Reports of Milton Friedman's death have not been greatly exaggerated. That's because he passed away in 2006. But this fact may have eluded Senator Rand Paul, who told Joshua Green of Bloomberg Businessweek in a somewhat strange interview that, if he had to pick a living person, he'd pick Friedman to run the Fed. Yeah, about that...

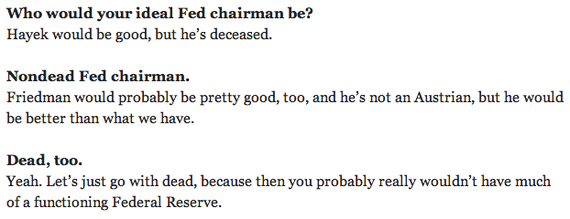

Now, it's not clear if Paul is just joking here, but what is clear is he doesn't know anything about what Friedman actually thought about monetary policy. See, Paul is a case of the apple not even falling from the tree. Like his father, he's no fan of the Fed, and thinks quantitative easing has only created an "illusory" recovery. So when he says he thinks Friedman "would be better than what we have," he almost certainly means that Friedman wouldn't be buying bonds like Bernanke has. And that, of course, couldn't be more wrong.

We know exactly what Friedman thought about quantitative easing, because he told us. Here's what he said the Bank of Japan needed to do back in 2000 when it was stuck in its own liquidity trap:

Now, the Bank of Japan's argument is, "Oh well, we've got the interest rate down to zero; what more can we do?" It's very simple. They can buy long-term government securities, and they can keep buying them and providing high-powered money until the high-powered money starts getting the economy in an expansion.

In other words, print money, and keep printing, until the economy recovers. (Of course, quantitative easing is more "printing money" than printing money -- it's really swapping one interest-bearing asset for another -- but it's close enough for our purposes).

This forgetting of Friedman is what Paul Krugman calls his "unpersonhood" in today's Republican Party. Now, Friedman the academic will certainly live on, but Friedman the popularizer has taken a hit. That Friedman had two big ideas: that free markets work, and that central banks could and should keep them working when they didn't. Republicans love the "free to choose" part of this, but, aside from a few lonely wonks, have discarded the rest. Even Friedman's watered-down case for government intervention -- only the central bank, and only if it follows a strict rule -- is too much for a GOP that's been ever more radicalized by the Great Recession.

Paul's mistake is assuming that Friedman's support for free markets made him "one of them" on the Fed. It didn't. Now, it's rather remarkable that someone who fashions himself as something of an expert on monetary policy, like Paul does, could be so ignorant -- but his ignorance is genuine. And it shows just how dead Friedman's ideas are to the modern-day Republican Party.

We want to hear what you think about this article. Submit a letter to the editor or write to letters@theatlantic.com.