The Chinese yuan was added to the IMF's special drawing rights basket on 1 October 2016

Remember back then all the talk about the CNY potentially rivaling the USD as the world's reserve currency? Well, yeah - almost a 1.5 years since that day - it looks like those talks were premature (maybe for now).

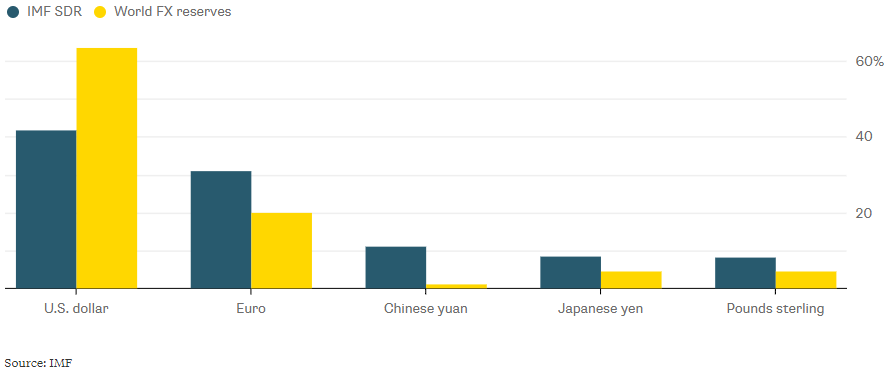

Although the CNY has a weightage of 10.92% (third largest) in the basket, only 1.1% of the world's forex reserves are held in the Chinese yuan as compared to the 63.5% held in the US dollar - as at Q3 2017 (IMF's latest measure).

A look into yields fail to offer any form of reasoning why central banks would not opt for the yuan - as Bloomberg shows that short-dated notes from China offer the highest yield among the major currencies in the SDR basket.

But the article mentions that part of the problem is liquidity as the Chinese yuan only constitutes to about 4% of the world's currency trades - data from 2016 by the BIS.

Not to mention it's also going to be a question of time. A change in the world's reserve currency isn't going to happen in a few years. It may take decades for some other currency to displace the USD.

Until then, the dollar remains the king of the forex world.