knightcoin

Full Member

Offline Offline

Activity: 238

Merit: 100

Stand on the shoulders of giants

|

|

January 23, 2014, 05:17:40 AM |

|

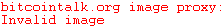

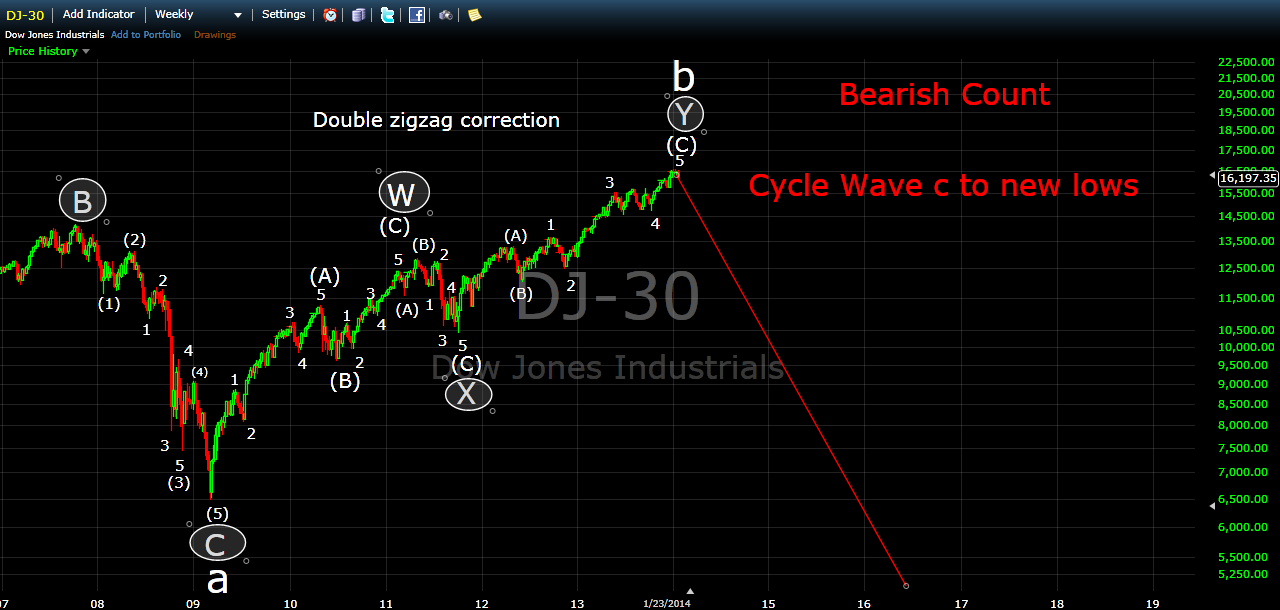

A part of me agrees with this chart wholly. very reasonable and well proportioned.

Finally a chart that makes sense  |

|

|

|

|

|

|

|

|

"With e-currency based on cryptographic proof, without the need to

trust a third party middleman, money can be secure and transactions

effortless." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

knightcoin

Full Member

Offline Offline

Activity: 238

Merit: 100

Stand on the shoulders of giants

|

|

January 23, 2014, 05:23:04 AM |

|

in the meanwhile in an exchange near by ...  |

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

January 24, 2014, 11:52:58 PM |

|

пoxoжe нe взлeтит

|

|

|

|

Miz4r

Legendary

Offline Offline

Activity: 1246

Merit: 1000

|

|

January 25, 2014, 12:17:08 AM |

|

пoxoжe нe взлeтит

Can't happen before the 31st, the market is completely terrified of the Chinese deadline and there can be no real take off before that. |

Bitcoin = Gold on steroids

|

|

|

sir faps

Member

Offline Offline

Activity: 91

Merit: 10

|

|

January 25, 2014, 12:37:54 AM |

|

in the meanwhile in an exchange near by ...  Haha very awesome picture |

|

|

|

|

BrightAnarchist

Donator

Legendary

Offline Offline

Activity: 853

Merit: 1000

|

|

January 25, 2014, 12:38:13 AM |

|

Stocks are done Bitcoin should eventually follow if the correlation is to continue  |

|

|

|

|

windjc

Legendary

Offline Offline

Activity: 2156

Merit: 1070

|

|

January 25, 2014, 01:13:04 AM |

|

Stocks are done Bitcoin should eventually follow if the correlation is to continue  Yep, because bitcoin is just a stock. |

|

|

|

|

|

Bitcoin BEAR

|

|

January 25, 2014, 01:57:37 AM |

|

Stocks are done Bitcoin should eventually follow if the correlation is to continue  Yep, because bitcoin is just a stock. In the last 5 years Bitcoin has held pretty decent correlation to the S&P. I only boxed the bear markets and consolidations to make it easier to see. With an exception of the $7.22 top in January of 2012, every consolidation lasted nearly identical amounts of time.  |

|

|

|

|

aminorex

Legendary

Offline Offline

Activity: 1596

Merit: 1029

Sine secretum non libertas

|

|

January 25, 2014, 03:35:03 AM |

|

[img]

That is a well-defined complex system. Analysis of such systems is challenging, perhaps, but the possibility is very motivating. |

Give a man a fish and he eats for a day. Give a man a Poisson distribution and he eats at random times independent of one another, at a constant known rate.

|

|

|

aminorex

Legendary

Offline Offline

Activity: 1596

Merit: 1029

Sine secretum non libertas

|

|

January 25, 2014, 03:36:49 AM |

|

In the last 5 years Bitcoin has held pretty decent correlation to the S&P.

The correlation with QE & LTROs would be a lot better. Then you'd be getting to the meat. |

Give a man a fish and he eats for a day. Give a man a Poisson distribution and he eats at random times independent of one another, at a constant known rate.

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

January 25, 2014, 03:38:10 AM |

|

Stocks are done

I'm worry too about this move. January nears to end as well as start of qe tapering. As I said, no money - no honey. US treasuries rates are about to take off. I don't like this. Bitcoin... Bitcoin also needs money, which are being tapered. Bitcoin wide acceptance and millions sales on overstock & co means only one: people buy goods, merchants sell bitcoins in their announced volume. |

|

|

|

|

dancingnancy

|

|

January 25, 2014, 03:43:23 AM |

|

Stocks are done? Fed funds rate still at 0-.25% or something. Stocks won't be done for a bit longer me thinks. Good buy opportunities.

|

|

|

|

|

windjc

Legendary

Offline Offline

Activity: 2156

Merit: 1070

|

|

January 25, 2014, 04:30:08 AM |

|

Stocks are done Bitcoin should eventually follow if the correlation is to continue  Yep, because bitcoin is just a stock. In the last 5 years Bitcoin has held pretty decent correlation to the S&P. I only boxed the bear markets and consolidations to make it easier to see. With an exception of the $7.22 top in January of 2012, every consolidation lasted nearly identical amounts of time.  Well there is some correlation, but certainly no causation. Bitcoin has dwarfed the growth of the stock market. Some economic aspects that would hurt the stock market would also hurt bitcoin, but to say that it would stop bitcoins price ascent - well, there just isn't any data to predict that. The last great economic fallout was before bitcoin and actually spawned bitcoin. So, this is mere speculation at best. Although, I suppose, this is the perfect forum for it.  |

|

|

|

|

Miz4r

Legendary

Offline Offline

Activity: 1246

Merit: 1000

|

|

January 25, 2014, 11:26:32 AM |

|

Well there is some correlation, but certainly no causation. Bitcoin has dwarfed the growth of the stock market. Some economic aspects that would hurt the stock market would also hurt bitcoin, but to say that it would stop bitcoins price ascent - well, there just isn't any data to predict that. The last great economic fallout was before bitcoin and actually spawned bitcoin. So, this is mere speculation at best. Although, I suppose, this is the perfect forum for it.  Well in a credit crunch and a stock market crash we will see deflation all over the globe, so everyone will be pretty much running for cash. This will most likely also count for Bitcoin at this point, as it is not a real substitute for fiat just yet. So I would expect a big drop in bitcoin value if this happens, but it will be shortlived imo as QE will be going to the moon in reaction to this and the realization will settle in that fiat is done for. |

Bitcoin = Gold on steroids

|

|

|

|

Equilux

|

|

January 25, 2014, 11:41:49 AM |

|

Stocks are done

Bitcoin... Bitcoin also needs money, which are being tapered. Bitcoin wide acceptance and millions sales on overstock & co means only one: people buy goods, merchants sell bitcoins in their announced volume. That doesn't need to be the case since bitpay offers the option to receive e percentage or the whole amount payed in BTC and not just in dollars. also many people who bought something at overstock with their BTC replenished them straight away by rebuying BTC at an exchange. |

|

|

|

Bimmerhead

Legendary

Offline Offline

Activity: 1291

Merit: 1000

|

|

January 25, 2014, 01:15:09 PM |

|

Stocks are done Bitcoin should eventually follow if the correlation is to continue  We've seen this call from you many times before. What makes this time more likely? (Serious question, not sarcasm. I am fan of EW analysis but have been burned on this call before many times) |

|

|

|

|

|

waveaddict

|

|

January 25, 2014, 06:54:18 PM

Last edit: January 25, 2014, 11:05:14 PM by waveaddict |

|

We've seen this call from you many times before. What makes this time more likely?

(Serious question, not sarcasm. I am fan of EW analysis but have been burned on this call before many times)

I would simply play it by ear. If the price doesn't bottom at SPX ~1550 (previous 2000 & 2007 highs), then this EW count has merit. If it bottoms at ~1550 then you pretty much have to assume that it'll revisit the highs. Furthermore, keep in mind that there are some other running corrective EW alternatives that allow for one or two more highs before a major top so a total collapse now is far from certain (i.e. I definitely wouldn't bet the farm on it...just yet). |

|

|

|

myself

Legendary

Offline Offline

Activity: 938

Merit: 1000

chaos is fun...…damental :)

|

|

January 26, 2014, 12:19:31 AM |

|

We've seen this call from you many times before. What makes this time more likely? (Serious question, not sarcasm. I am fan of EW analysis but have been burned on this call before many times) the question is more serious will the market win ? or will the central planers win ? correction versus money pumping, sadly money pumping can go on for allot of time, so do like Peter Schiff bet on inflation bet on the FED side |

Los desesperados publican que lo inventó el rey que rabió, porque todo son en el rabias y mas rabias, disgustos y mas disgustos, pezares y mas pezares; si el que compra algunas partidas vé que baxan, rabia de haver comprado; si suben, rabia de que no compró mas; si compra, suben, vende, gana y buelan aun á mas alto precio del que ha vendido; rabia de que vendió por menor precio: si no compra ni vende y ván subiendo, rabia de que haviendo tenido impulsos de comprar, no llegó á lograr los impulsos; si van baxando, rabia de que, haviendo tenido amagos de vender, no se resolvió á gozar los amagos; si le dan algun consejo y acierta, rabia de que no se lo dieron antes; si yerra, rabia de que se lo dieron; con que todo son inquietudes, todo arrepentimientos, tododelirios, luchando siempre lo insufrible con lo feliz, lo indomito con lo tranquilo y lo rabioso con lo deleytable.

|

|

|

|

T.Stuart

|

|

January 26, 2014, 03:15:45 PM |

|

Happy new year ) What I see? I see zig-zags, price in positive both daily and weekly BB. What could it mean? It could mean true ending diagonal, which never happened before. And also very fucking risky.   masterluc your E.W. analysis suggesting a significant upward break is mirrored by several other analysts. Can you add any more detail to your previous post? |

|

|

|

masterluc (OP)

Legendary

Offline Offline

Activity: 938

Merit: 1013

|

|

January 31, 2014, 10:38:38 AM |

|

New thoughts.

So. Now I see three possible scenarios

1. Entering long bearish count.

2. Entering short bullish last wave (I still see it is missing) after completing some triangle, or by starting bearish wedge to new ath

3. New. Entering long sideways range.

I see price failing leave daily bb borders for too long time. This makes me think that price may enter stagnation like it was jan-may 2012. But for a larger period of time. Probably till next reward halving like it was in 2012.

Now I watch for daily bb and taking decision to switch into range trading mode.

Also I removed mtgox from my graphs. It seems they trade with fake fiat they don't really have in backup which causes paradox price movements not confirmed with other exchanges.

|

|

|

|

|