India is moving at a rapid pace to adopt a green shift in its power sector, across industry and in transport, aiming to reduce dependence on the black fossil fuelled energy economy, write Simran Talwar and John A. Mathews. But finance remains a problem: many banks are complacent in their lending to fossil fuel projects. Attempts in the international trade arena to curb India’s strategies of building green power industries using the tools of local content requirements have also had a negative impact, forcing Indian ministries to rethink their strategies – but not their goals. Courtesy the Global Green Shift blog by John A. Mathews.

It has been conventional wisdom that India is powering ahead with its industrialization in the same manner as earlier industrializing powers, and most recently in the footsteps of China as a leading producer of black, coal-fired electric power. It has been widely assumed that India would be the next major producer and consumer of coal and of coal-fired power, taking over where China has left off.

But just as China has surprised the world with the speed and scale of its shift from black to green power, so attention is now shifting to India as it shows every intention of following in China’s green footsteps. And like China, India has powerful reasons for doing so – from a means to curb the ever-worsening urban air pollution associated with burning fossil fuels, to the economic security that comes with having to import lower volumes of coal, gas and oil, and the enhancement of energy security that comes with becoming less reliant on geopolitical hotspots for fossil fuel supplies.

And of course there is the issue of building the manufacturing and export industries of tomorrow, where clean energy and circular economy technologies promise to become central to future economic prosperity.

In October 2017 the International Energy Agency (IEA) in Paris reviewed progress around the world in building renewable energy industries, finding China, India and the US to be the world’s foremost players. The IEA projects that solar power will be the world’s fastest growing renewable energy source over the next five years (until 2022), raising the global level of power sourced from renewables from 24% in 2017 to an anticipated 30% by 2022.

For all these reasons it makes sense to closely examine India’s green strategies, to assess the impact that they might be having. India is already celebrated for having adopted very ambitious clean energy targets by 2022, when it is anticipated that India will have installed 100 GW of solar power and 60 GW of wind power, totaling 175 GW of clean power to be installed within the next five years. How realistic are these ambitious targets, and is there any evidence that India is on track to achieve them? To what extent can India be viewed as following the clean energy strategies that have powered change in recent years in China and Germany?

India’s electric power generation and the incipient green shift

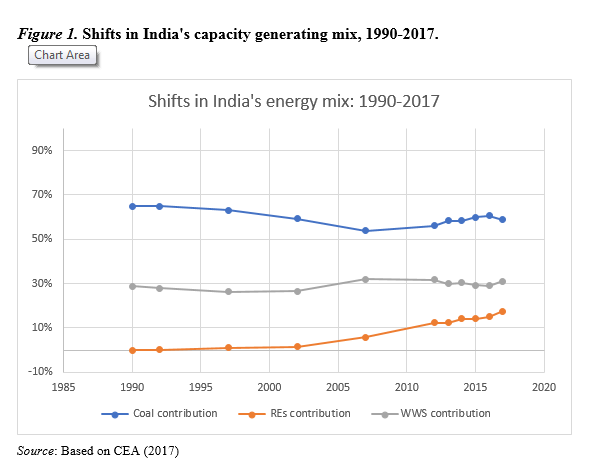

India has been building a vast electric power system with heavy reliance on coal as primary fuel. New companies like Adani have emerged, with almost total focus on building coal-fired power stations and coal infrastructure. But in recent years there has been a marked shift to wind and solar power which have now together taken over as leading alternative to fossil fuels from hydro-power. Indeed, whereas in some countries like China and Germany the proportion of electric power generated from water, wind and sun (WWS) is rising, sometimes steeply, in India it is falling – largely because of declining hydropower generation. But there is a marked rise in the proportion of power generated from wind and sun – designated as Renewable Energy sources (REs) in Figure 1.

Fig. 1 reveals that India has reduced dependence on fossil fuels for electric capacity to less than 70%, with WWS sources now accounting for 31% of capacity. But it is solar and wind (main contributors to Renewable sources) that are increasing rapidly, reaching 17.4% in 2017. Details on solar and wind power additions are provided below.

There are two aspects to the discussion of any country’s green shift – and India is no exception. There is electric generating capacity (in billion watts, or gigawatts, GW), and there is generation of electric energy, measured in billion kilowatt-hours (billion kWh) or terawatt-hours (TWh). The totals are displayed in Tables 1 and 2.

Table 1 demonstrates the contribution of fossil fuels and renewable sources to India’s electric power capacity. The total system is rated at 329 GW in early 2017 – with coal accounting for 194 GW (or 59%) and fossil fuels overall accounting for 220.6 GW (or 67%), while capacity utilizing WWS sources was rated at 101.9 GW (or 31% of the total).

But as in the case of China, it is important to look at the shift over the course of the past year. In the year 2016/17, thermal sources added just under 10 GW capacity, while solar and wind added 11.4 GW, plus hydro added 1.8 GW, making 13.2 GW for WWS sources. Thus, in terms of capacity added in the past year, which amounted to 24 GW, thermal sources accounted for 42% while WWS sources accounted for 55% (with nuclear and other minor sources making up the balance). So in terms of the leading edge, where new capacity is being added, already in India WWS sources outrank thermal sources by 55% to 42%.

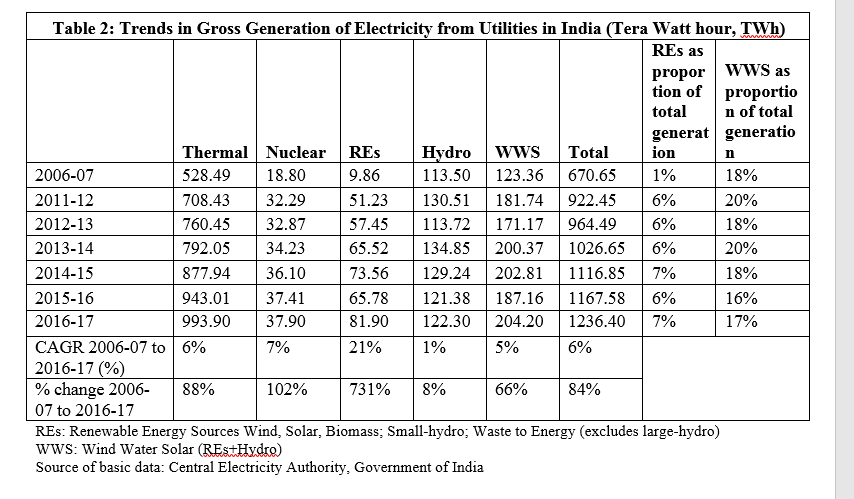

The trends for electricity generation are shown in Table 2, where the green shift is less clear (because of differing energy capacity levels for the different sources).

Table 2 reveals that India’s annual electric power generation as at early 2017 is 1236 TWh (utility power generation, not counting captive power generation in industry), which has been growing rapidly as India industrializes: in just half a decade it has grown from 922 TWh, and in a decade, it has grown from 270 TWh, or by five times over the course of the past decade (an annual rate of growth of 5.7%).

This puts India in the industrializing ‘super-power’ league. The same Table reveals that in 2017 coal accounted for 944.9 TWh (or 76%) and thermal sources altogether for 993.9 TWh (or 80%), while renewables (mainly wind and solar) accounted for 81.9 TWh (6%). Adding in hydro (accounting for 122.2 TWh) means that WWS altogether accounted for 204.2 TWh, or 16.5% of electricity generated in 2017.

When month-by-month data is examined, the shift to green power generation becomes clearer. It was reported that in July this year, Indian power generators sourced 13.2% of power from wind and solar – as compared with just 6% over the whole year 2016-17.[1] This provides a sense of the pace of change in the green shift in the power sector in India.

So — coal constitutes the source of 76% of power generated and just under 60% of electric power capacity. India is still a black energy economy, but one that is greening rapidly at the margin.

The 2022 targets: 175 GW of clean power

India’s erstwhile five-year plans have now been replaced by rigorous three-year plans, overseen by the National Institution for Transforming India (NITI Aayog). In 2015 new energy targets, taking the country up to the year 2022, were announced. An initial 100 GW solar target was proclaimed – a fivefold expansion of the existing target (announced as part of the J. Nehru National Solar Mission), which was itself considered very ambitious.

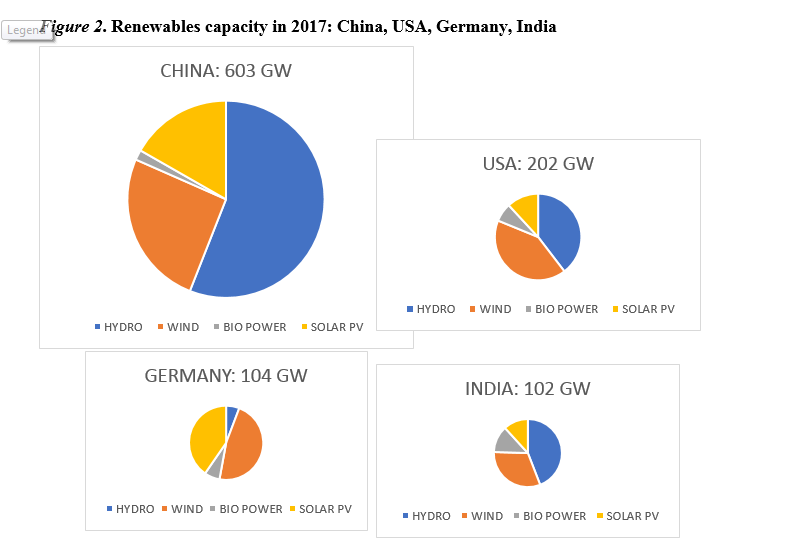

This was later complemented by a 60 GW target for wind power. With additional targets for 10 GW of biopower, and 5 GW of small hydro, the total targets for clean energy sources by 2022 are set at 175 GW, to be achieved over five years. This promises to be a huge expansion of renewable power in India, approaching 102 GW in 2017 (WWS), bringing it to a level comparable to Germany (104 GW), the USA (202 GW) although still trailing China (603 GW clean power, including hydro) – as shown in Fig. 2.

If we project India’s total power capacity to 2025 as being around 400 GW (allowing for economic growth but with energy expansion moderated by improvements in energy efficiency), then 175 GW in renewably sourced capacity (wind and solar) would represent 43% of total capacity. Adding around 40 GW sourced from hydro would mean capacity sourced from WWS of 215 GW – or more than 50% of India’s projected total capacity by that date. So, the tipping point where India can be expected to cross over from a predominantly black power system to a green system (in terms of capacity) is probably less than five years away. This is extremely good news for India (and bad news for coal exporters like Australia).

Within the 100 GW solar target, the Indian government has specified that 60 GW should come from large-scale (utility-scale) solar PV, and 40 GW from household/industrial rooftop solar. So, let us look at solar and wind developments in greater detail.

Solar targets

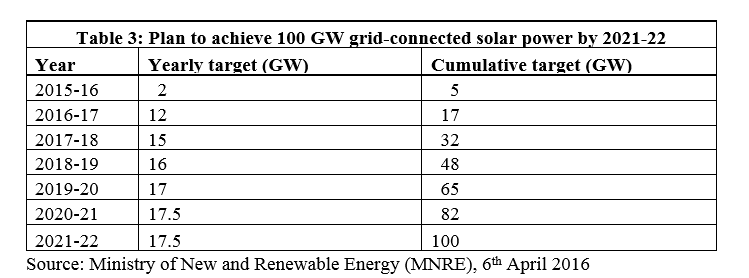

In April 2016 the Indian government specified yearly targets needed to achieve the solar target of 100 GW. These are specified as in Table 3.

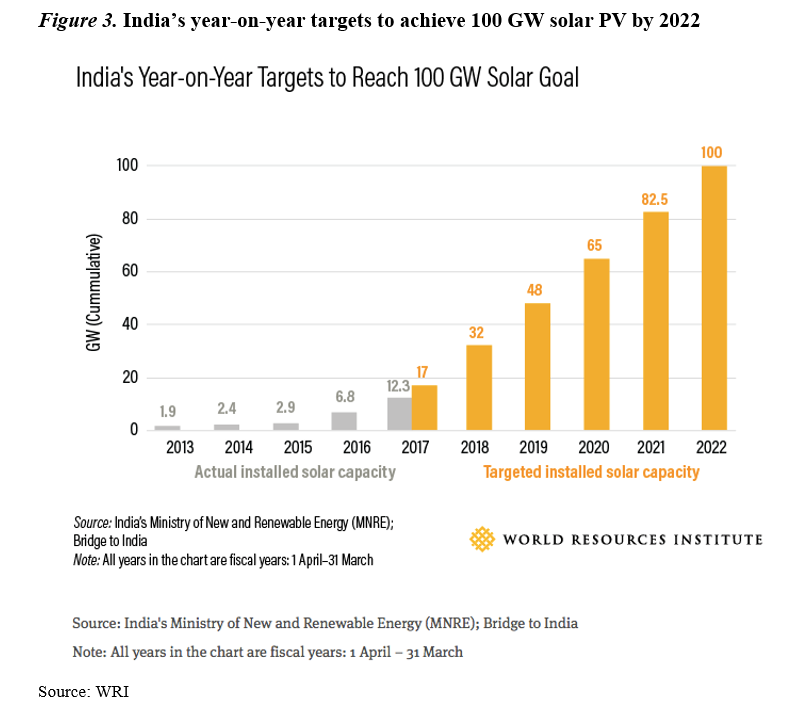

The World Resources Institute has recently published charts showing how these appear to be realistic steps towards fulfilment of the targets. Figure 3 shows the case for solar.

Of the 100 GW solar target for 2022, 60% is expected to be fulfilled by large- and medium-scale grid-connected solar power projects, and the balance by solar PV rooftop installations. Over 34 solar parks have been approved in the first phase, with plans to double their power generation target to 40 GW. Solar parks enable all-round infrastructure development including land use, road network, water and other utility upgrades, and state-of-the-art power transmission facilities.

International investment to the tune of USD 500 million has already been committed to these projects by the Japanese International Cooperation Agency (JICA), in addition to interest from the European Investment Bank and Asian Development Bank. Rooftop solar has been slow to pick up and at the end of 2016 was 1 GW, with Tamil Nadu, Gujarat and Punjab states in the lead.

India’s solar capacity is projected to reach 18.7 GW by the end of the year: 6% of the 303 GW global solar pie, and a growth rate of 89% over 2016. A 50% increase of 5.5 GW was recorded as of 31st March 2017; although, this increase was noteworthy, it did fail to meet the 12 GW annual target (Table 3). Rooftop installations, transmission infrastructure and finance availability need to be strengthened in order to continue the pace and surpass current growth.

While the former Power and Renewable Energy Minister Piyush Goyal was probably over-enthusiastic in claiming that India could achieve the 100 GW solar target by the end of 2017, nevertheless India is making significant progress towards this goal. The current level of solar power capacity is at 12 GW (tripling over the past three years), and the country is on track to install 20 GW for the full-year 2017.

It is the rapidly plunging costs of solar PV power that are driving the accelerated take-up. Public auctions of utility-scale solar have seen costs reduce from 4.3 rupees per kWh in January 2016 (itself a record) to 2.4 rupees (just a little over 3 US cents) in May 2017. This latter result means that solar is cheaper than coal – a world-historic milestone. Large-scale solar and wind are currently roughly equal in cost, and both are cheaper than coal and nuclear – according to investment bank Lazard’s.[2]

Wind power

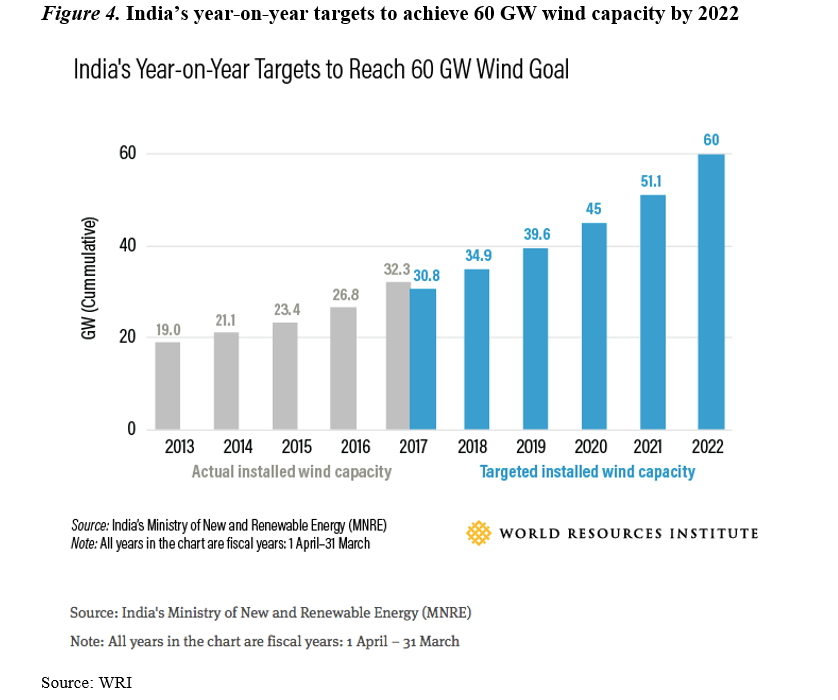

India has had two successive record years in installing wind turbines, and promises to break new records in 2017/18. India added 3.4 GW of new wind power in fiscal 2016 and a further (record) 5.4 GW in 2017 – bringing India’s cumulative total to 32.3 GW, as shown below in Figure 4. Mr Tulsi Tanti, the founder of Suzlon, India’s premier wind power company, has gone on the record to predict that India is likely to install a further 6 GW of new wind power capacity in fiscal 2018.[3] This is impressive – and exceeds the year-on-year addition needed for 2018 as calculated by WRI and shown in Figure 4.

The chart reveals that India’s installation of new wind power capacity in 2017 is already ahead of what would be needed to meet the 2022 target of 60 GW – meaning that the target is likely to be achieved sooner than projected. The latest guidelines for wind power project development and competitive tariff bidding in wind energy auctions have prompted keen interest. India has attained the status of the fourth largest installer of wind power in the world, after China, the United States and Germany.

Investment and FDI

Several leading power and technology firms are making large investments in India’s emerging renewable power sector. In mid-2015, the leaders of three of the largest tech firms in India, Taiwan and Japan announced their intention to build 20 GW of renewable solar power in India, with investments of USD 20 billion.

Japan’s Softbank for example, led by Japan’s leading technology entrepreneur Masayoshi Son, led the way, along with Taiwan’s Foxconn and India’s Bharti Enterprises. Since then, Son’s Softbank has already announced investment in a solar farm rated at 350 MW.[4] Mr Son went on the record in 2016 in committing Softbank to at least $10 billion in investments in renewables in India over the next 5-10 years.[5]

The World Bank has welcomed India’s national solar target of installing 100 GW of solar PV by 2022, and moved to provide unprecedented levels of lending to support this. Over $1 billion in loans have been committed, according to a statement from the World Bank in June 2016 – the largest investment in solar power from the World Bank in any country.[6]

After the acquisition of 1.1 GW of solar and wind energy assets from Welspun Energy in mid-2016, Tata Power, which owns cumulative solar/wind/hydro capacity of over 3 GW, announced the scale-up of renewable investments to the tune of USD 90 million. Immediate plans include the setup of large-scale solar power projects across six Indian states. Adani Green Energy, on the other hand, is seeking to raise USD 200 million to build a pipeline of over 2 GW solar projects. Aditya Birla and Dubai-based private equity firm Abraaj Group, Piramal Enterprises and Dutch pension fund asset manager APG Asset Management, Singapore sovereign fund GIC Pte Ltd, Abu Dhabi Investment Authority and Canadian pension fund Caisse de Dépôt et Placement du Québec (CDPQ) are other active players in India’s renewable landscape.

Some of India’s banks have been exposed in 2017 as being complacent in their approach to lending to fossil fuel projects, putting no less than USD 1.8 billion at risk in coal plants with an uncertain future.

A damning report from India’s Comptroller and Auditor General (CAG) issued in August 2017 found that this was the sum at risk after two financial institutions – the Rural Electrification Corporation (REC) and the Power Finance Corporation (PFC) – have been making loans to fossil fuel projects with what the CAG described as having little or no prospect of ever being viable. Most of the projects which were designated by CAG as having defaulted or as deemed to be ‘non-performing’ were for major coal projects.[7] Clearly India has need for national guidelines in the greening of finance, as pioneered by China and the People’s Bank of China.

Manufacturing of renewables devices

India’s consumption of solar modules this year was around 4 GW, of which domestically manufactured modules contributed 30%, and the rest was fulfilled mainly by Chinese imports pegged to be 10-20% cheaper than domestic competition. Competitiveness of India’s solar equipment manufacturing industry, presently facing severe pressure from Chinese producers, is critical for the long-term attractiveness of the sector. Investment in domestic manufacturing across the entire value chain, right from polysilicon, is needed. With latest projections that incentives for the sector will be gradually removed, it remains to be seen how and when commercial viability will make India’s power sector a formidable global force.

Meanwhile in wind turbine manufacturing, India already has a world class producer in Suzlon, which because of financial difficulties has slipped out of the World Top Ten manufacturers but is still an active presence in the Indian market.

Suzlon is a global turbine manufacturer, and the most vertically integrated of any of the world’s top firms. It has a manufacturing hub in India and one in China associated with its JV there. Suzlon is integrating vertically downstream by investing in wind farms, such as the 1GW wind farm created by Suzlon at Jaisalmer in Rajasthan. As noted above, the company founder Mr Tulsi Tanti predicts that India will add 6 GW of wind power capacity in 2017/18.

India’s reducing dependence on coal

India’s immediate challenge is to move away from the heavy dependence on coal; in 2016, coal constituted 60% of India’s energy mix. This is in stark contrast with the steep solar (100 GW) and wind (60 GW) targets it aims to achieve, and will warrant speedy transformation. Some progress is evident in the draft National Electricity Plan released by the Central Electricity Authority (CEA) in December 2016, which states that no new coal capacity addition was foreseen at least until 2027.

The CEA’s plan is in line with India’s international commitments for 175 GW renewables uptake as well as 20-25% reduction in emissions intensity. Not only will rapid expansion of solar and wind energy infrastructure offer a lasting solution to the electrification needs of over 20 million rural households but also scale up the green energy shift.

Tax reform

A 5% tax rate, the lowest slab under the Goods and Services Tax (GST), is applicable on solar water heaters and systems, renewable energy devices and spare parts for their manufacture, bio-gas plant, solar power-based devices, solar power generating system, wind mills and wind operated electricity generator. Ambiguity remains on GST for solar equipment which includes diodes, transistors and similar semiconductor devices, photosensitive semiconductor devices including photo voltaic cells, light emitting diodes (LED) and mounted piezoelectric crystals. An earlier decision to apply 18% GST is being reconsidered by the GST Council.

Industrial strategy and trade policy

Following in China’s green footsteps, India has been pursuing an industrial policy designed to foster manufacturing of renewables devices, utilizing trade tools known as Local Content Requirements (LCRs). While such LCRs are widely agreed to be very effective in building new industries (and were used to great effect by China to build its wind power industry), nevertheless many industrialized countries have sought to restrain their use by industrializing countries.

This was the case with India’s LCRs in its National Solar Mission, which have been challenged by the United States at the World Trade Organization (WTO), beginning in Feb 2013. India has defended its use of LCRs as effective tools of industry development and ones moreover that are required by India if it is to meet its international climate-related obligations.[8]

India has lost the case at the WTO, with an initial negative finding by an Appeal body in mid-2016 and, after India’s further appeal against this ruling, with India being placed on notice in October 2016 that it would be required to bring its trade policies into conformity with the general WTO provisions. India has been forced to bow to this decision (on pain of being exposed to the ultimate sanction of being expelled from the WTO) and informed the WTO jointly with the US in October 2017 that it would bring its trade policies into WTO conformity by December 14, 2017. The notification reads:

We wish to inform you that, pursuant to Article 21.3(b) of the Understanding on Rules and Procedures Governing the Settlement of Disputes (“DSU”), the United States and India have agreed that the reasonable period of time for India to implement the recommendations and rulings of the Dispute Settlement Body (“DSB”) in the dispute India – Certain Measures Relating to Solar Cells and Solar Modules (WT/DS456) shall be 14 months from the October 14, 2016, date of adoption of the DSB recommendations and rulings. Accordingly, the reasonable period of time expires on December 14, 2017. [9]

This is a clock that is now ticking over India’s strategies of fostering green industries. One of us (JAM) has argued in a paper published in 2017 in the journal Climate Policy that the Paris Agreement on national reductions in carbon emissions requires countries to foster new green industries as a means of meeting their emissions targets.[10]

The paper argues that this Agreement ratified under UN rules should be taken to provide countries like India with a legitimate defense in cases brought before the WTO. So far there has been no response – and India has been forced to abide by free trade rules that have nothing to do with national industry development strategies nor with climate change concerns. This is a live issue that is triggering ongoing international debate.[11]

Concluding remarks

India is already the world’s fourth largest producer and user of energy, and is now clearly on track to move rapidly from its dependence on coal and fossil fuels to newfound energy independence and shift to renewables, becoming a leader in the green energy sector. Great progress has been achieved by the outgoing Minister for Power and Renewable Energy in the Modi ministry (Piyush Goyal) but there is still much to be done by the incoming Minister, R.K. Singh.

India’s ambitious targets amounting to 175 GW by 2022 are driving investment into the energy sector, with industrial giants like Softbank, Bharti Industries and Tata Power leading the way. But finance remains a problem: many of India’s banks have been revealed as acting complacently, facilitating investments in fossil fuel systems that could result in major losses for shareholders.

The attempts in the trade arena to curb India’s strategies of building green power industries using the tools of local content requirements have also had a negative impact, forcing Indian ministries to rethink their strategies – but not their goals. While many commentators continue to refer to India as largely a coal-burning nation, this ignores the real efforts that India has made to reduce its coal dependence, and to build its energy security around a commitment to renewables.

By Simran Talwar and John Mathews

John A. Mathews is Professor of Management at Macquarie University, Australia. John Mathews is author of many books, including most recently Global Green Shift: When Cerest Meets Gaia. For more information see his blog Global Green Shift..

Simran Talwar is a Ph.D. candidate at Macquarie University.

This article was first published on the Global Green Shift and is republished here with permission.

[1] See ‘Renewable energy share hits all-time high in India – 13.2% of electricity’, CleanTechnica, Oct 22, 2017, at: https://cleantechnica.com/2017/10/22/renewable-energy-share-hits-time-high-india-13-2-electricity/

[2] See ‘Unsubsidized levelized cost of energy comparison’, Lazard’s, at: https://c1cleantechnicacom-wpengine.netdna-ssl.com/files/2016/12/solar-energy-costs-wind-energy-costs-LCOE-Lazard.png

[3] See ‘India Wind Power Primed for a Third Straight Record, Suzlon Says’, Bloomberg, April 6 2017, at:

[4] See ‘Softbank Joint Venture SB Energy commissions 350 MW solar project in India’, CleanTechnica, April 21 2017, at: https://cleantechnica.com/2017/04/21/softbank-joint-venture-sb-energy-commissions-350-megawatt-solar-project-india/

[5] See ‘Keen to invest in internet, solar energy in India: Masayoshi Son, Softbank’, The Economic Times (India), May 30 2016, at: https://economictimes.indiatimes.com/experts-views/keen-to-invest-in-int...

[6] See the statement at: http://www.worldbank.org/en/news/feature/2016/06/30/solar-energy-to-powe...

[7] See ‘Indian Auditor-General finds public banks have US$1.8 billion at risk on dud coal plants’, by Bob Burton, RenewEconomy, 31 Aug 2017, at: http://reneweconomy.com.au/indian-auditor-general-finds-public-banks-us1-8bn-risk-dud-coal-plants-35528/. For the Auditor-General report itself, on ‘Loans to Independent Power Producers by Rural Electrification Corporation and Power Finance Corporation’, see: http://www.cag.gov.in/sites/default/files/audit_report_files/Report_No.34_of_2017_-_Compliance_audit_Union_Government_Loans_to_Independent_Power_Producers_by_Rural_Electrification_Corporation_Limited_and_Power_Finance_Corporation_Limited_Reports_of_.pdf

[8] For the report of the Appellate Body on the dispute involving India’s LCRs as part of its NSM, see the WTO ruling at: https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds456_e.htm

It is worth noting that India has long used local content requirements in other industries such as its automobile industry until discontinuing them after losing an appeal at the WTO. The LCRs framed more recently for the solar PV industry can be said to have embodied lessons learned in these earlier disputes – but still encountered resistance at the WTO.

[9] See the WTO Notification from India and the US, at: https://www.wto.org/english/tratop_e/dispu_e/cases_e/ds456_e.htm

[10] See John A. Mathews, ‘Global trade and promotion of cleantech industry: A post Paris Agreement agenda’, Climate Policy, (2017), Vol 17 (1): 102-110, at: http://www.tandfonline.com/doi/abs/10.1080/14693062.2016.1215286

[11] For a comprehensive review of the issues, as of early 2016, see the article ‘WTO decision on local content requirements will not affect India solar ambitions, officials say’, posted to the website of the International Centre for Trade and Sustainable Development (Geneva), posted 4 March 2016, at: https://www.ictsd.org/bridges-news/biores/news/wto-decision-on-local-content-requirements-will-not-affect-india-solar

Sign in to Participate