Bitcoin surged on Thursday morning, blowing past $5,000 for the first time and setting a new record price above $5,200.

The rise is remarkable because there has been quite a bit of unfavorable news about Bitcoin in recent weeks. China, one of the biggest markets for Bitcoin, is shutting down trading. The Bitcoin community faces ongoing acrimony over how to scale the Bitcoin network. A contentious fork split the Bitcoin network in two in August, and there might be another schism in the Bitcoin community come November.

Finally, many experts believe that the broader blockchain world is in the middle of an unsustainable bubble. If that bubble pops, Bitcoin's price is likely to fall with it.

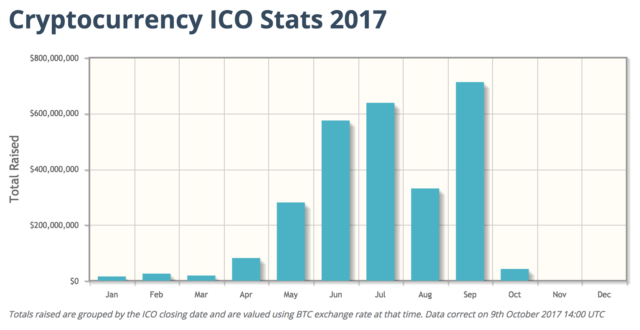

So what explains Bitcoin's rise? One factor may simply be that the blockchain bubble hasn't run its course. People are continuing to hold "initial coin offerings" of newly invented cryptocurrencies. Despite a falling Bitcoin price last month, ICOs raised more than $600 million in September, according to data from CoinSchedule.

A healthy ICO market creates demand for Bitcoin because Bitcoin is often used as an intermediary currency for token sales. Legal and logistical barriers make it difficult to sell a newly created cryptocurrency for conventional currencies like dollars or euros. But it's relatively easy to sell a new cryptocurrency in exchange for Bitcoin. So people wanting to participate in ICOs often need to buy Bitcoins first, pushing up Bitcoin's price.

Another possible reason for Bitcoin's rise: the market might actually see forks as a good thing. The August fork split the Bitcoin network in half, creating a new cryptocurrency called Bitcoin Cash that was a perfect copy of the original Bitcoin network—including its transaction history. Anyone who owned one Bitcoin before the fork owned one Bitcoin after the fork and one unit of Bitcoin Cash. And surprisingly, the combined value of these two currencies was higher than Bitcoin had been worth prior to the fork.

So the market may be shrugging off the possibility of another fork in November because it doesn't expect another fork to hurt Bitcoin's value. In fact, it might make holders of existing Bitcoins richer.

A final factor driving Bitcoin's growth: increasing interest from mainstream financial institutions. For example, rumors circulated last week that Goldman Sachs was preparing to open a "Bitcoin desk" for trading cryptocurrency. Speculators may be bidding up Bitcoin's price in anticipation of greater demand from Wall Street in the coming months.

reader comments

185