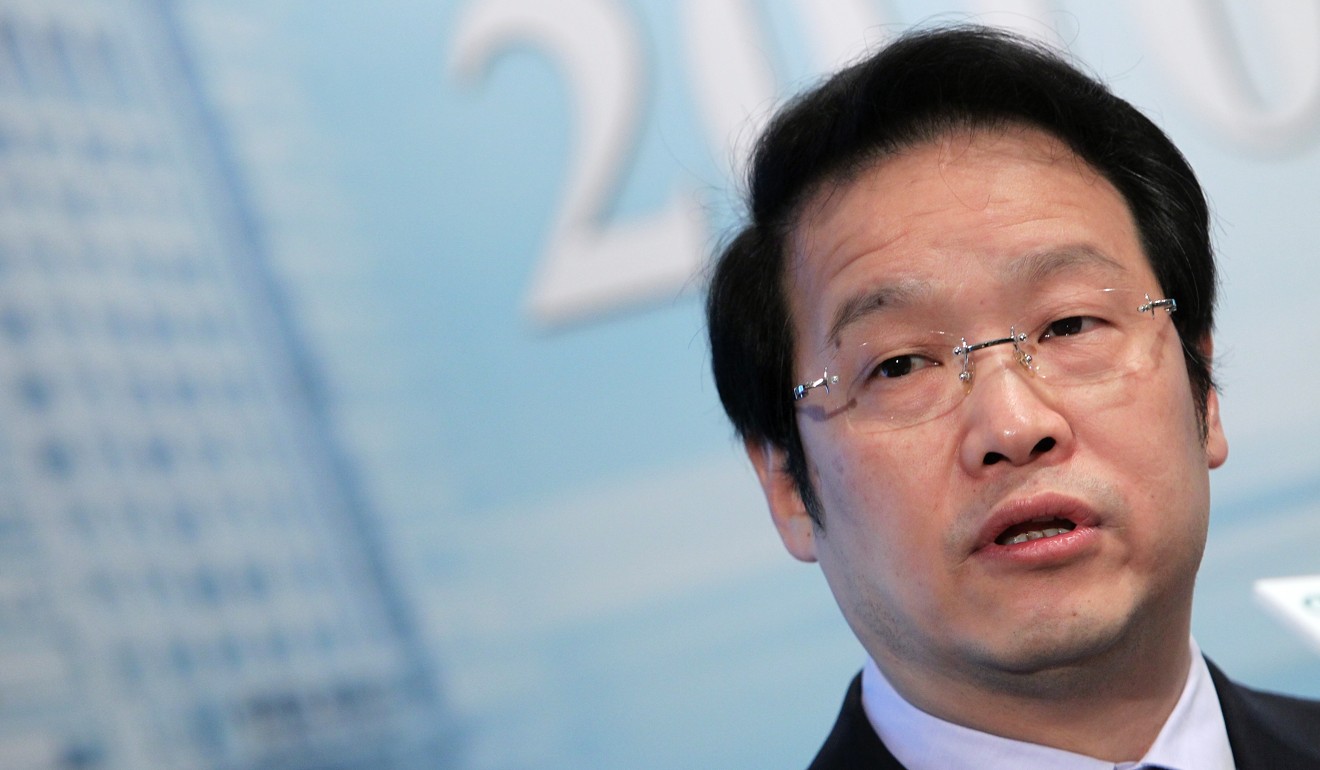

Detention of Anbang boss a milestone in financial industry crackdown, analysts say

Wu Xiaohui – who married a granddaughter of Deng Xiaoping – is reportedly the latest heavyweight to be detained amid anti-graft drive

The reported detention of Anbang Insurance chairman Wu Xiaohui could be a milestone in efforts to take on vested interests – many with connections to the political elite – in China’s financial sector, paving the way for reform, analysts say.

Wu is the latest figure said to have been detained for investigation in a financial industry crackdown which began after a stock market rout in the summer of 2015 that wiped trillions of yuan from the portfolios of small investors – costing Beijing hundreds of billions of yuan in a bailout.

It later developed into an extensive operation seeking to stem collusion among senior regulators, family members of the ruling elite and tycoons.

“Senior executives in China’s financial sector usually have powerful [political] backers. The anti-graft campaign in this sector is not only about corruption – it also aims to reduce interference by these backers,” said Zhuang Deshui, deputy director of Peking University’s Clean Government Centre.

“If these backers are still around, any attempt at financial reform will be futile. The ties with these backers need to be cut to overhaul the financial sector,” he said.

“The probe into Wu indicates that this anti-corruption drive isn’t just targeting those coming up from the grass roots, but also the princelings,” said Hu Xingdou, a professor of economics at the Beijing Institute of Technology. “This is a milestone showing that the campaign, especially in the financial sector, has entered a new stage.”

Hu added that the campaign would continue to target “the most corrupt area” of mainland society.

Big players in the insurance industry have caused controversy with aggressive acquisitions of listed companies and overseas assets using client money and high leverage.

Their investment in the stock market drew criticism from Liu Shiyu, chairman of the China Securities Regulatory Commission, at a forum last November, when Liu referred to such insurers as “barbarians” and “evil”.

One of the most eye-catching examples of this was the battle for control of one of the mainland’s biggest property developers, China Vanke. Anbang, Qianhai Life Insurance and Evergrande Life Insurance all joined the fray at the end of 2015, and Qianhai ultimately emerged with a 25 per cent controlling stake based on high leverage and several securities investment schemes.

Chen Zhiwu, a professor of finance at the University of Hong Kong, said the regulators had been overwhelmed by the extent of Anbang’s shopping spree in recent years. “They wondered whether they should be dealing with the acquisitions under existing rules or [if they should let Anbang off] given its special background,” Chen said, referring to Wu’s ties with the Deng family.

With Wu at the helm, the insurer has grown by more than 100 times its size in just 10 years – it had total assets of 2.2 trillion yuan (US$323.59 billion) by the end of last year.

The company has pursued acquisitions in both the domestic and overseas markets in recent years, from a stake in China Minsheng Bank and the China Vanke investment, to Delta Lloyd Bank in Belgium and the Waldorf Astoria hotel in New York.

Communist Party anti-graft chief Wang Qishan spent the early part of his career in the financial industry and he was in charge of financial issues during his term as vice premier from 2008 to 2013.

But even with that experience, the crackdown on the financial sector only came after an unprecedented anti-graft drive against senior officials and the military’s top brass.

“It will take time to eradicate corruption in the financial sector given all the vested interests,” Zhuang of Peking University said. “The deep-rooted interests of the princelings are not easy to tackle.”

More than 40 top financial regulatory officials and executives have come under investigation in the latest crackdown.

That includes several senior officials from the banking, insurance and securities regulators who have been detained for investigation. Yao Gang, vice chairman of the China Securities Regulatory Commission, and its assistant chairman Zhang Yujun were charged with corruption in 2015.

Beyond this far-reaching crackdown on corruption and irregularities in the financial sector, Chen said the authorities had much work to do in overhauling the mainland’s regulatory regime.

“There’s still huge room for [improvement in] financial regulation, including the quality of listed firms and the delisting system,” Chen said.

Peking University’s Zhuang said the Anbang case could serve as a warning to the sector. He expected there would be an industry overhaul after the political reshuffle during the party congress in autumn.

“[The authorities] need to ensure stability ahead of the 19th National Congress. Tackling the Anbang case could pave the way for this type of work after the congress,” Zhuang said. “There will be ... a power reshuffle after the congress, which will provide better conditions for the financial sector’s anti-graft campaign.”