on for next month’s increase in rates, but we will know more by the end of the week.

In Europe I suppose the thing that the UK should be looking for will be signals as to what long-term relationship the EU with the UK would like, rather than the ill-tempered debate at the moment. It is hard to strip the substance out of the rhetoric, and I don’t think we have had much substance as yet.

One of the central problems is that what is tactically sensible for Europe to do – demand the highest exit bill – is strategically unwise, partly because it damages the UK economy but also because it is seen that Europe wishes to damage the UK. You can understand why it wishes to damage the UK Government, but that will make a long-term relationship much harder to build, whoever is in power in Britain. The EU made this mistake in its relations with Russia. It may make the same mistake again.

Of the rest, Japan has a general election. The big issue from a global perspective is whether the recent signs are sustained that the long stagnation of the past 30 years has come to an end. A more vibrant Japan would be very positive for the world as a whole. This is not a data issue; it is an emotional one. What do the Japanese people really want? Look for clues.

And finally, as always, I am interested in trends in technology, and the financial consequences of that. Has Apple peaked – or more to the point, has the whole high-tech share boom of the US peaked? I don’t think so quite yet, but the long bull in shares is remarkable and valuations are very stretched. Following the IMF/World Bank meetings in Washington over the past few days, investors seem more relaxed about the global economy, and less concerned about equity valuations. Complacency or common sense?

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies