Dan Ryan is Banking and Capital Markets Leader and Roberto Rodriguez is Director of Regulatory Strategy at PricewaterhouseCoopers LLP. This post is based on a PwC publication by Mr. Ryan, Mr. Rodriguez, Mike Alix, Adam Gilbert, and Julien Courbe.

The Trump Administration has been critical of the Dodd-Frank Act since day one, and one of the primary targets has been the Volcker Rule (“rule”). The rule was born in a highly politicized environment during the financial crisis, and while its proprietary trading restriction was intended to promote financial stability, the complexity of implementing the rule has been considered problematic by banks and regulators alike. Since its inception, leading regulators—including Federal Reserve (Fed) Chair Janet Yellen, Former Fed Governor Daniel Tarullo, and New York Fed President William Dudley—have acknowledged that there is room to reduce the rule’s compliance burden and to tailor its “one-size fits all” approach.

In the most concrete action thus far, the Treasury Department devoted a great deal of attention to the rule in its first report on financial regulation. Unlike the Financial CHOICE Act which recently passed the House of Representatives, the report does not seek to repeal the rule. Instead, it proposes significant changes aimed at reducing the cost and burden of compliance on banks while still remaining true to the policy-intent of the rule.

So far, there are signs that at least some of Treasury’s recommendations will be considered and ultimately implemented. In recent testimony before the Senate Banking Committee, representatives of three of the five agencies responsible for enforcing the rule—the Fed, the Federal Deposit Insurance Corporation (FDIC), and Office of the Comptroller of the Currency (OCC)—voiced support for the general sentiment of reducing the compliance burden and for several specific recommendations. Endorsement from the key regulatory agencies is significant because many of Treasury’s recommendations can be implemented directly by the agencies rather than through a change in statute by Congress.

While many of Treasury’s recommendations appear reasonable, some will be viewed as “too little too late” as impacted banks have already spent significant time and resources over the last four years to alter their business models to meet the rule’s requirements. All have made large investments in governance and infrastructure to support compliance programs, both from a technology and resourcing perspective. More importantly, banks have also re-aligned and restructured their core businesses to adhere to the requirements of the rule. This change has been further reinforced by other post-crisis capital and liquidity requirements that make proprietary trading unattractive. Therefore, despite the possible changes to come, it is highly unlikely that banks would return to their pre-crisis business models. The implementation of several of the recommendations, however, should help to “right size” the compliance burden and allow banks to redirect resources to core profit-making activities.

This post analyzes the Treasury report’s recommendations and regulator sentiment to revise the Volcker Rule, offers our view on what will change, and explains what the industry should do next.

What changes did Treasury recommend?

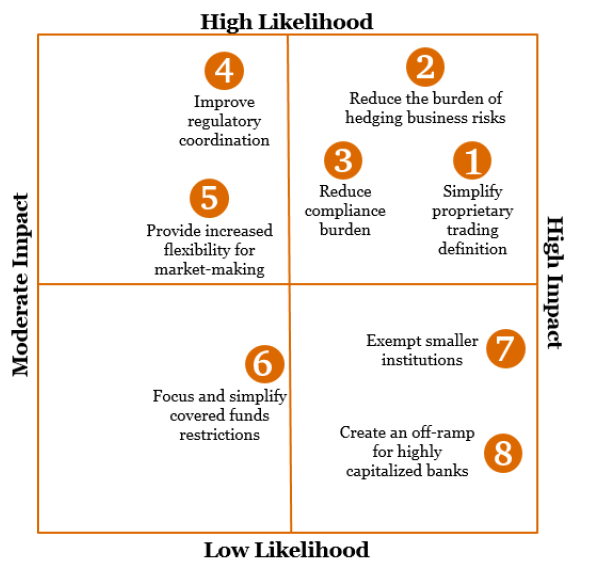

We have assessed the Treasury recommendations based on two parameters: the level of impact it would have on the industry and the likelihood that it would come to fruition. The level of impact it would have on the industry is largely based on (a) the current challenges that banks face in complying with the rule’s requirements, and (b) the level of prioritization of the recommendation by banks in their advocacy efforts. Whether or not a recommendation is likely to be implemented is primarily based on whether the recommendation could be enacted by the regulatory agencies (which could be done more quickly) or by Congress (which is unlikely in the near future).

Accordingly, the table below illustrates our assessment of the recommendations in the Treasury report along these parameters.

High likelihood, high impact

The three recommendations in the high likelihood-high impact quadrant are placed there because regulators can make the changes without Congress and they have the biggest impact on banks in terms of reducing the overall compliance burden.

1. Simplify the proprietary trading definition

One of the primary criticisms of the Volcker Rule since its inception has been the lack of clarity around what qualifies as proprietary trading. Accordingly, the Treasury report recommends two modifications of the definition: (1) remove the 60-day rebuttable presumption, and (2) assess the elimination of the Purpose Test. Banks have argued that both are over-encompassing and ambiguous in part because the length of a trade does not infer the intent. As a result, the banks can be left in a difficult position to either extend a trade’s duration beyond its use or exit the position at a time when it would qualify as short-term and therefore be in-scope for proprietary trading requirements. Further, the Treasury report questions the necessity of the Purpose Test altogether because other rules (i.e., market risk capital and status) can be relied upon to objectively verify the trading activity. In particular, the market risk capital rule requires that banks adjust their capital levels based on the riskiness of their positions, thereby ensuring that they are protected for potential loss without having to interpret the purpose of a trade.

Although not discussed in the Treasury report, we believe banks would welcome the reconsideration of the Purpose Test requirements for “out of scope” trading desks (e.g., loans, banking books, seed capital hedges). These areas hedge with financial instruments, but monitoring and demonstrating that the trades are not for short-term intent is quite onerous. They are also required to establish controls over business areas where there is limited active trading to ensure what is out of scope stays out of scope, which carries a high operating cost to the bank.

2. Reduce the burden of hedging business risks

Under the Risk-Mitigating Hedging exemption requirements, banks are required to create and maintain correlation analysis for every hedging transaction. However, many banks and business areas have shied away from leveraging the exemption given the amount of analysis and documentation required to prove risk correlation. Because those hedging activities are ultimately aimed at reducing the bank’s risk profile, this may result in banks taking on more of the risks that the rule intended to reduce.

The excessive documentation required contemporaneous to the trade, combined with data analysis demonstrating the effectiveness of the hedge, and the ongoing monitoring and re-calibration requirements makes the compliance costs associated with these trades too high to execute. Therefore, simplification of the compliance requirements for the Risk-Mitigating Hedging exemption would likely yield a large benefit to banks, allowing them to manage their risks and capital more efficiently.

3. Reduce burden of compliance

As part of Treasury’s overall sentiment to reduce the compliance burden, they are specifically recommending that agencies eliminate any required metrics for reporting that are not necessary for effective supervision. In our experience, some of the metric reporting requirements as defined by the rule have been costly to develop and maintain but yield little benefit for the ongoing compliance program, such as derivative inventory aging, and customer-facing trade ratio (given the broad definition of customer). Banks have argued that if the metric does not yield any probative value or is not necessary for effective supervision, time and resources can be better allocated elsewhere. The same can be said for the requirement that the nine largest banks (by total consolidated assets) report metrics within 10 business days of the month, while other banks are required only within 30 days—banks would welcome a review of this requirement or clarification of why an ongoing difference in timing is necessary.

In addition, following a theme throughout the report of tailoring regulation to bank activities rather than overall size, Treasury recommends that the enhanced Volcker compliance program should be based on the volume and amount of trading activity a bank engages in rather than total consolidated assets. Banks have long argued that the rule follows a one-size-fits-all approach and does not contemplate differences in business activities and risk profiles. Allowing greater flexibility for banks to design compliance programs around their business activities will help banks to both manage compliance costs and focus attention to the areas that pose the most risk. This recommendation is fully supported by regulators from both the Fed and the OCC, as both stressed in their Congressional testimony the importance of reducing overly strict compliance programs placed on banks regardless of their activities.

High likelihood, moderate impact

The following recommendations can be implemented through action by the regulatory agencies, but they might not have as much of an impact on the banks due to the time that has passed since they have “taken the medicine” by implementing requirements.

4. Improve regulatory coordination

One of Treasury’s mandates for the report was to streamline and rationalize regulation and supervision across the agencies, and as the rule involves five agencies, it was a clear target for a recommendation to improve coordination. While the agencies may resist having their authority reduced, we are already seeing direction from Treasury Secretary Steven Mnuchin as Chair of the Financial Stability Oversight Council (FSOC) to direct the agencies to streamline their responsibilities with respect to the rule.

Ostensibly, having five regulatory bodies oversee the enforcement of the rule lends itself to too much complexity and variability of enforcement. In practice, however, we have not seen as much of an impact on banks as anticipated due to the fact that, to date, not all five agencies have been actively involved.

The two agencies that have taken the lead, however, are the OCC, which has conducted numerous onsite examinations, and the Fed, which has provided regulatory guidance and legal oversight (and more recently, enforcement). The FDIC has had little direct involvement given the overlap in scope with the OCC.

The SEC has been participatory, but narrow in focus, performing in depth reviews of a limited number of trading desks at several banks, and the CFTC oversight has primarily involved off-site queries around trading activities within the Swap Dealer.

As such, this recommendation will not do much to ease banks’ compliance programs. The biggest benefit to increased regulatory coordination is that substantive changes should be easier to approve.

5. Provide increased flexibility for market-making

Treasury’s recommendation with respect to the market making exemption seeks to mitigate some of the onerous data requirements, asking regulators to give banks additional flexibility to determine a reasonable amount of market-making inventory. They are also asking for policymakers to evaluate the benefits of changing the “reasonably expected near-term demand” (RENTD) framework required by the market making and underwriting exemptions, including an opt-out if banks have enhanced trader mandates.

In reality, however, the RENTD formulation actually resulted in limits that are higher (i.e., less conservative) than business and strategy level bank limits. At most banks, the risk appetite is lower than the RENTD-informed limits being set through historical calculation of market demand. Because the calculation for RENTD is not very prescriptive, there has not been a very large business or monetary impact for most banks. However, banks have spent considerable time adapting to this completely new concept and building their initial calculations as well as ongoing monitoring and recalibration processes.

Therefore, although this recommendation would not present a major business impact, it would have a significant benefit of reducing the documentation and independent review standards that the rule requires on a go-forward basis.

Low likelihood, moderate impact

The following recommendation cannot be entirely implemented through action by the regulatory agencies, and it has limited impact given the maturity of banks’ compliance programs.

6. Focus and simplify covered funds restrictions

One of the most heavily discussed recommendations in the report is the focus and simplification of the covered funds restrictions. Treasury calls on regulators to adopt a simpler definition that focuses on more practical characteristics of hedge funds and private equity funds, while restoring 23A exemptions and providing additional extensions for “seeding periods.” Further, they suggest an exemption to the definition of a “banking entity” for foreign funds owned or controlled by foreign affiliates of US banks.

The proposed changes to the covered fund definition would be beneficial to banks as the current definition is overly complex and far-reaching. For example, banks must engage in detailed analysis for a significant number of legal entities to make a covered fund analysis determination. Further, the definition also extends the parameters of a covered fund beyond products like hedge and private equity funds to encompass products that the industry argues should be exempted (e.g., securitizations). Treasury’s recommendations to provide further relief and clarity around Super 23A transactions and extend the initial seeding period from one to three years would also benefit banks.

Although these recommendations are not nearly as impactful as the relief that the regulators already provided with the recent granting of illiquid fund extensions to certain covered fund investments, they would be welcome modifications for banks, particularly those with large custody businesses.

Low likelihood, high impact

The final two recommendations would have a high impact on banks that would qualify for the associated relief, but they would both take action by Congress, which means they would face significant push back and take a long time to see results.

7. Exempt smaller institutions from the rule

Consistent among the Treasury report, the regulatory agencies’ feedback, and current deregulatory trends is the need to exempt or simplify the rule’s compliance requirements for smaller institutions (i.e., those with less than $10 billion in total assets or less than $1 billion in trading assets and liabilities). A full exemption from the rule would need to be passed through Congress, but as a practical matter, we could see the regulators differentiate requirements and enforcement as they have started to do for other post-crisis reforms like resolution planning and stress testing.

The case for this recommendation is fairly simple: the intent of the rule was to limit the systemic impact posed by riskier activities such as proprietary trading, and smaller institutions pose a much lower systemic risk because they engage in a fairly limited amount of trading. Further, smaller institutions argue that their investment in implementing an effective compliance program is disproportionate, impacting their ability to properly manage their banking activity. While smaller banks have already implemented compliance programs, they would experience significant cost savings going forward by being excluded from the rule’s requirements.

8. Create an off-ramp for highly capitalized banks

In addition to the recommendations to reduce requirements for smaller banks, Treasury is also seeking to allow “sufficiently well-capitalized” banks the ability to opt out of the rule altogether. Treasury makes the point that highly capitalized banks have adequate capital to manage and absorb the risk of proprietary trading, and an off-ramp would provide some flexibility in how banks manage their capital.

While “sufficiently well-capitalized” is not explicitly defined, the Treasury report indicates a bank with a 10% non-risk weighted leverage ratio as an example of one that could opt out. Such a high leverage ratio would be unattractive to larger banks, so depending on the bar Congress sets for a bank to be considered well-capitalized, this recommendation may only affect banks of a certain size.

Further, given the high capital requirements and uncertainty of returns, we would not expect even highly capitalized banks to revert from their core market making service to heavily engage in proprietary trading. Rather, this off-ramp would provide these banks with relief from the compliance and reporting requirements under the rule. These banks would still be subject to examination and supervision and would need controls in place to monitor their capital against any criteria that the regulators would set out for highly capitalized banks, but their compliance burden would be significantly reduced.

What’s next and how should the industry proceed?

While it is already clear from regulator comments that they are willing to make changes to the rule, we will likely see more decisive action as the Trump Administration continues to replace the “referees” at the Fed and FDIC over the next six months. The first and most likely step to occur will be improved regulatory coordination driven by FSOC as we said back in November. At the FSOC meeting in May, the agencies discussed the “efficacy” of the rule and Secretary Mnuchin reportedly asked the five agencies in charge of oversight to conduct a review of the rule. Recently, Acting Comptroller Noreika indicated that there would be an update on this effort discussed at the next FSOC meeting on July 28th.

Noreika even stated that he is trying to lead efforts on a notice of proposed rulemaking with some of the recommended reforms, and said that the OCC would also consider independently requesting comments. However, it is becoming increasingly likely that there will be coordinated action from the agencies. In fact, Fed Chair Yellen reiterated her support for reducing the rule’s compliance burden in her most recent testimony to Congress, and further suggested willingness to work with the other agencies to reconsider the scope for the rule.

With respect to Congress, proposals to repeal the rule entirely continue to be highly unlikely along with targeted legislation to reform the rule (e.g., create an off-ramp for highly capitalized banks). The earliest possible Congressional action on the rule would occur through policy riders to must-pass budget legislation, but this move would not be without complication.

While current developments represent a positive step forward to refine the rule, it is still uncertain as to if and when changes will actually occur. While banks should not modify their compliance programs ahead of any official announcements, we recommend that they begin to think about how the high likelihood-high impact recommendations would specifically affect their business. At a minimum, this would include impacts to strategy, organization, staffing, monitoring, and reporting. It is important to remember that the core policy intent of the rule will remain, so banks will need to remain compliant while redirecting resources and changing their capital management practices.

The complete publication, including footnotes, is available here.

Print

Print