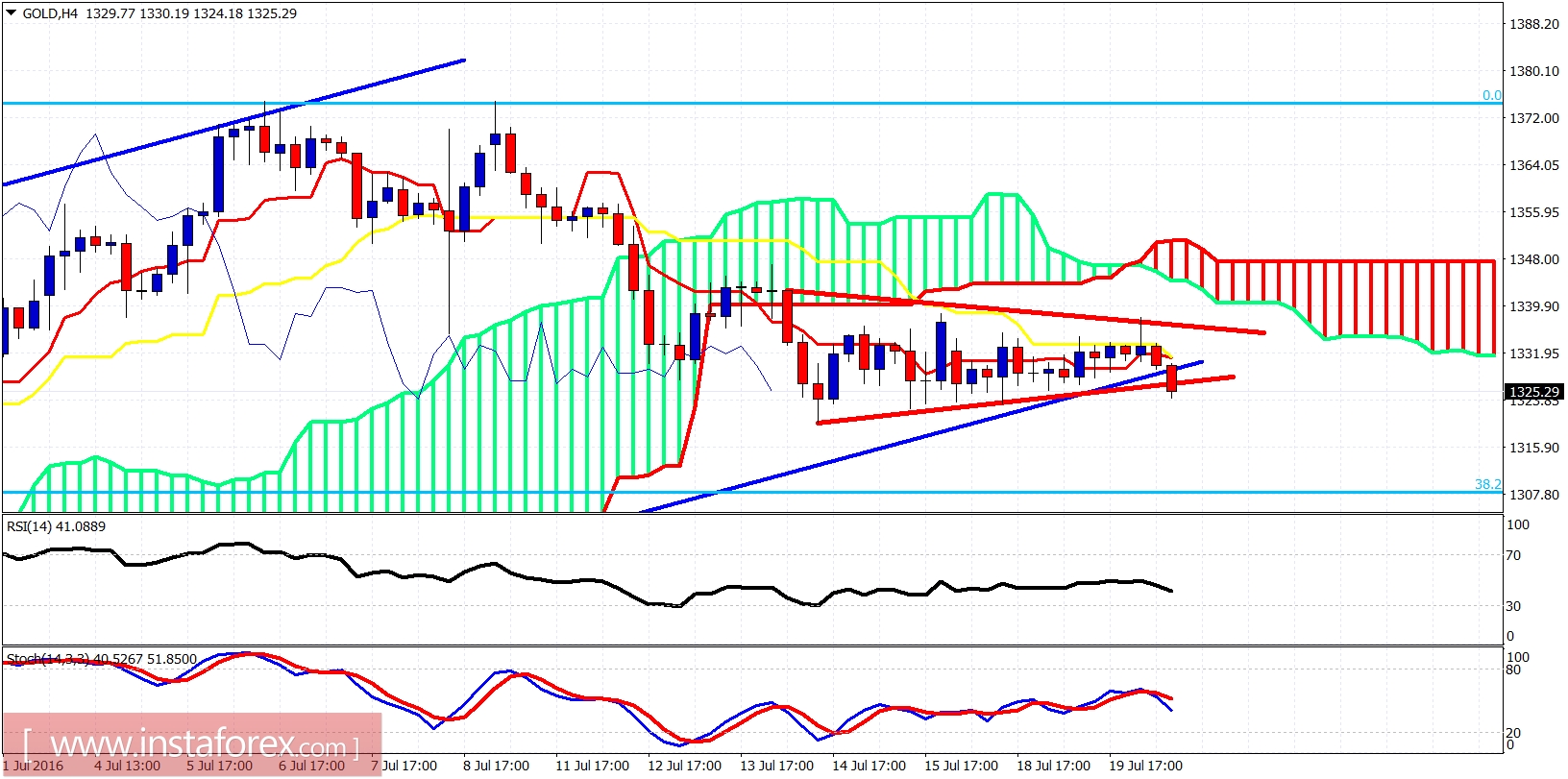

Gold price is breaking short-term support and triangle pattern to the downside. This implies that $1,300 will be tested. This is most probably that the final downward extension of the decline started at $1,375.

Red lines - triangle pattern

Blue lines - bullish channel

Gold price is trading below the 4 hour Kumo (cloud) and is breaking below the triangle pattern. This will imply a push towards $1,300 to finish the entire decline from $1,375. Resistance is at $1,340 and a move above will confirm a change of the trend to bullish.

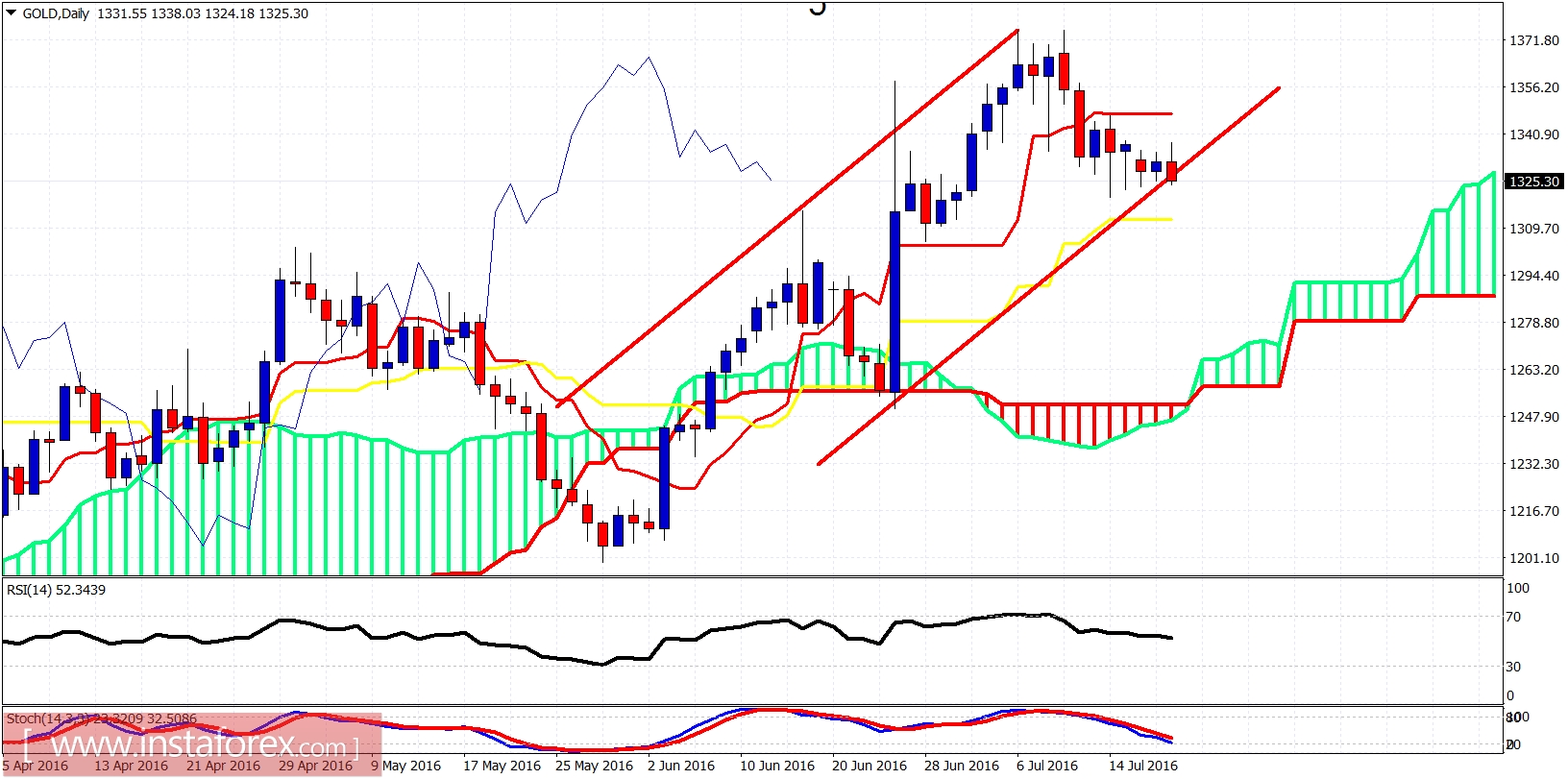

Red lines - bullish channel

Gold price is testing the lower channel boundary.

Support is at $1,324-25 and next, at $1,310. The price is above daily Kumo (cloud) but a pullback towards the cloud is not out of the question for next few weeks. Daily resistance is at $1,347. A break above will open the way for a re-test of the recent highs. I remain longer-term bullish and a pullback towards $1,250-$1,170 will be a gift for bulls.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.