Macy's reiterated on Tuesday that it will close roughly 100 total stores over the next few years as it works to restore its dwindling profitability.

After outlining 68 of the stores it plans to close last month, Macy's said in its fourth-quarter earnings reportthat it will close roughly 34 additional stores "over the next few years." It did not provide additional details regarding where those stores would be.

The chain has been struggling to grow earnings as consumers increasingly spend their money at off-price stores and on the internet. Macy's woes have been compounded by the presence of too many stores in the U.S., which has led to an oversupply of inventory.

(See below for the list of closures Macy's previously announced.)

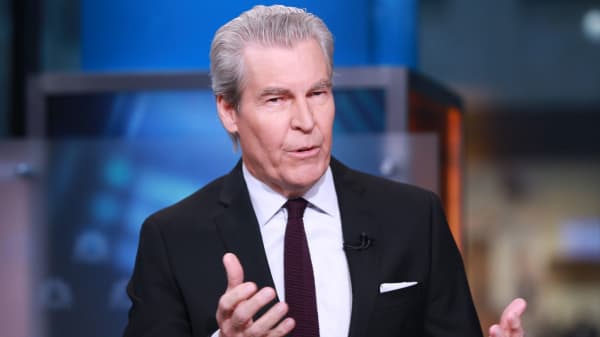

"This will give us a healthy physical portfolio," CEO Terry Lundgren told analysts, emphasizing that bricks-and-mortar stores will continue to be an important part of its business moving forward.

Macy's formula for deciding which stores to shutter has been complicated because none of its locations were cash flow negative, CFO Karen Hoguet said. The chain looked at factors including the demographics and household incomes of each marketplace; where the population was growing; and where Macy's had a nearby store.

Though Hoguet cautioned that she "couldn't possibly" predict what the retailer's footprint will look like in five years, it did try to anticipate the ideal future footprint as best as it could, she said.

"Clearly customers are choosing to purchase less in stores and more through digital means," Hoguet said.

Closing underperforming stores is only one leg of Macy's three-step approach to make money from its real estate portfolio.

Under pressure to do so from activist investor Starboard, Macy's has also entered a joint venture with Brookfield Asset Management to potentially redevelop 50 of its locations. It has also been selling off its flagship stores, including its Union Square Men's building in San Francisco.

In fiscal 2016, Macy's generated $673 million in cash from asset sales, $209 million of which has been booked.

"This monetization of assets provides Macy's with a war chest that it can use to invest in improving its proposition," said Neil Saunders, managing director of GlobalData Retail, in a written statement. "However, we believe that it is vital that this money is spent wisely and well. It should not be used in a piecemeal way to simply smarten up existing stores, but to overhaul the whole customer experience and to reinvigorate the Macy's brand. This is the last chance saloon for Macy's: if it gets this wrong, it will increasingly find itself without the resources to implement a decent turnaround and will begin a downward spiral into oblivion."