It's Coming: $65 Oil

The sudden collapse in gas prices is a mix of good news (energy production is up, all over the world) and bad news (there is no good economic growth story, anywhere).

Gas prices are falling below $3 a gallon across the United States for two big reasons: (1) the world economy is growing slower than we hoped, and (2) global oil production is improving faster than we expected.

"India and China are slowing down,” said Charles K. Ebinger, director of the Energy Security Initiative at Brookings. "The IMF just downgraded Europe’s growth to less than 1 percent, and they're already quite energy efficient. Brazil’s a problem, too. All around the world there is no great growth story, and expectations are that things will stay that way or get worse."

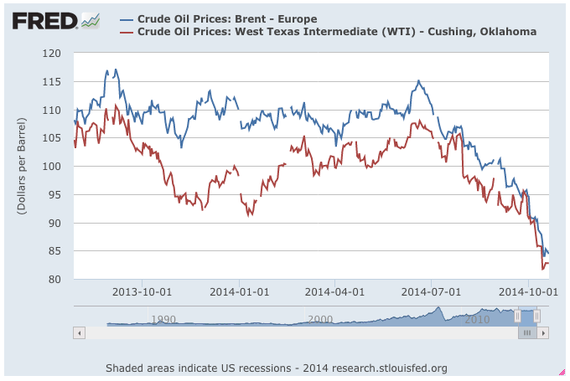

There is also unanticipated supply. A few years ago, political turmoil was taking up to 2 million barrels a day off the market. Now production is roaring back in Libya, southern Sudan, Yemen, Nigeria, and even Iraq, and the global price of crude has fallen about 25 percent in the last five months. It's the same old story: low demand, high supply, etc.

Andrew John Hall, the alleged "God" of oil trading, is predicting $150 barrels within the next five years. But the deeper you dig, the more reasons you find to be down on the price of oil in the near future. "Japan’s announcement that they’re starting two reactors means that there will be less oil import for Japan,” Ebinger said. Second, there are industrial shifts that are reducing oil’s share in the energy market. For example, many U.S. companies are using natural gas rather than petroleum products to power their refineries. Third, hedge funds went long on crude when they saw the Middle East flaming up. But as the price has moved against them, they've dumped oil into a soft market, further driving down the price of crude.

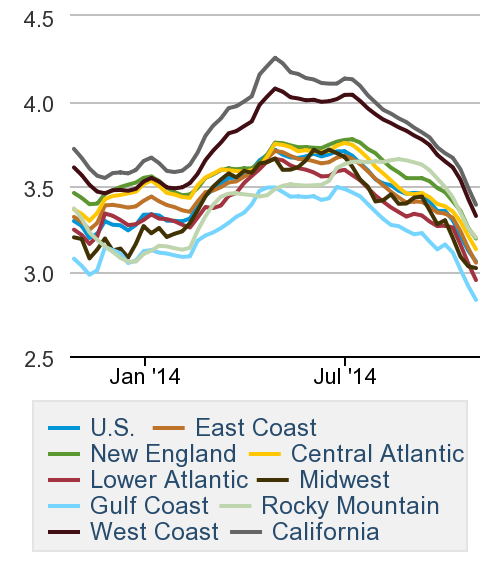

It’s hard to say how the sliding price of gas will affect the United States, as a whole, because the economy is a messy mix of cities, industries, and consumers behaviors, each of which experience falling prices differently. In cities with lots of driving and not much energy production—e.g. throughout California—cheaper gas is simply good, the end. Three-buck gasoline gives back as much as $500 a year to the typical family with two cars, compared to the $4.50 gallons from a few years ago.

Regular Gasoline Prices, in Dollars Per Gallon

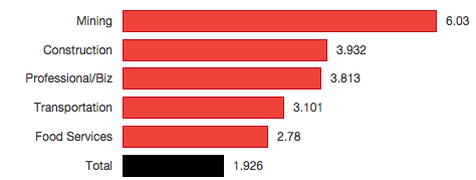

But mining and energy jobs have been the fastest-growing sector of the labor market, and thinner profits for energy producers will hurt states like North Dakota and New Mexico, who have relied on energy exports to pay for new jobs and higher wages.

Percent Job Growth in 2014, by Industry

"The International Energy Industry is saying that at $80 [a barrel], some production will start to shut down," Ebinger said, "but I was talking to North Dakota producers, and they’ve said their cheaper wells are okay down to $25 and their higher-cost wells are okay down to $45, because some of their losses would be protected under the federal tax code." Dakota firms might not drill new wells under that price, but “they can probably survive down to pretty low levels.”

"I think it’ll go lower than $70," he said. "I think $65 is not at all impossible. I just don’t see what changes."

Derek Thompson is a staff writer at The Atlantic and the author of the Work in Progress newsletter.