Senate Tax Bill Makes Millionaires Eligible For Child Tax Credit

Republicans say tax reform will benefit middle-class families. Yet one of the key tax breaks in their proposal, an increase in the child tax credit, will mainly benefit the rich.

Under the Senate’s tax bill, couples earning as much as $1 million would be newly eligible for the proposed $1,650 child tax credit. Low-income families would see little to no benefit from the increase because of the way Republican lawmakers structured the credit.

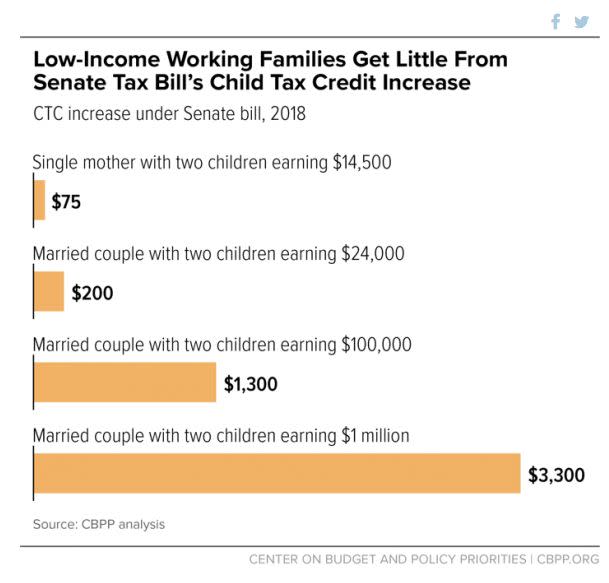

The parents of 10 million children — those earning around minimum wage — would get a tax break of $75 or less under the highly touted increase, according to an analysis from the liberal Center on Budget and Policy Priorities. Meanwhile, millionaire and six-figure-earning parents would be newly eligible for what has traditionally been a tax break for the middle class.

“I almost fell out of my chair when I saw it,” said Chuck Marr, director of federal tax policy at the Center, who wrote a blog post on the disparity. The fact that this tax break is mainly going to high-income earners is “startling,” he said.

Under the current law, the child tax credit reduces a household’s tax bill by $1,000 per child and is available to couples making as much as $110,000, with the size of the benefit shrinking as income rises above that point. The House legislation would increase the threshold to $230,000.

Astonishingly, the Senate bill would push the cap all the way to $1 million.

“It’s a substantial change,” Duke University Law School tax professor Larry Zelenak told HuffPost. “All of the benefit of which goes to people making between $110,000 and $1 million.”

The competing child tax proposals are just one of several differences between the House and Senate bills that will need to be ironed out before any sort of tax reform legislation can reach President Donald Trump’s desk.

The proposed changes to the child tax credit are crucial, because they are one of the ways Republicans say they’ll avoid raising taxes on the middle class, as part of legislation that wipes out deductions and exemptions that most of those households use to lower their tax bill.

Republicans say they want to get rid of deductions in order to simplify the tax code and reduce the amount of revenue the bill loses through its corporate and individual rate cuts.

Neither the House nor Senate bill would deliver a tax cut to every household. The Joint Committee on Taxation, a congressional tax scorekeeper, has said that more than a quarter of households earning above $50,000 would face higher taxes under the Senate plan by 2027.

The child tax credit is only partially refundable, meaning that if you don’t owe any federal income tax, you usually can’t get the full value of the credit in cash (unlike with the earned income tax credit, which is fully refundable). The Senate’s bill raises the credit to $1,650 per child, but almost all of that increase is non-refundable ― meaning low-income workers get nothing.

As a result, a single mother of two earning $14,500 would receive a $75 break, according to CBPP’s analysis. That’s enough to buy about two tanks of gas, Marr pointed out. Meanwhile, families earning six figures get a brand-new tax benefit. For example, parents with two children earning $1 million a year would get a break of as much as $3,300.

Under current law, workers can get a partial refund worth 15 percent of their earnings above $3,000, with the refund not exceeding $1,000 per child. Under the Senate’s proposal, workers can get a partial refund above $2,500 ― a reduction that’s essentially a token, Marr said. The refund is capped at $1,100 for next year, but the cap would rise according to an inflation index.

Workers can get the earned income tax credit, by contrast, based on their first dollar of earned income.

White House senior adviser Ivanka Trump has touted the child tax credit increase as essential for working parents. “It is a legislative priority to ensure that American families can thrive,” she said last month.

Sens. Marco Rubio (R-Fla.) and Mike Lee (R-Utah) want to increase the credit’s value to $2,000 and make it fully refundable, which would open it up to low-income workers.

“While we are glad to see an increase to the child tax credit, like the House bill, it is simply not enough for working families,” Rubio and Lee said in a joint statement on Thursday.

Also on HuffPost

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.