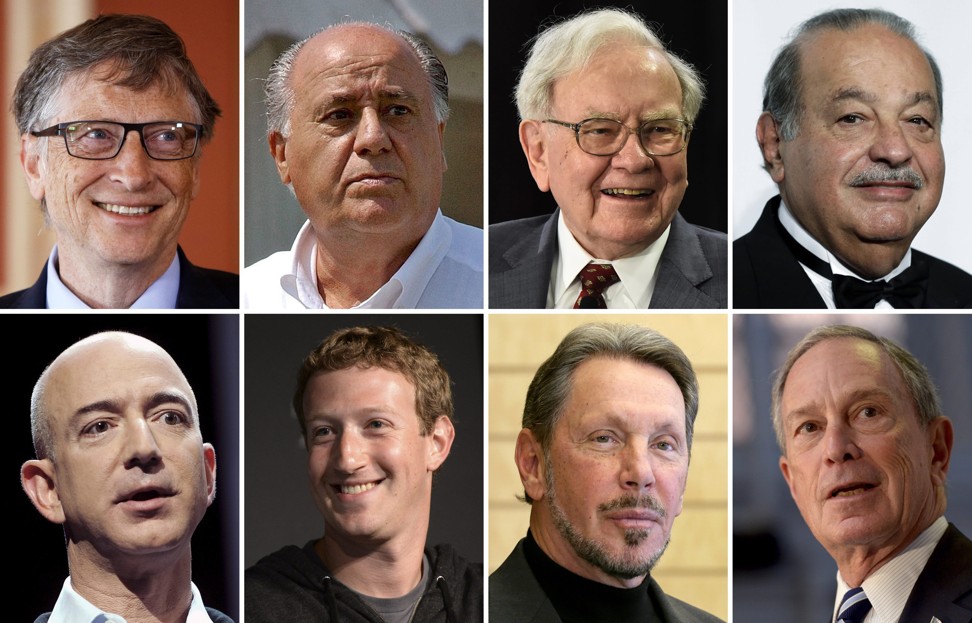

Richest 1 per cent own half the world’s wealth, study finds

The globe’s richest 1 per cent own half the world’s wealth, according to a new report highlighting the growing gap between the super-rich and everyone else.

The world’s richest people have seen their share of the globe’s total wealth increase from 42.5 per cent at the height of the 2008 financial crisis to 50.1 per cent in 2017, or US$140 trillion, according to Credit Suisse’s global wealth report published on Tuesday.

“The share of the top 1 per cent has been on an upward path ever since [the crisis], passing the 2000 level in 2013 and achieving new peaks every year thereafter,” the annual report said. The bank said “global wealth inequality has certainly been high and rising in the post-crisis period”.

The increase in wealth among the already very rich led to the creation of 2.3 million new US dollar millionaires over the past year, taking the total to 36 million.

“The number of millionaires, which fell in 2008, recovered fast after the financial crisis, and is now nearly three times the 2000 figure,” Credit Suisse said.

These millionaires – who account for 0.7 per cent of the world’s adult population – control 46 per cent of total global wealth that now stands at US$280 trillion.

At the other end of the spectrum, the world’s 3.5 billion poorest adults each have assets of less than US$10,000. Collectively these people, who account for 70 per cent of the world’s working age population, account for just 2.7 per cent of global wealth.

The report said the poor are mostly found in developing countries, with more than 90 per cent of adults in India and Africa having less than US$10,000.

“In some low-income countries in Africa, the percentage of the population in this wealth group is close to 100 per cent,” the report said. “For many residents of low-income countries, life membership of the base tier is the norm rather than the exception.”

Meanwhile at the top of what Credit Suisse calls the “global wealth pyramid”, the 36 million people with at least US$1 million of wealth are collectively worth US$128.7 trillion. More than two-fifths of the world’s millionaires live in the US, followed by Japan with 7 per cent and the UK with 6 per cent.

However, the collapse in the value of the pound since the Brexit vote meant the total number of dollar millionaires in Britain fell by 34,000 to 2.19 million. Just over half of the UK’s 51 million adults have wealth in excess of US$100,000. The mean average wealth of a UK adult is US$278,038, but the median is $102,641.

While the global population of millionaires has grown considerably, the number of ultra-high net worth individuals (UHNWIs) – those with a net worth of US$50m or more – has increased even faster. “The number of millionaires has increased by 170 per cent [since 2000], while the number of UHNWIs has risen five-fold, making them by far the fastest-growing group of wealth-holders,” the report said.

Most of the new UHNWIs have been created in the US, but 22 per cent come from emerging economies, notably China.

The biggest losers, the report says, are young people who should not expect to become as rich as their parents.

“Those with low wealth tend to be disproportionately found among the younger age groups, who have had little chance to accumulate assets,” Urs Rohner, Credit Suisse’s chairman, said. “But we find that millennials face particularly challenging circumstances.”

Rohner, who is paid US$4 million, said millennials have been dealt a series of blows including high unemployment, tighter mortgage rules, increased income inequality and reduced pensions.

“With baby boomers occupying most of the top jobs and much of the housing, millennials are doing less well than their parents at the same age, especially in relation to income, home ownership and other dimensions of well-being assessed in this report.”

He said that millennials are much more educated than their parents. But he added: “We expect only a minority of high achievers and those in high demand sectors such as technology or finance to effectively overcome the ‘millennial disadvantage’.”

Oxfam said Credit Suisse’s research showed that politicians need to do more to tackle the “huge gulf between the haves and the have-nots”.