Barcelona-based blue-collar recruitment app CornerJob has closed a $19 million Series C. It last raised in July 2016, when it took in a $25M Series B round — $5M of which was a media for equity agreement investment. It also closed a $10M Series A in February of the same year. Total funding to date is now pegged at $54M.

The new financing will be used for product development, says CEO David Rodriguez, as well as bolstering its position in “strategic markets” and expanding into some new ones.

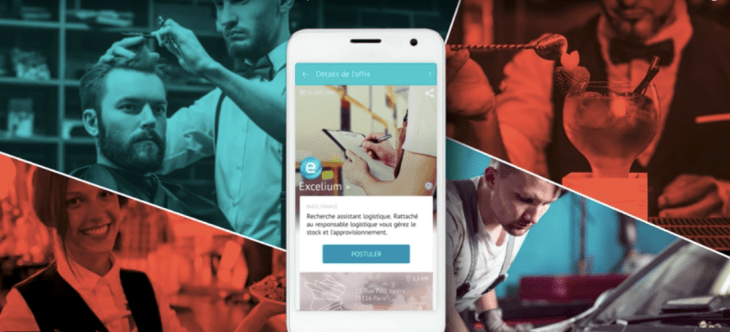

CornerJob focuses on low-skill, high-turnover recruitment, aiming to streamline the hiring and job-search process via a lightweight mobile app that lets employers advertise jobs via its location-based app platform, as well as shortlist and chat with potential recruits.

It’s also building SaaS tools for employers aimed at speeding up the hiring process and ultimately resulting in successful hires — which is how it intends to monetize. Among its investor roster is the VC arm of human resources giant, Randstad, spying some clear synergies.

On the job seeker’s side, as with other mobile startups playing in this app space, CornerJob offers quick and easy location-based job search that can be filtered by sector — aiming to do away with the need for CVs for this jobseeker segment.

“On the product side, we will keep on improving the candidate experience, but… we will [also] concentrate a lot on providing more productivity tools for companies, step up our machine learning initiatives, and reinforce our presence on all elements of the recruitment value chain. For instance on the transactional part with many iterations planed on the service we’ve launched together with Randstad,” says Rodriguez.

“New tools include the ‘flash questions’ feature which allows companies to ask multiple choice questions very specific to the job offer and translate into a chat bot interaction on the candidate side to make the experience always seamless. We’re also introducing a set of features that add more transparency on candidate and company behavior on the platform with reviews, ratings, response times, etc. These are just a few examples of evolutions underway,” he adds.

CornerJob is active in four markets at present, namely: France, Italy, Spain and Mexico, with France and Italy (where it launched first) being its biggest markets. It had previously considered expanding into either the UK or Germany by the end of last year but that move is still to come.

An (unnamed) European market and the US are the places it’s eyeing to expand now, it says.

The blue-collar recruitment app space has sparked something of a race among European startups with multiple players vying for job seekers — including Accel-backed JobToday, which inked a $35M media for equity deal in March, and which operates in the UK and Spain. A longer term player in the recruitment space, Jobandtalent, also pivoted into mobile hiring for SMEs last year. Though different players claim to be putting a bit of a different spin on their recruitment offer.

CornerJob isn’t breaking out how many job seekers it has on its platform at this point — it says it prefers to focus on shortlistings as indicative of its jobs marketplace functioning as intended; and on that front it says it has 700k per month (saying this is growing at an average compound monthly growth of 30 per cent). On the employer side, it’s reached 150,000 registered companies, and has 74 per cent as repeat listers on a monthly basis. Its job listers are growing 10 per cent month over month, it adds.

Rodriguez adds that it’s expecting to close an additional media for equity agreement with a “major media player” to help push its geographical expansion as part of the Series C — although it’s not quite nailed that piece down yet, hence the Series C being smaller than the Series B.

Investors in this latest funding round include Northzone, Randstad Innovation Fund, e.ventures, Samaipata Ventures, Caixa Capital Risc, Sabadell Venture Capital, Mediaset Italia, Mediaset España, Groupe TF1, 5M Ventures, Media Digital Ventures, Augesco Ventures and TV Azteca.