The Trump administration's promises to lower tax rates for high earners could be bringing forward the date the federal government runs out of cash and can no longer fund itself without breaching the statutory debt limit, according to the Congressional Budget Office and budget experts.

The congressional scorekeeper said in a recent report that from October to June, tax revenue that is not withheld from normal wages and salaries was down 2%, or $10 billion, from last year. That suggests that high earners who have discretion over when to recognize income and pay taxes are deciding to wait. Many investors are sitting on big gains in their portfolios as stocks have been rising for over eight years.

"Some individuals and businesses who may be able to defer income that would be received this year to a future year may be inclined to do so because they prospectively think they'll be able to pay lower taxes," Shai Akabas, director of fiscal policy at the Bipartisan Policy Center, told BuzzFeed News.

This week's report builds on the CBO's warning last month that tax revenue was coming in at a slower rate than expected, and that "taxpayers may have shifted more income than projected from 2016 to later years, expecting legislation to reduce tax rates to be enacted this year."

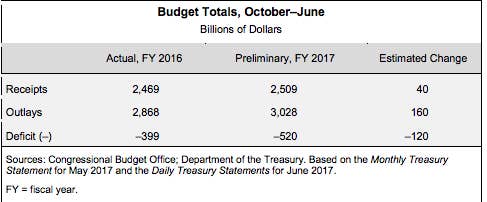

The federal government's budget deficit for the first nine months of its fiscal year is $520 billion, compared to $400 billion in the same period last year.

The CBO last month moved up its estimate of when the government would hit the debt ceiling to early to mid-October. Already, the Treasury Department has been using what it calls "extraordinary measures" to fund the government and not default on its debt, and has called on Congress to raise the ceiling.

"One fact that’s affecting the deficit is that [there's] less tax revenue than expected," Akabas said. "If the revenues are lower, the government needs to make up that reduction with more borrowing."

Total tax receipts were up 2%, bringing in $40 billion more than the previous year, but that increase is mostly from a 5% increase in taxes withheld from normal wages and salaries.

While direct evidence of the effect of shifting earnings may be hard to find until a full year's worth of tax receipts has come in, it would reflect a fairly normal practice among high-income taxpayers who have flexibility in when they recognize some kinds of income.

"There are many investors who have discretion about when they want to sell. One of the results of the election last year was that all of a sudden investors had to start thinking that the taxes they would pay on capital gains might go down," Donald Marron, a former member of President George W. Bush's Council of Economic Advisors and the director of economic policy initiatives at the Urban Institute, told BuzzFeed News.

"There is a long history of this situation occurring and the impact on tax receipts. I'm sure an increase in people delaying taxable events is normal and to be expected," billionaire investor Mark Cuban told BuzzFeed News.

The White House supports a much lower corporate tax rate, fewer and lower individual tax rates, and repealing the taxes on investment income included in the Affordable Care Act (although the investment taxes may stay under a new version of the Senate health bill). So far, the White House has only released a one-page outline of its tax proposals, and has not agreed with either the House or the Senate on what plan to pursue.

The Trump Administration Is Proposing A Giant Round Of Tax Cuts

Trump's Tax Proposal Includes A $638,000 Yearly Bonus For The Mega-Rich

The Trump Boom Is Happening On Paper, But Not In The Real World

CORRECTION

Shai Akabas's name was misspelled in an earlier version of this post.