A “green” investment that pays an extraordinary 12% interest and has received a semi-endorsement from a government minister was launched this week.

Some people’s instant reaction might be “where do I sign?” – but anyone thinking about taking up this offer needs to remember that you don’t get something for nothing in the world of investment. This is a whole lot riskier than putting your money into a high street savings account, with no compensation if things go wrong. So it’s definitely not for the faint-hearted.

This scheme has been launched by a company that wants to raise £5m to revive the Green Deal, the government energy efficiency programme which was launched in a blaze of glory in 2013 and then scrapped little more than two years later because of low take-up.

It’s the result of a linkup between a firm called GDFC Services and the ethical investment platform Abundance, and takes the form of a three-year bond with a minimum investment of just £5. Those behind the scheme are holding out the prospect of a 12%-a-year return before tax, or tax free if the bond is held within an innovative finance Isa. The offer document says that if you invested £1,000 you would get back £1,387 in three years’ time – ie, a 38.7% increase.

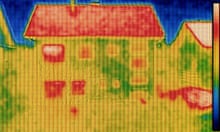

So who’s behind this, and is it kosher? GDFC Services is the company issuing the bond, and is part of the Green Deal Finance Company, which was originally a not-for-profit business set up by the government to support its Green Deal programme. The Green Deal was a flagship energy-saving scheme aimed at making people’s homes warmer and cheaper to run without their having to shell out large sums up front. Households were encouraged to take out a special type of unsecured loan to pay for insulation, a new boiler or other improvements. The loan, with interest charged on top, would be paid back over time through your electricity bill, and the aim was that the cost of the work would be covered by the savings you would make.

It all sounded very laudable but the scheme was a flop, and the government pulled its funding in July 2015. By that point only about 10,000 households had had improvements installed using Green Deal finance.

You might have imagined that would have been the end of the story, but in January a consortium of City investors bought the Green Deal Finance Company’s assets and remaining loan book. The plan is to relaunch the Green Deal and offer loans to homeowners and landlords. The £5m it is looking to raise would be used to accelerate this rollout. However, potential investors should be aware that this is currently a loss-making business, and whether it can turn its plans into a money-making reality remains to be seen.

Those who invest in the scheme would be buying debentures, which are like IOUs issued by companies. The firm says investors would earn 12% interest a year over the three-year term (the maturity date is 30 June 2020), and adds that 70% of the return would be paid out twice a year until maturity, while the remaining 30% would be “rolled up” and earn interest itself. This part of the return would be paid to the investor, along with their original capital, at the end of the term.

However, the document points out that the debentures are “unsecured obligations” of the company and “there is no guarantee that you will receive any interest, or that your capital will be returned”. So you could be left high and dry if this “privatised” Green Deal flops. Furthermore, debentures are not covered by the Financial Services Compensation Scheme.

Those who are interested can sign up via Abundanceinvestment.com. Bruce Davis at Abundance says this is a great opportunity for people to invest in an entrepreneurial company, but acknowledges “it’s a riskier investment, for sure, than what we’ve done in the past”.

The climate change minister, Nick Hurd, has given an endorsement of sorts. He says the government has committed to improving the insulation of Britain’s homes, adding: “It’s encouraging to see private sector firms working to deliver energy efficiency to consumers through the Green Deal framework.”

A potentially less risky proposition is a new £10m “mini-bond” scheme from Good Energy, which was founded 18 years ago and supplies renewable electricity to more than 71,000 homes and businesses, and carbon-neutral gas to more than 44,000 households.

The mini corporate bonds – basically a way of raising money from private investors – offer a gross interest rate of 4.75% a year over four years, or 5% if you are a customer. The minimum investment is £250.

The bonds are an unsecured debt of the firm and, as the small print states, “there is no certainty that the company will be able to repay them”. They also can’t be sold, traded or transferred. On top of that they are not covered by the FSCS. That said, the company has more than doubled its revenues and profits since 2013 and owns and operates a number of wind and solar farms.

Applications for the offer close on 5 June. For more information, go to Goodenergy.co.uk/new-bond.

Comments (…)

Sign in or create your Guardian account to join the discussion