In the last two years, 135 coal power plants in the US have shut down. Dozens more are due to be decommissioned. To Curtis VanWalleghem, CEO of the Canadian company Hydrostor, that sounds like a lot of batteries. Abandoned coal plants give Hydrostor cheap access to the industrial infrastructure, transmission lines, and water sources it wants to build giant air-compressed batteries for the grid.

Hydrostor is the most commercially advanced compressed-air energy storage (CAES) technology in the energy storage market. The technology squeezes large volumes of air into a small space using electricity during off-peak hours. When electricity demand goes back up, the pressurized air is released, and is forced through turbines, spinning them to generate up to hundreds of megawatts of electricity.

While simple in concept, the physics are tricky. The biggest challenge is efficiency. When air is compressed, it generates heat, but that heat dissipates. This means more than half the energy from conventional compressed-air storage systems is lost before it’s even released. Then, because turbines work best in warm air, natural gas is used to reheat it before it passes by the turbine blades. That makes it inefficient, and even uneconomical, in many cases. Locating a good site is also hard. Natural caverns that can contain highly-pressured air are rarely conveniently located near cities and other demand centers.

Hydrostor says it’s solving both problems with off-the-shelf technology, reports Greentech Media. It has adapted existing oil and gas compressors to pump air into tunnel shafts drilled in the ground (about 1,200 feet deep) instead of using natural caverns. Water in a reservoir connected to the shaft is displaced by the incoming air creating a constant, optimal pressure. Hydrostor also developed a system to capture heat lost during compression with a proprietary thermal storage system (rocks have been used in the past). The stored heat warms up the air as it is released, boosting the system efficiency 40-60% with no fuel needed, according to the company. A small structure on the surface manages the pumping with minimal noise or pollution.

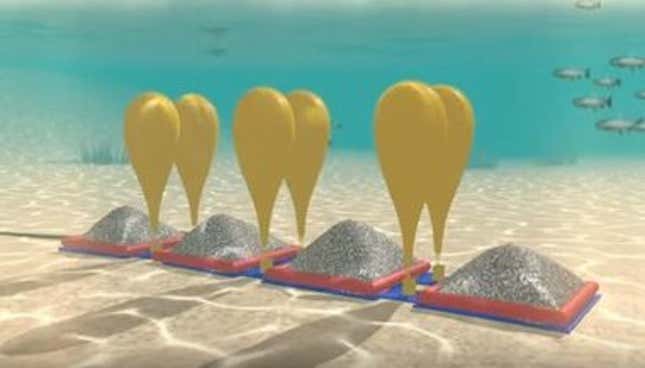

By using former coal power plants, Hydrostor saves money by repurposing existing transmission lines and water supplies. They don’t yet have any coal plant systems, but they are already starting to test the types of technology needed to take advantage of decommissioned plants. For example, it has a test facility already operating near downtown Toronto that pipes air into six large balloons anchored 200 feet below the surface of Lake Ontario storing energy for the grid. A second site under construction in Goderich, Canada will use an existing salt cavern for storage.

Companies working on compressed-air energy storage technology still have a lot to prove. Historically, they’ve have struggled to get products to market. Silicon Valley startup LightSail Energy, which has raised more than $70 million in financing since 2009, said in 2016 it was switching its immediate focus from compressed-air energy storage to selling natural gas storage tanks (although it was within ”striking distance of commercializing” a compressed-air product). Many other companies folded before ever getting to market.

Hydrostor claims it can compete on price with natural gas plants and batteries for energy storage. The company told GTM Research its storage systems run just $150 per kilowatt-hour compared to the energy storage markets’ median price of $550 per kilowatt-hour in 2017.

Even if that’s true, it’s facing major competition from lithium-ion batteries. Prices are plummeting, driven by fierce competition and Tesla’s massive new manufacturing capacity. Battery prices dropped 12% last year, prompting utilities to place large orders: Tesla, AES, and other companies have begun rolling out projects with a total of 77.5 MW of battery storage for California’s grid.

Batteries offer simplicity, efficiency, and responsiveness that compressed-air technology can’t match. If compressed-air storage technology prevails, however, it will likely be due to scale and durability. Hydrostor and others envision massive facilities capable of storing 200MW and rated to last as long as a century. By contrast, the largest grid-connected battery today is Southern California utility San Diego Gas & Electric’s 30MW unit. The expected lifetime for such projects is 15 to 30 years. For the biggest storage applications, that may give CAES the edge. Now they just need to sell a few.