What's coming up on the calendar front for today

Howdy, people! How're you all doing today?

It's been a quiet trading day so far - as we await more news about the US tax bill vote (Senate has already passed the voting stage, now it's back to the House vote on Wednesday morning in the US). It's looks like it's a done deal at this point as the House and Senate try to match their versions of the bills (only 2-3 provisions differ) and it looks like it should be able to reach Trump by the end of the week to be passed as law.

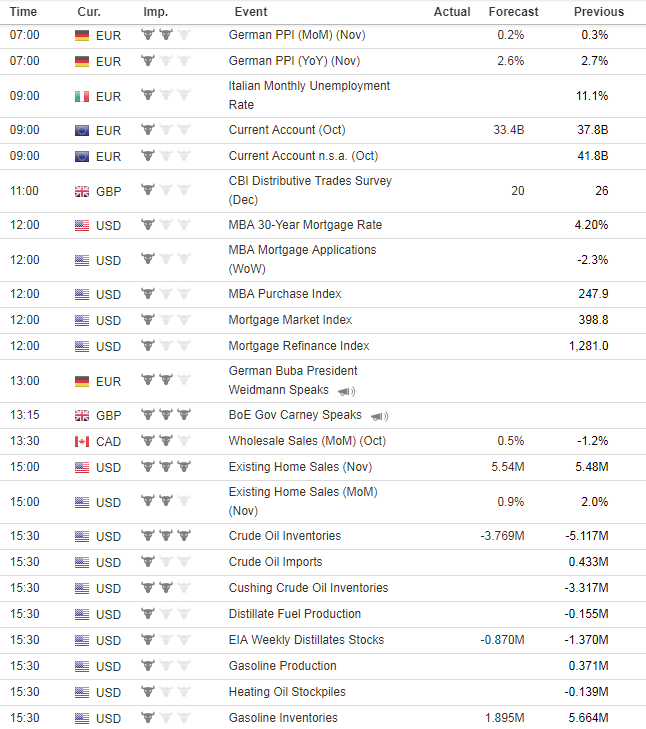

Anyway, for European trading today we have yet another light calendar day ahead. Here's what the line up looks like:

0700 GMT - Germany November PPI numbers

- m/m expected +0.2%; prior +0.3%

- y/y expected +2.6%; prior +2.7%

Producer prices have been rising in Germany since bottoming out in 1H 2016. Don't read too much into the numbers, they are somewhat correlated to inflation - but not a one-to-one direct translation that inflation is growing at the same pace (but still, positive number is still a positive number - you can't go wrong there).

0900 GMT - Eurozone October current account

Seasonally adjusted numbers released by the ECB. Not much of an impact, considering the goods portion has already been released here last week. But worth noting on the services portion - but not a major data point by any means.

1100 GMT - UK CBI retailing reported sales

Another survey on retailers and wholesalers on the level of current sales volume. Just a general sentiment indicator - a minor one.

1200 GMT - US MBA mortgage applications w.e. 15 Dec

Your weekly dose of housing data from the US. A relatively minor data point - as it generally shows the mortgage activity during the week.

1300 GMT - Bundesbank's president Weidmann speaks in Milan

1315 GMT - BOE governor Carney speaks in a parliament hearing in London

He's due to address the November financial stability report - may have some comments on BOE policy.

That's about it from the calendar in Europe today. Nothing major honestly in terms of data points. The US Senate voting has begun on the tax bill, so maybe that could be the major headline for the session.

Hope you all have a nice day, and as always, good luck in your trading!