The cannabis market rallied with a pick up in volume, perhaps due to attention focused on Nevada. The state has issued the first 2 distribution licenses to alcohol distributors, hopefully averting shortages of product at retail. Health Canada issued license #51 to Ontario-based TerrAscend.

Here are some of this week's highlights for Focus List names:

- ACBFF will be uplisting to the TSX. The company hosted an Australian delegation and also announced that it has made it to the final stage in the German license procurement process

- AMMJ announced that its SoHum Soil received an award from High Times for "best potting mix"

- APHQF reported strong sales due to an increase in oils and a strong harvest as it lowered costs significantly. The company reported a negative net income due to losses on its extensive investment portfolio

- CNNRF formed CR Advisory Services, which has engaged Stoic Advisory, and announced Alternative Medical Enterprises, in which it is an investor, as its first client ($150K up-front fee)

- DIGP received its lab testing license for recreational and renewed it for medical

- GBLX unveiled its recreational brand, Cultivation Labs. The company also issued its 10-K for the year ending 3/31 (see Forum for review)

- HLSPY announced a $94K order from an Oregon cannabis grower

- KSHB reported 103% sales growth, which included organic growth of 49% and a strong contribution (just one month) from recently acquired CMP Wellness.

- MJNA pre-announced Q2 sales of $6.13mm, up 269% from a year ago

- MSRT will be focusing on dispensaries using the platform and monthly recurring revenue rather than "registered users". The company closed its acquisition of POS vendor Odava. Its COO resigned as the company plans to hire someone more experienced for the position.

- NXTTF reported record sales of $C1.34mm for June

- TWMJF has taken Bedrocan BV to arbitration, claiming it is not honoring its responsibilities under the Bedrocan Cannabis licensing agreement

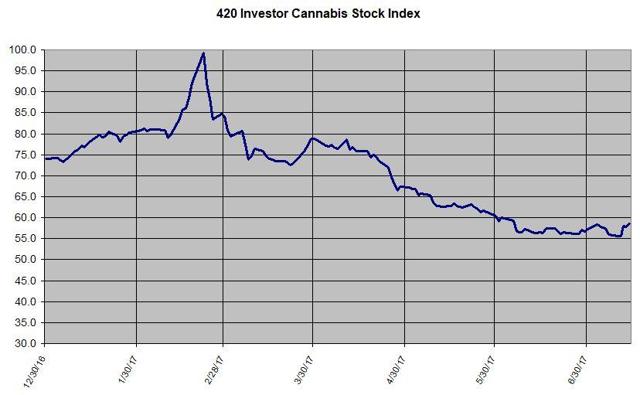

The 420 Investor Cannabis Stock Index rebounded after declining to begin the month, gaining 4.5% for the week to end at 58.55. The index, which lost 27.0% in Q2, is up 2.4% in July but down 21.0% YTD after gaining 88.8% in 2016. It currently includes 50 stocks and ended 2016 at 74.10.

420 Opportunity ended the week valued at $42,339, up 12.9%, and is down 6.0% YTD. In 2016, the model portfolio increased 293.4% compared to the 88.8% increase in the index. 420 Quality ended the week at $49,845, up 6.8%. This model portfolio was launched on March 2nd targeting long-term investors seeking to invest in leading cannabis stocks with minimal portfolio turnover and has lost 0.3% since inception compared to the 27.6% loss in the index.

Outlook

Valuations have increased and remain cautionary, and fundamentals are questionable for most of the >500 companies in the sector. The market has been consolidating for eight months in the U.S. and since April in Canada after it had rallied on the cannabis legalization votes last year as well as the legalization path in Canada. There are some catalysts ahead, including Nevada going legal next month as well as progress in the Canadian legalization and in German MMJ, but the consolidation of the gains from last year is likely to persist for a while.

The big themes ahead are likely to be insight into the new President's plans regarding the federal view on state-legal cannabis (especially in light of Jeff Sessions serving as Attorney General), hopeful extension of the Rohrabacher-Farr Amendment (which is set to sunset at the end of September) to insulate state-legal medical cannabis businesses from DOJ intervention, better clarity from the federal government for banks and cannabis research (both part of the proposed CARERS Act and other proposed legislation), DEA pushback towards the CBD from industrial hemp industry, the inclusion of a broader range of extracts in Health Canada's ACMPR program and its continued growth in patient enrollment, likely legalization in Canada, the rollout of MMJ in Germany, Mexico and in Australia as well as continued advances in South America, progress with respect to the new legal cannabis implementations in CA, MA, ME, and NV and the new MMJ implementations in Arkansas, Florida, Hawaii, Illinois, Maryland, Minnesota, Montana, Nevada, North Dakota, Ohio, New York, Nevada, Massachusetts, Pennsylvania and Texas, the implementation of the new medical program in California and the possible legalizations via the legislatures in NM and RI.

The slide, which began in March of 2014, reversed out the entire gains from early 2014, with the market currently near the summer 2013 lows after the rally since February 2016. Most valuations remain high. Positively, we are seeing some new entrants into the publicly-traded sector of higher quality, and hopefully we see more in 2017, especially with the number of legal states doubling. Please remember that it remains the case that most of the penny stocks will not succeed. I expect that there will be just a few winners among the 500+ companies that are currently on our Broad List.

Here are some of the most interesting stories we published on New Cannabis Ventures this week:

Aphria Q4 Sales Rise 106%

Aurora Cannabis German Domestic Production Application Advances to Final Stage

Breaking: Nevada Cannabis Distribution License Award Averts Shortages

Cannabis Wheaton to Invest $15mm in ABcann at $2.25 per Share

Canopy Growth Bedrocan Licensing Dispute Heads to Arbitration

Elixinol: “Majority of Hemp-Based CBD Sellers Will Disappear”

Kush Bottles Quarterly Sales Rise 103%

Resources:

- Stay on top of all of the NCV news on publicly-traded stocks

- Track cannabis stocks with the 420 Investor Cannabis Stock Index

- Access free Canadian cannabis investor resources

- Learn about our featured companies

- Follow all the NCV news real-time, by liking the Facebook page

- Get the NCV App (Apple)

- Get the NCV App (Google Play)

420 Investor, founded in 2013, is an online due diligence platform that includes a Forum, 10 videos a week, news alerts, blogs, a weekly live chat, model portfolios and a monthly newsletter. The monthly subscription is $42, with a 30-day money-back guarantee, and there is a annual option for $420. The newsletter is also offered as a separate offering for $149 per year. Based on over 1300 reviews, the service has a 4.6 rating on a scale of 1 to 5.

- Subscribe to 420 Investor

- Subscribe to the monthly 420 Investor Newsletter