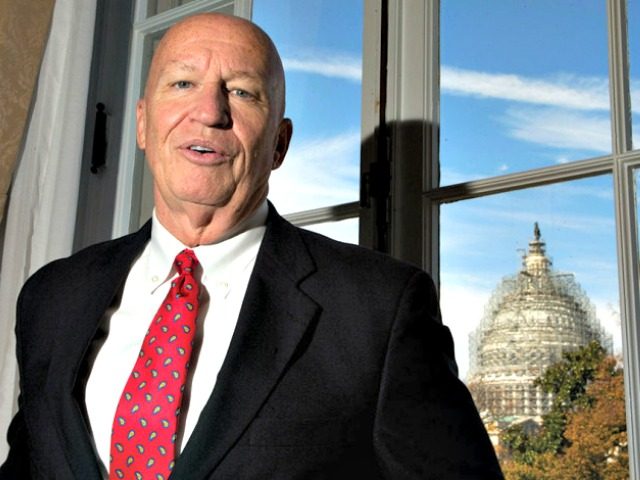

House Ways and Means Chairman Kevin Brady (R-TX) announced that the Republican tax plan will include the state and local tax (SALT) deduction, a measure that will that will smooth the Republicans’ rollout of tax reform later this week.

The House barely passed the Senate budget resolution last week 216-212, featuring unanimous Democrat opposition and 20 Republican votes against the measure. Many Republicans voted against the budget measure due to the tax plan’s repeal of the state and local tax deduction; Brady decided to keep the SALT deduction to prevent another roadblock in tax reform.

Chairman Brady said in a statement, “At the urging of lawmakers, we are restoring an itemized property tax deduction to help taxpayers with local tax burdens.”

The House will unveil their tax proposal this week, which features massive tax cuts for small businesses and middle-class families. The Republican tax platform would lower the tax brackets to rates of 12, 25, and 35 percent and double the standard deduction for the average American. The Republican tax plan would have eliminated the state and local tax deduction, which allows for Americans from high-tax, mostly Democrats states such as New Jersey, California, and New York to deduct their high taxes from their federal income taxes.

Rep. Dan Donovan (R-NY), said in a statement, “I’m grateful to the Chairman and House leaders for listening to the argument that I and others made about the basic unfairness of double taxation, and I look forward to analyzing the tax relief proposal in its entirety next week.”

Rep. Leonard Lance (R-NJ), one of the four New Jersey Republicans to oppose the budget, said, “This is a step in the right direction but I will need to see legislative text to determine if this proposal is in the best interest of New Jersey. We already send more than enough money to Washington. I am pleased this debate has reminded lawmakers from other states of that fact. There is more work to be done on the SALT issue.”

Nicole Kaeding, an economist with the Tax Foundation, explained that the SALT deduction mostly favors wealthy Americans in high tax states and that Republicans planned to use deduction’s repeal to pay for tax cuts.

Kaeding argued, ““Repealing SALT is not happening in a vacuum. It is offsetting revenues needed to finance other tax cuts.”

President Donald Trump said that tax reform will be “rocket fuel for our economy.”

COMMENTS

Please let us know if you're having issues with commenting.