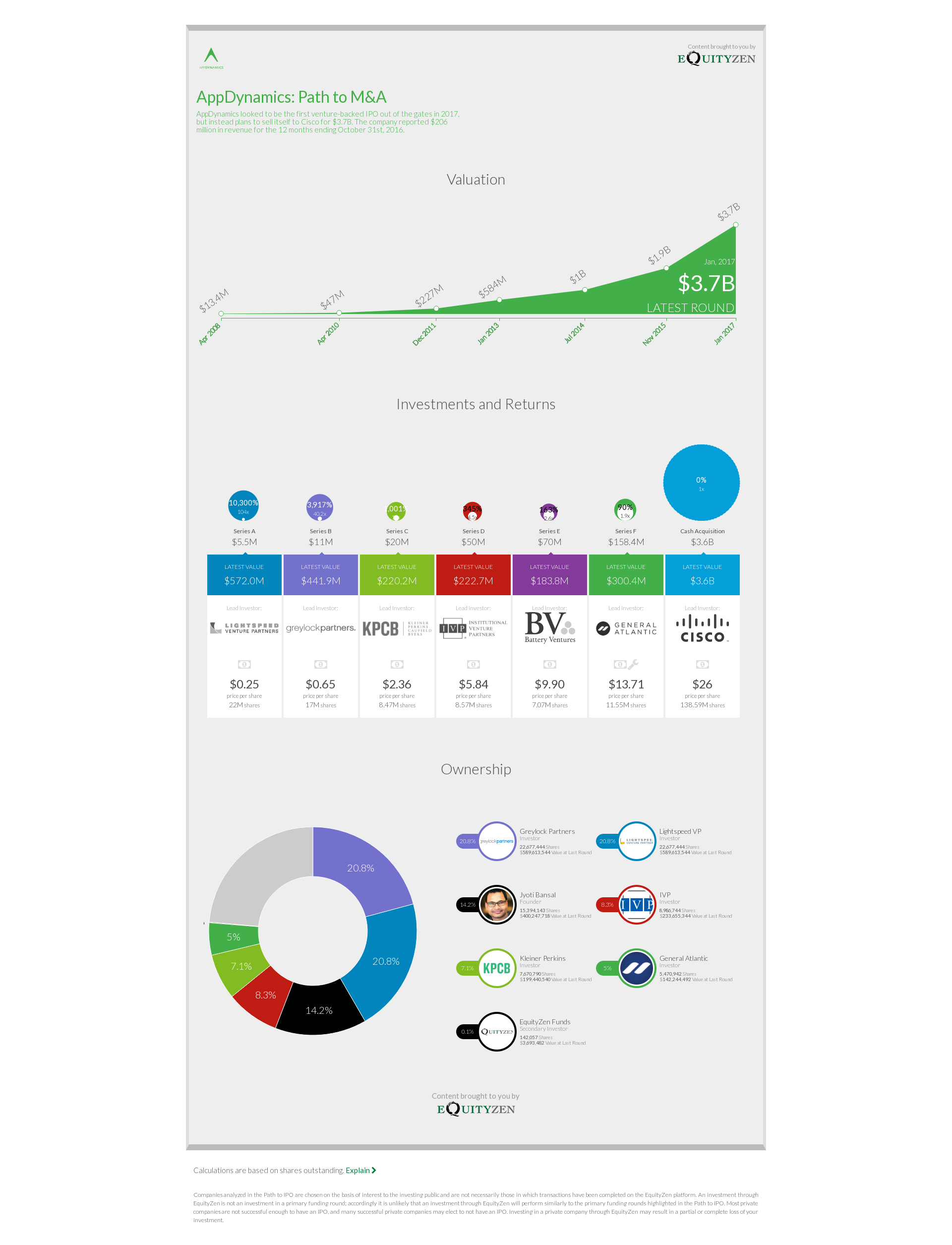

AppDynamics looked to be the first venture-backed IPO out of the gates in 2017, but instead plans to sell itself to Cisco for $3.7B. The company reported $206 million in revenue for the 12 months ending October 31st, 2016.

0 shares

22M shares

17M shares

8.47M shares

8.57M shares

7.07M shares

11.55M shares

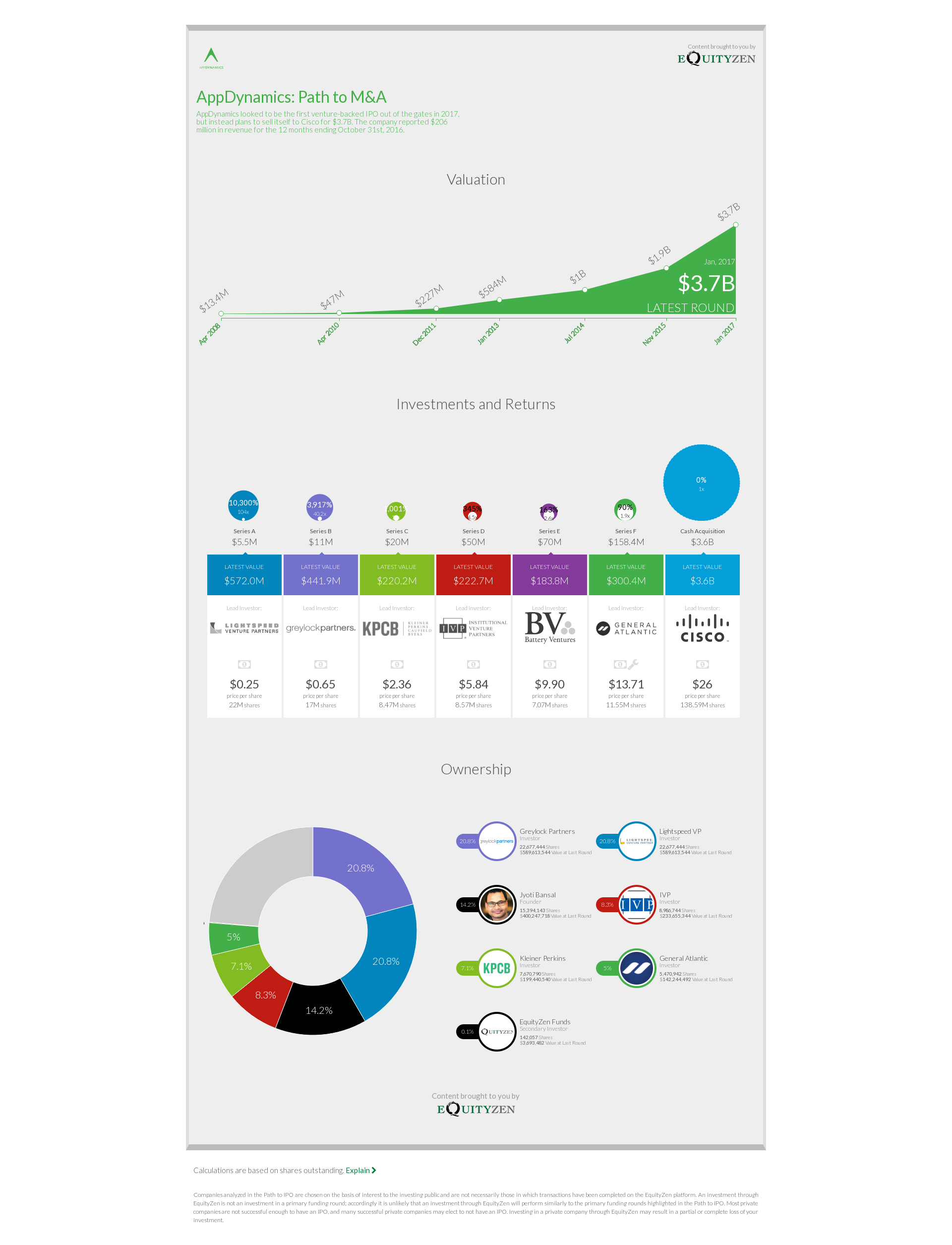

20.8%

20.8%

14.2%

8.3%

7.1%

5%

0.1%

Content brought to you by

Calculations are based on shares outstanding. Explain Hide explanation

Tech companies often use their fully-diluted share count when they're private companies, to increase their perceived valuation. When they file to go public, however, the number of shares is typically only the shares outstanding (a smaller number than the fully-diluted share count). As a result, the company's "valuation" may decrease even though the price paid per share has gone up.

Companies analyzed in the Path to IPO are chosen on the basis of interest to the investing public and are not necessarily those in which transactions have been completed on the EquityZen platform. An investment through EquityZen is not an investment in a primary funding round; accordingly it is unlikely that an investment through EquityZen will perform similarly to the primary funding rounds highlighted in the Path to IPO. Most private companies are not successful enough to have an IPO, and many successful private companies may elect to not have an IPO. Investing in a private company through EquityZen may result in a partial or complete loss of your investment.

To learn more about whether you're eligible, typical investment size, company valuation, and share price, request access here.