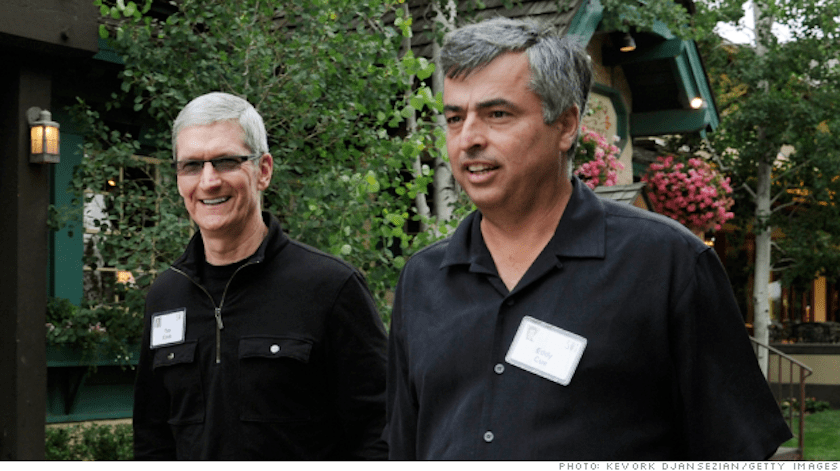

The news of the day on Wednesday was Apple’s $3 billion deal to buy the music and electronics company Beats. But the comment of the day was a seemingly off-the-cuff remark by Apple (AAPL) executive Eddy Cue about what’s next for Apple. “Late this year we’ve got the best product pipeline I’ve seen in my 25 years here,” he said, during an interview at an industry conference in California.

Cue, Apple’s deal guy under Steve Jobs and currently its head of online services, must understand the enormity of his comment. The last 15 years or so of the period he referenced included the launch of the iPod, iPhone and iPad, three product lines that revolutionized whole industries as well as Apple itself. If he’s serious, the moment may finally be at hand that Apple shows its hand for the breakthrough products the world has been waiting for from its post-Steve Jobs existence. If he was blowing afterglow smoke from having completed a glamorous entertainment-industry deal, Cue will rue the day he made such a bold claim.

Either way, it is boom times for sure in the tech industry. In buying Beats, Apple has departed from its longstanding tradition of avoiding multibillion-dollar deals. Whether or not the acquisition of the headphone maker and streaming music provider is successful, it surely will be a relatively trivial deal for cash-rich Apple. Investments bankers the world over must be salivating at the new opportunities presented by an acquisitive Apple willing to step up to the deal plate.

***

New Wal-Mart Stores (WMT) chief executive Doug McMillon has been spending a fair amount of time in the San Francisco Bay Area, visiting three time since the beginning of the year. He says he’s “trying to be a good student” of the tech industry. Tech trends that are most interesting to the retailer include 3-D printers, wearables and the “connected home.” At the same industry event as Apple’s Cue — The Code Conference — McMillion shed some light on the difficulty of measuring the success of Walmart’s digital business. He said that 10% of mobile purchases happen in Walmart stores, for example. He also said a good deal of his company’s real estate allocation is going toward grocery fulfillment, as opposed to new stores. The competitor of special interest to Wal-Mart: China’s Alibaba.

***

Softbank CEO Masayoshi Son was a shining star at The Code Conference, easily the most engaging and entertaining chief executive I heard present. He likened the duopolist wireless carriers AT&T (T) and Verizon (VZN) as well as the monopolist broadband company Comcast (CMCSA) to NTT, which he took on — and beat — in Japan. The U.S. incumbents, Son said, provide slow Internet connectivity at inflated prices, all while they have spend $100 billion on dividends and stock buybacks over the past three years. “Instead of having price competition or speed competition they pay a divdidend,” he said. Though he wouldn’t say so directly, Son wants to buy T-Mobile (TMUS) and combine it with Sprint (S), which he controls, in order to achieve scale that rivals AT&T and Verizon. He implied that if regulators allow that deal he’ll provide a credible alternative to the dominant players. “I will provide net neutrality,” he quipped.

***

“Cloud” software providers Marc Benioff of Salesforce.com (CRM) and Aneel Bhusri of Workday (WDAY) teed off on incumbent software providers, which include Oracle (ORCL), SAP and Microsoft (MSFT). “They are mature, single-digit growers, with acquisitions,” Benioff said. “They are not innovating.” Added Bhusri: “Oracle faces five years of secular headwinds.”

Nest CEO Tony Fadell, whose company recently sold to Google (GOOG), hinted that the company’s next products could come in areas including health and safety, water regulation and security. It is more than he has said lately about where his company — best known for its thermostat and Protect smoke detector — is heading.

The Code Conference concludes Thursday morning; please return to Fortune.com tomorrow for more coverage.

Previously: For Microsoft’s CEO, no need to mince words