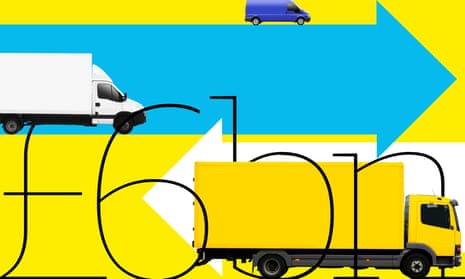

Crashing out of the European Union without a trade deal would saddle British exporters with more than £6bn a year of extra costs, according to analysis that reveals the limited options facing UK negotiators just weeks before Brexit talks start.

Theresa May has insisted “no deal is better than a bad deal” when it comes to the terms of Britain’s departure from the EU, suggesting the prime minister believes falling back on World Trade Organisation rules is a credible alternative if she cannot get her preferred option of a new free trade agreement with the EU.

Yet the implications of such a dramatic plan B remain poorly understood, even within Whitehall, where civil servants are scrambling to assemble the detailed market data needed to negotiate quotas that might cushion a hard landing. One senior official said the picture remained hazy because civil servants “haven’t done the homework yet”.

However, without EU cooperation, the cost of the prime minister’s “no deal” scenario is clear. As part of a series examining the plausibility and impact of a hard Brexit, the Guardian has analysed the latest international trade figures compiled by the UN and World Bank – showing that the $204bn-worth of British goods bound for Europe each year would be hit with $7.6bn in new tariffs under current WTO rules, equivalent to £6.1bn at today’s exchange rate.

“This would be a pretty big shock and it is very clearly unwelcome,” said Prof Alan Winters, director of the UK Trade Policy Observatory at Sussex University. “At the end of the two years, it’s up to the Europeans to decide if we have a deal. The government has got to pretend that it is OK if we don’t, otherwise they have no leverage. This is a piece of political spin to try to persuade us that if this happens, it is not a catastrophe.”

Although tariffs are typically paid by importers, relatively low-margin sectors such as agriculture and car manufacturing – which currently enjoy tariff-free trade with the EU – would be hit hardest with tariffs ranging from 10% for cars and 16% for lorries to 23% on ham and 109% on sugar beet.

“I doubt UK farmers know what’s coming,” said John Springford, director of research at the Centre for European Reform. “There is a real risk for the average British farmer that they could be dealing with much worse trading terms.”

Britain’s former EU ambassador Sir Ivan Rogers has warned that negotiating a replacement trade agreement with Europe could take up to a decade, meaning that in the worst case scenario UK exporters would need to absorb £60bn of extra tariff costs to stay competitive or see a dramatic slump in sales in the interim.

Previous attempts to estimate the bill for this hardest of Brexits have averaged its impact across industries and left out additional tariffs that are calculated by volume, but the Guardian analysis examines the total impact across 4,500 separate lines of trade.

This reveals new potential casualties – such as the British fashion industry, which alone faces an extra customs bill of more than $1bn – and pockets of high tariffs affecting leave-voting areas such as Stoke-on-Trent and its ceramics industry.

“The government will come under a lot of pressure from different sectors to cushion the blow,” said Winters. “But you can’t avoid the hit; you can only spread it around.”

Publicly, the government remains confident it can avoid such a scenario by persuading its EU counterparts that they have even more to lose from not agreeing a free trade deal.

A Downing Street spokesperson said the prime minister was “focused on securing the best trade deal possible”. Both David Davis and Liam Fox have told parliament it would be economically irrational for the EU not to agree a deal.

It is true that due to Britain’s trade deficit, large EU exporters such as Germany and France would each face WTO tariff bills that are almost as high as the UK’s, but there are strong countervailing political pressures to ensure the single market remains attractive to remaining members.

This mutual dependency also threatens British consumers. A WTO estimate before the referendum calculated that British consumers faced total annual tariffs on EU imports of £9bn, which could not be waived without also allowing a flood of cheap imports from the rest of the world. That would make exports to Britain more expensive and possibly uncompetitive, something Brexit supporters hope could stimulate domestic producers but may also just fuel inflation.

Privately, government officials are surprised there has not been more scrutiny of May’s claim to be able to swiftly negotiate a free trade deal that replicates most of the advantages of the single market without any concessions.

“People don’t seem to understand that any trade deals are years off,” said a senior civil servant in Liam Fox’s Department for International Trade. “There are 27 other countries with their own aspirations about Brexit. We cannot even start for two years. The Brexit-leaning press seems to have lost all its critical faculties. They seem unable to scrutinise what is going on because they have so much invested in the decision.”

Whitehall officials also face a more pressing near-term challenge to ensure that Britain can at least enjoy existing WTO market access with non-EU countries, something that will also require complex negotiations to unpick shared agricultural quotas.

“I don’t know the answer to the quota question because we haven’t done the homework yet,” said a senior official involved in preparing for WTO scenarios. “There are people stuck in a basement in Defra [Department for Environment, Food and Rural Affairs] going through thousands of pages of trade data working out where the beef actually goes.”

Among industrialists, there is mounting concern about the prospect of a WTO tariff regime for trade with Europe. Even Nissan, which has been given private assurances of support to maintain its competitiveness, is now sounding more gloomy about UK investment in such circumstances.

“I do not know what Brexit is for now,” its chief executive, Carlos Ghosn, told French magazine Le Point last week. “What we have made is European investment, not British, based in Britain … If walls are erected between the EU and Britain, investments will be reduced.”

Not all British manufacturers are worried. Andy Palmer, of Aston Martin, which exports heavily to the US and Asia, points to the fall in sterling as a temporary compensation for higher tariffs and is hopeful other trade deals can offset lost business in Europe.

“Reducing trade barriers with the US, which one hopes we can do, could deliver a double benefit from Brexit: with a lower pound and lower tariffs,” he said.

But economic modelling of the overall impact of higher trade barriers with nearby markets in Europe suggest it is far higher than any potential offsetting gains in the rest of the world.

Monique Ebell, of the National Institute of Economic and Social Research, estimates the long-term reduction in UK trade with Europe could be as high as 30% if it is is hit with WTO tariffs, while the maximum uplift from additional free trade agreements with English-speaking countries and countries such as China and India is unlikely to exceed 5%.