A changing of the guard at TransferWise, the unicorn startup based out of London that specialises in providing money-transfer services, typically with better rates than banks and other incumbent providers. The company’s CEO and co-founder Taavet Hinrikus announced that he is stepping down and staying on in a part-time role as chairman and board member. He will be replaced by his co-founder, Kristo Käärmann.

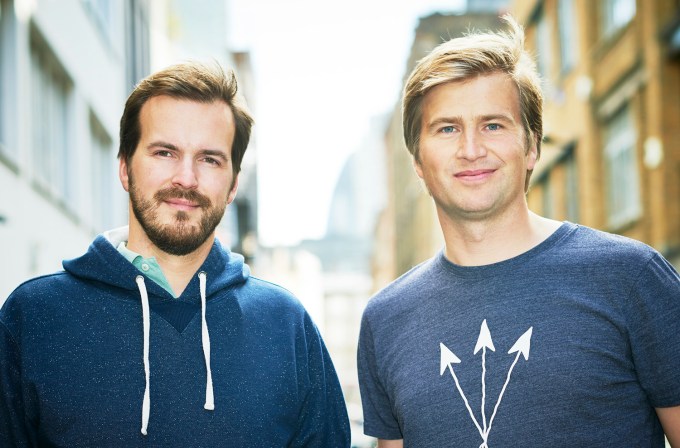

TransferWise founders (from left): Taavet Hinrikus and Kristo Käärmann

This is not the first time that Hinrikus and Käärmann, both Estonians, have swapped the CEO role, but the move comes at an interesting time for the startup.

On one hand, it sounds like it is at a stable point right now: Transferwise has raised around $117 million in funding from investors that include Andreessen Horowitz, Ballie Gifford and Peter Thiel, and a spokesperson told TechCrunch that it has been profitable and cash-generating since the start of this financial year.

That’s a big improvement: according to its last annual accounts filed with companies house, for the year that ended March 31, 2016, the company reported turnover (revenues) of £27,852,000 ($36 million) and a loss before tax of £17,406,000 ($23 million).

The company’s last round valued it at $1.1 billion, and Hinrikus projected that this year it will be doing $100 million in revenue.

At the same time, the company is still in growth mode and other things are still in flux. The company launched “Borderless” accounts in May of this year for small businesses who make regular international transactions, and that product is expanding later this year with Borderless accounts for individuals and payment cards.

This is on top of other developments and experiments such as the company’s bot for Facebook Messenger, which lets people transfer money and set up rate alerts using the chat platform’s AI-based interface.

The company says that it has 10 percent of the transfer market in the UK, and it is now aiming to repeat that proportion globally. The international focus is interesting, too, considering at Hinrikus and TransferWise have been outspoken critics of the Brexit movement.

TransferWise currently lets people in 38 countries send money, and has the facilities to receive money in 61 countries. The aim is to expand that in coming years to more geographies. “For us to truly achieve our mission we need to reach everyone in the world who needs us: we have yet to impact the people who pay the highest fees to transfer money,” Hinrikus writes.