You could call it the battle of the breadsticks. When Darden Restaurants, owner of Olive Garden, Bahama Breeze, LongHorn Steakhouse and, until last month, Red Lobster, holds its annual shareholder meeting next month in Orlando, Fla., the stage will be set for a high-tension gathering that has a lot of potential to turn ugly for the company's board. Here's a look at what's at stake and what's taken shape in the last eight months since two activist hedge funds have gotten involved in an increasingly hostile fight with the struggling restaurant chain.

At time time of its annual meeting on September 30, Darden will likely have a lame duck CEO and newly appointed Chairman of its board.

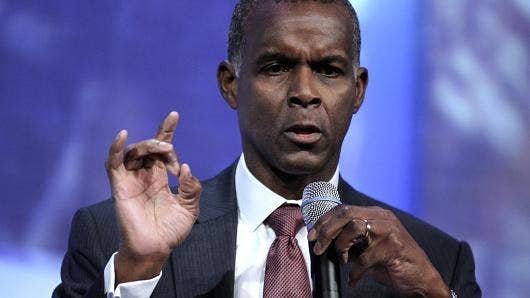

Last week, Darden announced the sudden resignation of Chairman and CEO Clarence Otis the day its sale of Red Lobster closed. Otis stepped down from his Chairmanship immediately, but will stay at the helm of the company as CEO until Darden can find a replacement or the end of the year, whichever comes first. The company's board also decided to split the two roles going forward.

The activist hedge fund Starboard Value wants to replace Darden's entire board.

Starboard has spent the better part of a year advocating for change at Darden, and had specifically been pushing for the company not to sell Red Lobster due to the value of its real estate assets, among other reasons. When Darden announced it would sell Red Lobster, in spite of Starboards protestations, the hedge fund fired back, launching a proxy battle for the entire board that has not let up. After the sale of Red Lobster closed and Otis stepped down, Starboard issued some harsh words for the company.

"We also do not believe it is a coincidence that Darden announced that Mr. Otis is stepping down and that the Board has conceded three seats at this early stage of the proxy contest on the very day that the Company announced the closing of the irreversible and value-destroying Red Lobster sale," Starboard CEO Jeff Smith said in a statement.

"Unfortunately, Mr. Otis leaving represents just one small step in the transformation that is urgently needed at Darden. To be clear, the Company still requires a major overhaul at the Board level. This Board has proven over an extended period of time that it is unable to respectfully and capably represent the best interests of the shareholders they were elected to represent and cannot be trusted to make the incredibly important decision as to the selection of the next CEO of Darden. There needs to be a true and complete process to vet both internal and external talent in order to find a truly great, transformational, operationally-focused restaurant leader."

And another hedge fund, Barington Capital, is also out for board blood.

Barington, which had been pushing for Otis's removal as Chairman of the Darden board, has recently come out in favor of Starboard's proposal, stating that Smith's plan was "the best course of action" for the company, supporting Smith's push for replacing most or all of Darden's board.

This is the first time shareholders will meet with the company minus the Red Lobster brand.

The company recently went through a major rebranding of Olive Garden, including some big changes to its menu, while the brand continues to struggle.

It's also the first time Darden shareholders will meet since the company went against their wishes for a special meeting ahead of the sale of Red Lobster.

Perhaps one of the most aggressive moves on Darden's part throughout this entire saga was its decision to go ahead with the Red Lobster sale in spite of the fact that a majority of shareholders had voted for a special meeting to discuss the matter ahead of the proposed sale. Though the sale did not require shareholder approval under the company's corporate guidelines, it still left many shareholders feeling ignored. Board member election, however, is up to shareholders, and will be voted upon at the meeting next month.

Darden has only nominated nine board members to its 12-person board, leaving three spots open for activists. Still, all 12 seats are up for reelection, leaving the entire board in play.

And Smith does not appear to be letting up. In a recent statement, he declared that Darden's cession of three seats was not good enough.

"We view the Company's decision to nominate nine of twelve director candidates as a transparent tactic designed to manipulate and maintain the problematic status quo majority following the 2014 Annual Meeting," Smith said in last week's statement. "This is yet another example of the Board attempting to make an easy decision. Rather than working toward the best possible Board for shareholders, the Board is only willing to offer representation for vacancies created by retiring directors. It is clear that such token Board change is not sufficient given the depth of the value destruction and the abominable corporate governance that this Board has overseen. That this Board would think that the retirement of just two independent directors would erase years of poor performance and oversight demonstrates once again that this Board is out of touch with reality and unwilling to take responsibility for its mistakes or to make the difficult decisions that are necessary to benefit shareholders."