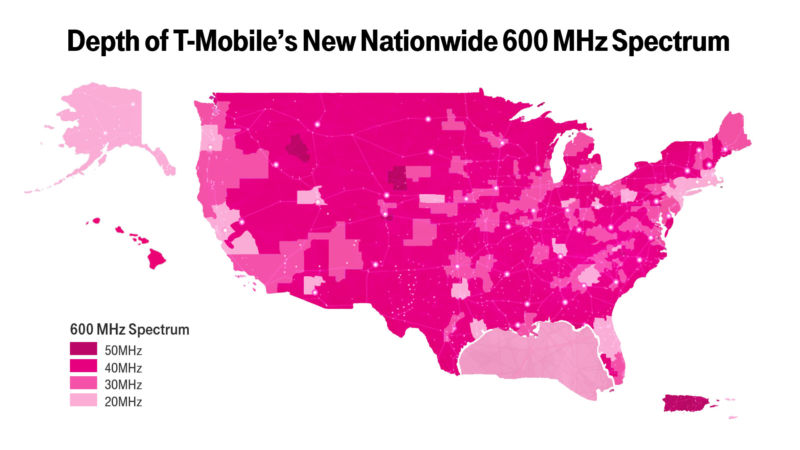

T-Mobile USA was the biggest winner in an auction that shifted licenses in the 600MHz spectrum band from TV broadcasters to the cellular industry.

T-Mobile will pay $7.99 billion for 1,525 licenses spread throughout the country, according to the results announced today. T-Mobile boasted in a press release that it won 45 percent of the spectrum in the auction, amounting to "31MHz nationwide on average, quadrupling the Un-carrier’s low-band holdings."

Low-band spectrum is particularly important for covering long distances and penetrating obstacles such as building walls, which have long been problems for T-Mobile's network. The new spectrum should also help T-Mobile in rural areas, where it lags behind AT&T and Verizon in network quality. T-Mobile generally performs well in metro areas.

The auction began under former Federal Communications Commission Chairman Tom Wheeler, who helped T-Mobile and other carriers not named AT&T or Verizon by setting aside up to 30MHz in each geographic area for carriers that don't have significant amounts of low-band spectrum in the region. T-Mobile's win is a turnaround from January 2015, when AT&T and Verizon Wireless dominated a $41.3 billion auction.

T-Mobile said it will begin deploying its new spectrum "later this year in parts of the country." T-Mobile started getting ready for this last year, and it's using Ericsson and Nokia network equipment that supports 600MHz airwaves. Smartphones compatible with 600MHz spectrum could start coming out this year, the carrier also said. Qualcomm has announced new chips that support 600MHz spectrum.

"With this purchase, T-Mobile now has significantly more low-band spectrum per customer than any other major provider and nearly triple the low-band spectrum per customer than Verizon," T-Mobile said.

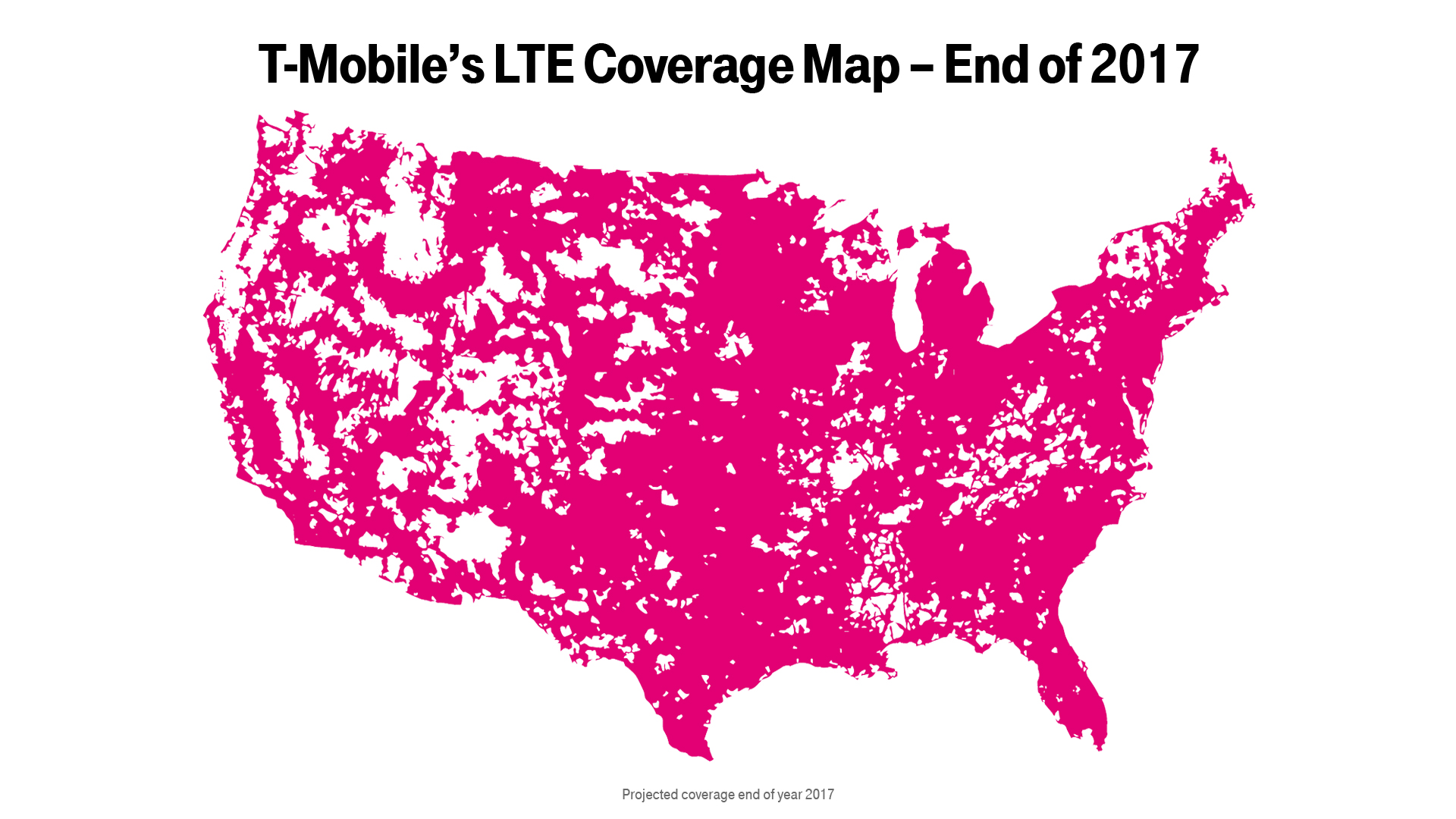

The map above this story shows T-Mobile's new spectrum. Here's another map that illustrates what T-Mobile expects its actual LTE network coverage will look like at the end of this year, combining deployments from existing spectrum and the spectrum it just acquired:

Overall, 50 winning bidders will pay $19.3 billion for 70MHz of spectrum, the Federal Communications Commission said. About $7.3 billion will be used to reduce the federal deficit, while more than $10 billion will go to 175 broadcasters that gave up spectrum licenses or agreed to switch to different channels. There are also administrative costs and funds for reimbursing an additional 957 stations that must change channels.

A channel-sharing system will help ease the shift, and there will be a 39-month transition period for moving broadcast stations to new channel assignments, the FCC said.

Comcast buys spectrum but uses Verizon network

Big winners besides T-Mobile include Dish, Comcast, and US Cellular.

Dish, which has been buying spectrum for years without revealing plans for offering cellular service, spent $6.2 billion for 486 licenses covering the entire US. Dish bid through an entity called ParkerB.com Wireless.

Comcast bid through an entity called CC Wireless Investment, taking 73 licenses in 72 geographic areas (out of 416 areas covering the US and its territories) for $1.7 billion. Comcast plans to offer wireless service by June to its home Internet customers by reselling Verizon Wireless data, but it could use the new spectrum to boost coverage later on. Comcast NBCUniversal-owned TV stations also received $481.6 million in proceeds from relinquishing spectrum in New York, Philadelphia, and Chicago.

US Cellular won 188 licenses in 92 areas for $328.7 million. AT&T spent $910 million for 23 licenses in 18 areas. Verizon and Sprint did not acquire any new spectrum.

Another 14MHz of spectrum is being made available for unlicensed use and wireless microphones, the FCC said. The unlicensed spectrum is "essential to kick-starting greater investment in using TV white spaces for rural broadband, IoT applications and for extending the range of Wi-Fi in mobile devices," said Michael Calabrese, director of the Wireless Future Program at New America's Open Technology Institute.

reader comments

100