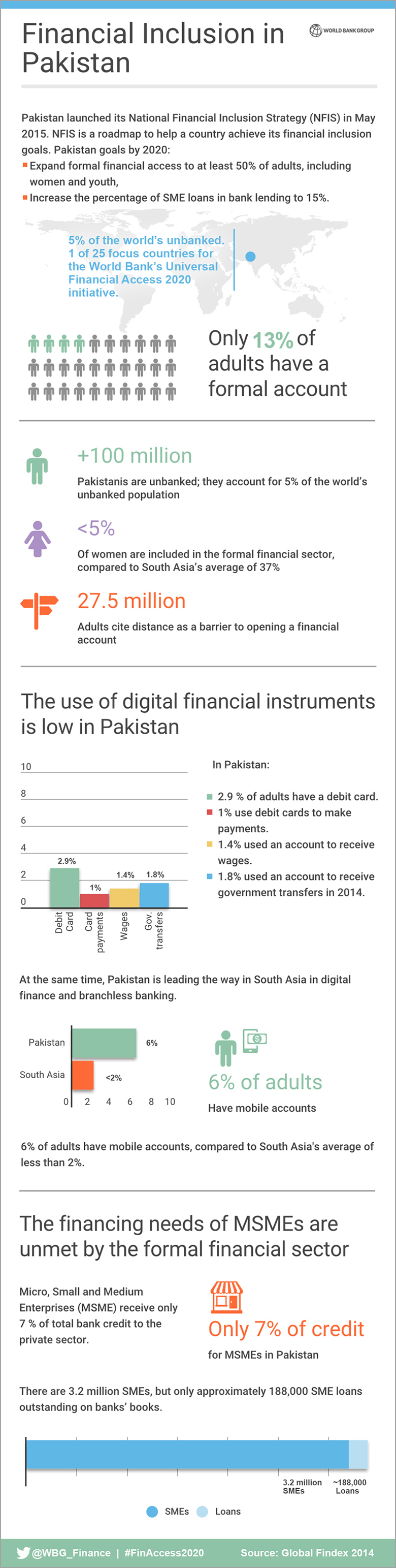

About 100 million adults in Pakistan don’t have access to formal and regulated financial services. This number accounts for about 5% of the world’s unbanked population, which stands at 2 billion.

Having a formal and regulated transaction account opens access to other financial services, such as savings, payments, insurance and credit, all of which can help people better manage their lives and reduce poverty.

In May 2015, Pakistan launched its National Financial Inclusion Strategy (NFIS), a roadmap to help a country achieve its financial inclusion goals.

Pakistan’s goal is to achieve universal financial access, with a headline NFIS target of expanding formal financial access to at least 50% of adults, including women and youth, and to increase the percentage of SME loans in bank lending to 15% by 2020.

Pakistan’s financial inclusion strategy focuses on four areas:

- Promoting digital transaction accounts and reaching scale through bulk payments

- Expanding and diversifying access points

- Improving capacity of financial service providers

- Increasing levels of financial awareness and capability

The World Bank Group is supporting these country-led efforts, which are reflected in Pakistan’s Country Partnership Strategy (2015-19), with reforms and other actions to expand financial access and inclusion.

Pakistan is also among the 25 countries the World Bank Group and partners are prioritizing as part of the efforts to reach Universal Financial Access by 2020.

Pakistan’s Financial Access Statistics

- , according to Global Findex 2014.

- Less than 5% of women are included in the formal financial sector, compared to South Asia’s average of 37%.

- ; they account for 5% of the world’s unbanked population.

- 27.5 million of Pakistani adults cite distance to a financial institution as a barrier to opening a financial account.

The use of digital financial instruments is low.

- 2.9% of adults in Pakistan have a debit card, and only 1% of adults use them to make payments.

- Only 1.4% of adults use an account to receive wages and 1.8% of adults use it to receive government transfers in 2014.

At the same time, and branchless banking.

- 6% of adults have mobile accounts, compared to South Asia’s average of less than 2.6%.

The financing needs of MSMEs are unmet by the formal financial sector.

- Micro, Small and Medium Enterprises (MSME) receive only 7 % of total bank credit to the private sector.

- There are 3.2 million SMEs, but only approximately 188,000 SME loans outstanding on banks’ books.