The Trump administration’s ambivalence—some might say hostility—toward science and research took a turn for the worse when the president signed a controversial new tax bill into law at the end of last year. Donald Trump’s first year in office was marked by questionable appointments to federal departments and agencies—including Scott Pruitt at the Environmental Protection Agency and Rick Perry at the Department of Energy (DoE)—that handle important policy decisions best informed by science. Large tax cuts added a blow to any hope Congress might be able to ease some of the steepest proposed budget cuts for fiscal year 2018, which would affect the EPA as well as the Agriculture and the Health and Human Services departments.

One of the administration’s stated goals in reducing corporate tax rates is to lure manufacturing and business investment back to the U.S. Apple, most notably, announced plans this month to open a new campus as part of a five-year, $30-billion U.S. investment plan, and will make about $38 billion in one-time tax payments on its overseas cash. Additional incentives to repatriate manufacturing operationscame last week, when the White House imposed a four-year increase in tariffs on imported solar panels.

Those tariffs, not to mention the budget and tax cuts, raise particularly interesting questions about the future of the energy sector—which for the past several years has marched toward radical change, as technological advances steadily beat down the cost of harvesting solar and wind energy. Scientific American spoke with Joshua Rhodes, a postdoctoral research fellow in The Webber Energy Group and at The University of Texas at Austin’s Energy Institute, about the potential impact of the Trump administration’s financial policies on energy research—and how the U.S. might better prepare itself to meet its future energy needs.

On supporting science journalism

If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today.

[An edited transcript of the conversation follows.]

How much is the new tax law likely to affect funding for energy research?

You have to look at which programs are cut. Originally there was the potential for a lot of slashing of funding at the DoE, including funding programs such as ARPA–E [Advanced Research Projects Agency for Energy]—which is funny because they are one of the government programs that can actually prove a return on the dollar. The tax bill doesn’t necessarily mean that funding will go away, but based on who’s in charge of the different agencies that typically do a lot of scientific research, it seems that the focus will be more for applied, commercially viable research.

Beyond the tax bill, what is the potential impact of the proposed 70 percent cut in funding for the Energy Department’s Office of Energy Efficiency and Renewable Energy? EERE does a lot of data-gathering that other researchers can use and that would be missed if those efforts are not supported. That office builds a lot of tools that, for example, measure energy efficiency and evaluate the cost-effectiveness of different energy conservation measures—that is, do they actually save money? If those services go away, or go away significantly, researchers who had been using those tools will have to do a lot of that work themselves. EERE has also funded a lot of start-up companies through different SBIR [Small Business Innovation Research] programs. I’ve applied for their grants myself. EERE can inject money into start-ups and small businesses, so cutting their funding seems counterintuitive to the American idea of our economy running on small businesses and that everyone can be their own boss.

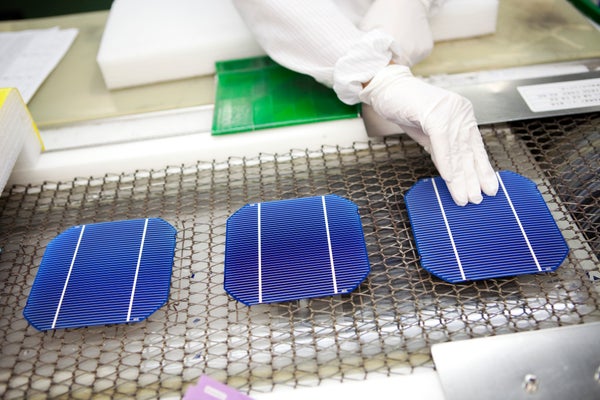

Are solar cells and modules made in China and elsewhere “a substantial cause of serious injury to domestic manufacturers,” as the Trump administration has claimed?

The companies that complained the loudest to the U.S. International Trade Commission to get the tariffs are majority foreign-owned anyway [one, SolarWorld, is a German company; another, Suniva, is Chinese-owned]. China gave their solar industry a $47-billion line of credit. When you go all-in like that, you’re going to be able to really drive down prices. There’s also an abundance of skilled labor there, which is important when an industry—like solar—is in its early stages.

Will the tariffs have their intended impact of bringing solar cell manufacturing to the U.S.?

Any new manufacturing facilities that come to the U.S. will be highly automated anyway, so I can’t see that many jobs being created on the manufacturing side if companies decide to do more of that in the U.S. A better idea than the tariffs is the $3-million American Made Solar Prize that the DoE announced [on January 24]. The competition is a step in the right direction, and I hope they go after some moon shot ideas. The U.S. created the solar industry, and then other countries took it and ran with it. We can stay at the forefront of new technologies and new types of manufacturing if we keep going, but I don’t know that manufacturing will the U.S.’s strong suit in the solar industry. If a company was already going to build a highly automated plant in China, they may now have an incentive to build in the U.S., which will help in terms of tax revenue to the states. But it’ll probably have the same impact on jobs: not that much.

Is offshoring solar cell panel manufacturing one of only the ways the technology can compete with fossil fuels?

Getting the costs of those panels down 80 percent in just a few years was a huge part of solar energy being able to compete in terms of price. The thing about talking about the cost of solar is that, by the time you get done talking about it, it’s already down another 10 percent. There’s much more to consider than the upfront costs; 99 percent of your costs is getting your concrete, steel and silicon into the ground, so once you install a solar or wind farm you’ve basically locked in a price for the next 25 years.

How significant is the increase in solar panel tariffs likely to be over the next four years?

For a sunny location in the U.S. over the next couple of years, it looks like the tariff will raise the cost of solar energy by about 4 percent. That’s about $1.30 per megawatt-hour, or 0.1 cent per kilowatt-hour. The tariff is just on the solar modules themselves, which are about 30 percent of the cost of a solar farm. Thus the tariff will probably raise the capital cost of the entire utility-scale plant by 10 percent for the first year of the tariff.

Given how quickly the cost of solar is dropping, within a year or two we’ll have already caught up to the effect of the tariff. It maybe sets the industry back to 2016 or last year’s prices, but it’s not a huge setback. It’s more of a poke in the eye than a punch in the jaw. If you really wanted to stop solar, the tariff is really too little too late.

How would the tariffs affect states that haven’t already invested heavily in solar?

The best place to capture solar power, where you have the most solar radiation hitting the ground, is in the Southwest. The Southeast isn’t terrible—but given the forest cover, the amount of aerosols in the air and other factors, there just isn’t that much solar radiation hitting the ground. A solar panel in Georgia is going to produce less than the same panel in Arizona. So the cost of the panel has to come down further in Georgia for it to be as competitive as it is in Arizona. The tariff is more likely to affect areas where solar was just beginning to make economic sense, such as Wisconsin or the Southeast. It might put the solar industry on pause there for a year or two. In places that were already going gangbusters for solar, the tariff might not make a big difference.

What are other important areas to consider when looking at the cost of energy?

At the Energy Institute we’re starting a study called the energy infrastructure of the future. A lot of people talk about different energy futures and what they’ll look like, but not that many people look at the infrastructure—pipelines, wires, cables and other hardware—needed to support that future. Even fewer people look at the infrastructure we have now, and how that might be migrated to what we need to support the future. Maybe it’ll be a more distributed future with more solar and batteries. Or maybe it’ll turn out that batteries are better at utility scale, and we just need more wires. If we electrify transportation, we’ll have to decide where we want to get that energy from. If we decide that energy will come through renewables, then wires have to be used, because the best renewables come from certain parts of the country. If we decide to do that with more natural gas or more nuclear power, then the wires might need to go in different places. So we are looking at the geographical impact of different energy futures.