China's property prices fall in September

- Published

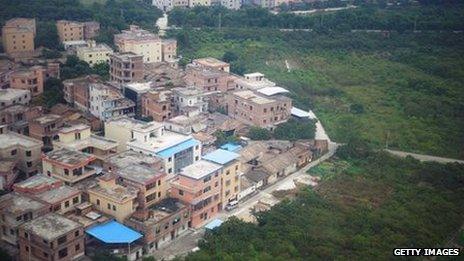

China has said its property prices fell 1.3% in September, marking the first year-on-year fall in the sector.

The government measures property prices across its 70 biggest cities.

It said new home prices in 69 of those cities had shown month-on-month drops in September, compared to 68 in August.

The housing sector accounts for some 15% of China's economy, which grew at its slowest pace in the three months to September since 2009.

Sales in the sector have been falling across 2014 and banks have become more cautious about lending to both developers and investors.

Property developers in China have also been cutting prices in an attempt to revive slow sales.

The latest numbers for home prices marks the fifth consecutive monthly drop.

Sluggish sales

The slump in the market comes despite China's central bank, the People's Bank of China, making attempts to boost mortgage lending by banks.

State-owned news agency Xinhua said housing prices in 58 out of the 70 cities were lower from a year ago on an annual basis.

"New home prices in Beijing and Shanghai dropped by 0.9% and 1.1% respectively," the agency said.

Analyst Wang Tao from UBS in Hong Kong said the property sector's downturn was still the main drag on the China's economy.

"The negative impact of the ongoing property downturn is being felt not only in heavy industry production, but also in manufacturing investment," Mr Wang said.

Economist Shane Oliver from AMP Capital in Sydney said it was quite clear the Chinese property market was continuing to deteriorate, but that he was not surprised.

"Just as it took a long time for property tightening measures to slow house price gains, it will also take a while for recent easing of property curbs to have an impact in arresting falls," he said.

"This means property prices will likely continue falling well into next year."

He said the property downturn was the biggest threat to Chinese growth, but said given the "huge control the Chinese authorities have over the Chinese economy", the government should be able to ensure other sectors, including consumer spending, will pick up the slack.

"It does mean that more 'mini-stimulus' measures will likely be required, though," he added.

China's economy grew at 7.3% in the three months to September - the slowest pace since the first three months of 2009.

Economists were forecasting growth to come in at 7.2%.

- Published21 October 2014

- Published21 October 2014

- Published20 January 2014

- Published25 August 2023