The Energy Collective Group

This group brings together the best thinkers on energy and climate. Join us for smart, insightful posts and conversations about where the energy industry is and where it is going.

Post

Researchers Have Been Underestimating the Cost of Wind and Solar

How should electricity from wind turbines and solar panels be evaluated? Should it be evaluated as if these devices are stand-alone devices? Or do these devices provide electricity that is of such low quality, because of its intermittency and other factors, that we should recognize the need for supporting services associated with actually putting the electricity on the grid? This question comes up in many types of evaluations, including Levelized Cost of Energy (LCOE), Energy Return on Energy Invested (EROI), Life Cycle Analysis (LCA), and Energy Payback Period (EPP).

I recently gave a talk called The Problem of Properly Evaluating Intermittent Renewable Resources (PDF) at a BioPhysical Economics Conference in Montana. As many of you know, this is the group that is concerned about Energy Returned on Energy Invested (EROI). As you might guess, my conclusion is that the current methodology is quite misleading. Wind and solar are not really stand-alone devices when it comes to providing the kind of electricity that is needed by the grid. Grid operators, utilities, and backup electricity providers must provide hidden subsidies to make the system really work.

This problem is currently not being recognized by any of the groups evaluating wind and solar, using techniques such as LCOE, EROI, LCA, and EPP. As a result, published results suggest that wind and solar are much more beneficial than they really are. The distortion affects both pricing and the amount of supposed CO2 savings.

One of the questions that came up at the conference was, “Is this distortion actually important when only a small amount of intermittent electricity is added to the grid?” For that reason, I have included discussion of this issue as well. My conclusion is that the problem of intermittency and the pricing distortions it causes is important, even at low grid penetrations. There may be some cases where intermittent renewables are helpful additions without buffering (especially when the current fuel is oil, and wind or solar can help reduce fuel usage), but there are likely to be many other instances where the costs involved greatly exceed the benefits gained. We need to be doing much more thoughtful analyses of costs and benefits in particular situations to understand exactly where intermittent resources might be helpful.

A big part of our problem is that we are dealing with variables that are “not independent.” If we add subsidized wind and solar, that act, by itself, changes the needed pricing for all of the other types of electricity. The price per kWh of supporting types of electricity needs to rise, because their EROIs fall as they are used in a less efficient manner. This same problem affects all of the other pricing approaches as well, including LCOE. Thus, our current pricing approaches make intermittent wind and solar look much more beneficial than they really are.

A clear workaround for this non-independence problem is to look primarily at the cost (in terms of EROI or LCOE) in which wind and solar are part of overall “packages” that produce grid-quality electricity, at the locations where they are needed. If we can find solutions on this basis, there would seem to be much more of a chance that wind and solar could be ramped up to a significant share of total electricity. The “problem” is that there is a lower bound on an acceptable EROI (probably 10:1, but possibly as low as 3:1 based on the work of Charles Hall). This is somewhat equivalent to an upper bound on the affordable cost of electricity using LCOE.

This means that if we really expect to scale wind and solar, we probably need to be creating packages of grid-quality electricity (wind or solar, supplemented by various devices to create grid quality electricity) at an acceptably high EROI. This is very similar to a requirement that wind or solar energy, including all of the necessary adjustments to bring them to grid quality, be available at a suitably low dollar cost–probably not too different from today’s wholesale cost of electricity. EROI theory would strongly suggest that energy costs for an economy cannot rise dramatically, without a huge problem for the economy. Hiding rising energy costs with government subsidies cannot fix this problem.

Distortions Become Material Very Early

If we look at recently published information about how much intermittent electricity is being added to the electric grid, the amounts are surprisingly small. Overall, worldwide, the amount of electricity generated by a combination of wind and solar (nearly all of it intermittent) was 5.2% in 2016. On an area by area basis, the percentages of wind and solar are as shown in Figure 1.

Figure 1. Wind and solar as a share of 2016 electricity generation, based on BP Statistical Review of World Energy 2017. World total is not shown, but is very close to the percentage shown for China.

There are two reasons why these percentages are lower than a person might expect. One reason is that the figures usually quoted are the amounts of “generating capacity” added by wind and solar, and these are nearly always higher than the amount of actual electricity supply added, because wind and solar “capacity” tend to be lightly used.

The other reason that the percentages on Figure 1 are lower than we might expect is because the places that have unusually high concentrations of wind and solar generation (examples: Germany, Denmark, and California) tend to depend on a combination of (a) generous subsidy programs, (b) the availability of inexpensive balancing power from elsewhere and (c) the generosity of neighbors in taking unwanted electricity and adding it to their electric grids at low prices.

As greater amounts of intermittent electricity are added, the availability of inexpensive balancing capacity (for example, from hydroelectric from Norway and Sweden) quickly gets exhausted, and neighbors become more and more unhappy with the amounts of unwanted excess generation being dumped on their grids. Denmark has found that the dollar amount of subsidies needs to rise, year after year, if it is to continue its intermittent renewables program.

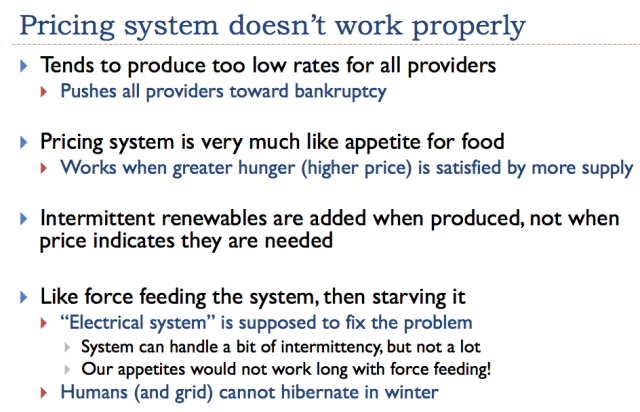

One of the major issues with adding intermittent renewables to the electric grid is that doing so distorts wholesale electricity pricing. Solar energy tends to cut mid-day peaks in electricity price, making it less economic for “peaking plants” (natural gas electricity plants that provide electricity only when prices are very high) to stay open. At times, prices may turn negative, if the total amount of wind and solar produced at a given time is greater than the overall amount of electricity required by customers. This happens because intermittent electricity is generally given priority on the grid, whether price signals indicate that it is needed or not. A combination of these problems tends to make backup generation unprofitable unless subsidies are provided. If peaking plants and other backup are still required, but need to operate fewer hours, subsidies must be provided so that the plants can afford to hire year-around staff, and pay their ongoing fixed expenses.

If we think of the new electricity demand as being “normal” demand, adjusted by the actual, fairly random, wind and solar generation, the new demand pattern ends up having many anomalies. One of the anomalies is that required prices become negative at times when wind and solar generation are high, but the grid has no need for them. This tends to happen first on weekends in the spring and fall, when electricity demand is low. As the share of intermittent electricity grows, the problem with negative prices becomes greater and greater.

The other major anomaly is the need for a lot of quick “ramp up” and “ramp down” capacity. One time this typically happens is at sunset, when demand is high (people cooking their dinners) but a large amount of solar electricity disappears because of the setting of the sun. For wind, rapid ramp ups and downs seem to be related to thunderstorms and other storm conditions. California and Australia are both adding big battery systems, built by Tesla, to help deal with rapid ramp-up and ramp-down problems.

There is a lot of work on “smart grids” being done, but this work does not address the particular problems brought on by adding wind and solar. In particular, smart grids do not move demand from summer and winter (when demand is normally high) to spring and fall (when demand is normally low). Smart grids and time of day pricing aren’t very good at fixing the rapid ramping problem, either, especially when these problems are weather related.

The one place where time of day pricing can perhaps be somewhat helpful is in lessening the rapid ramping problem of solar at sunset. One fix that is currently being tried is offering the highest wholesale electricity prices in the evening (6:00 pm to 9:00 pm), rather than earlier in the day. This approach encourages those adding new solar energy generation to add their panels facing west, rather than south, so as to better match demand. Doing this is less efficient from the point of view of the total electricity generated by the panels (and thus lowers EROIs of the solar panels), but helps prevent some of the rapid ramping problem at sunset. It also gets some of the generation moved from the middle of day to the evening, when it better matches “demand.”

In theory, the high prices from 6:00 pm to 9:00 pm might encourage consumers to move some of their electricity usage (cooking dinner, watching television, running air conditioning) until after 9:00 pm. But, as a practical matter, it is difficult to move very much of residential demand to the desired time slots based on price. In theory, demand could also be moved from summer and winter to spring and fall based on electricity price, but it is hard to think of changes that families could easily make that would allow this change to happen.

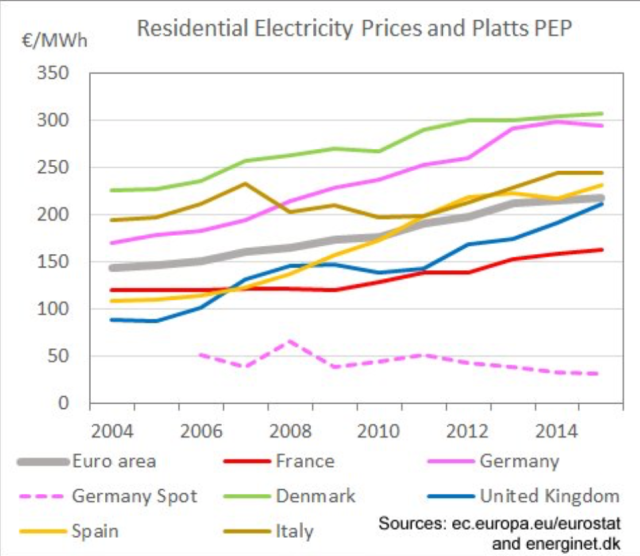

With the strange demand pattern that occurs when intermittent renewables are added, standard pricing approaches (based on marginal costs) tend to produce wholesale electricity prices that are too low for electricity produced by natural gas, coal, and nuclear providers. In fact, wholesale electricity rates for supporting providers tend to diverge further and further from what is needed, as more and more intermittent electricity is added. The dotted line on Figure 2 illustrates the falling wholesale electricity prices that have been occurring in Europe, even as retail residential electricity prices are rising.

Figure 2. European residential electricity prices have risen, even as wholesale electricity prices (dotted line) have fallen. Chart by Paul-Frederik Bach.

The marginal pricing scheme gives little guidance as to how much backup generation is really needed. It is therefore left up to governments and local electricity oversight groups to figure out how to compensate for the known pricing problem. Some provide subsidies to non-intermittent producers; others do not.

To complicate matters further, electricity consumption has been falling rapidly in countries whose economies are depressed. Adding wind and solar further reduces needed natural gas, coal, and nuclear generation. Some countries may let these producers collapse; others may subsidize them, as a jobs-creation program, whether this backup generation is needed or not.

Of course, if a single payer is responsible for both intermittent and other electricity programs, a combined rate can be set that is high enough for the costs of both intermittent electricity and backup generation, eliminating the pricing problem, from the point of view of electricity providers. The question then becomes, “Will the new higher electricity prices be affordable by consumers?”

The recently published IEA World Energy Investment Report 2017 provides information on a number of developing problems:

“Network investment remains robust for now, but worries have emerged in several regions about the prospect of a “utility death spiral” as the long-term economic viability of grid investments diminishes. The still widespread regulatory practice of remunerating fixed network assets on the basis of a variable per kWh charge is poorly suited for a power system with a large amount of decentralised solar PV and storage capacity.”

The IEA investment report notes that in China, 10% of solar PV and 17% of wind generation were curtailed in 2016, even though previous problems with lack of transmission had been fixed. Figure 1 shows China’s electricity from wind and solar amounts to only 5.0% of its total electricity consumption in 2016.

Regarding India, the IEA report says, “More flexible conventional capacity, including gas-fired plants, better connections with hydro resources and investment in battery storage will be needed to support continued growth in solar power.” India’s intermittent electricity amounted to only 4.1% of total electricity supply in 2016.

In Europe, a spike in electricity prices to a 10-year high took place in January 2017, when both wind and solar output were low, and the temperature was unusually cold. And as previously mentioned, California and South Australia have found it necessary to add Tesla batteries to handle rapid ramp-ups and ramp-downs. Australia is also adding large amounts of transmission that would not have been needed, if coal generating plants had continued to provide services in South Australia.

None of the costs related to intermittency workarounds are currently being included in EROI analyses. They are generally not being included in analyses of other kinds, either, such as LCOE. In my opinion, the time has already arrived when analyses need to be performed on a much broader basis than in the past, so as to better capture the true cost of adding intermittent electricity.

–

–

–

Of course, as we saw in the introduction, worldwide electricity supply is only about 5% wind and solar. The only parts of the world that were much above 5% in 2016 were Europe, which was at 11.3% in 2016 and the United States, which was at 6.6%.

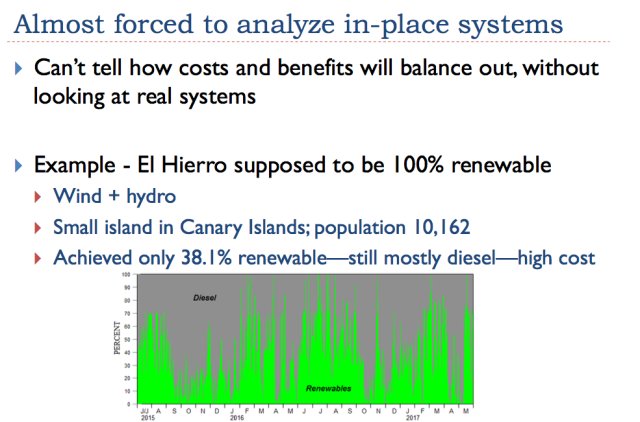

There has been a lot of talk about electrical systems being operated entirely by renewables (such as hydroelectric, wind, solar, and burned biomass), but these do not exist in practice, as far as I know. Trying to replace total energy consumption, including oil and natural gas usage, would be an even bigger problem.

The amount of electricity required by consumers varies considerably over the course of a year. Electricity demand tends to be higher on weekdays than on weekends, when factories and schools are often closed. There is usually a “peak” in demand in winter, when it is unusually cold, and second peak in summer, when it is unusually hot. During the 24-hour day, demand tends to be lowest at night. During the year, the lowest demand typically comes on weekends in the spring and fall.

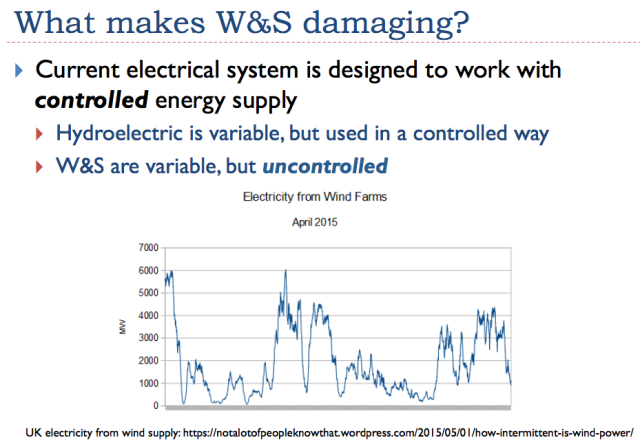

If intermittent electricity from W&S is given first priority on the electric grid, the resulting “net” demand is far more variable than the original demand pattern based on customer usage. This increasingly variable demand tends to become more and more difficult to handle, as the percentage of intermittent electricity added to the grid rises.

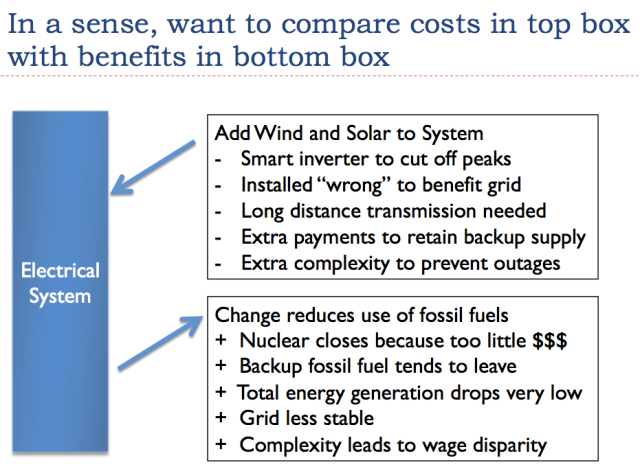

EROI is nearly always calculated at the level of the solar panel or wind turbine, together with a regular inverter and whatever equipment is used to hold the device in place. This calculation does not consider all of the costs in getting electricity to the right location, and up to grid quality. If we move clockwise around the diagram, we see some of the problems as the percentage of W&S increases.

One invention is smart inverters, which are used to bring the quality of the electrical output up closer to grid quality, apart from the intermittency problems. Germany has retrofitted solar PV with these, because of problems it encountered using only “regular” inverters. Upgrading to smart inverters would be a cost not generally included in EROI or LCOE calculations.

The next problem illustrated in Slide 6 is the fact that the pricing system does not work for any fuel, if wind and solar are given priority on the electric grid. The marginal cost approach that is usually used gives too low a wholesale price for every producer subject to this pricing scheme. The result is a pricing system that gives misleadingly low price signals. Regulators are generally aware of this issue, but don’t have a good way of fixing it. Capacity payments are used in some places as an attempted workaround, but it is not clear that such payments really solve the problem.

It is less obvious that in addition to giving too low pricing indications for electricity, the current marginal cost pricing approach indirectly gives artificially low price indications regarding the required prices for natural gas and coal as fuels. As a result of this and other forces acting in the same directions, we end up with a rather bizarre situation: (a) Natural gas and and coal prices tend to fall below their cost of production. (b) At the same time, nuclear electricity generating plants are being forced to close, because they cannot afford to compete with the artificially low price of electricity produced by the very low-priced natural gas and coal. The whole system tends to be pushed toward collapse by misleadingly low wholesale electricity prices.

Slide 6 also shows some of the problems that seem to start arising as more intermittent electricity is added. Once new long distance transmission lines are added, it changes the nature of the whole “game.” It becomes easier to rely on generation added by a neighbor; any generation that a country might add becomes more attractive to a neighbor. As long as there is plenty of electricity to go around, everything goes well. When there are shortages, then arguments begin to arise. Arguments such as these may destabilize the Eurozone.

One thing I did not mention in this chart is the increasing need to pay intermittent grid providers not to produce electricity when there is an oversupply of electricity. In the UK, the amount of these payments was over 1 million pounds a week in 2015. I mentioned previously that in China, 17% of wind generation and 10% of solar PV generation were being curtailed in 2016. EROI calculations do not consider this possibility; they assume that 100% of the electricity that is generated can, in fact, be used by the system.

The pricing system no longer works because W&S are added whenever they become available, in preference to other generation. In many ways, the pricing system is like our appetite for food. Usually, we eat when we are hungry, and the food we eat reduces our appetite. W&S are added to the system with total disregard for whether the system needs it or not, leaving the other electricity producers to try to fix up the mess, using the false pricing signals they get. The IEA’s 2017 Investment Report recommends that countries develop new pricing schemes that correct the problems, but it is not clear that this is actually possible without correcting the hidden subsidies.

Why add more electricity supply, if there is a chance that you can use the new supply added by your neighbor?

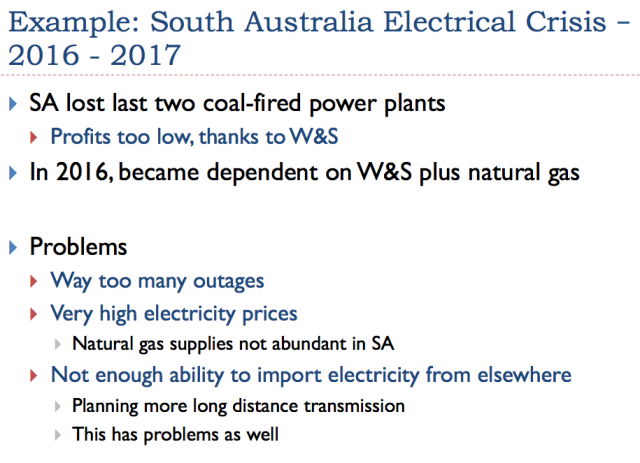

South Australia had two recent major outages–both partly related to adding large amounts of wind and solar to the electric grid, and the loss of its last two coal-fired electricity generation plants. The first big outage came during a weather event. The second big outage occurred when temperatures were very high during summer, and because of this, electricity demand was very high.

One planned workaround for supply shortages was natural gas. Unfortunately, South Australia doesn’t actually have a very good natural gas supply to operate its units generating electricity from natural gas. Thus, the available natural gas generators could not really respond as hoped, except at very high prices. Some changes are now being made, including a planned Tesla battery system. With the changes being made, there are reports of electricity rate increases of up to 120% for businesses in South Australia.

The irony of the situation is that Australia is a major natural gas exporter. Businesses expected that they could make more money selling the natural gas abroad as LNG than they could by providing natural gas to the citizens of South Australia. These exports are now being curbed, to try to help fix the South Australia natural gas problem.

These issues point out how interconnected all of the different types of electricity generation are, and how quickly a situation can become a local crisis, if regulators simply assume “market forces will provide a solution.”

An expert panel in Australia has recommended an approach similar to this. It simply becomes too difficult to operate a system with built-in subsidies.

–

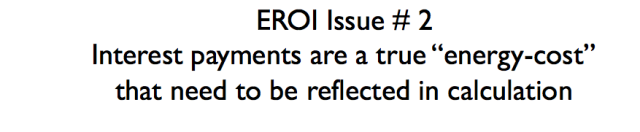

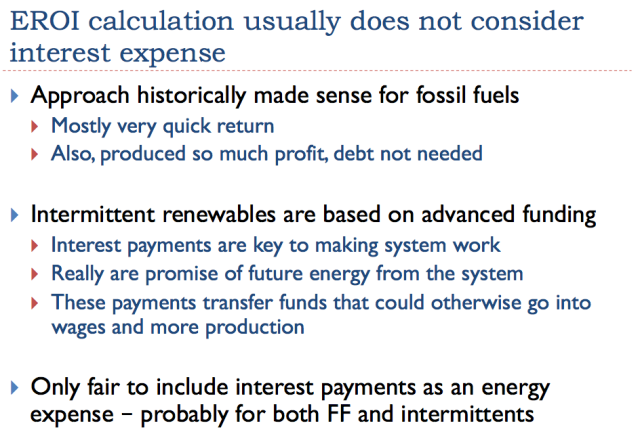

Timing makes a difference. The payments that are made for interest need to be made, directly or indirectly, with future goods and services that can only be made using energy products. Thus, they also require the use of energy products.

–

There is a real difference between (a) looking at the actual operating experiences of an existing oil and gas or coal company, and (b) guessing what the future operating experience of a system operated by wind panels and solar panels might be. The tendency is to guess low, when it comes to envisioning what future problems may arise.

It is not just the wind turbines and solar panels that will need to be replaced over time; it is all of the supporting devices that need to be kept in good repair and replaced over time. Furthermore, the electric grid is dependent on oil for its upkeep. If oil becomes a problem, there is a real danger that the electric grid will become unusable, and with it, electricity that is generally distributed by the grid, including wind and solar.

–

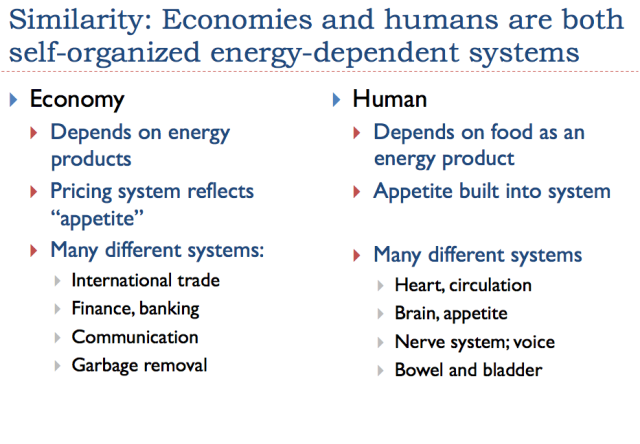

Economies and humans are both self-organized systems that depend on energy consumption for their existence. They have many other characteristics in common as well.

We know that with humans, we really need to examine how a new medicine or a change in diet works in practice. For one thing, medicines and diets aren’t necessarily used as planned. Unexpected long-term changes occur that we could not anticipate.

The same kinds of problems occur when wind and solar are added to a grid system. We really have to look at what is happening to see the full picture.

Anyone who has followed the news knows about medicine’s long history of announcements followed by retractions.

A fairly similar situation can be expected to happen with proposed energy solutions.

There is a whole package of costs and a whole range of direct and indirect outcomes to consider.

As far as I know, none of the attempts at producing a system that operates on 100% renewable energy have been a success. There has been some reductions in fossil fuel usage, but at a high cost.

A 2013 Weissabach et al. EROI analysis examines a situation with partial buffering of wind and solar (approximately 10 days worth of buffering). It leaves out several other costs of bringing wind and solar up to grid quality electricity, such as extra long distance transmission costs, and more significant buffering to allow transferring electricity produced in spring and fall to be saved for summer or winter. These authors calculated a partially buffered EROI of 4:1 for wind, and a partially buffered EROI range of 1.5:1 to 2.3:1 for solar PV.

Of course, more investigation, including looking at the full package of needed devices to provide non-intermittent electricity of grid quality, is really needed for particular situations. Improvements in technology would tend to raise EROI indications; adding more supplemental devices to bring electricity to grid quality would tend to reduce EROI indications.

If the cutoff for being able to maintain a modern society is 10:1, as mentioned earlier, then wind and solar PV would both seem to fall far below the required EROI cutoff, if they are to be used in quantity.

If, as Hall believes, an EROI as low as 3:1 might be useful, then there is a possibility that some wind energy would be helpful, especially if a particular wind location has a very high capacity factor (can generate electricity a large share of the time), and if pricing problems can be handled adequately. The EROI of solar PV would probably still be too low in most applications. In any event, we need to be examining situations more closely, instead of simply assuming that hidden subsidies can be counted on indefinitely.

Get Published - Build a Following

The Energy Central Power Industry Network® is based on one core idea - power industry professionals helping each other and advancing the industry by sharing and learning from each other.

If you have an experience or insight to share or have learned something from a conference or seminar, your peers and colleagues on Energy Central want to hear about it. It's also easy to share a link to an article you've liked or an industry resource that you think would be helpful.

Sign in to Participate