House prices are slipping again and new mortgage approvals are slowing, adding to the impression of a weakening property market.

The Nationwide building society said average home prices declined by 0.4 per cent in April, following a 0.3 per cent decline in March.

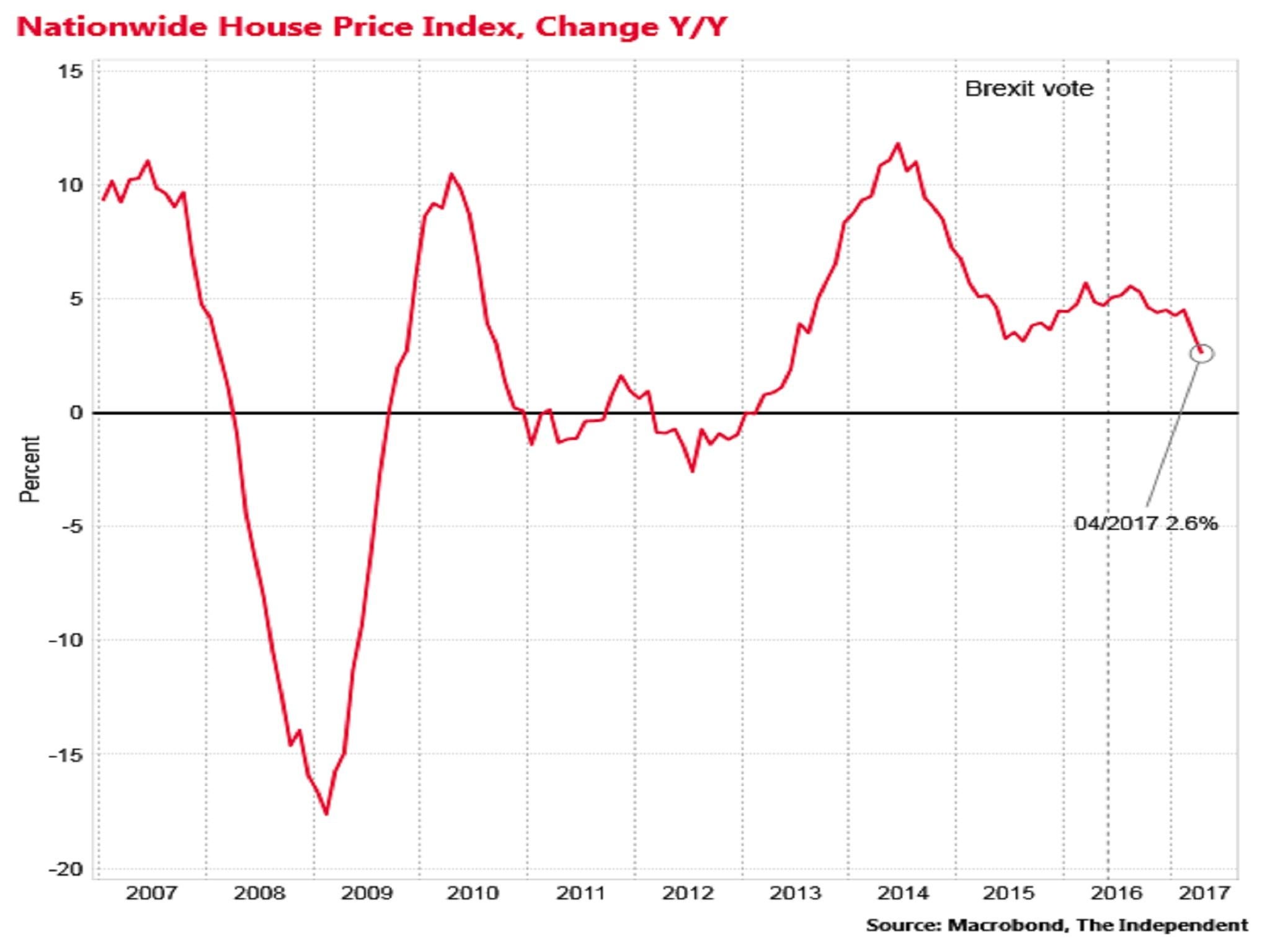

That took the annual rate of growth, according to this index, down to 2.6 per cent from 3.5 per cent previously and the slowest pace of growth in almost four years.

“While monthly figures can be volatile, the recent softening in price growth may be a further indication that households are starting to react to the emerging squeeze on real incomes or to affordability pressures in key parts of the country," said Robert Gardner, chief economist at Nationwide.

House prices weakening

The Halifax's rival house price index has also been showing a slowdown, reporting earlier this month that that annual growth slipped to 3.8 per cent in March, down from 5.1 per cent in February.

Before the Brexit vote a Treasury analysis forecast that a Leave result would reduce average house prices by between 10 and 18 per cent relative to otherwise by 2018.

Separately, the British Bankers' Association on Friday also reported that mortgage lending slowed in March.

It said there were 41,061 mortgage approvals for house purchase in the month, down from 42,247 in February.

Mortgage market slowing

The BBA also said that annual consumer lending growth dipped to 6.1 per cent, down from 6.5 per cent the previous month and slipping further from October's 10 year-high of 7.2 per cent.

Consumer spending has been the driver of UK economic growth since last June's referendum vote, but it has been supported by higher personal borrowing and lower savings rather than growing incomes.

The aggregate household savings rate dipped to an all-time low of 3.3 per cent in the final quarter of 2016.

The preliminary estimate of GDP growth from the Office for National Statistics on Friday pointed to a sharp slowdown of growth in the first quarter of 2017 to 0.3 per cent, down from 0.7 per cent in the final quarter of 2017.

Analysts said this likely reflected consumers feeling the pinch from higher inflation and finally reining in their spending.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies