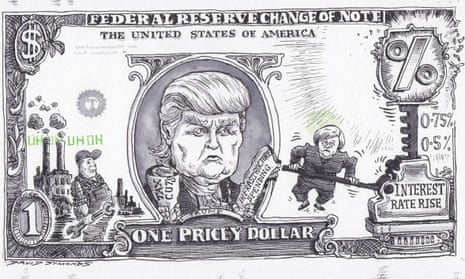

Donald Trump spent much of his campaign for the White House attacking the Federal Reserve chief Janet Yellen. Shouting at the camera in the first presidential debate, he even went as far as to accuse the head of the central bank of “being political”, spurring her to deny she was anything but impartial.

Trump’s anger was a lightning rod for American savers, who like savers across the developed world, have suffered eight years of ultra-low interest rates. A rate rise this week will be taken as another sign by commentators that the Fed is slowly capitulating to the new president’s tub-thumping campaign.

In December, the Fed raised interest rates for the first time in a year, and only the second time since the 2008 financial crisis, up 0.25 percentage points to a band between 0.5% and 0.75%. Three further rates increase are predicted for 2017.

The latest jobs figures published on Friday, which bounced much higher than analysts expected, make it a racing certainty the first of these three will take place on Wednesday.

Yet the jobs figures are a legacy of the Obama presidency and nothing to do with Trump. Neither is the good news from the manufacturing sector or pretty much any other economic indicator, except the stock market, which could be said to have benefited from a significant Trump bounce.

The president could decide to join the chorus of approval and even claim the rise is only the result of his pressure. But he should be cautious. An increase in the base rate, however small, will tighten the screw on younger voters and some of the poorest communities who voted for him and rely on credit to get by.

More importantly for his economic programme, higher interest rates in the US will act like a honeypot for foreign investors, who will transfer their funds to New York.

The bankers will adore being the prime recipients of all this fresh money and being able to charge higher interest rates, but sucking in foreign cash has a price and that is an expensive dollar and worsening trade balance.

Trump might want to think twice about supporting a policy that hits exports and pretty soon the profits of major corporations. It might undermine his call for the repatriation of factories to the rust-belt states if goods cost 10% or 20% more to export.

The dollar is already 20% higher against a basket of currencies than last year. If it goes up any further, corporations could restrict investment and freeze wages to compete.

Trump called for higher interest rates, but not lower wages or investment. But all the signs are that the president and his chief advisers will ignore these negative effects.

Treasury secretary Steve Mnuchin, like Trump, believes the administration is about to unleash an economic revolution that will spark rocketing growth without the inflationary pressures that spur interest rate rises. Mnuchin’s plans for tax cuts and infrastructure spending, far from increasing inflation alongside growth and forcing the Fed to raise rates further, are supposed to raise productivity, allowing supply to stay in synch with rising demand. Prices would stay subdued and the Fed could raise rates almost without any effect on the economy, which – in a Trumpian world – could be given the tools to grow without concerning itself with the cost of borrowing.

But few believe a mix of deregulation, tax cuts and infrastructure spending can have the desired effect, let alone work their magic in a fashion that leaves inflation subdued.

One of the many reasons is that the US has already enjoyed one of the longest periods of economic expansion on record. Trump’s spending plans are a last sugar rush for a period of growth that is past its sell-by date. A recession is looming – and a recession delayed is only worse. Let’s hope it’s not a full-blown crash.

Something to take shine off JD Sports prize

Strange how myopic the business world can be. After an evening that kicked off with an inspirational speech from cobbler John Timpson about the power of treating staff well, the retail industry handed its highest accolade to JD Sports, a business recently heavily criticised for its treatment of warehouse workers.

JD has been an exceptional retailer in many ways: its stores and products are bright and exciting. Sales and profits have soared, and chairman Peter Cowgill has pulled the business back from what seemed like terminal decline. JD has said a Channel 4 documentary highlighting alleged poor practises at its warehouse did not reflect the working environment in an accurate or balanced way, but it did launch an investigation.

Naming JD Sports Retailer of the Year with no mention of these problems, even in the accompanying magazine interview with Cowgill, does neither the journal behind the awards, Retail Week, nor JD any favours. Was the company not asked about the matter, or did it refuse to touch on it?

The industry cannot blindfold itself to evidence of poor treatment of workers. JD’s higher-profile competitor Sports Direct may have knocked out many competitors with its “savvy” business skills, but it has brought shame on the industry with its treatment of warehouse workers in particular.

There are business as well as moral implications. Not every shopper will actively consider workers’ rights when they want a cheap pair of trainers. But poor corporate behaviour can only encourage the seeking of alternatives.

Sports Direct is now suffering financially, partly because major brands don’t want to be tarnished by its tacky discount-focused stores or links with “Victorian workhouse” conditions.

JD’s strength is partly built on its better image, which has helped it forge long-lasting and mutually beneficial relationships with brands. Maintaining that reputation should bring the issues at its warehouse into sharp focus.

Barclays needs new symbols

Eight foot high and 20ft wide, the five acrylic blocks that have been a fixture in the characterless, cavernous foyer at Barclays for the past four years have gone. They were emblazoned with the words “respect, integrity, service, excellence and stewardship” and were a symbolic gesture by chief executive Antony Jenkins to show the bank was trying to clean up its reputation in the wake of the Libor crisis. It has taken 14 months for Jenkins’s successor, Jes Staley, to tear them down and install screens.

It was easy to mock the blocks – which were moved around the foyer to create new patterns – as a desperate attempt to look as if the bank was doing the right thing.

Staley was right to move them out. But in so doing, the American banker must ensure he does not create an impression that Barclays is back to its gung-ho days.