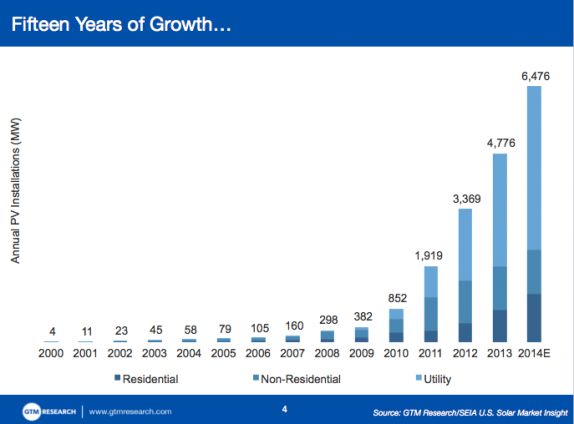

The U.S. solar industry, much like the Wisconsin bratwurst industry, is somewhat jaded by its relentless growth.

According to GTM's Senior VP of Research, Shayle Kann, "We have an increasingly diverse market by geography -- but we are still reliant on a few key states."

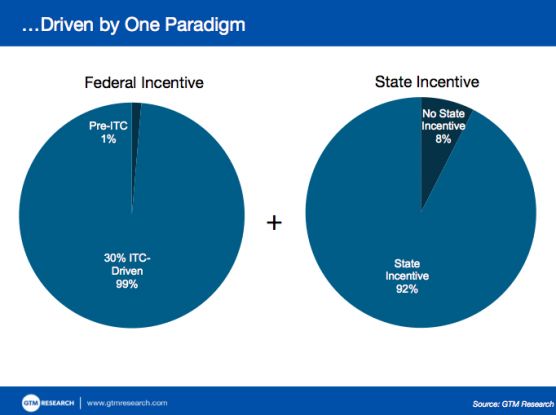

The growth of solar has been "driven by a single paradigm" at the federal (ITC) and state levels. Almost all solar has taken advantage of -- and needed to take advantage of -- state-level incentives, although that's changing in California and other states. Kann said, "Broadly speaking, state-level incentives are on the decline, although some states like New York are creating new state markets."

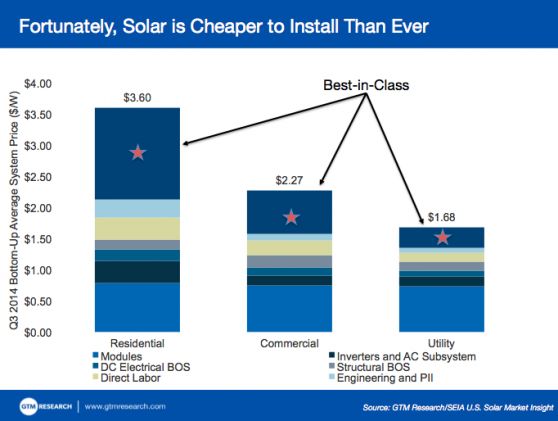

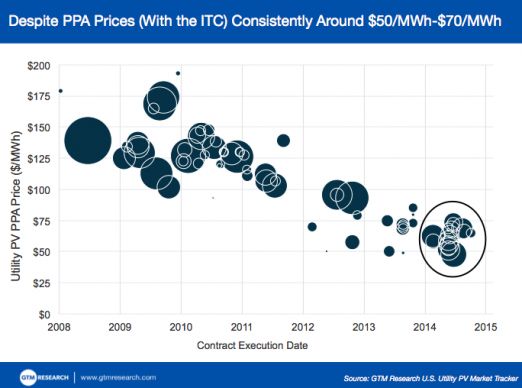

The countervailing force is the continued drop in solar installation costs. Kann reports that you can get residential solar installed for under $3.00 per watt, commercial for under $2.00 per watt, and utility for under $1.50 per watt.

Grid parity analysis and tipping point

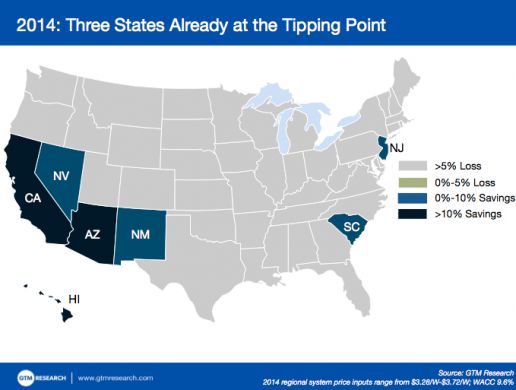

Kann notes that traditional grid parity analyses ignore utility rate structures. He cites Connecticut as an example of why that matters. By raising its solar fixed charge, Connecticut will impede the competitiveness of solar for the next few years.

GTM Research has undertaken a sophisticated analysis to determine the grid-competitiveness of solar. That data set and calculations were circulated to all the attendees at this year's U.S. Solar Market Insight conference in San Diego.

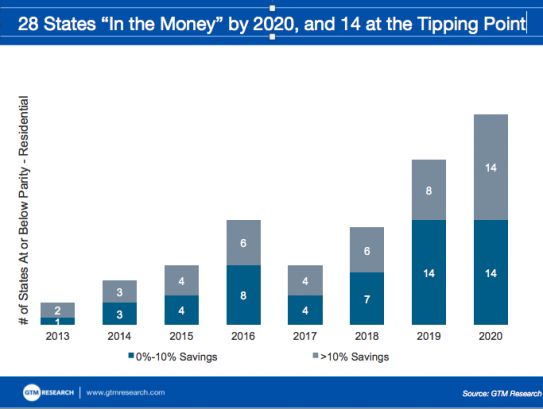

Kann suggests that the tipping point for solar is not some mushy concept of "grid parity," but rather whether solar can offer a customer 10 percent net savings in year one. He suggests that grid parity is "not that exciting -- we have to entice the customer with the savings of solar." GTM Research has picked the 10 percent year-one savings as its tipping-point metric.

Kann points us to where the U.S. stands today. In 2014, we have three states that have exceeded the tipping point, and four more at grid parity but not yet at the tipping point. He notes that in California, the vast majority of residential solar takes place outside of state incentive programs, and the same trend holds true in Arizona.

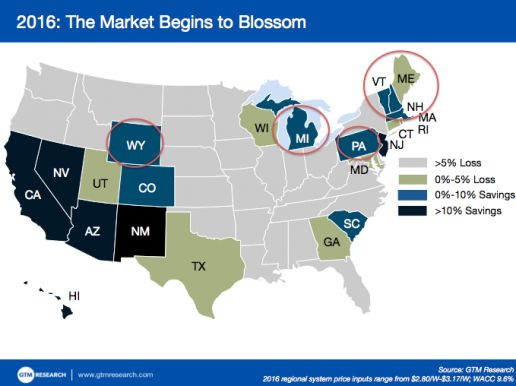

Ahead of the ITC expiration, more and more states will be reaching grid parity or coming close to grid parity. "We'll see some small market growth -- a little, but not a boom." He looks to all of New England and even states such as Wyoming and Michigan to become meaningful solar markets.

The ITC cliff

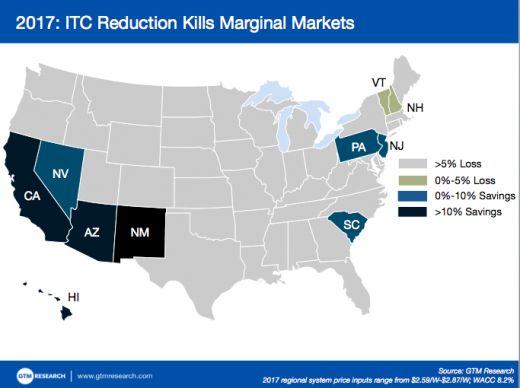

Kann referred to the expiration of the Investment Tax Credit as "the cliff" which will force the solar industry to essentially revert to its 2014 levels. He notes that 2016 is going to look really big with meaningful growth, but those marginally competitive states will be lost as the industry retreats to its 2014 levels.

He adds that "utility-scale is going to look like a boom in the next two years," but there is only 1 gigawatt of utility-scale solar slated to begin operation in 2017. Kann sees a "serious impact on utility-scale" solar. He suggested that the loss of the solar ITC will be akin to the loss of the wind production tax credit.

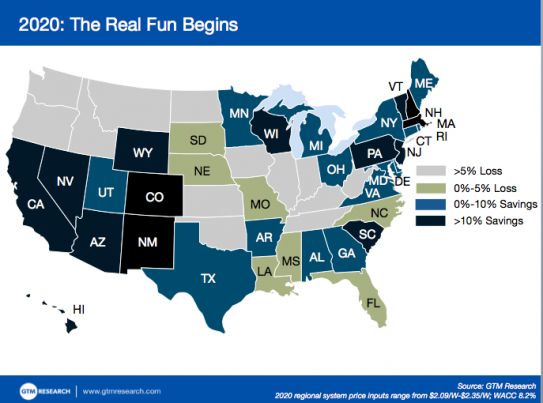

It's in 2020 that things start to get exciting, according to Kann. With the price of solar continuing to drop, more and more states become competitive.

Kann suggests that 28 states will be at grid parity in 2020 and the addressable market for solar in the U.S. will be 100 gigawatts of residential solar -- that's 100X today's market.

He concludes, "In the meantime, we have a lot of work to do."

Stay tuned to the live feed of presentations from GTM Research and the solar industry's stars at U.S. SMI 2014 in San Diego.