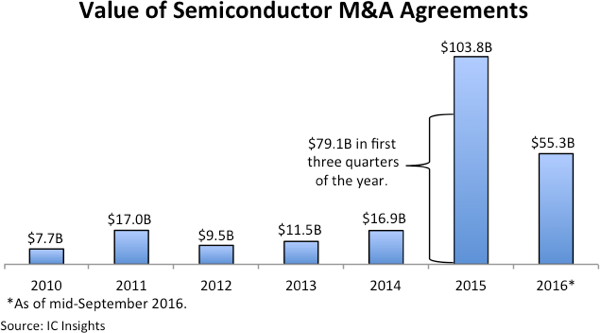

2015 was the all-time high for M&A with deals worth $103.8 billion.

So far this year, the total value of M&A deals is $55.3 billion.

In the first half of 2016, it appeared the enormous wave of semiconductor acquisitions in 2015 had subsided substantially, with the value of transactions announced between January and June being just $4.3 billion compared to $72.6 billion in the same six-month period in 1H15.

However, the three big Q3 deals ensure that 2016 will be second only to 2015 in terms of the total value of announced semiconductor M&A transactions.

A major difference between the huge wave of semiconductor acquisitions in 2015 and the nearly 20 deals being struck in 2016 is that a significant number of transactions this year are for parts of businesses, divisions, product lines, technologies, or certain assets of companies.

This year has seen a surge in the agreements in which semiconductor companies are divesting or filling out product lines and technologies for newly honed strategies in the second half of this decade

Electronics Weekly Electronics Design & Components Tech News

Electronics Weekly Electronics Design & Components Tech News